AP Group Payments

The Group Payments feature simplifies the allocation of payments by letting you process a single large payment against groups of suppliers instead of having to make smaller individual payments.

Exploring

Group payments are used to pay one amount to a primary supplier who in turn distributes the payment to one or more secondary suppliers. Payment runs for group payments are processed using the AP Group Payments program to pay the following:

-

Supplier groups within the same SYSPRO company (referred to as group payments).

-

Supplier groups spanning two or more SYSPRO companies (referred to as intercompany group payments).

Multi-currency payments are not supported for group payments, but secondary suppliers with different base currencies can be included in an intercompany group payment run.

-

Improved administrative processing time.

-

Reduced errors typically associated with the manual preparation of individual transactions.

-

Single payment across multiple SYSPRO companies for numerous suppliers.

For example:

The OUTDOORS Company owns Grand Adventures, Bayside Bikes and The Garden Executive.

-

Grand Adventures and Bayside Bikes both need to be paid an amount of $15.

-

The Garden Executive needs to be paid $20.

It makes sense to consolidate this into one payment of $50 to The OUTDOORS Company (i.e. the primary supplier) who then distributes the payment to its subsidiaries (i.e. secondary suppliers).

The suppliers can be within one or more SYSPRO companies.

-

The programs related to this feature are accessed from the Program List of the SYSPRO menu:

-

Program List > Accounts Payable

-

Program List > Cash Book

This is a single large remittance to a primary supplier instead of multiple payments to many individual suppliers.

This type of payment is processed using a group supplier, which comprises a primary supplier (who receives the payment) and multiple associated downstream secondary suppliers. A group supplier is created using the AP Group Suppliers program (Program List > Accounts Payable > Setup).

A group payment is created using the AP Group Payments program (Program List > Accounts Payable > Payment Processing).

This comprises a primary supplier and one or more associated downstream suppliers (i.e. secondary suppliers). These groups are used to create and process group payments.

Group Suppliers are maintained using the AP Group Suppliers program (Program List > Accounts Payable > Setup).

An intercompany group payment affects two or more SYSPRO companies and involves the Accounts Payable and Accounts Receivable modules.

The transaction is processed in the primary company and involves payments to secondary companies for Accounts Payable or payments from secondary companies for Accounts Receivable.

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

This refers to the process of paying your suppliers. You can create and run multiple payment runs simultaneously. Each payment run is assigned a unique payment run number and is created for a single bank, currency and payment type (i.e. you can't have a single payment run containing payments from different banks, different currencies or different payment types). You create and maintain payment runs to process payments to your suppliers using the Payment Cycle Maintenance program.

If all suppliers included in a payment run belong to the primary company, then the payment run is referred to as a group payment run. If one or more of the suppliers belong to another company, i.e. not the primary company, then the payment run is regarded as an intercompany group payment run. You create and maintain group payment runs to process payments to your supplier groups using the AP Group Payments program.

This is the company in which you process the group/intercompany group payment.

This is also the company where the primary customer (for Accounts Receivable) or primary supplier (for Accounts Payable) is located.

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

This is the supplier against which the single remittance for payments to multiple secondary suppliers is processed (i.e. recipient of the aggregate payment). This single remittance is known as a group payment.

When processing group/intercompany group payments, this is the supplier in the primary SYSPRO company against which payments to multiple secondary suppliers either in the same or secondary SYSPRO company are processed.

Primary suppliers are created and maintained using the AP Group Suppliers program (Program List > Accounts Payable > Setup).

A document sent from the customer to the supplier indicating which invoices the customer is paying.

For intercompany group payments, this is the document sent from the primary SYSPRO company to the supplier, indicating which invoices the primary SYSPRO company is paying.

This supplier is paid together with its associated primary supplier via a single remittance (i.e. group payment).

Suppliers for group payments are defined using the AP Group Suppliers program (Program List > Accounts Payable > Setup).

Secondary SYSPRO companies are updated by the transaction that is initiated and processed in the primary SYSPRO company.

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

Suppliers provide a mechanism for you to raise purchase orders within SYSPRO, as well as being used as a selection criterion to generate reports.

You can configure group suppliers to facilitate group and intercompany group payments (i.e. processing a single large remittance to a primary supplier instead of multiple payments to many individual suppliers).

Static information configured against a supplier is used to determine applicable tax, discounts, etc., when processing purchasing transactions.

Documents received from a supplier (e.g. invoices, credit notes, debit notes, etc.) are stored against the supplier and let you keep track of the company's liabilities.

You maintain supplier details using the Suppliers program and you create group suppliers using the AP Group Suppliers program (Program List > Accounts Payable > Setup).

Starting

To use the AP Intercompany Group Payments feature, the following setup option(s) must be configured:

Setup Options > General Ledger Integration > Payables Ledger Codes

-

Intercompany payments interface

Select the Maintain hyperlink to access the Intercompany Payments GL Interface program where you can select the intercompany loan account for each company to which your intercompany group payments will be posted.

The following setup options must be the same across all companies when using the AP Intercompany Group Payments feature:

-

This must be done prior to capturing the Accounts Payable group supplier structure.

-

To change a setup option after the AP group supplier structures are defined, remove the company from the AP group supplier structure before attempting the change.

Setup Options > Keys > Financials

-

Suppliers

-

Key type

-

Suppress leading zeros

-

Presentation length

-

Numbering method

-

-

Setup Options > General Ledger Integration > General Ledger Codes

-

Integration level

-

Create general ledger journal

-

Post general ledger journal

-

Force check no

-

Force general ledger analysis

-

Dimension analysis

Setup Options > Configuration > Financial > Accounts Payable

-

Invoice exchange rate for payment

Setup Options > Tax > Company Tax Options

-

Use descriptive tax codes

Setup Options > Tax > Accounts Payable

-

Request tax amount

Setup Options > Company > General

-

Accounting periods

You can secure this feature by implementing a range of controls against the affected programs. Although not all these controls are applicable to each feature, they include the following:

-

You restrict operator access to companies for which intercompany payments can be processed using the Operator Maintenance program.

Select the Configure hyperlink at the AP access control field of the Intercompany transactions section (within the Security tab) to maintain access control options using the Security per Company program.

You can only release invoices for payment for companies to which you have been given access.

-

You restrict operator access to activities within a program using the Operator Maintenance program.

-

You can restrict operator access to the fields within a program (configured using the Operator Maintenance program).

-

You can restrict operator access to functions within a program using passwords (configured using the Password Definition program).

When defined, the password must be entered before you can access the function.

-

You can restrict access to the eSignature transactions within a program at operator, group, role or company level (configured using the Electronic Signature Configuration Setup program).

Electronic Signatures provide security access, transaction logging and event triggering that gives you greater control over your system changes.

-

You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

-

You can restrict operator access to programs by assigning them to roles and applying access control against the role (configured using the Role Management program).

The following restrictions apply to group/intercompany group payments:

-

You can only process manual and voided checks, but you will not be able to re-establish voided checks and invoices for manual payments.

-

Multi-currency payments are not supported for group payments, but secondary suppliers with different base currencies can be included in an intercompany group payment run.

-

Custom form fields are not supported in secondary companies.

-

The group/intercompanygroup payments fields were added to the standard sample remittance document, but you will have to redesign the remittance document to include them.

-

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

-

Transactions where the same currency code is used to represent different currencies in different companies can't be processed.

-

If the secondary company differs from the primary company and GL integration level of the Variance interfaces is defined at Bank level, then the supplier's bank (i.e. not the payment run bank) is used to determine the GL codes for the exchange rate variance and the unrealized foreign exchange loss or gain. In addition, tables in the secondary company that contain a Bank field are populated with the supplier's bank.

-

The AP Supplier Code Conversion program only converts the selected supplier in the company you are currently accessing.

-

The AP Group Supplier Cash Requirements report caters for a maximum of 1000 secondary suppliers per primary supplier.

-

Running the AP Currency Conversion program may cause suppliers in secondary companies to have an invalid currency equivalent in the primary company. Use the Intercompany Currency Cross Reference program to create a link between the currency code of the primary company and the currency code in the secondary company.

Solving

This error message is displayed when there are incomplete payment runs in another company for the supplier selected in the AP Currency Conversion program.

Prior to converting the supplier currency, the payment register and all checks must be printed for all intercompany payments. This must be done in all companies where the supplier is used as a primary or secondary supplier.

Once all payment runs for this supplier in all companies have been completed, then you can continue with the conversion.

This error message is displayed when you attempt to manually add allocations to a group payment run that was created using a software version prior to SYSPRO 8 2022.

You can't add manual allocations to an existing payment run after upgrading to SYSPRO 8 2022, due to the extensive software changes made to incorporate intercompany group payments.

You can either delete and re-capture the group payment run, or execute the group payment run.

-

Capture the primary and secondary suppliers using the Suppliers program.

-

Once the suppliers are captured, you can create group supplier structures as follows:

-

Open the AP Group Suppliers program (Program List > Accounts Payable > Setup).

-

Indicate the code associated with the group supplier in the Primary supplier toolbar field and tab off your entry.

-

Indicate the secondary supplier company and the secondary supplier(s) that you want to associate with the group supplier (i.e. Primary supplier) at the Supplier column of the Secondary Supplier listview.

-

-

Open the AP Group Suppliers program (Program List > Accounts Payable > Setup).

-

Select the secondary supplier that you want to remove.

-

Select the Delete function from the Secondary Supplier listview.

Group supplier data is maintained in the ApSupplierGroup table.

This table maintains the links between the primary supplier and linked secondary suppliers.

This depends on the version of SYSPRO you are running:

-

When using software prior to SYSPRO 8 2022:

Group payment runs are created using the AP Group Payments program (Program List > Accounts Payable > Payment Processing) and executed using the Execute AP Payment Run program.

-

From SYSPRO 8 2022 onwards:

The AP Group Payments program (Program List > Accounts Payable > Payment Processing) is used to create payment runs for group payments and intercompany group payments, and the AP Execute Group Payment Run program is used to execute them.

-

Access the AP Group Payments program (Program List > Accounts Payable > Payment Processing).

-

Indicate a unique Payment run number for the group/intercompany group payment run that you're creating.

This is only applicable if your Numbering method for the AP payment run setup options is defined as Manual (Setup Options > Keys > Financials). However, if this is defined as Automatic, then the next Payment run number is automatically assigned.

-

Specify the details for the group/intercompany group payment in the Payment Run Information pane.

-

Save the details you specified for the new group/intercompany group payment.

-

Select the Manual Allocation function in the toolbar of the Suppliers to Pay listview.

This loads the AP Group Payment Manual Allocation program.

-

Indicate the indicate the company and supplier code against which individual invoices are to be selected for payment.

-

Indicate the following information in the Payment details pane:

-

Amount in supplier currency

-

Payment reference

-

-

Select Release Invoice or Automatic Release from the Invoices Selected for Payment pane.

-

The option you select depends on whether you want to manually browse and select invoices for payment to the supplier, or alternatively to automatically release invoices according to Due date or Invoice date.

-

The Automatic Release function is only available if the supplier selected for payment belongs to the primary company, i.e. it is not available if you have selected for intercompany group payments where the company selected differs from the primary company.

-

-

View details, such as the Bank and Payment run number, pertaining to the group/intercompany group payment in the Payment Run Information pane.

-

If required, select Change to edit Payment information, Withholding tax information and Tax on Settlement Discount Information for the selected supplier invoice before releasing the invoice.

-

If required, select Change Exchange Rate to change the Exchange rate for the supplier invoice.

-

If required, select Remove to remove the invoice currently highlighted in the listview.

-

-

Select Save to save the details you entered and invoices that you selected for payment.

-

Repeat steps 5 to 10 to create new allocations for any of the suppliers in the group supplier structure associated with the Primary supplier indicated in the AP Group Suppliers program.

Close the AP Group Payment Manual Allocation program.

-

Select the Allocations hyperlink in the Suppliers to Pay listview to view details of the selected invoices associated with the supplier currently highlighted.

This loads the AP Invoices for Payment Run program.

-

If required, select Remove Supplier to remove either the primary or secondary supplier currently highlighted in the listview and the specific invoices released for payment to the supplier.

-

If required, select Clear to remove all the suppliers and their associated invoices released for payment from the listview.

-

-

Select Save and OK when prompted with the Save Payment Run informational message.

-

Select the Execute Payment Cycle option under the Payment Cycle menu to pay the invoices that you released for the group payment.

This loads the AP Execute Group Payment Run program.

-

Indicate the relevant details in the Information pane.

-

If required, select Change Period.

-

-

Select Start Processing.

-

Select the Print Checks/Remittances option to print the remittance advices for the invoices that have been paid.

This loads the AP Check and Remittance Print program (Program List > Accounts Payable > Payment Processing).

-

Select Print/Send to proceed with printing this document.

-

Select the CB Integration/Print Payment Register option to generate a list of checks issued and voided and to integrate the payment to Cash Book.

-

If required, select the Selected Payment Registers option under the Reprint menu to reprint a selection of payment registers previously printed.

You can use the AP Payment Register Reprint report to access all the report functionality available to reprint payment registers.

-

-

If processing a void payment run, select the Reconcile re-established voided checks option to proceed with integrating to Cash Book and to render the AP Void Check Payment Register.

This integrates the payment to Cash Book and displays the AP Payment Register report.

-

Use the Supplier Query program (Program List > Accounts Payable) to view information regarding the group payment and verify its accuracy.

Payment run information for supplier group payments is stored within the following tables:

-

ApPayRunHdr

-

ApCheckIss

-

ApInvoice

-

ApGrpPayRunDet

-

ApGrpPayRunSup

-

Open the Cash Book Deposits and Withdrawals program (Program List > Cash Book > Transaction Processing).

-

Indicate the code associated with the Bank that you indicated under the Payment Run Information pane in the AP Group Payments program (Program List > Accounts Payable > Payment Processing).

-

Locate the transaction associated with the group payment in the Bank Transactions listview.

-

Review the Check/EFT column to locate the transaction.

The Group payment column indicates whether this is a transaction is a group payment. This can assist you in locating the transaction if you perhaps have many non-group payment transactions.

In addition, the Intercompany column indicates whether this transaction was an intercompany group payment where payments were made to suppliers from different companies.

-

Select the hyperlink value in the Bank equivalent column.

This loads the AP Details for Check Number window (Cash Book Zoom on AP Transactions program).

-

Open the AP Group Payments program (Program List > Accounts Payable > Payment Processing).

-

Select Query menu from the toolbar.

-

Select the Check Query option.

This loads the AP Browse on Checks program.

Or

-

Open the Cash Book Deposits and Withdrawals program (Program List > Cash Book > Transaction Processing) or the Bank Query (Program List > Cash Book).

-

Select the hyperlink value in the Check/EFT column.

This loads the AP Browse on Checks program.

The voiding process is a complete reversal of what occurred when you initially created, executed and posted your group payment. Therefore, you can only void group payments that have already been completed (i.e. with a Payment status of L - Complete).

-

Load the AP Group Payments program (Program List > Accounts Payable > Payment Processing).

-

Indicate a unique Payment run number to be associated with the group payment that you want to void.

This is only applicable if your Numbering method for the AP payment run setup options is defined as Manual (Setup Options > Keys > Financials). However, if this is defined as Automatic, then the next Payment run number is automatically assigned.

-

Select Void checks as the Payment type.

You can also indicate the Operator group and the Payment reference if required.

-

At the Payment run to void field, indicate the existing Payment run number associated with the group payment that you want to void.

The header details from the group payment that was processed are displayed.

-

Select the Auto Void function of the Suppliers to Pay pane to reverse all the invoices and allocations released for the suppliers displayed.

-

Select the Execute Payment Run option from the Payment Cycle function. A new window is displayed.

-

Select the Start Processing function to begin processing the complete reversal of the group payment.

-

Select the CB Integration/Print Pay Register to load the AP Integration to Cash Book window.

-

Select OK to update the Cash Book. The void register report is displayed.

The Reconcile re-established voided checks option is inconsequential as you can't re-establish a void check for group payments to suppliers.

-

Details of the voided check can be seen in various programs within SYSPRO, e.g. Cash Book Deposits and Withdrawals, Bank Query, Supplier Query, etc.

The following occurs when you delete an AP Group Payment run:

-

The statuses of released invoices are reset.

-

The Manual checks and Void checks payment information against invoices within the group payment is cleared.

-

Records associated with the group payment are deleted in the following SQL tables:

- ApGrpPayRunDet

-

ApGrpPayRunSup

-

ApPayRunHdr

-

ApCheckIss (applicable to Manual checks group payments)

-

The following SQL tables are updated:

-

ApInvoice

-

ApCheckIss (applicable to Void checks group payments)

-

Group payment run numbers are allocated according to the configuration of the following AP payment run setup options (Setup Options > Keys > Financials):

-

Numbering method

-

Key type (define whether a payment run number is Alphanumeric or Numeric)

-

Suppress leading zeros

-

Presentation length

-

(if your Numbering method is configured as Automatic)

Once a supplier’s currency has been converted using the AP Currency Conversion program, voiding of the original payment run won't be allowed as the converted currency no longer matches the currency of the original payment run.

The Automatic Release option within the AP Group Payment Manual Allocation program is not available when processing payments for a company where the setup differs from the primary company.

The following setup options must be the same across all companies when using the AP Intercompany Group Payments feature:

-

This must be done prior to capturing the Accounts Payable group supplier structure.

-

To change a setup option after the AP group supplier structures are defined, remove the company from the AP group supplier structure before attempting the change.

Setup Options > Keys > Financials

-

Suppliers

-

Key type

-

Suppress leading zeros

-

Presentation length

-

Numbering method

-

-

Setup Options > General Ledger Integration > General Ledger Codes

-

Integration level

-

Create general ledger journal

-

Post general ledger journal

-

Force check no

-

Force general ledger analysis

-

Dimension analysis

Setup Options > Configuration > Financial > Accounts Payable

-

Invoice exchange rate for payment

Setup Options > Tax > Company Tax Options

-

Use descriptive tax codes

Setup Options > Tax > Accounts Payable

-

Request tax amount

Setup Options > Company > General

-

Accounting periods

To process intercompany group payments, the currency must exist in primary and secondary companies and we highly advise that the currency code is the same across companies.

To achieve this, you can do one of the following:

-

Create the same currency code in primary and secondary companies using the Currency Maintenance program.

-

Use the Intercompany Currency Cross Reference program to create a link between the currency code of the primary company and the currency code in the secondary company.

For example:

Company EDU1 has the currency code for US Dollar defined as $.

Company EDU2 has the currency code for US Dollar defined as USD.

As they are the same currency that are defined differently in different companies, you must create a relational link for these currency codes using the Intercompany Currency Cross Reference program.

Using

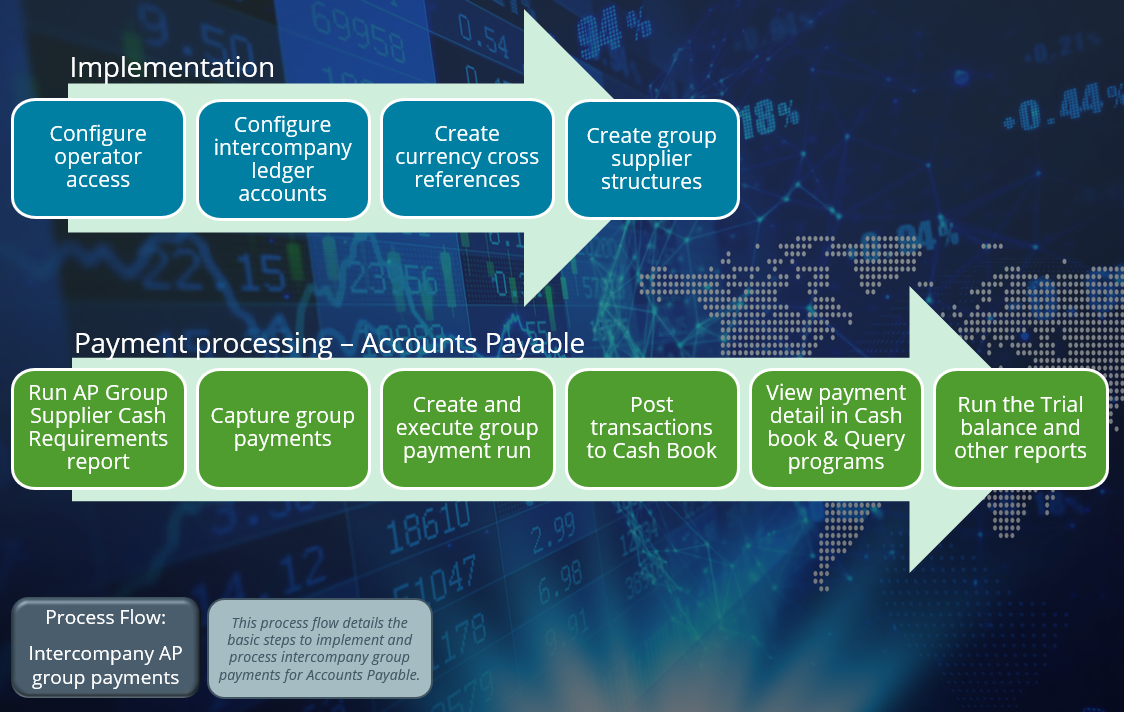

-

Configure operator access and the link between primary and secondary companies.

Step-by-step instructions

Step-by-step instructions

-

Login to the primary company.

-

Access the Operator Maintenance program and select the Configure hyperlink at the AP access control field to access the Security per Company program.

-

Configure the operator access type and ensure that access is given to to all other companies with which you wish to conduct AP intercompany payments (these are known as secondary companies).

-

-

Configure intercompany ledger accounts.

Step-by-step instructions for the General Ledger integration

Step-by-step instructions for the General Ledger integration

-

Login to the primary company.

-

Create an intercompany loan account for each secondary company with which you will transact using the General Ledger Codes program.

These accounts are typically specified as control accounts with the Account type defined as Liability.

-

Login to each secondary company consecutively.

-

Create an intercompany loan account for the primary company using the General Ledger Codes program.

This account is typically specified as a control account with the Account type defined as Liability.

These ledger accounts are used when processing intercompany transactions from the primary company to secondary companies.

Step-by-step instructions to set up the sub module integration to the General Ledger

Step-by-step instructions to set up the sub module integration to the General Ledger

-

Login to the primary company.

-

Select the Maintain hyperlink at the Intercompany payments interface setup option (Setup Options > General Ledger Integration > Payables Ledger Codes).

The Intercompany Payments GL Interface program is displayed.

-

Select the intercompany loan accounts defined in step 2 above for each of the secondary companies to link these to the primary company, i.e. the company you are currently logged in to.

The ledger accounts you select should be defined as control accounts with an account type of Liability.

-

Login to every secondary company consecutively.

-

Repeat step b and c, but this time select the intercompany loan account for the primary company.

The ledger accounts you select should be defined as control accounts with an account type of Liability.

-

-

Create currency cross references

This step is only required if the same currency has been created using different currency codes in primary and secondary companies.

For example:

SA Rand could have been defined as SAR in one company and ZAR in another.

Step-by-step instructions

Step-by-step instructions

-

Log into the primary or secondary company.

-

Open the Intercompany Currency Cross Reference program (Program List > Accounts Payable > Setup).

-

Create a cross reference of the currency codes by selecting both companies and both currency codes.

-

-

Create group suppliers

Step-by-step instructions

Step-by-step instructions

-

Open the AP Group Suppliers program (Program List > Accounts Payable > Setup).

-

Indicate the code associated with the group supplier in the Primary supplier toolbar field and tab off your entry.

-

Indicate the secondary supplier company and the secondary supplier(s) that you want to associate with the group supplier (i.e. Primary supplier) at the Supplier column of the Secondary Supplier listview.

-

-

Run the AP Group Supplier Cash Requirements report to view a list of invoices where payment is outstanding and decide which invoices should be paid.

-

Capture group/intercompany group payments in the group payment run using the AP Group Payments program.

Step-by-step instructions

Step-by-step instructions

-

Select the primary supplier.

-

Use the Manual Allocation option to add the payments to the suppliers whose invoices are to be released for payment.

This loads the AP Group Payment Manual Allocation program.

If the payments you add are only to the primary supplier or to secondary suppliers within one company, it is considered a group payment.

If you add payments to secondary suppliers across companies, the payment run is considered an intercompany group payment.

-

Execute the payment by selecting Execute Payment Run from the Payment Cycle menu.

The AP Execute Group Payment Run program is displayed.

-

If the group payment run was created using software prior to SYSPRO 8 2022, the Execute AP Payment Run program is displayed.

-

The Payment Cycle menu option will only be enabled once the Check amount on the Payment Run Information pane and the Allocated check amount on the Payment Cycle Information pane correspond. (The Check amount can be changed to achieve this).

-

-

-

Run the Cash Book integration, i.e. post the transactions to the cash book.

Step-by-step instructions

Step-by-step instructions

-

Select the CB Integration/Print Pay Register option from the Payment Cycle menu in the AP Group Payments program.

-

When the integration is completed, the AP Intercompany Payment Register is displayed.

The payment runs with all the that have been processed for the primary and secondary companies and all relevant detail is displayed in the report.

-

-

View payment detail using the Cash Book Deposits and Withdrawals, Bank Query and Supplier Query programs.

-

Run the trial balance and reports.

-

Ensure that your currency rates are accurate by updating them on a regular basis using the Currency Maintenance program.

-

Update the exchange rates regularly and synced them between different SYSPRO companies that share group suppliers.

This will ensure that accurate exchange gains and losses are reported on group/intercompany group transactions and facilitate simplified balancing of intercompany loan accounts.

By default, payments are posted to each company's current financial period when the payment run is executed or posted.

You can post to previous period 1 or previous period 2 of the companies by selecting the Change Period option.

To easily reconcile the General Ledger and intercompany loan accounts, we strongly advise that the companies included in a payment run are in the same financial period when the payment run is executed.

The status of an AP payment run indicates the current stage of the payment run and changes according to the functions performed against the payment run.

The current status of a payment run dictates the functions that are available. Therefore, the following table indicates the possible statuses for an AP payment run:

| Status | Description | Function Performed |

|---|---|---|

|

New |

The payment run is currently being created. No records have been created yet. |

Add New Payment Run for all payment types. |

|

O - Open |

The payment run was created and saved. Records have been created. |

End Payment Run for the following payment types:

|

|

O - Open void |

The payment run was created and saved. |

Void Check Entry and End Payment Run for the following payment types:

|

|

P - Paid |

Invoices released for payment are recorded as paid. |

Execute Payment Run for the following payment types:

|

|

P - Voided |

Check/EFT recorded as voided. |

Execute Payment Run for the following payment types:

|

|

C - Printed |

Checks and/or remittance advices have been printed or checks and/or EFTs have been voided. |

Print Checks/Remittances for all payment types. |

|

L - Complete |

Integration to Cash Book has been completed and the payment register for the payment run has been printed. |

CB Integration/Print Payment Register for all payment types. |

The following indicates areas in the product that may be affected by implementing this feature:

Program List > Accounts Payable > Setup

This program lets you establish a link between the currency codes within companies that make use of intercompany group payments, where different currency codes are assigned to the same currency.

For example:

The currency South African Rand could have the currency code SAR in one company and ZAR in the other company. The Intercompany Currency Cross Reference program is then used to create a link between these different currency codes that in fact represent the same currency.

Accessible from the Configure hyperlink at the AP access control section of the Security tab within the Operator Maintenance program.

This program lets you restrict operator access to companies for which intercompany group payments can be processed.

The program title bar shows whether you are configuring operator access for Accounts Payable or Accounts Receivable group payments.

Accessible from the Maintain hyperlink at the Intercompany payments interface field within the Setup Options program (Setup Options > General Ledger Integration > Payables Ledger Codes).

This program lets you set up the Accounts Payable and Accounts Receivable intercompany ledger loan accounts that are used when processing intercompany payments.

The loan account must be set up for each company to and from which intercompany payments will be made.

Program List > Accounts Payable > Setup

Prior to converting the supplier currency, all payment runs in all other companies where this company/supplier is used as a secondary company/supplier must be complete. An error message is displayed when there are incomplete payment runs in another company for the selected supplier for which you are converting the currency.

Once the supplier currency has been converted, you can't void a payment run for that supplier, as a different currency was held against the supplier when the payment was initiated.

Converting the supplier currency may result in suppliers in the secondary company not having an equivalent currency or cross-reference currency in the primary company. You must then manually maintain the currency cross-reference using the Intercompany Currency Cross Reference program.

Program List > Accounts Payable > Setup

This program lets you change the Group supplier or Supplier that you've browsed for in the Supplier Code Conversion listview.

The following SQL tables listed under Supplier Code Conversion Tickover are applicable to group payments and are updated when you're updating fields as displayed in the Supplier Code Conversion listview:

-

ApSupplierGroup (Group supplier and Supplier fields)

-

ApGrpPayRunDet (Supplier)

-

ApGrpPayRunSup (Supplier)

-

ApPayRunHdr (Supplier)

-

The ApPayRunHdr table is applicable to both standard payment and group payment runs.

-

This is only applicable once invoices have been released for suppliers in a group payment.

-

Program List > Accounts Payable > Setup

This program lets you capture and maintain details of suppliers which can be used to create supplier groups.

Supplier groups are the mechanism through which you create, process and execute group payments for suppliers.

Supplier groups consist of primary and secondary suppliers, which are created using the AP Group Suppliers program.

Program List > Accounts Payable > Setup

This program lets you define a group supplier structure that is used to create, execute and process a group payment for suppliers.

The Company column in the Secondary Supplier pane displays the company code against the secondary supplier for intercompany group payments. The intercompany group payment amounts and number of transactions are displayed on the report details.

To use this feature with its entire functionality, enable the following eSignatures in the eSignature Setup program:

-

AP Group supplier added

-

AP Group supplier deleted

-

AP Group supplier updated

Accessible from the CB Integration/Print Pay Register option of the AP Group Payments program.

This program ensures that the Cash Book is updated with the associated transactions against the payment run currently being processed using the AP Group Payments program.

Program List > Accounts Payable > Payment Processing

This program lets you make a single payment against a supplier group, rather than numerous smaller payments against individual suppliers. This functions similar to a normal payment run.

Use the Manual Allocation option at the Suppliers to Paylistview to release supplier invoices ready for payment. Only companies for which the user has access can be selected for the allocation of payments. Once invoices have been released for payment, they are listed per company/supplier in the Suppliers to Paylistview.

The View AP Periods button displays the Intercompany Periods progam to view current and previous period data for all companies to which you have access.

Selecting the Execute Payments function displays AP Execute Group Payment Run program for group and intercompany group payment runs.

To use this feature with its entire functionality, enable the following eSignatures in the eSignature Setup program:

-

AP Delete payment run

-

AP Execute payment run

-

AP Payment run entry

-

AP Void check entry

-

AP Manual check entry

Program List > Accounts Payable > Payment Processing > AP Group Payments > Supplier to Pay > Manual Allocation

This program lets you manually allocate payments and release invoices for both primary and secondary suppliers in a supplier group for a particular group payment run.

You can select the company for which you want to allocate an group/intercompany group payment. Only companies for which the user has access can be selected for the allocation of payments. The Currency Conversion button at the Invoices Selected for Payment listview lets you view the current conversion rate for intercompany payments using different currencies.

Once group/intercompany group payments have been allocated, they are listed per company/supplier in the Suppliers to Pay listview within the AP Group Payments program.

Program List > Accounts Payable > Payment Processing > AP Group Payments > Suppliers to Pay > Auto Void

Group/intercompany group payment checks can only be voided using the Auto Void function in the AP Group Payments program.

Accessible from the Execute Payment Run option from the Payment Cycle menu within the AP Group Payments program.

This program lets you pay the invoices that have been released for payment within a group payment run.

Group payment runs are processed for invoices that are released against the primary company.

Whereas Intercompany group payment runs are processed for invoices that are released against multiple companies, which may include or exclude the primary company.

Program List > Accounts Payable > Payment Processing

This program lets you create and maintain payment runs for suppliers that are not group/intercompany group payments.

An error message is displayed within this program if you indicate a Payment run number that is associated with an existing group/intercompany group payment for suppliers.

-

From SYSPRO 8 2022 onwards:The AP Group Payments program (Program List > Accounts Payable > Payment Processing) is used to create payment runs for group payments and intercompany group payments, and the AP Execute Group Payment Run program is used to execute them.

-

When using software prior to SYSPRO 8 2022:Group payment runs are created using the AP Group Payments program (Program List > Accounts Payable > Payment Processing) and executed using the Execute AP Payment Run program.

Accessible from the Execute Payment Run option of the Payment Cycle Maintenance program.

This program is used to execute payment runs for suppliers that are not group/intercompany group payments.

-

Before SYSPRO 8 2022, group payment runs were processed using the Execute AP Payment Run program.

-

Since SYSPRO 8 2022, group- as well as intercompany group payments are executed using the AP Execute Group Payment Run program.

Program List > Cash Book > Transaction Processing

The following column(s) were added at the Bank Transactions listview:

- Group payment

- Intercompany

- AP payment run

Program List > Accounts Payable

This program lets you purge group/intercompany group payments once the retention period for Payment cycle details is reached (Setup Options > History > Financials > Accounts Payable).

When pay run data for intercompany group payments is deleted from the ApGrpPayRunDet table, all corresponding entries for the secondary company are removed from the ApInterCoChkReg table.

A summary of processing details is displayed in the Reports listview:

-

The number of group payments deleted

-

The number of group void payments deleted

Program List > Cash Book

This program lets you purge supplier group payments once the retention period for Payment cycle details is reached (Setup Options > History > Financials > Accounts Payable).

When pay run data for intercompany group payments is deleted from the ApGrpPayRunDet table, all corresponding entries for the secondary company are removed from the ApInterCoChkReg table.

A summary of processing details is displayed in the Reports listview:

-

The number of group payments deleted

-

The number of group void payments deleted

Program List > General Ledger > Setup > Change Financial Year End

The following financial period and year fields in the ApGrpPayRunDet table (associated with group payments for suppliers) are updated according to the entries you've indicated in the Year and Period fields under Current ledger:

-

PayMonth

-

PayYear

-

TrnMonth

-

TrnYear

Program List > General Ledger > Setup > Change Financial Year End

The following fields in the ApGrpPayRunDet table (associated with group payments for suppliers) are updated according to the Number of years that you've indicated to Increment or Decrement your Current financial year by:

-

PayYear

-

TrnYear

Program List > General Ledger > Tax

This program lets you generate tax return documents.

Selecting the Include AP settlement option includes group/intercompany group payment settlement discounts from the Accounts Payable module.

The following columns were added at the AP Settlement listview:

-

Group payment

-

Payment run

-

Intercompany

-

Primary company

-

Primary supplier

-

Xref check register

Program List > Accounts Payable > Payment Processing

This lets you generate your reports to include information from group/intercompany group payments for suppliers for the following Report type options:

-

Manual check list

-

Void check list

Program List > Accounts Payable > Payment Processing

This program lets you print checks and/or remittance advices for the single payment (consisting of smaller multiple transactions to secondary suppliers) that has been processed using the AP Execute Group Payment Run program.

The description and type of payment run is indicated at of the Payment type field as well as these check boxes:

-

Group payment

-

Multi-currency payment

-

Intercompany payment

Program List > Accounts Payable > Payment Processing

This report lets you include group payments for suppliers by selecting the Group payment option.

Program List > General Ledger > Tax > Reports

This report includes the tax on settlement discount transactions arising from group/intercompany group payments created, executed and processed for suppliers.

Program List > Accounts Payable > Reports

This report displays the data defined for the group suppliers you've created.

Supplier groups are the mechanism through which you can create group/intercompany group payments for suppliers.

Program List > Accounts Payable > Payment Processing

This report lets you print a list of cash requirements for each primary supplier and each of the associated secondary suppliers withing a group supplier structure.

This enables you to forecast future liabilities and to determine past due and current liabilities. The purpose is to indicate when funds need to be available to pay invoices while taking advantage of available discounts.

Program List > General Ledger > GL Integration

This report lets you generate a report of Accounts Payable and Accounts Receivable payments interfaces, i.e. the intercompany loan accounts used for intercompany payments.

Program List > Accounts Payable

This program displays invoice information of suppliers who were paid with a group/intercompany group payment. Primary suppliers can be linked to multiple secondary suppliers.

The Group and interco payments hyperlink at the Supplier Information pane displays all payment runs where the queried supplier is the primary supplier. You can then drill down to view the secondary supplier detail using the Invoices and Check options within the AP Browse on Payment Runs program.

The following columns within the Payments listview cater for this enhancement:

-

Intercompany

-

Group payment

-

Payment run

-

Primary supplier

-

Primary company

-

Primary register

-

Supplier cur xref

-

Amount (local cur sec)

-

Local cur xref

-

Local cur primary

-

Amount (local cur primary)

-

Ex rate

-

The data displayed in these columns is based on the data sourced from the AP Group Payments program (Program List > Accounts Payable > Payment Processing).

-

These columns are hidden by default and can be added using the Field Chooser function.

Program List > Cash Book

This program includes information on transactions of Accounts Payable and Accounts Receivable group payments for a particular bank.

The following columns within the Transactions listview cater for this enhancement:

-

Group payment

-

Intercompany

-

AP payment run

Accessible from the View AP periods option within the AP Group Payments program.

This program lets you view the financial periods for the primary company, as well as all companies linked to the primary supplier or customer.

Accessible from the Allocations hyperlink within the Suppliers to Pay listview of the AP Group Payments program.

This program lets you view the details of invoices paid to suppliers within a group payment.

The following columns were added to cater for this enhancement:

- Company

- Intercompany

- Primary company

- Group payment

- Payment currency

- Supplier currency

- Net (local primary)

- Net (local secondary)

- Secondary check register

- Ex rate (sec to primary local)

These columns are hidden by default and can be added using the Field Chooser function.

Accessible from the hyperlink within the Bank equivalent column of the Transactions listview within the Bank Query or Cash Book Deposits and Withdrawals program.

This lets you view details about the group/intercompany group payment associated with the transaction selected within the Transactions listview of the Bank Query or Cash Book Deposits and Withdrawals program.

You can view payment run detail by selecting the hyperlink at the AP payment run field using the AP Browse on Payment Runs program.

The following columns within the AP Invoice Details listview cater for this enhancement:

- Group payment

- Intercompany

- Company

- Currency xref

- Net (primary local)

- Check register

- Primary supplier

These columns are hidden by default and can be added using the Field Chooser function.

Accessible from the Supplier to pay browse function of the AP Group Payment Manual Allocation program.

This program lets you browse on the secondary suppliers associated with the primary supplier of the payment run you are capturing.

The Currency Xref column displays the currency in the primary company that is equivalent to the supplier currency. The currency cross-reference is set up using the Intercompany Currency Cross Reference program and is used for intercompany group payments when the currency code differs between companies.

Accessible from the Payment run browse function of the AP Group Payments program.

This program lets you browse on all payments for suppliers and define the criteria according to which you want to display these payment runs.

This program includes the following columns to cater for this enhancement:

- Group check

- Group payment

- Supplier

- Intercompany

These columns are hidden by default and can be added using the Field Chooser function.

Accessible from the Check Query function of the AP Group Payments program.

This program lets you view details of the manual check associated with the group/intercompany group payment run you have created. These details are based on your allocations of invoices in the Suppliers to Pay listview as well as the data indicated in the Payment Run Information pane.

The Group payment and Intercompany columns were added to cater for this enhancement.

These columns are hidden by default and can be added using the Field Chooser function.

Program List > Accounts Payable > Browses

This program lets you view details of the suppliers currently defined in the Suppliers program.

The Primary supplier column was added to cater for this enhancement.

This column is hidden by default and can be added using the Field Chooser function.

Accessible from the Show hyperlink against the invoice or from the Invoice option within the Query menu of the Supplier Query program or when selecting the invoice at the Posted Invoices field within the AP Permanent Entries Posting program.

The Primary company and Primary supplier columns can be added to the listview using the Field Chooser option.

Manual intercompany is displayed at the Status field for intercompany group payments.

The following indicates the business objects that are affected by this feature:

The AP Supplier Group Maintenance business object lets you define primary and secondary suppliers for payment against a group supplier. Records are written to the ApSupplierGroup table.

The Intercompany Currency Cross Reference business object lets you establish a link between currency codes in different SYSPRO companies and is used when the same currency was assigned a different code in each company.

The AP Intercompany GL Interface business object lets you create and maintain General Ledger company loan accounts for intercompany payments from the Accounts Payable module.

The Intercompany Transaction Security Setup business object lets you create and maintain General Ledger accounts for intercompany payments from the Accounts Receivable module.

The AP Execute Payment business object lets you execute a payment run as part of SYSPRO's fully-automated supplier payment process. This allows customers to tailor their supplier pay run processing using third party applications and to better manage the approval and execution of big payment runs.

This business object caters for group payments but doesn't accommodate intercompany group payment runs.

The AP Payment Cycle Maintenance business object lets you create and maintain payment runs when processing payments to your suppliers and is used by the Payment Cycle Maintenance program.

The AP Void Check business object lets you cancel a manual check that has already paid an invoice (e.g. the check has been lost or dishonored).

The AP Manual Check Payments business object lets you record manual checks used to pay suppliers.

The Post Accounts Payable Setup Options business object lets you maintain setup options for the Accounts Payable module.

The Post Admin Tax Options business object lets you maintain tax setup options.

The Post GL Setup Integration business object lets you maintain setup options for the General Ledger module.

The Post Company Control Setup Options business object lets you maintain company setup options.

The Post Key Information business object lets you update key information defined against the SYSPRO company you are currently logged into.

The GL Journal Posting business object lets you create, maintain and post the different types of journals and post sub-ledger transactions to the General Ledger.

The Intercompany Transaction Security Query business object lets you query the interface entries created in the Intercompany Payments GL Interface program.

The Intercompany Payments Interface Entries business object lets you query the interface entries created in the Intercompany Payments GL Interface program.

The AP Cash Requirements business object lets you generate a consolidated list of cash requirements for each group supplier structure, (i.e. the primary supplier associated with multiple secondary suppliers in a group supplier structure) and obtains information for the AP Group Supplier Cash Requirements program.

The AP Released Payments Query business object lets you print a list of all invoices that you have released for payment and obtains information for the Released Payments Report program.

The AP Withholding Tax Report business object lets you generate a report of withholding tax entries made in the Accounts Payable module and obtains information for the AP Withholding Tax Report program.

The AP Tax Distribution Report business object lets you generate a report indicating the taxable portion of all payments made in the Accounts Payable module and obtains information for the AP Tax Distribution Report program.

The AP Disbursement Distribution Query business object lets you generate a report of General Ledger distributions entries generated from the Accounts Payable module and obtains information for the AP Second Tier Tax Report program.

The AP Payment Register business object obtains information for the AP Payment Register program.

The AP Trial Balance & Aged Analysis Report business object lets you generate a selective list of all amounts owing to suppliers.

The AP Supplier Query business object lets you view supplier information.

The Cash Book Transaction Query business object returns the balance and transaction details for a specific bank.

The Tax Submission Query business object lets you query tax information which will be returned in XML format.

The AP List of Supplier Groups Query business object lets you query records held against the ApSupplierGroup table in order to establish the primary and secondary supplier relationships for processing group payments.

The AP Group Supplier Cash Requirements business object lets you query cash requirements for a group supplier.

Copyright © 2025 SYSPRO PTY Ltd.