You use this program to invoice a customer based on work completed for a non-stocked job or to raise an asset in suspense for a capex requisition line linked to the job (see Asset Capex Items and Assets in Suspense).

At the same time the work in progress value is reduced and can be distributed to General Ledger codes of your choice.

Although you can also use this program to clear out residual work in progress values without invoicing a customer, this should rather be performed using the Job Closure program.

- Toolbar and menu

- Transaction Date

- Part Billings

- Order Details

- GL Distribution

- Preferences

- Notes and warnings

| Field | Description | ||||

|---|---|---|---|---|---|

| Edit | |||||

| Change Posting Period | Select this to change the General Ledger period to which to post the transaction entries (see Change posting Period). | ||||

| Set Transaction Date | Select this to change the date that must be used for

the transaction.

|

||||

| Options | |||||

| Preferences | Select this to customize processing by indicating default selections to apply for this program. | ||||

| Job |

Indicate the job for which to part-bill the customer. You are prompted to process kit issues for the job when the Automatic kit issue of job required preference is enabled. You can part bill a sub job, however part billing a sub job does not update the master job. If you want to update the master job, then you must issue the sub job to the master job using the Transfer Work in Progress program. You cannot access this field when the Part Billings program is run from the Billing Schedule Review program. The job description is displayed alongside the Job field, and Hierarchical job is displayed for hierarchical non-stocked jobs. |

||||

| Play | Select this to use the Multimedia program to view any multimedia objects assigned to the job. | ||||

| O/s WIP Value | Select this to indicate the posting period for which you want to clear outstanding work in progress amounts. You can select the current month or the previous two months. | ||||

| Post |

Select this to post entries to General Ledger. All outstanding amounts must be fully distributed before you can use this function. See P&C Distribute COS and Billings. This function is only enabled if you specified at least one quantity to release. The WIP Track Lots and Serials program is called from the Part Billings program if you selected the setup option: Require component to parent lot tracking and the non-stocked parent part is defined as lot traceable. This enables you to link the lot numbers of component parts to the parent part. If the part billing is for a job for a capex requisition line (see Asset Capex Items) then an asset in suspense is created for the requisition line (see Assets in Suspense). If you selected the option: Create new sales order, then the sales order which is created is numbered according to the Sales order numbering method defined (Set Key Information). If you selected the option: Create new sales order and against the Order Details you specified that the order must be created in a status of 8, then you are prompted to supply an invoice number if the option: Billing type is set to Post-billing with invoice (Sales Orders Setup) and the option: Auto invoice numbering - order release is set to No (Set Key Information). If you did not select the option: Same invoice for different customers (Set Key Information) then no duplicate invoice numbers are allowed within the current SYSPRO company. This applies irrespective of both the order and the invoice numbering methods selected. If you selected the setup option: Print online delivery note with release (Work in Progress Setup) and you have an hierarchical job linked to an hierarchical sales order, then you can generate a delivery note online. You are also given the option to reprint the delivery note if required. The quantity on the delivery note is the current ship quantity (as per the sales order). The amount on the sales order is only reset when you print an invoice. Therefore if you release a quantity of one, but you previously released a quantity of two, then the delivery note is generated for a quantity of three until you issue an invoice for the quantity of two previously released. |

||||

| Close | Select this to exit the program. | ||||

This screen is displayed when you select the Change Posting Period option from the Edit menu.

| Field | Description |

|---|---|

| Change Posting Period | Select this to use the Change Posting Period program to indicate the General Ledger period to which you want to post the transaction entries. |

| Close | Select this to return to the previous screen. |

| Current period | |

| Month | This indicates the period the General Ledger is currently in. |

| Year | This indicates the year the General Ledger is currently in. |

You use the Set Transaction Date option from the Edit menu to indicate the date that must be used for the transaction.

The transaction date is used as the journal start date and the inventory movement date.

When the transaction extends over two days (e.g. the processing of the transaction begins before midnight and ends after midnight) then the actual date of posting is used instead of the date on which the program was loaded. In this example, the date after midnight is used as the transaction date.

![[Note]](images/note.png)

|

|

|

Although a number of programs provide the facility to change the date to use for the transaction, we recommend that you exercise caution when setting the transaction date.

|

|

The transaction date defaults to the current system date when the Set accounting date to system date option is enabled (Operators).

| Field | Description |

|---|---|

| OK | Select this to accept the date you entered. |

| Cancel | Select this to ignore the date entered and to return to the previous field. |

| Transaction date | Enter the default transaction date to use for the transaction. |

Example:

If you post a Part Billing transaction on 14 January 2004, but you set the transaction date to 31 December 2003, then the transaction is posted to the General Ledger period in January. However, if you print the Job Transaction Report for January (01/01/04 to 31/01/04), the transaction is not included on the report.

If you use this option to post additional costs to a job that is already marked as complete, and the date you enter differs from the original completion date for the job, then the system displays the following prompt:

| Field | Description |

|---|---|

| Change the job completion date to the transaction date? | |

| Yes | Select this to change the job completion date to the date you entered using the Set Transaction Date function. |

| No | Select this to leave the job completion date as the original job completion date. |

| Cancel | Select this to abort the posting and ignore the transaction. |

| Field | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| General | |||||||||||||||||

| Job | This indicates the job number for which you are processing the part billing. | ||||||||||||||||

| Job description | This indicates the description assigned to the job number. | ||||||||||||||||

| Journal | |||||||||||||||||

| Hierarchical job | This indicates whether the job is hierarchical. | ||||||||||||||||

| Customer | This indicates the customer assigned to the job. | ||||||||||||||||

| Customer description | This indicates the customer's name. | ||||||||||||||||

| Sales order | This indicates the number of the sales order linked to the job. | ||||||||||||||||

| Sales order status | This indicates the status of the sales order linked to the job. See Sales Order Status Codes. | ||||||||||||||||

| WIP value | This indicates the work in progress value of the job. | ||||||||||||||||

| Quantity outstanding | This indicates the quantity still outstanding for the job. | ||||||||||||||||

| Quantity |

Indicate the quantity of the non-stocked item that has been manufactured. For hierarchical jobs linked to a sales order, you use this field to indicate the quantity by which you want to increase the quantity manufactured for the job. It is the quantity which must be moved from back order to ship on a pre-existing sales order line(s). If an order does not exist, it becomes the quantity ordered and shipped on a new sales order. You cannot access this field when the Part Billings program is run from the Billing Schedule Review program. If the job is linked to a sales order and the quantity you enter in this field is greater than the quantity on backorder against the sales order, a warning is displayed. You are given the opportunity to increase the sales order quantity or to leave it as it is. If you select to increase the order quantity, then the order quantity is increased to match the quantity received plus the quantity already shipped. If you select to leave the quantity as is, then the quantity still on back order is added to the quantity to ship. See Activity considerations in Notes and warnings. |

||||||||||||||||

| Quantity to bill |

This field is displayed only for hierarchical jobs and if a zero quantity was entered at the Quantity field. It is used to release non-merchandise lines on a sales order (e.g. escalation charges, refunds, etc) which have no bearing on the quantity of the product still to be produced. |

||||||||||||||||

| WIP value based on | Indicate the source to use for the outstanding WIP

value.

|

||||||||||||||||

| WIP material value | Indicate the value by which the material portion of

work in progress must be reduced.

This field is only enabled if the WIP value is based on Manual entry. |

||||||||||||||||

| WIP labor value | Indicate the value by which the labor portion of work

in progress must be reduced. This field is only enabled if the WIP value is based on Manual entry. |

||||||||||||||||

| Value basis | Indicate the basis for the material/labor values

entered. If the WIP value based on is set to Original expected costs or Actual cost, then the Value basis is set to Unit. If the WIP value based on is set to Outstanding WIP, then the Value basis is set to Total.

|

||||||||||||||||

| Action | This option is only available if you entered a customer in the Customer field when you created the job (Job Entry). The customer assigned to the job is only validated when a part billing is made. For hierarchical jobs, the sales order number linked to the job is indicated at the Linked to s/o field. In addition, all the sales order options (i.e. No sales order link, Create new sales order, Update sales order and Append to sales order) are disabled as you can only update the sales order(s) to which the hierarchical job is linked. You cannot part bill a job linked to a sales order for which a delivery note has already been printed if maintenance of sales orders after the delivery note is printed is denied (Sales Orders Setup).See Activity considerations in Notes and warnings.

|

||||||||||||||||

| Billing method |

|

||||||||||||||||

| Order details | Select this to append detail lines to an existing sales

order (see Sales Order Number) or to

assign sales order header information for the part billing if

a link to sales order is required (see Order Details).

|

||||||||||||||||

| Additional reference |

Enter an additional reference or notation. The text you enter here is printed on the WIP Part Billings Distribution report and is displayed in the WIP Booked pane of the WIP Query. |

||||||||||||||||

| Job complete | Select this to indicate that the job is complete. The program checks that there are no outstanding purchase orders, operations, or material allocations for the job. When you set a job to complete:

|

||||||||||||||||

| Lot number |

Enter a lot number for the non-stocked item you are part billing. The lot number must not already exist, unless you are crediting an existing sales order (i.e. the quantity being part billed is negative), in which case the lot number must exist. For a positive quantity being part billed, this creates a lot number for a non-stocked item. The warehouse code against this lot number is designated as **. In addition, the sales order line created for the non-stocked item is assigned to the lot number entered, so that a subsequent invoice reduces stock on hand of that lot number to zero. This field is only enabled if:

|

||||||||||||||||

| Concession | Enter a concession number if applicable. This applies only if a non-zero entry was made at the Quantity field, and the finished stock code of the job is a traceable item (Stock Codes). |

||||||||||||||||

| Certificate | Enter the certificate number. The certificate number

serves to identify the certification of your product to your

customer. This number can be printed on your delivery note or

invoice to the customer. This applies only if a non-zero entry was made at the Quantity field, and the finished stock code of the job is a traceable item (Stock Codes). |

||||||||||||||||

| Session details | |||||||||||||||||

| Transaction date | This indicates the transaction date to be used for the transaction (see Transaction Date) | ||||||||||||||||

| Posting period | This indicates the period into which the transaction will be posted. | ||||||||||||||||

This screen is displayed when you select the Edit option at the Order details field and you selected the Action: Append to sales order. This enables you to indicate the sales order number to which you want to add detail lines.

| Field | Description |

|---|---|

| Continue | Select this to accept the sales order number you entered and to return to the previous screen. |

| Close | Select this to ignore any entry you made and to return to the previous screen. |

| Append to sales order | |

| Order number to append | Indicate the order number to which you want to append lines. |

This screen is displayed when you select the Edit option at the Order details field if all of the following are true:

- the option: Calculate and check gross profit (Work in Progress Setup) is enabled

- the job is set to complete

- you selected to create a new sales order

The screen enables you to perform a margin check and does not update any data (i.e. it is used for information purposes only).

| Field | Description | ||||

|---|---|---|---|---|---|

| Continue | Select this to perform the margin check. | ||||

| Close | Select this to return to the previous screen. | ||||

| Costs to date | |||||

| Material | This indicates the current material costs of the job. | ||||

| Labor | This indicates the current labor costs of the job. | ||||

| Markup percentage | Indicate the markup percentages to add to the cost.

The following warning is displayed if the percentages entered are not within the percentages defined at the option: Calculate and check gross profit (Work in Progress Setup): The gross profit is below/above the acceptable limit. Do you wish to continue? See Password considerations in Notes and warnings.

|

||||

| Material | Indicate the markup percentage you want to add to the material cost. | ||||

| Labor | Indicate the markup percentage you want to add to the labor cost. | ||||

| Details | |||||

| Selling price | This indicates the calculated selling price of the job according to the Markup percentages you entered in the previous fields. | ||||

| Gross profit | This indicates the calculated gross profit using the Markup percentages entered. The gross profit is the difference in value between the accumulated costs to date and the selling price of the job. |

||||

The pane is enabled when you select theEdit option at the Order details field and you selected the Action: Create new sales order.

![[Note]](images/note.png)

|

|

|

The options and field in this pane are enabled when you select the Edit option at the Order details field in the Part Billings pane and create a new sales order. |

|

| Field | Description |

|---|---|

| Order Header |

Select this to use the SO Header Maintenance program to maintain the sales order header information. If you selected the option: Create new sales order and against the Order status you specified that the order must be created in a status of 8, then you can enter an invoice number against the Order header if:

|

| Maintain This order | This only applies to the Action: Update sales

order. Select this to use the Sales Order Entry program to maintain the sales order. The following warning message is displayed by the Sales Order Entry program when you select this option: "There are one or more jobs attached to this order. Certain maintenance may invalidate these links. Do you wish to continue?" This field is not enabled if you selected the preference: Apply recommended cost automatically. |

| Apply Recommended | This option is displayed when you select the

Action: Update sales order. Select this to apply the value in the Unit cost - Recommended field to the Unit cost - New field. This field is not enabled if you selected the preference: Apply recommended cost automatically, because the recommended cost will already have been calculated. |

This pane is displayed if the Billing method is set to Progress payment or Selling price and you selected a sales order link.

| Field | Description |

|---|---|

| General | |

| Customer purchase order | Enter the customer's purchase order reference details if required. |

| Order status | Select the status to which you want to set the order. See Sales Order Status Codes. |

| Salesperson | The salesperson assigned to the customer is displayed

here as the default. You must specify a valid salesperson before you will be allowed to post the transaction. |

| Order value | Indicate the amount you want to bill the customer. |

| Selling price | This indicates the selling price of the finished item as defined against the job (Job Entry). |

| Customer currency | This indicates the currency of the customer and is displayed for foreign currency customers. |

| Line details | |

| Stock code | This indicates the code of the item you are billing. |

| Stock code description | This indicates the description for the code. If the item is non-stocked, then this defaults to the description entered when the job was created, but can be changed here. |

| Product class | Indicate the product class to use for the billing.

A valid product class must be entered before you can post the transaction. |

| Commission |

Assign a commission code to the non-stocked line. You can only access this field if you indicated that commission must be calculated, and that the calculation must use the code held against the price (Sales Orders Setup). |

| Taxable | Select this to apply tax to the billing. |

| Tax code |

Indicate the tax code to apply. If you are using the EC VAT system, you will have to enter EC information when performing part billings for EC customers. |

| GST taxable | Select this to apply GST. |

| GST code | Indicate the GST code to apply. |

| Credit | These fields are only enabled for credit

notes. If you selected option: Ask reason code for new credit note (Sales Orders Setup) then you must enter a reason code. |

| Credit reason | Indicate the reason code for the credit. |

| Credit reason description | This is the description of the Credit reason code selected. |

| Adjust qty on backorder for linked SO |

You can process a credit note for an invoice you have not yet printed, by entering a negative Quantity and selecting the Update sales order action. If you select this option, then a new line is created on the original sales order with a credit in the back order quantity field to adjust the quantity on back order. This enables you to correct mistakes made on an hierarchical sales order, by adjusting the original order back to its original state. If you do not select this option, then the original sales order quantity is not reversed and the contract will not be fully billed. For example, if you invoice a quantity of 1 out of a total contract quantity of 5 and then reverse the invoice, Part Billings will not put back the 1 unless this option is selected. This means that the sales order is 20% short and you will only part bill 80% of the original contract. Put another way, if you invoice 0.2 of 1.00, then later discover you need to reverse 0.2, part billings does not put back the 0.2. The consequence is that the sales order is 20% short, or you are only part billing 80% of the original contract. This option is only available when processing a credit for an hierarchical order with a job is linked to a valid and incomplete sales order. If the sales order is complete and a credit note is required, then you first need to set the order to incomplete in Sales orders. This option is not available when you access the Part Billings program by processing a credit note for an hierarchical sales order using the Sales Order Entry program. The back order quantity for the linked sales order would have been adjusted using the SO Sales Order Lines from Reprint program. |

This pane is displayed if the Billing method is set to Line details and you selected a sales order link.

| Field | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| General | |||||||||

| Customer purchase order | Enter the customer's purchase order reference details if required. | ||||||||

| Order status | Select the status to which you want to set the order. See Sales Order Status Codes. | ||||||||

| Salesperson | The salesperson assigned to the customer is displayed

here as the default. You must specify a valid salesperson before you can post the transaction. |

||||||||

| Stocked lines to be valued at | For any selection made here the quantity issued is

the quantity not yet billed to the customer and the cost of

sales is based on the actual cost of the material issued to

the job.

|

||||||||

| Markup percentage | |||||||||

| Material | Indicate the material markup percentage to be applied to the line. This defaults to the percentage entered at the time the job was created. | ||||||||

| Labor | Indicate the labor markup percentage to be applied to the line. This defaults to the percentage entered at the time the job was created. | ||||||||

| Details applied for non-stocked lines | |||||||||

| Product class | Indicate the product class to be assigned to the

non-stocked line. You must specify a valid product class before you can post the transaction. |

||||||||

| Apply product class to stocked lines |

Select this to apply the product class specified for non-stocked lines to stocked lines as well. Otherwise the product class held against the stock item is used. |

||||||||

| Commission |

Assign a commission code to the non-stocked line. You can only access this field if you indicated that commission must be calculated, and that the calculation must use the code held against the price (Sales Orders Setup). |

||||||||

| Details applied for operations | |||||||||

| Default product class | Indicate the default product class to be assigned to the operation line. | ||||||||

| Create details for each operation |

Select this to create a miscellaneous charge line for each unbilled operation. Otherwise a single miscellaneous charge line is created for all unbilled operations. The lines are created with a default product class of _OTH and the description defaults to your entry made at the preference: Comment text for operations. |

||||||||

| Summarize by product class |

Select this to summarize all unbilled operations by product class. The product class defined against each work center used in each operation is used. If this is blank then the default product class is used. The program creates miscellaneous charge lines for the summarized operations. The description assigned to each charge line will be the product class description. If this is blank or the product class is not found, then this defaults to your entry made at the preference: Comment text for operations. You can only access this option if you selected the option: Create details for each operation. |

||||||||

| Use labor service charges |

Select this to apply a labor service charge to the current sales order line. The service charge code against the work center (Work Centers) is used to determine the charge. If no service charge code is defined against the work center, then the default code defined at the Default labor service charge field (Work in Progress Setup) is used to determine the charge. This field is only enabled if Labor service charge is set to Prompt operator (Work in Progress Setup). If labor service charges are set to Required, then this field is automatically selected and cannot be deselected. Refer to Labor Service Charges in Part Billings for additional information. |

||||||||

| Additional | |||||||||

| Copy narrations attached to labor allocations |

Select this to copy labor allocation narrations to a sales order when creating the sales order with the billing method of Line details. This option is only enabled when you select the options: Create details for each operation or Use labor service charges. |

||||||||

| Copy narrations attached to mat allocs | Select this to copy material allocation narrations to a sales order when creating the sales order with a billing method of Line details. | ||||||||

| Seq mats with associated labor allocs |

This option is only enabled when you select the options:Create details for each operation or Use labor service charges. If you select this option, then when creating a sales order with the billing method: Line details, the material allocations linked to labor allocations are attached to the sales order after the labor allocations to which they are linked. If materials use offset days, then these materials are inserted before the labor allocation lines. For example, a job has the following: Operation 1 Operation 2 Component A uses offset days Component B is required for Operation 1 Component C is required for Operation 1 Component D is required for Operation 2 Component E is required for Operation 2 If you select to sequence materials with labor allocations, then the sales order lines are created as follows: 1 Component A 2 Miscellaneous operation line 1 3 Component B 4 Component C 5 Miscellaneous operation line 2 6 Component D 7 Component E |

||||||||

| Tax details for non-stocked/operations | The tax details entered for non-stocked items applies equally to all operation charge lines created. | ||||||||

| Taxable | Select this to apply tax to the billing amount. | ||||||||

| Tax code |

Indicate the tax code to apply to the billing. If you are using the EC VAT system, you will have to enter EC information when performing part billings for EC customers. |

||||||||

| GST taxable | Select this to apply GST to the billing amount. | ||||||||

| GST code | Indicate the GST code to apply to the billing. |

Labor service charges are only applied when you create a sales order with the Billing method of Line details.

Before you can process labor service charges from the Part Billings program, you must have done the following:

- Defined at least one service charge code for labor using the Service Charges program.

- Selected Required or Prompt operator against the setup option: Labor service charge (Work in Progress Setup).

- Defined a default service charge code for labor at the Default labor service charge (Work in Progress Setup).

- Used the Work Centers program to optionally define a service charge code for labor against one of more work centers

- Used the Job Entry program to create a job with at least one operation.

Labor allocations are processed is as follows:

-

When processing labor allocations to add to a sales order and the option: Use labor service charges is selected then:

For normal allocations, a miscellaneous charge line is created for each labor allocation. This follows the normal rules for processing that type of service charge.

- The charge code is taken from the work centre file/table. If this is not defined, or the work center is not on file, the system default is used.

-

The quantity is taken as the labor time units.

The labor time units are calculated as:

Total time issued to date (sum of run time issued, setup time issued, startup time issued and teardown time issued) LESS Total time billed to date.

- The price per unit is taken from the service charge.

-

The cost is calculated from the Total labor cost (value issued to date less value billed to date).

Note that usually when quantity is involved, the cost is a unit cost, but in this case it is always the outstanding amount from the allocation.

-

When processing subcontract allocations and the option: Use labor service charges is selected then a check is made for a charge code on the associated work centre. If there is no charge code, then a charge line is created by applying the markup to cost.

If there is a charge code, then a miscellaneous charge line is created which follows the normal rules for processing that type of service charge.

- The charge code is taken from the work centre file/table.

-

The quantity is the quantity completed for the subcontract operation.

This is calculated as:

Total quantity completed less total quantity billed to date. The result is multiplied by the subcontract quantity per if the quantity per is non-zero.

- The price per unit is taken from the service charge.

-

The cost is calculated from the Total labor cost (value issued to date less value billed to date).

Note that usually when quantity is involved, the cost is a unit cost, but in this case it is always the outstanding amount from the allocation.

This pane is displayed when you select the Action - Update sales order.

| Field | Description |

|---|---|

| General | |

| Sales order | This indicates the sales order number you are updating. |

| Current status | This indicates the current status of the sales order. See Sales Order Status Codes. |

| New order status | This enables you to indicate the status to which you want to set the sales order. |

| Unit cost | |

| Recommended | This indicates the recommended unit cost amount. This is based on your selection at the WIP value based on field in the Part Billings pane. |

| New | You use this field to indicate the new unit cost to

use for the billing. By default, the new unit cost is assumed to be the current unit cost plus the unit value of the work in progress to be distributed. |

This editable listview enables you to assign any outstanding WIP value for the job to specific General Ledger codes.

You can also use the listview to change any details for transaction lines that have been entered, or delete the entry.

If you selected the option: Tracking cost only, then the outstanding amount for each head/section is automatically distributed to the ledger code you defined in the Cost ledger code field for that head/section (P&C Maintenance of Job Hierarchies).

When part billing a completed job where additional material or labour has been posted after the job was completed, you need to select the Post function to enable the GL Distribution pane.

| Field | Description |

|---|---|

| Delete |

Select this to remove the listview entry currently highlighted. |

| Apply Undistributed | Select this function to assign the total outstanding amount (displayed in the Undistributed field) to the specified ledger code. |

| G/L Distribution | |

| Ledger code |

Indicate the ledger code against which the amount must be posted. This defaults to the account indicated at the preference: Default G/L distribution account. Your entry here is validated only if the Work in Progress module is integrated to General Ledger in detail or summary (General Ledger Integration). If you are part billing a hierarchical order and a Cost ledger code is defined against the head/section of a hierarchy (P&C Maintenance of Job Hierarchies) then that ledger code is displayed in this field. If the job is for a Capex item, then the General Ledger distribution account defaults to the Asset clearing account defined against the Asset branch/group in the Assets Ledger Interface program when General Ledger integration is enabled. The account indicated at the preference: Default G/L distribution account is ignored. |

| Description | This indicates the description of the ledger code selected. |

| WIP ledger code | This indicates the Work in Progress |

| Amount | You use this field to indicate the amount you want to distribute. |

| Undistributed amount | This indicates the value that must still be distributed to ledger codes. It is updated for each listview entry added, deleted or changed. |

You use the Preferences option from the Options menu to customize processing by indicating default selections to apply for this run of the program.

| Field | Description |

|---|---|

| Save | Select this to save your selections against your operator code. Your selections will remain in force until changed. |

| Close | Select this to save the preferences for the current run of the program only. |

| Field | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| General | |||||||||

| Default WIP value based on | This enables you to indicate the default setting for

the option: WIP value based on in the

Part Billings pane.

|

||||||||

| Sales order creation | |||||||||

| Default order status |

Indicate the order status to use when creating a new sales order. The following statuses are available:

|

||||||||

| Default billing method | Indicate the preferred billing method to use when creating a new sales order, or appending lines to an existing sales order. | ||||||||

| Line detail defaults for SO creation | |||||||||

| Default product class for operations | Indicate the product class to use when creating miscellaneous charge lines for operations. | ||||||||

| Comment text for operations | You use this field to indicate the text you associated with operation miscellaneous charge lines. | ||||||||

| Create details for each operation | Select this to create a miscellaneous charge line for each operation allocated to the job. | ||||||||

| Summarize by product class | Set the default setting you require for the option: Summarize by product class in the Sales Order Billing Details screen. | ||||||||

| Use labor service charges |

Set the default setting you require for the option: Use labor service charges in the Sales Order Billing Details pane. This preference is only enabled if labor service charges are set to Prompt operator (Work in Progress Setup). |

||||||||

| Copy narrations attached to labor allocs | Set the default setting you require for the option: Copy narrations attached to labor allocations in the Sales Order Billing Details pane. | ||||||||

| Copy narrations attached to mat allocs | Set the default setting you require for the option: Copy narrations attached to material allocations in the Sales Order Billing Details pane. | ||||||||

| Sequence mats with assoc labor allocs | Set the default setting you require for the option: Sequence materials with associated labor allocations in the Sales Order Billing Details pane. | ||||||||

| Sales order update | |||||||||

| Default order status |

Indicate the default status to which an existing sales order must be set when the order is updated. This preference is applied when you update the sales order but do not use the Order Details pane.

The following options are available:

|

||||||||

| Apply recommended cost automatically |

Select this to apply the recommended cost when updating a sales order as long as the recommended cost is valid. This preference enables you to apply the recommended cost to the sales order without having to use the Order Details screen. If you select this preference, then the Apply Recommended function and the Unit cost - New field on the Update Sales Order screen are disabled, because the recommended cost will already have been calculated and you cannot change the new cost. |

||||||||

| G/L distribution | |||||||||

| Default G/L distribution account |

Indicate the default ledger account to be used when distributing entries to General Ledger. This does not apply when processing a job for a Capex item. In that case, your entry here is ignored and the General Ledger distribution account defaults to the Asset Clearing account if General Ledger integration is enabled. |

||||||||

| Kit issue | |||||||||

| Automatic kit issue of job required | Select this to be able to apply kit issues for outstanding materials and labour to a job for a non-stocked item during the part billing process. | ||||||||

-

If the GL analysis required option is enabled for a ledger account used in this program (General Ledger Codes or GL Structure Definition) then the Capture GL Analysis Entries program is displayed when you post the transaction, so that you can enter the analysis details. For a sub module transaction, the sub module must also be linked to the General Ledger in Detail at company level (General Ledger Integration) or at ledger account code level (General Ledger Codes or GL Structure Definition). GL analysis entries cannot be entered from sub modules if the sub module is linked to the General Ledger in Summary at company level or at ledger account code level.

Note that the GL analysis required option is ignored for all GL codes which are defined in General Ledger Integration. This applies even when the GL code is manually entered in a posting program. Although GL integration programs may be entered manually, they may also be called automatically by other programs or may be automated, which means that they can never be stopped to allow GL analysis entries to be captured.

If the GL analysis code used does not exist in the GenAnalysisCat table, then a message to this effect is displayed and the program will not prompt for analysis again. The GL journal will be created but not posted until the GL code, GL analysis code and GL journal are corrected.

The Ask Me Later function is only available when the option: Force GL Analysis - GL journal posting is enabled for the sub-module (General Ledger Integration).

General Ledger analysis entries are always distributed in the local currency, regardless of the currency in which the original transaction is processed.

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the eSignature Setup program.

| eSignature Transaction | Description |

|---|---|

| WIP Part billings |

Controls access to the Post function in the Part Billings program. |

Operator access to the following activities within this program can be restricted. You configure this using the Operators program.

| Activity | Description | ||||

|---|---|---|---|---|---|

| WIP Allow over-receipts for jobs | Controls whether an operator can over-receipt a job using the Job Receipts and Part Billings programs and the WIP job

receipts and WIP part billings business objects. When denied, the operator cannot receipt in a quantity which is greater than the Quantity outstanding or which is greater than the Quantity outstanding less the Quantity in inspection for the job. |

||||

| SO Maintain sales order after delivery note print |

Controls whether an operator can maintain order lines or cancel an order once the delivery note has been printed, or when it is ready to be invoiced. It also controls whether an operator can maintain detail lines for credit notes, debit notes and billings (i.e. the operator won't be able to add, change or cancel lines or add comments to these order types). This also includes:

|

||||

Password access to the following functions in this program may be defined in the Password Definition program. When defined, the password must be entered before you can access the function.

| Field | Description |

|---|---|

| WIP Posting to a previous month | This password restricts access to posting Work in Progress transactions to a previous period (see Multi-period accounting). |

| WIP Completing a job if outstanding po's/materials/operations | This password restricts access to using the Job ReceiptsJob Closure or Part Billings program to set a job to Complete when there are outstanding materials or operations to be issued to the job, or outstanding purchase orders against the job. |

| WIP Override on gross profit check in Part Billings | This password restricts access to overriding the gross profit margin check warning in the Part Billings program. This applies when the Calculate and check gross profit option is enabled and the gross profit calculated is higher or lower than the percentages defined (Work in Progress Setup). |

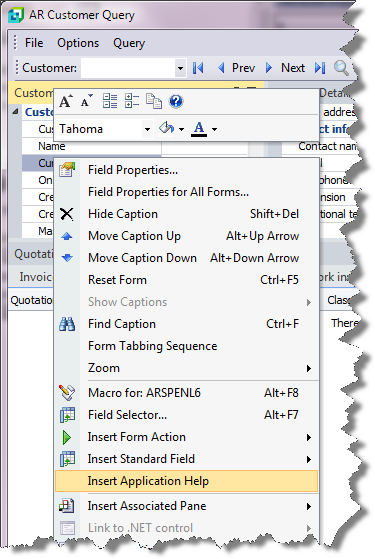

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.