You use this program to create and maintain payment runs for processing payments to your suppliers.

The program enables you to create and run multiple payment runs simultaneously. Each payment run is assigned a unique payment run number and is created for a single bank, currency and payment type. You can therefore never have a single payment run containing payments from different banks, different currencies or different payment types.

This program controls the entire supplier payment cycle and enables you to:

- print a list of invoices that require payment

- release invoices for payment

- place invoices on hold to prevent future payment

- print a list of invoices released for payment

- pay the invoices released for payment

- print checks and/or remittance advices

-

process EFTs (Electronic Funds Transfers)

- print and reprint payment registers

- enter details of checks written manually to pay supplier invoices.

- enter details of checks/EFT payments you want to void.

- Toolbar and menu

- Payment Run Information

- Bank Information

- Payment Cycle Information

- Invoices Released for Payment

- Payment Run Statuses

- Notes and warnings

The security settings against your operator code and the eSignature settings, determine the availability of the various options.

| Field | Description |

|---|---|

| File | |

| Add New Payment Run | Select this to create and enter details for a new payment run. |

| Cancel Addition of Payment Run | Select this to abandon the addition of the current payment run. This only applies before you save the payment run information. Once saved, you need to delete the payment run if it is not required. |

| Delete Payment Run |

Select this to delete the current payment run. Only payment runs in a status of Open can be deleted. When you delete a payment run, invoices released in the run are cleared from their Released status and set back to Normal. In addition, void payment and manual payment information against invoices in the run is also cleared. See Activity considerations in Notes and warnings. |

| End Payment Run | Select this to end the current payment run and to save

the information you entered. You are prompted to allocate a unique payment run number/code to the payment run when you create a new payment run and your AP payment run - numbering method is set to Manual (Set Key Information). |

| Exit | Select this to exit the program. |

| Payment Cycle | |

| Execute Payment Run | Select this to use the Execute AP Payment Run program to pay the

invoices you released for payment. This option is only enabled if the payment run is in a status of Open and invoices have been released for the run. When you select this option, the system compares the posting period of the payment run to the posting period against the invoices to be paid. Any invoice with a posting period after (later than) the payment run period is ignored and removed from the payment run. |

| Print Checks/Remittances | Select this to use the AP Check and Remittance Print program to print checks

and/or remittance advices for invoices that have been paid.

If your payment run is for Manual Checks, then you do not need to run the AP Check and Remittance Print program (before running the AP Payment Register program), unless you want to produce remittance advices for the manual checks. When processing system checks, you can only reprint checks as long as you have not printed the Payment Register for those checks. Remittances can, however, be reprinted when the Payment Register has been printed and the payment run is in a status of Complete. EFT remittances can be reprinted after the Payment Register has been printed. To reprint checks/remitances, you need to select the Payment Run Maintenance option form the Functions menu. |

| CB Integration/Print Pay Register | Select this to use the AP Payment Register program to update the

Cash Book and print a list of checks issued and voided as well

as EFT (Electronic Funds Transfers) payments processed.

This option only applies when Accounts Payable is integrated to Cash Book (General Ledger Integration). When you select this option:

If you are processing EFT payments, you need to use the EFT Payments Extract program to extract the payments into a batch for payment by the bank. This option is only enabled when the payment run is in a status of Paid (for Manual check payment runs) or Printed. |

| Print Payment Register |

Select this to use the AP Payment Register Reprint program to generate a list of checks issued and voided as well as EFT (Electronic Funds Transfers) payments processed. This option only applies when Accounts Payable is not integrated to Cash Book (General Ledger Integration) and is only enabled when the payment run is in a status of Paid (for Manual check payment runs) or Printed. If you are processing EFT payments, you need to use the EFT Payments Extract program to extract the payments into a batch for payment by the bank. You can select this option more than once to reprint the Payment Register for the current payment run. You can also use the Reprint > Reprint Payment Registers option or the AP Payment Register Reprint program to reprint payment registers. |

| Query | |

| Check Query | Select this to use the AP Browse on Checks program to view details of checks and EFTs created from payment runs. |

| Reprint | |

| Selected Payment Registers | Select this to reprint a selection of payment registers

previously printed. See Reprint Options. The AP Payment Register Reprint program can also be used to reprint payment registers. |

| Reports | |

| Cash Requirements | Select this to print a list of cash requirements for

each supplier. Refer to Cash Requirements for details. |

| Release Schedule | Select this to produce a list of invoices that require

payment. Refer to AP Release Schedule for details. |

| Released Payments Report | Select this to print a list of all the invoices that

you have released for payment. Refer to Released Payments Report for details. |

| Payment run | Enter the code of the payment run to

maintain. This is the unique payment code assigned to the payment run when it was created. When you initially load the Payment Cycle Maintenance program, focus is set on this field. If your payment run numbers are set to manual numbering (Set Key Information) then entering a new, unique run number in this field enables the Payment Run Information fields so you can add the details for the new payment run. If your run numbers are set to automatic and you enter a non-existent run number, an error message is displayed indicating that the run number is not on file. To add a new payment run, you need to use the Add option on the toolbar or the Add New Payment Run option from the File menu. Payment run numbers are allocated according to the numbering method defined for payment runs (Set Key Information). If you enter an existing payment run number, the program assumes you want to maintain that payment run. You cannot maintain a payment run to which you do not have access according to the Operator group defined against that payment run. All payments within a payment run are created for a single bank, currency and payment type (i.e. a payment run cannot contain payments from different banks or for different currencies or payment types). See Activity considerations in Notes and warnings. |

| Add | Select this to create and enter details for a new payment run. |

| Cancel | Select this to abandon the addition of the current payment run. This only applies before you save the payment run information. |

| Delete |

Select this to delete the current payment run. Only payment runs in a status of Open can be deleted. When you delete a payment run, invoices released in the run are cleared from their Released status. In addition, void payment and manual payment information against invoices in the run is also cleared. See Activity considerations in Notes and warnings. |

| End Payment Run | Select this to end the current payment run and to save

the information you entered. If you are creating a new payment run and your AP Payment run - Numbering method is set to Manual (Set Key Information) then you are prompted to allocate a unique payment run number/code to the payment run. |

| Status | This is displayed at the bottom of the screen and

indicates the current status of the payment run. The status of a payment run determines which functions are available (enabled) and which are not available (disabled). Refer to Payment Run Statuses for details on payment run statuses. |

This screen is displayed when you select the Reprint > Selected Payment Registers option.

These options enable you to indicate the criteria for reprinting AP Payment Registers.

The AP Payment Register Reprint program can also be used to reprint AP Payment Registers.

| Field | Description |

|---|---|

| Period selection | |

| Period | Enter the financial period for which you want to reprint the Payment Register(s). |

| Year | Enter the financial year for the financial period for which you want to reprint the Payment Register(s). |

| Check register selection | |

| All | Select this to reprint all Payment Registers for the period and year entered in the previous fields. |

| Range | Select this to reprint the Payment Register(s) for a range of check registers within the period and year selected. |

| Single | Select this to reprint a single Payment Register within the period and year selected. You indicate this Payment Register number in the From check register field below. |

| From check register | Enter the first Payment Register number in a range of register numbers you want to reprint. If you selected to reprint a single register, then you enter that register number in this field. |

| To check register | Enter the last Payment Register number in a range of register numbers you want to reprint. |

| Select this to reprint the Accounts Payable Payment Register(s) according to the selection criteria you indicated. | |

| Close | Select this to accept your selections and to return to the previous screen. |

You use the fields in this pane to enter the payment run details. These fields are only enabled once you Enter or Tab off the Payment run field or you select the Add option from the toolbar or the Add New Payment Run option from the File menu.

| Field | Description |

|---|---|

| Bank | Enter a valid SYSPRO bank for which you want to create

a payment run. This field defaults to the default bank defined against your operator code, if defined (Operators - Defaults). You can only enter a bank code to which you have been granted access (Operators - Security). This field is only enabled when you create a new payment run. |

| Operator group | Optionally enter a valid SYSPRO operator primary group.

This is used to determine the operators who will be allowed to

maintain the payment run. If this field is left blank, then the payment run can be maintained by any operator who has access to the Payment Cycle Maintenance program. If you enter an operator group, the payment run can only be maintained by:

|

| Currency | This indicates the currency for the payment run and

defaults to the currency defined against the bank. If you entered a local currency bank at the Bank field, then you can enter any valid SYSPRO currency in this field (see Currencies). If you entered a foreign currency bank at the Bank field, then this field defaults to the currency of the bank and cannot be changed. |

| Payment type | Indicate the type of payment run you want to create.

This option is only enabled when you create a new payment run. The payment type you select determines which options and functions are enabled/disabled at the Release Invoices function in the Invoices Released for Payment listview. |

| System Checks |

Select this to create a payment run to pay supplier invoices using system checks. Suppliers for whom the option: EFT payments required is set to Yes (Suppliers) can be paid by system check if:

|

| Manual Checks | Select this to create a payment run to record checks written manually to pay supplier invoices. |

| Void Checks | Select this to create a payment run to cancel a check

or EFT (Electronic Funds Transfer) already issued to a

supplier (e.g. the check has been lost or dishonored). See

AP Void Checks. If a payment run consists of many checks, then each check must be voided separately. The purpose of the Void Checks function is not to reverse a payment run that has been executed in error. After voiding the check or EFT transaction, you can create a payment run to issue a replacement check or re-process an EFT transaction. |

| EFT Payments |

Select this to create a payment run to pay supplier invoices via Electronic Fund Transfers (EFTs). This only applies if the option: EFT payments required is enabled against the bank specified for the payment run (Banks). If the bank you entered does not require EFT payments, then an error message is displayed when you end the payment run or you select the Release Invoices option. In addition, the option: EFT payments required (Suppliers) must be enabled against the supplier you include in the payment run. See Activity considerations in Notes and warnings. |

| Payment reference |

Enter a reference for the payment. Any reference made against the manual check will override the reference entered here. |

The information in this pane relates to the Bank you entered in the Payment Run Information pane.

| Column | Description |

|---|---|

| Bank |

This indicates the code of the SYSPRO bank for which you are processing the payment run. |

| Description | This indicates the description of the SYSPRO bank for which you are processing the payment run. |

| Currency |

This indicates the currency of the bank. |

| Bank Account | This indicates the bank account number assigned to the account by the bank. |

| Telephone | This indicates the bank's telephone number. |

The fields in this pane display information about the status of the payment run.

These fields are not updated with the payment cycle value until the Execute Payment Run option has been run. They will therefore reflect as zero until the payment run is in a status of Paid, Printed, Voided or Complete.

The values in some fields are only displayed when the relevant stage in the payment cycle is reached.

| Column | Description |

|---|---|

| Payment status | This indicates the current status of the payment run. See Payment Run Statuses. |

| Payment posting period | This indicates the month and year into which the transactions for the payment run were processed. |

| Payment date | This indicates the payment date for the payment run. |

| Gross payment |

This indicates the gross total value of invoices released for payment for all supplier(s). This excludes invoices placed on hold. |

| Discount | This indicates the total discount for the entire payment run (for all suppliers included in the payment run). |

| Withholding tax |

This indicates the withholding tax value applicable for the released supplier invoice(s) in the payment run. This only applies when the Withholding tax required option is enabled and the AP withholding accounting basis is set to Payment (Company Tax Options Setup). Withholding tax is automatically calculated when all of the following apply:

Withholding tax is not calculated if the option: Automatic calculation of withholding tax is not enabled, even when the option Withholding tax required is enabled. |

| Net payment | This indicates the total net payment amount for the entire payment run (for all suppliers included in the payment run). |

![[Note]](images/note.png)

|

|

|

If, after you released invoices for payment, you select the End Payment Run, Delete Payment Run, Execute Payment Run or Exit option from the menu or toolbar, then the program calculates the total Net value of invoices released per supplier. If this results in a negative value and you are not processing a Void check payment run, then the error message "A negative check value is invalid" is displayed and the option you selected is not processed. In addition, if the total net value of invoices released per supplier is zero, then the error message: "A zero check value is invalid" is displayed. You cannot save the payment run until the net value released per supplier is greater than zero. |

|

The functions available for a System checks payment run are: Change, Change Exchange Rate (for a foreign currency invoice), Remove Invoice, Hold Invoice and Remove Supplier.

The function available for a Manual checks payment run is Clear Manual Check. The function available for a Void checks payment run is Clear Void Check.

You cannot release invoices:

- for suppliers on hold (Suppliers)

- if you are denied access to the bank defined against the supplier or against the invoice

- if you are denied access to the branch defined against the supplier or against the invoice

- if the bank against the supplier does not match the bank of the payment run

- if the currency of the supplier does not match the currency of the payment run

-

that have been added to another payment run which is not complete. Once a payment run is in a Printed status, then the invoices are moved back to a Normal status and you can post another payment against those invoices.

| Field | Description | ||||

|---|---|---|---|---|---|

| Release Invoices | Select this to indicate the supplier invoices you want to include in the payment run. If you select this option when adding a new payment run, you are prompted to save the payment run details before continuing.By default, foreign currency invoices are released at either the invoice exchange rate or the current currency exchange rate on the Currency table, depending on your selection at the Payment release and voiding option (Accounts Payable Setup). You use the drop-down menu to select the option you require. If you select the Release Invoices option itself, then the program automatically selects the System Checks/EFT - Review Invoices menu option. |

||||

| System Checks/EFT - Review Invoices | Select this to indicate the supplier invoices you want to pay using either system checks or Electronic Fund Transfers (EFTs). Selecting this option enables you to use the AP Release Invoices to Pay by Review program to review invoices by supplier and manually select the invoice(s) you want to release for payment.This option is only enabled if the Payment type is set to System checks or EFT Payments and the payment run is in a status of Open. |

||||

| System Checks/EFT - Automatic Release | Select this to select the supplier invoices you want to pay using either system checks or Electronic Fund Transfers (EFTs). Selecting this option enables you to use the AP Automatic Release of Invoices to Pay program to select multiple suppliers and their invoices to release for payment.Only includes invoices for which the supplier's bank matches the bank defined against the payment run are included for release. This option is only enabled if the Payment type is set to System checks or EFT Payments and the payment run is in a status of Open. |

||||

| Manual Checks | Select this to use the AP Manual Check Entry program to enter

details of checks written manually to pay supplier

invoices. This option is only enabled when you are maintaining a payment run with Payment type: Manual checks. In addition, the payment run must be in a status of Open or New. |

||||

| Void Checks | Select this to use the AP Void Checks program to enter the

details of checks/EFT payments you want to void.

|

||||

| Change | Select this to maintain the Gross

payment and Discount amount

for the currently highlighted invoice in the Invoices Released

for Payment listview (see Change Payment Details).

See Activity considerations in Notes and warnings. |

||||

| Change Exchange Rate | Select this to change the exchange rate to be used for

the payment (see Change Exchange Rate). This option is only enabled if the payment run is for a foreign currency and the exchange rate against this currency is not set to Fixed (Currencies). The exchange rate can only be changed for invoices that are in a status of Open. See Activity considerations in Notes and warnings. |

||||

| Remove | You use the drop-down menu to select the option you require. If you select the Remove option itself, then the program automatically selects the Remove Invoice option. | ||||

| Remove Invoice |

Select this to remove selected invoice(s) from being released for payment. If you highlight a supplier invoice in the Invoices Released for Payment listview and select the Remove Invoice option, then that invoice is removed from the payment run. The invoice is removed from the listview and theNet payment value for the supplier and for the payment run is adjusted accordingly. In addition, the Released status is removed from the invoice. An invoice can only be removed from the Invoices Released for Payment listview if its status is Open. If you want to remove a supplier from the payment run, then all the supplier's invoices must be in a status of Open. See Activity considerations in Notes and warnings. You can use your mouse pointer together with the Ctrl and Shift keys to highlight the invoices you want to remove from the payment. You can then select the Remove Invoice option to remove the selected invoices. |

||||

| Remove Supplier | Select this to remove the supplier from the payment run. You remove all invoices for a supplier by highlighting one of the supplier's invoices in the listview and selecting the Remove Supplier option. When you select this option, the highlighted supplier and all the supplier's released invoices are removed from the payment run. The status of the supplier's invoices is reset to Normal and the Payment Cycle information for the payment run is updated accordingly. If the payment run is for Manual checks, then the manual check information for all checks for the selected supplier is removed. Invoices can only be removed from the Invoices Released for Payment listview if their status is Open. If you want to remove a supplier from the payment run, then all the supplier's invoices must be in a status of Open.See Activity considerations in Notes and warnings. |

||||

| Hold Invoice | Select this to set the currently highlighted invoice in

the Invoices Released for Payment listview on hold. The invoice on hold is removed from the listview and the Net payment value for the supplier and for the payment run is adjusted accordingly. The status of the invoice is changed from Released to Hold. You use the AP Release Invoices to Pay by Review program to remove the hold status. You can only place an invoice on hold if it is in a status of Open. See Activity considerations in Notes and warnings. |

||||

| Clear Manual Check | Select this to delete the currently highlighted invoice

from the Invoices Released for Payment

listview. The invoice is removed from the listview and from the payment run. You can only remove an invoice if its status is Open. See Activity considerations in Notes and warnings. |

||||

| Clear Void Check | Select this to delete the currently highlighted invoice

from the Invoices Released for Payment

listview. The invoice is removed from the listview and the payment run and its status is changed from voided to normal. In addition, the payment details for the payment run are updated accordingly. You can only remove an invoice if its status is Open void. See Activity considerations in Notes and warnings. |

||||

This listview displays the invoices released for payment or for voiding for the selected supplier(s).

You can customize the listview to display the information with subtotals per supplier as follows:

- Use your right mouse button on the Supplier column heading and select the Group by This Field option.

-

Use your right mouse button on the Gross payment column heading and select Autosum > Column Sum.

Repeat this for the Discount and Net payment columns.

The column totals for all suppliers are displayed at the bottom of the listview.

-

Use your right mouse button on the Gross payment column heading and select Autosum > Group Totals.

Repeat this for the Discount and Net payment columns.

The subtotals for each supplier are displayed.

The following information is included in this listview:

| Column | Description |

|---|---|

| Withholding tax |

This indicates the withholding tax value applicable for the invoice and only applies when the Withholding tax required option is enabled and the AP withholding account basis is set to Payment (Company Tax Options Setup). Withholding tax is automatically calculated if all of the following apply:

Withholding tax is not calculated if the option: Automatic calculation of withholding tax is not selected, even if the option Withholding tax required is selected, however withholding tax can be calculated using the Change option. The withholding tax values that are saved when the invoice was initially released are displayed as default, but can be changed if required. |

| Withheld at capture | (SQL only) This indicates the withholding tax portion included in the gross amount for the invoice. It only applies when the At point of capture withholding tax option (Company Tax Options Setup) is enabled. |

This screen is displayed when you select the Change option from the Invoices Released for Payment listview. It enables you to change the invoice amount to pay, the discount and optionally the tax for the released invoice.

| Field | Description | ||||

|---|---|---|---|---|---|

| Save | Select this to save the information you entered and to return

to the previous screen. If the settlement discount Tax code is spaces, a warning message is displayed indicating that the settlement discount Tax portion will not be included in the Tax Return report. |

||||

| Cancel and Close | Select this to return to the previous screen, without making any changes to the invoice. | ||||

| Payment information | |||||

| Supplier | This indicates the supplier for the invoice you are maintaining. | ||||

| Invoice | This indicates the number of the released invoice you are maintaining. | ||||

| Gross payment | Enter the new gross payment value for the

invoice. Changing the invoice payment amount is typically done to process a prepayment to the supplier on a zero value invoice. |

||||

| Discount amount | Enter the settlement discount amount for the

invoice. The Tax on settlement discount fields are not enabled when this value is zero. |

||||

| Tax on settlement discount | This section is only enabled when the Discount amount is not zero. | ||||

| Tax code | This is the tax code to use to calculate the Tax portion on

the settlement Discount amount. This defaults

to the Default tax code for settlement discount

(Accounts Payable Setup) but can be changed. This can be a valid tax code or spaces. When the code is spaces, the Tax portion is not included on the Tax Return report.

|

||||

| Tax portion |

This indicates the tax amount applicable to the settlement Discount amount. It is automatically calculated by the system based on the Default tax code (Accounts Payable Setup). The rate to use is determined by the Calculate tax using historical rates option. When this option is enabled, the Invoice date is used to ascertain the tax rate at that date. When this option is disabled, the current tax rate against the tax code is used (Tax Code Setup).

The Tax portion is not automatically calculated when you manually enter a Tax code. You need to use the Calculate function to calculate the appropriate Tax portion. The Tax portion reduces the Discount amount posted to the General Ledger. Example: The supplier takes a 10 pound discount on a payment inclusive of tax. The tax is 10%. The tax portion (0.91) reflects as tax on settlement discount in the ledger. The discount portion is reduced by the tax amount and is therefore calculated as 10 - 0.91 = 9.09 (i.e. Discount amount less Tax portion of settlement discount). This field is only available for a local currency payment run and when the setup option: Settlement discount - Request tax amount is enabled (Accounts Payable Setup). This option is not available when the Withholding tax system is required (Company Tax Options Setup). |

||||

| Calculate | Select this to calculate the appropriate Tax portion and QST portion when you manually enter or change the Tax code or QST code. | ||||

| QST code | This indicates the QST tax code to use to calculate the QST

settlement amount. This defaults to the Default QST

code for settlement discount (Accounts Payable Setup) but can be changed. This can be a valid QST code or spaces.

|

||||

| QST portion |

This indicates the QST tax amount applicable to the settlement Discount amount. It is automatically calculated by the system based on the Default QST code (Accounts Payable Setup). The rate to use is determined by the Calculate tax using historical rates option. When this option is enabled, the Invoice date is used to ascertain the QST rate at that date. When this option is disabled, the current tax rate against the QST code is used (Tax Code Setup). The QST portion is not automatically calculated when you manually enter a QST code. You need to use the Calculate function to calculate the appropriate QST portion.

The formulae for this calculation are as follows:

This field is only displayed when the following options are enabled in the Accounts Payable Setup program:

|

||||

| Withholding tax information | These fields are only available when the Company Tax Options Setup options: Withholding tax required and Accounting basis - Payment are enabled and a valid withholding tax code is defined against the supplier (Suppliers). | ||||

| Taxable amount |

Indicate the amount of the transaction which is subject to tax. Alternatively, you can use the Calculate option to calculate the taxable amount. |

||||

| Calculate | Select this to automatically calculate the Taxable

amount, based on the current transaction values. If the option: Automatic calculation of withholding tax is not selected, then the taxable amount is calculated as: (Gross payment - discount amount). If the option: Automatic calculation of withholding taxis selected, then the taxable amount is calculated as: (Gross payment - normal invoice tax amount - discount amount). |

||||

| Withholding tax code | This defaults to the Withholding tax code defined against the supplier (Suppliers) but can be changed. | ||||

| Tax amount |

Indicate the amount of tax you are withholding from the invoice being paid. Alternatively, you can use the Calculate option to calculate the Tax amount. The rate used depends on the tax code entered and your selection at the Use current tax rate % option. The tax amount is re-calculated and redisplayed each time you select/deselct the Use current tax rate % option. |

||||

| Calculate | Select this to automatically calculate the Tax

amount, based on the current transaction values entered.

The tax amount is calculated as: ((Taxable amount * withholding tax rate) / 100). The withholding tax rate used depends on the tax code entered and your selection at the Use current tax rate % option as follows:

|

||||

| Use current tax rate % | Select this to calculate the tax amount using the

Current tax rate % defined against the tax code

(Tax Code Setup). If you do not select this option, then the tax amount is calculated using the Invoice tax rate %. The tax amount is automatically re-calculated and redisplayed each time you select/deselct the Use current tax rate % option. |

||||

| Invoice tax rate % | This indicates the withholding tax rate currently held against the invoice. | ||||

| Current tax rate % | This indicates the tax rate currently applicable as defined against the tax code (Tax Code Setup). | ||||

This screen is displayed when you select the Change Exchange Rate option from the System Checks/EFT menu. It enables you to change the exchange rate for a foreign currency invoice payment, providing the exchange rate for the currency is not defined as Fixed (Currencies).

The exchange rate can only be changed for invoices that are in a status of Open.

| Field | Description | ||||

|---|---|---|---|---|---|

| Save | Select this to apply the new exchange rate according

to your selections. A warning message is displayed if you select to change the exchange rate against an invoice processed with a fixed exchange rate. |

||||

| Change Period | Select this to use the Change Posting Period program to change the

period to which to post the exchange rate variance

transaction.

|

||||

| Cancel and Close | Select this to return to the previous screen without changing the exchange rate. | ||||

| Variance posting period | |||||

| Posting month | This indicates the period into which the exchange

rate variance transaction must be posted. This only applies if you selected the option: Apply rate to outstanding invoice balance option. |

||||

| Posting year | This indicates the year into which the exchange rate

variance transaction must be posted. This only applies if you selected the option: Apply rate to outstanding invoice balance option. |

||||

| Exchange rate information | |||||

| Exchange rate | Enter the exchange rate required for the invoice

payment. This defaults to the invoice rate. |

||||

| Apply rate to outstanding invoice balance | Select this to apply the Exchange

rate in the previous field to the entire invoice

balance of the currently selected invoice. If you select this option, then:

If you do not select this option, then the new exchange rate is applied to the payment (or part payment) that is being made against the selected invoice, and the exchange variance is posted to the Realized variance account defined in the AP Currency Variance GL Interface program (General Ledger Integration - Variance Interfaces). Any variances that arise are assigned to the current Accounts Payable period. If the option: Create general ledger journal is not enabled for Accounts Payable (General Ledger Integration) then run the AP Payments GL Integration program to create the journal for this transaction. If the option: Post general ledger journal is not enabled for Accounts Payable (General Ledger Integration) then use the GL Journal Entry or GL Post Multiple Normal Journals program to post the journal into the General Ledger. |

||||

The status for a payment run indicates the current stage of the payment run. The status changes according to the functions performed against the run.

The current status of a payment run dictates which functions are available (enabled) and which are not available (disabled).

The following table indicates the possible statuses for a payment run:

| Status | Description | Function Performed |

|---|---|---|

| New | The payment run is currently being created. No records have yet been created. |

Add New Payment Run for any Payment type. |

| Open (O) | The payment run was created and saved. Records are created. |

End Payment Run for Payment types: System checks, Manual checks or EFT payments. |

| Open void (O) | The payment run was created and saved. | Void Check Entry and End Payment Run for Payment type: Void checks |

| Paid (P) | Invoices released for payment are recorded as paid. | Execute Payment Run for Payment types: System checks, Manual checks or EFT payments. |

| Voided (P) | Check/EFT recorded as voided. | Execute Payment Run for Payment type: Void checks. |

| Printed (C) | Checks and/or Remittance advices have been printed or Checks/EFTs have been voided. | Print Checks/Remittances for all Payment types. |

| Complete (L) | The Payment Register has been printed for the payment run. | Print Payment Register for all Payment types. |

-

This program is subject to resource locking, which means that only one operator at a time can access a specific payment run number.

In addition, the supplier transactions are locked and no payment transactions can be processed for the supplier until the operator who caused the lock has completed the transaction.

-

If the GL analysis required option is enabled for a ledger account used in this program (General Ledger Codes or GL Structure Definition) then the Capture GL Analysis Entries program is displayed when you post the transaction, so that you can enter the analysis details. For a sub module transaction, the sub module must also be linked to the General Ledger in Detail at company level (General Ledger Integration) or at ledger account code level (General Ledger Codes or GL Structure Definition). GL analysis entries cannot be entered from sub modules if the sub module is linked to the General Ledger in Summary at company level or at ledger account code level.

Note that the GL analysis required option is ignored for all GL codes which are defined in General Ledger Integration. This applies even when the GL code is manually entered in a posting program. Although GL integration programs may be entered manually, they may also be called automatically by other programs or may be automated, which means that they can never be stopped to allow GL analysis entries to be captured.

If the GL analysis code used does not exist in the GenAnalysisCat table, then a message to this effect is displayed and the program will not prompt for analysis again. The GL journal will be created but not posted until the GL code, GL analysis code and GL journal are corrected.

The Ask Me Later function is only available when the option: Force GL Analysis - GL journal posting is enabled for the sub-module (General Ledger Integration).

General Ledger analysis entries are always distributed in the local currency, regardless of the currency in which the original transaction is processed.

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the eSignature Setup program.

| eSignature Transaction | Description |

|---|---|

| AP Payment run entry |

Controls access to the Add a New Payment Run function of the Payment Cycle Maintenance program. |

| AP Delete payment run |

Controls access to the Delete This Payment Run function of the Payment Cycle Maintenance program. |

| AP Release invoices by review |

Controls access to the System Checks/EFT - Review Invoices function of the Payment Cycle Maintenance and AP Release Invoices to Pay by Review programs. |

| AP Automatic invoice release |

Controls access to the System Checks/EFT - Automatic Release function of the Payment Cycle Maintenance and AP Automatic Release of Invoices to Pay programs. |

| AP Manual check entry |

Controls access to the Manual check entry function of the Payment Cycle Maintenance and AP Manual Check Entry programs. |

| AP Void check entry |

Controls access to the Void checks entry function of the Payment Cycle Maintenance and AP Void Checks programs. |

| AP Execute payment run |

Controls access to the Execute payment run function of the Payment Cycle Maintenance and Execute AP Payment Run programs. |

| AP Print checks/remittances |

Controls access to the Print Checks/Remittances function of the Payment Cycle Maintenance and AP Check and Remittance Print programs. |

| AP Integration to Cash Book |

Controls access to the Integration to Cash Book function of the Payment Cycle Maintenance and AP Payment Register programs. |

| AP Invoice placed on hold |

Controls access to the Hold function in the Payment Cycle Maintenance, AP Release Invoices to Pay by Review, AP Invoice Posting and AP Supplier Invoices programs. |

Operator access to the following activities within this program can be restricted. You configure this using the Operators program.

| Activity | Description |

|---|---|

| AP Delete payment run | Controls whether an operator can delete a payment run using the Payment Cycle Maintenance program. |

| AP Change/remove/hold invoices from payment run |

Controls whether an operator can:

|

| AP Clear manual/void check payment information from payment run | Controls whether an operator can use the Payment Cycle Maintenance program to:

|

| AP Change exchange rate of invoices in payment run | Controls whether an operator can use the Change Exchange Rate option in the Payment Cycle Maintenance program to change the exchange rate to use for a payment. |

| AP EFT supplier invoice payment | Controls whether an operator can add or maintain an EFT payments type payment run in the Payment Cycle Maintenance program. |

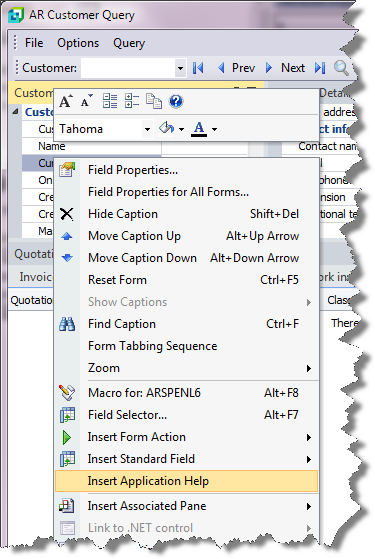

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.