You use this program to define non-merchandise charges that you can include on a customer's sales order.

| Field | Description | ||||

|---|---|---|---|---|---|

| Function | |||||

| Attached to a stock code |

Select this to assign service charges to a specific stock item. These charge lines are automatically calculated and inserted into the order for that particular stock item in the Sales Order Entry program.

You can add a maximum of 20 service charges against each stocked item when you attach a service charge to a specific stock item. |

||||

| Miscellaneous charge type |

Select this to define coded service charges that you can insert into an order when processing a miscellaneous charge line using the Sales Order Entry program. Miscellaneous charge types are also used for defining minimum order charges (see Customers - General Details - Minimum order rules). |

||||

| New | Select this to add a new charge code. | ||||

| Delete | Select this to delete the charge code currently displayed. | ||||

| Save | Select this to save the information you entered. | ||||

| Stock code |

Indicate the stock code to which you want to allocate the service charge(s). This only applies to maintaining a service charge attached to a stock code. |

||||

| Service charge |

Indicate the code for the service charge you want to add or maintain. This only applies when maintaining a miscellaneous service charge. This code is retrieved when processing a miscellaneous charge line during sales order entry or Part billings. Service charges assigned to a stock code are automatically calculated and inserted against the order as miscellaneous charge lines. |

||||

| Field | Description | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Service charge |

This indicates the code for the charge being maintained. |

||||||||||||||||||||||||||||||

| Calculation type | If you selected to maintain a Miscellaneous

service charge, then you can only select the

calculation types Fixed value,

User defined, Labor, Minimum

order value or Returnable

item. The calculation types available depend on whether the service charge is a miscellaneous charge type or it is attached to a stock code.

|

||||||||||||||||||||||||||||||

| Description |

Enter text to describe the charge code. This description is printed on the delivery note and invoice providing you do not require charge lines to be summarized on invoices. |

||||||||||||||||||||||||||||||

| Product class |

You cannot assign any of the following product classes to a service charge: _RND, _TAX, _FRT, _FIN, _DEP, _FED, _GST as these product classes are reserved for system use. Aside from the system-generated product classes mentioned above, the entry made at the Product class field is not validated. If you specify an invalid product class, then a warning message is displayed whenever this charge code is selected during processing in the Order Entry program. If you indicate that the charge line is to be summarized on the invoice (Other Options) then this is done by product class. |

||||||||||||||||||||||||||||||

| Currency | Assign a currency to the charge code. You can only access this field if you selected the option: Foreign currency sales required (Accounts Receivable Setup). |

||||||||||||||||||||||||||||||

| User defined prompt |

If you are defining a user-defined miscellaneous charge code, then enter the wording to display for this charge line at the quantity field in the Sales Order Entry program. If you are defining a miscellaneous service charge for the calculation type: Labor, then enter the wording to display for the quantity field in the SO Service Charges from Order Entry program. When this field is left blank, the wording 'Quantity' is used in the SO Service Charges from Order Entry program. |

||||||||||||||||||||||||||||||

| Tax information | |||||||||||||||||||||||||||||||

| Taxable | Select this to apply tax to the service charge. | ||||||||||||||||||||||||||||||

| Tax code |

Assign a tax code to the charge line. This applies only if your Tax system is set to Basic taxsystem or Tax by geographic area (Company Tax Options Setup). The tax code entered here is used for integration to General Ledger and Sales Tax analysis. |

||||||||||||||||||||||||||||||

| GST Taxable |

Select this to assign a GST code to the charge line that is used for integration to General Ledger and Sales Tax analysis. This applies only if your nationality code is set to CAN (System Setup) and the option: Canadian GST required is enabled (Company Tax Options Setup). |

||||||||||||||||||||||||||||||

| GST code |

Indicate the GST code you want to assign to charge lines in Sales Order entry (see Sales Order Entry). This applies only if your nationality code is set to CAN (System Setup) and the option: Canadian GST required is enabled (Company Tax Options Setup). |

||||||||||||||||||||||||||||||

| Stock code |

Enter the returnable item's stock code. For example, the re-usable container, crate, pallet, etc. The cost and the product class used for the service charge are defined against this stock code. The stock code must be defined as a returnable item (Stock Codes). This only applies for the Calculation type: Returnable item. |

||||||||||||||||||||||||||||||

| Fixed value |

Assign a fixed value to the charge line that will be used as the default entry inserted against the order. You can only access this field if you selected a calculation type of Fixed. |

||||||||||||||||||||||||||||||

| Fixed cost |

Enter the fixed cost in local currency that you want to assign to the charge line. This only applies for the Calculation type: Fixed. |

||||||||||||||||||||||||||||||

| Unit price |

Enter the unit price that you want to assign to the charge line. If you select the Apply quantity factor option (Other Options) then the value of the charge is calculated by either multiplying or dividing the unit price by the quantity entered during sales order entry. If you are defining a miscellaneous service charge, then you can only access this field if you selected a calculation type of User defined, Labor or Returnable item. If you are defining a service charge attached to a stock code, then you cannot access this field if you selected a calculation type of Fixed value, Fixed percent or Comment. |

||||||||||||||||||||||||||||||

| Unit cost |

Enter the unit cost in local currency that you want to assign to the charge line. If you are defining a miscellaneous service charge, then you can only access this field if you selected a calculation type of User defined. If you are defining a service charge attached to a stock code, then you cannot access this field if you selected a calculation type of Fixed value, Fixed percent, Comment, Minimum quantity or Returnable item. |

||||||||||||||||||||||||||||||

| Minimum quantity |

Indicate the minimum order quantity for which a charge must be raised. If the order quantity is less than or equal to the quantity entered in this field, then a service charge is raised against the sales order line. This field is only enabled if you selected the Calculation type: Minimum quantity. |

||||||||||||||||||||||||||||||

| Minimum charge |

Indicate the minimum service charge value to be invoiced to the customer. If the charge value calculated during sales order entry is less than the amount specified here then a warning message is displayed and the entry made here is automatically applied to the charge line. If you are defining a miscellaneous service charge, then you can only access this field if you selected a calculation type of User defined. If you are defining a service charge attached to a stock code, then you cannot access this field if you selected a calculation type of Fixed value, Fixed percent, Comment or Returnable item. |

||||||||||||||||||||||||||||||

| Maximum charge |

Indicate the maximum service charge value to be invoiced to the customer. If the charge value calculated during sales order entry exceeds the amount specified here then a warning message is displayed and the entry made here is automatically applied to the charge line. If you are defining a miscellaneous service charge, then you can only access this field if you selected a calculation type of User defined. If you are defining a service charge attached to a stock code, then you cannot access this field if you selected a calculation type of Fixed value, Fixed percent, Comment or Returnable item. |

||||||||||||||||||||||||||||||

| Percentage |

This option is only available if:

OR

|

||||||||||||||||||||||||||||||

| Percentage applied | Define how the percentage must be applied when the service charge is applied. | ||||||||||||||||||||||||||||||

| Less | Select this to deduct the percentage. | ||||||||||||||||||||||||||||||

| More | Select this to add the percentage. | ||||||||||||||||||||||||||||||

| Summarize charge line on invoice |

Select Yes if you want to summarize charge lines by product class within the Invoice totals section (see SO Document Formats) of the invoice. If you select this option, then you can only print a summary service charge line on the invoice, which is the product class and description for the service charge. If you select No, then each service charge line is printed as a miscellaneous charge line within the invoice details section (see SO Document Formats) of the invoice. |

||||||||||||||||||||||||||||||

| Include charge line in invoice total |

Select this to include the calculated value of the charge line in the invoice total calculation. If you do not select this option (i.e. you want to exclude the charge line from the invoice total calculation), then no General Ledger journal is created for the service charge, records are not output to the sales transaction file and sales analysis is not affected. This option is automatically selected for a Minimum order value calculation type and cannot be changed. |

||||||||||||||||||||||||||||||

| Allow review in order entry | Select this to be able to select the service charge lines to assign to orders before they are inserted. You can only select this option if you selected the option to attach service charges to a stock code.This option is automatically selected for a Minimum order valuecalculation type and cannot be changed. |

||||||||||||||||||||||||||||||

| Quantity factor information | |||||||||||||||||||||||||||||||

| Apply quantity factor |

Select this to apply a quantity factor to the charge line before calculating the value of the charge line. For example: If your service charge is a packing charge per crate, but you package in boxes (at 5 boxes per crate) then the value of the service charge is determined as follows:

You cannot access this field for Fixed value miscellaneous charges. This option is automatically selected for Returnable item service charges, because a quantity factor must be entered for returnable item charges. A factor of one can be entered. |

||||||||||||||||||||||||||||||

| Quantity factor |

Indicate the quantity factor you want to apply to the entry made at the Quantity field (Sales Order Entry) before calculating the value of the charge line. A quantity factor must be entered if you are defining a returnable item service charge. This factor may be one. |

||||||||||||||||||||||||||||||

| Method | Indicate whether you want to multiply or divide the entry made at the Quantity field (Sales Order Entry) by the Quantity factor specified. | ||||||||||||||||||||||||||||||

| Multiply | Select this to multiply the entry made at the Quantity field (Sales Order Entry) by the Quantity factor specified. | ||||||||||||||||||||||||||||||

| Divide | Select this to divide the entry made at the Quantity field (Sales Order Entry) by the Quantity factor specified. | ||||||||||||||||||||||||||||||

| Round to number of decimals | Indicate the number of decimals to which you want to round the quantity. A maximum of 3 decimals can be specified. | ||||||||||||||||||||||||||||||

| Rounding method | Indicate whether you want to round the quantity up or down to the nearest decimal or whole number. | ||||||||||||||||||||||||||||||

| Up | Select this to round the quantity up. | ||||||||||||||||||||||||||||||

| Down | Select this to round the quantity down. | ||||||||||||||||||||||||||||||

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the eSignature Setup program.

| eSignature Transaction | Description |

|---|---|

| SO Add service charge |

Controls the addition of service charges in the Service Charges program. |

| SO Change service charge |

Controls the maintenance of service charges in the Service Charges program. |

| SO Delete service charge |

Controls the deletion of service charges in the Service Charges program. |

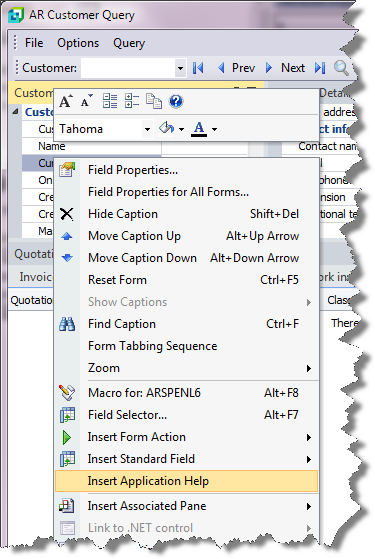

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.

![[Note]](images/note.png)