You use this program to enter suppliers individually and to perform the following functions for each supplier:

- manually release invoices for payment

- hold invoices to prevent future payment

- maintain invoices to release

-

clear invoices that have been previously released

- clear invoices that have been previously placed on hold.

Indicate the criteria to use to include invoices in the manual payment release review.

| Field | Description |

|---|---|

| File | |

| Cancel Review | Select this to abandon all changes and to start a new review. |

| Save Review Changes |

Select this to release all the invoices you selected for payment and save changes you made to any of the invoices. Invoices previously released against the payment run are not over-written. Additional released invoices are merely added to the set of released invoices for the payment run. Invoices that are on hold cannot be released until the hold is cleared. The suppliers and invoices released for payment are displayed in the listview of the Payment Cycle Maintenance program. Invoices released in error can be removed from the release payment list using the Clear function from this program or the Remove option from the Payment Cycle Maintenance program. |

| Exit | Select this to return to the previous screen. |

| Supplier | Enter the supplier for whom you want to release the

invoices for payment. A valid SYSPRO supplier code must be entered. You can only edit the review options once you Tab or Enter off the Supplier field. The currency defined against the supplier must be the same as the currency of the payment run. If you are processing an EFT payments type payment run, then the option: EFT payments required must be selected against the supplier. |

| Cancel | Select this to abandon all changes and to start a new review. |

| Save | Select this to release all the invoices you selected for payment and to save any changes made to any of the invoices. Invoices that are on hold cannot be released until the hold is cleared. Invoices released in error can be removed from the release payment list using the Clear function from this program or the Remove option from the Payment Cycle Maintenance program. |

| Field | Description |

|---|---|

| Supplier | This indicates the code of the supplier for whom you want to release the invoices for payment. |

| Supplier name | This indicates the name of the Supplier. |

| Due date | Indicate the dates to use to include invoices for release. Any non-zero balance invoice with a due date that is equal to or after the From date and prior to the Next payment date will be released for payment. |

| From due date | This indicates the earliest date that the program must use to ascertain whether to select an invoice to display in the review list. |

| To next payment date | This is the highest (oldest) date that the program must

use to ascertain whether an invoice is displayed for release.

This date must be later than the From due date. |

| Branch | |

| Supplier branch selection | When processing invoices against suppliers using the

AP Invoice Posting program, you can specify the branch to use for a

particular invoice. This option enables you to indicate the AP branch(es) for which you want to release invoices. The selection is based on the branch defined against the invoice and not on the branch defined against the supplier. An error message is displayed if you select a branch to which you are denied access. |

| Include invoices | Indicate which invoices you want to include in the list of supplier invoices to release for payment. |

| Past due | Select to include invoices that are past due for

payment. If an invoice has a due date that is prior to the date entered in the From due date field above, it is included in the review list. |

| Due | Select to include invoices that are due for

payment. If an invoice has a due date that is greater than or equal to the From due date and is prior to the To next payment date entered above, it is included in the review list. |

| Discountable | Select this to include discountable invoices. If an invoice has a discount date that is greater than or equal to the From due date and is prior to the To next payment date entered above, it is included in the review list. |

| Released (not due) | Include invoices that are not due for payment, but which you have released manually in a previous run of the program. |

The following information is included in this pane:

| Column | Description |

|---|---|

| Payment run | This indicates the payment run code into which you are releasing the invoices for payment. |

| Currency | This indicates the currency of the payment run and currency in which payment will be made. |

| Bank | This indicates the code of the bank from which the payment will be made. |

| Bank name | This indicates the name of the bank from which the payment will be made. |

This listview displays the invoices selected according to the Review Options you specified.

![[Note]](images/note.png)

|

|

|

Not all columns are displayed in the list view by default (see Listview functions). |

|

| Toolbar functions | Description |

|---|---|

| Start Review | Select this to view the invoices selected according to the criteria you specified. |

| Select All | Select this to mark all the invoices in the listview as

selected for payment (released). A tick is placed in the Released column of the listview for all invoices, except those that are on hold. |

| Deselect All |

Select this to deselect any selections that you made in the invoice list. No invoices remain marked for release. See Activity considerations in Notes and warnings. |

| Change |

Select this to change the highlighted invoice's gross amount and/or discount amount. See Change Payment Details. See Activity considerations in Notes and warnings. |

| Include | Select this to include an invoice that has an Invoice due date outside the From due date and To next payment date criteria specified. |

| Column headings | Description |

|---|---|

| Released |

A tick in the checkbox in this column indicates that you selected the invoice for release. This option is not enabled for invoices which are On hold. See Activity considerations in Notes and warnings. |

| On hold |

Select this to place the invoice on hold. Invoices that are on hold cannot be released until the hold is cleared. See Activity considerations in Notes and warnings. |

| Supplier invoice | This indicates the supplier's invoice number. |

| Original amount | This indicates the original value of the invoice. |

| Invoice balance | This indicates the amount not yet paid against the invoice. |

| Invoice date |

This indicates the date of the invoice. This date is used to determine the tax/QST rate for Settlement discount when the Calculate tax using historical tax rates option is enabled in the Accounts Payable Setup program. |

| Discount date |

This indicates the settlement discount date for the invoice. The system calculates this date using the From due date and the To next payment date you entered as follows:

|

| Reference | This indicates the reference entered against the invoice when it was captured. |

| Tax code | This indicates the tax code |

| Taxable amount | This indicates the amount of the transaction subject to tax. |

| Withheld at capture |

(SQL only) This indicates the withholding tax portion included in the gross amount for the invoice. It only applies when the At point of capture withholding tax option (Company Tax Options Setup) is enabled. |

| Withholding tax |

This indicates the withholding tax value applicable for the invoice and only applies when the Withholding tax required option is enabled and the AP withholding account basis is set to Payment(Company Tax Options Setup). For unreleased invoices, withholding tax is automatically calculated and displayed when all of the following apply:

Withholding tax is not calculated if the option: Automatic calculation of withholding tax is not enabled, even when the option Withholding tax required is enabled, however withholding tax can be calculated using the Change option. The withholding tax values that are saved when the invoice was initially released are displayed as default, but can be changed if required. |

| Adjustments |

This indicates the supplier-customer contra adjustment amount. This is displayed when the contra amount is less than the original amount of the AP supplier-customer contra. |

You use the Change function to change the highlighted invoice's gross amount and/or discount amount.

![[Note]](images/note.png)

|

|

|

You can only change an invoice that has been selected for release. |

|

| Field | Description | ||||

|---|---|---|---|---|---|

| Save | Select this to save the information you entered and to return

to the previous screen. If the settlement discount Tax code is spaces, a warning message is displayed indicating that the settlement discount Tax portion will not be included in the Tax Return report. |

||||

| Cancel and Close | Select this to return to the previous screen, without making any changes to the invoice. | ||||

| Payment information | |||||

| Supplier | This indicates the supplier for the invoice you are maintaining. | ||||

| Invoice | This indicates the number of the released invoice you are maintaining. | ||||

| Gross payment | Enter the new gross payment value for the

invoice. Changing the invoice payment amount is typically done to process a prepayment to the supplier on a zero value invoice. |

||||

| Discount amount | Enter the settlement discount amount for the

invoice. The Tax on settlement discount fields are not enabled when this value is zero. |

||||

| Tax on settlement discount | This section is only enabled when the Discount amount is not zero. | ||||

| Tax code | This is the tax code to use to calculate the Tax portion on

the settlement Discount amount. This defaults

to the Default tax code for settlement discount

(Accounts Payable Setup) but can be changed. This can be a valid tax code or spaces. When the code is spaces, the Tax portion is not included on the Tax Return report.

|

||||

| Tax portion |

This indicates the tax amount applicable to the settlement Discount amount. It is automatically calculated by the system based on the Default tax code (Accounts Payable Setup). The rate to use is determined by the Calculate tax using historical rates option. When this option is enabled, the Invoice date is used to ascertain the tax rate at that date. When this option is disabled, the current tax rate against the tax code is used (Tax Code Setup).

The Tax portion is not automatically calculated when you manually enter a Tax code. You need to use the Calculate function to calculate the appropriate Tax portion. The Tax portion reduces the Discount amount posted to the General Ledger. Example: The supplier takes a 10 pound discount on a payment inclusive of tax. The tax is 10%. The tax portion (0.91) reflects as tax on settlement discount in the ledger. The discount portion is reduced by the tax amount and is therefore calculated as 10 - 0.91 = 9.09 (i.e. Discount amount less Tax portion of settlement discount). This field is only available for a local currency payment run and when the setup option: Settlement discount - Request tax amount is enabled (Accounts Payable Setup). This option is not available when the Withholding tax system is required (Company Tax Options Setup). |

||||

| Calculate | Select this to calculate the appropriate Tax portion and QST portion when you manually enter or change the Tax code or QST code. | ||||

| QST code | This indicates the QST tax code to use to calculate the QST

settlement amount. This defaults to the Default QST

code for settlement discount (Accounts Payable Setup) but can be changed. This can be a valid QST code or spaces.

|

||||

| QST portion |

This indicates the QST tax amount applicable to the settlement Discount amount. It is automatically calculated by the system based on the Default QST code (Accounts Payable Setup). The rate to use is determined by the Calculate tax using historical rates option. When this option is enabled, the Invoice date is used to ascertain the QST rate at that date. When this option is disabled, the current tax rate against the QST code is used (Tax Code Setup). The QST portion is not automatically calculated when you manually enter a QST code. You need to use the Calculate function to calculate the appropriate QST portion.

The formulae for this calculation are as follows:

This field is only displayed when the following options are enabled in the Accounts Payable Setup program:

|

||||

| Withholding tax information | These fields are only available when the Company Tax Options Setup options: Withholding tax required and Accounting basis - Payment are enabled and a valid withholding tax code is defined against the supplier (Suppliers). | ||||

| Taxable amount |

Indicate the amount of the transaction which is subject to tax. Alternatively, you can use the Calculate option to calculate the taxable amount. |

||||

| Calculate | Select this to automatically calculate the Taxable

amount, based on the current transaction values. If the option: Automatic calculation of withholding tax is not selected, then the taxable amount is calculated as: (Gross payment - discount amount). If the option: Automatic calculation of withholding taxis selected, then the taxable amount is calculated as: (Gross payment - normal invoice tax amount - discount amount). |

||||

| Withholding tax code | This defaults to the Withholding tax code defined against the supplier (Suppliers) but can be changed. | ||||

| Tax amount |

Indicate the amount of tax you are withholding from the invoice being paid. Alternatively, you can use the Calculate option to calculate the Tax amount. The rate used depends on the tax code entered and your selection at the Use current tax rate % option. The tax amount is re-calculated and redisplayed each time you select/deselct the Use current tax rate % option. |

||||

| Calculate | Select this to automatically calculate the Tax

amount, based on the current transaction values entered.

The tax amount is calculated as: ((Taxable amount * withholding tax rate) / 100). The withholding tax rate used depends on the tax code entered and your selection at the Use current tax rate % option as follows:

|

||||

| Use current tax rate % | Select this to calculate the tax amount using the

Current tax rate % defined against the tax code

(Tax Code Setup). If you do not select this option, then the tax amount is calculated using the Invoice tax rate %. The tax amount is automatically re-calculated and redisplayed each time you select/deselct the Use current tax rate % option. |

||||

| Invoice tax rate % | This indicates the withholding tax rate currently held against the invoice. | ||||

| Current tax rate % | This indicates the tax rate currently applicable as defined against the tax code (Tax Code Setup). | ||||

You use the Include function to include an invoice that has an Invoice due date outside the From due date and To next payment date criteria specified for review.

| Field | Description |

|---|---|

| Include Invoice | Select this to add the invoice to the review list. |

| Cancel and Close | Select this to return to the previous screen without adding the invoice to the review list. |

| Supplier invoice | Enter the invoice you want to include for release. You can use the Browse icon to use the AP Supplier Invoices program to select the invoice your require. |

| Invoice details | |

| Original amount | This indicates the original value of the invoice. |

| Invoice balance | This indicates the amount not yet paid against the invoice. |

| Invoice date | This indicates the date of the invoice. |

| Discount date | This indicates the settlement discount date for the invoice. |

| Reference | This indicates the reference entered against the invoice when it was captured. |

-

This program can be accessed by selecting the Release Invoices > System Checks/EFT - Review Invoices option from the Invoices Released for Payment listview menu of the Payment Cycle Maintenance program.

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the eSignature Setup program.

| eSignature Transaction | Description |

|---|---|

| AP Release invoices by review |

Controls access to the System Checks/EFT - Review Invoices function of the Payment Cycle Maintenance and AP Release Invoices to Pay by Review programs. |

| AP Invoice placed on hold |

Controls access to the Hold function in the Payment Cycle Maintenance, AP Release Invoices to Pay by Review, AP Invoice Posting and AP Supplier Invoices programs. |

| AP Clear invoice hold |

Controls access to the Clear invoices on hold function in the AP Release Invoices to Pay by Review and AP Supplier Invoices programs. |

Operator access to the following activities within this program can be restricted. You configure this using the Operators program.

| Activity | Description |

|---|---|

| AP Change/remove/hold invoices from payment run |

Controls whether an operator can:

|

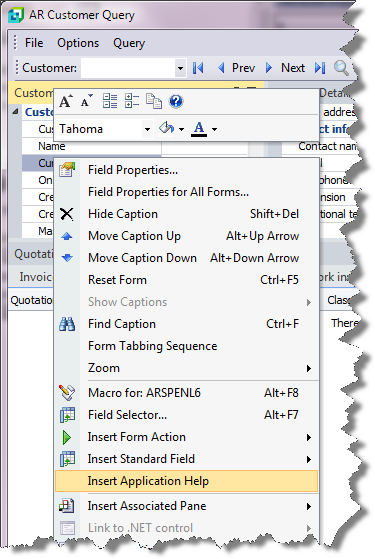

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.