You use this program to import asset cost and quantity details for assets that have been added using the Asset Import program.

This program is typically used to import asset data created outside of SYSPRO. The data can be in the form of a flat file containing rows of data according to the file layout specified (File layout for 7) or an Microsoft Excel spreadsheet prepared according to the required file layout.

| Field | Description |

|---|---|

| Import | Validates the contents of the import file and import records if there are no errors. |

| Save Form Values | This option is only enabled in Design mode (Automation Design). Your selections are saved and applied when the

program is run in automated mode. Form values and defaults are applied at operator level. They are not saved at role or group level. |

| Field | Description | ||||

|---|---|---|---|---|---|

| Import method | |||||

| From file | Select this to import data from a file. | ||||

| Use data grid | Select this to enter the import data directly into the grid

of the Details pane You can paste the contents of an Excel spreadsheet into the grid. A blank line is created as the first line in the grid because by default, focus is set on the first editable line for all import program grids. |

||||

| File location | |||||

| Server | Indicates the import file resides on the server. | ||||

| Client | Indicates the import file resides on the client. | ||||

| File name | Indicate the name of the import file (include the full path). | ||||

| Review file | This loads the contents of the import file into the

Details pane, which lets you validate the

lines on the grid prior to importing the file. The

Import button is enabled only when all lines

are valid.

|

||||

| Field | Description |

|---|---|

| Import only if all rows are valid | Validate the contents of the import file before the

import is processed to ensure that the data is valid.

The validation includes a number of checks to ensure that:

|

| Calculate depreciation |

Automatically calculate depreciation.

Otherwise the entries in the import file are

used.

If you enable this option, then you won't be able to access any depreciation fields displayed in the Acquisition Import Details listview. |

| Generate GL entries |

Automatically create ledger entries (if your

Assets module is integrated to General

Ledger).

Entries are generated according to your selections in the General Ledger Integration program. No GL distribution entries are created when this option is not enabled. |

| Field | Description | ||||

|---|---|---|---|---|---|

| Print the Details | Generate a report of the contents of the Details entry grid. | ||||

| Email the Details | Generate an email of the contents of the Details entry grid. | ||||

| Print the Import Results | Generate a report of the contents of the Import Results pane. | ||||

| Email the Import Results | Generate an email of the contents of the Import Results pane. | ||||

| Email recipients | Indicate the email addresses of recipients to whom you want to email the information displayed in the output panes. | ||||

| Delete file after use | Indicate whether you want to delete the import file after

all records are successfully imported.

|

||||

| Close the application | Exits the program once processing is complete. Do not select this if you want to be able to view the information on screen when processing is complete or you want to print or email the contents of the Details and Import Results panes. | ||||

| Field | Description |

|---|---|

| Validate | This verifies whether there are any errors in the grid,

without actually importing records. Exclamation marks in the Validation status column indicates that one or more fields in the line are invalid. An explanatory error message is displayed when you hover your mouse pointer over the exclamation marks. |

| Prints the contents of the import file, or changes made in the grid. | |

| Export to Excel | Outputs data from the Details pane to an Excel spreadsheet. |

| Search text | |

| Clear | Clears the contents in the search text field. |

| Edit | |

| Copy | Copies the lines in the Details pane. |

| Paste (all columns) | Ensure that you have data for all the columns that can

appear in the data grid before selecting this option. When you select to Paste (all columns) the date you are pasting must be in the format CCYYMMDD. Although no validation errors are displayed, the date is not converted into your SYSPRO date format. |

| Paste (visible columns only) | Pastes data into the columns that currently appear in the

data grid, in the sequence that they appear. When you select to Paste (visible columns only) and the date you are pasting is not in CCYYMMDD format, you are prompted for the date format. The program correctly inserts it into the grid in the SYSPRO date format. |

| Duplicate | Copies the current row to the end of the data grid. |

| Find and Replace |

Displays a summary of the results of the validation/import.

This information can be printed or emailed providing you did not select to Close the application in the After processing completed section.

The following table defines the structure of the import file that must be defined to successfully import asset acquisitions from 3rd party application software.

| Field | Start position | Field length and description |

|---|---|---|

| Header | ;SYSPRO IMPORT - Version=001 - ASSIMQ Mandatory entry of this comment on the first line of the import file to distinguish it from a SYSPRO 6.1 layout file. This comment is not case-sensitive. |

|

| Asset Code (mandatory) | 1 | 30 The code for the asset. The system checks that the asset code already exists in the system. If the code is numeric, then the field size is 15. |

| Acquisition quantity (mandatory) | 31 | 19 This must be a numeric value greater than zero. |

| Investment allowance (%) | 50 | 8 For tax book value. Must be a numeric value or blank. |

| Initial allowance (%) | 58 | 8 For tax book value. Must be a numeric value or blank. |

| Tax paid | 66 | 16 Value of tax paid at the time of acquisition (e.g. VAT or GST). This field is notational and is not used in the calculation of the asset's value. A warning is given if this value is greater than the Asset cost/value. |

| Book Value Details | ||

| Book Value asset cost | 82 | 16 Asset Book Value before any revaluations. Must be a numeric value or blank. |

| Book Value last year depreciation | 98 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Book Value accumulated depreciation | 114 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Book Value depreciation period 1 | 130 | 16 Depreciation value for current year period 1. Must be a numeric value or blank. |

| Book Value depreciation period 2 | 146 | 16 Depreciation value for current year period 2. Must be a numeric value or blank. |

| Book Value depreciation period 3 | 162 | 16 Depreciation value for current year period 3. Must be a numeric value or blank. |

| Book Value depreciation period 4 | 178 | 16 Depreciation value for current year period 4. Must be a numeric value or blank. |

| Book Value depreciation period 5 | 194 | 16 Depreciation value for current year period 5. Must be a numeric value or blank. |

| Book Value depreciation period 6 | 210 | 16 Depreciation value for current year period 6. Must be a numeric value or blank. |

| Book Value depreciation period 7 | 226 | 16 Depreciation value for current year period 7. Must be a numeric value or blank. |

| Book Value depreciation period 8 | 242 | 16 Depreciation value for current year period 8. Must be a numeric value or blank. |

| Book Value depreciation period 9 | 258 | 16 Depreciation value for current year period 9. Must be a numeric value or blank. |

| Book Value depreciation period 10 | 274 | 16 Depreciation value for current year period 10. Must be a numeric value or blank. |

| Book Value depreciation period 11 | 290 | 16 Depreciation value for current year period 11. Must be a numeric value or blank. |

| Book Value depreciation period 12 | 306 | 16 Depreciation value for current year period 12. Must be a numeric value or blank. |

| Book Value depreciation period 13 | 322 | 16 Depreciation value for current year period 13. Must be a numeric value or blank. |

| Tax Details | ||

| Tax asset cost | 338 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Capital gains tax cost | 354 | 16 Capital gains tax cost. Must be a numeric value or blank. |

| Tax last year depreciation | 370 | 16 Total depreciation previous year. Must be a numeric value or blank. |

| Tax accumulated depreciation | 386 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Tax depreciation period 1 | 402 | 16 Depreciation value for current year period 1. Must be a numeric value or blank. |

| Tax depreciation period 2 | 418 | 16 Depreciation value for current year period 2. Must be a numeric value or blank. |

| Tax depreciation period 3 | 434 | 16 Depreciation value for current year period 3. Must be a numeric value or blank. |

| Tax depreciation period 4 | 450 | 16 Depreciation value for current year period 4. Must be a numeric value or blank. |

| Tax depreciation period 5 | 466 | 16 Depreciation value for current year period 5. Must be a numeric value or blank. |

| Tax depreciation period 6 | 482 | 16 Depreciation value for current year period 6. Must be a numeric value or blank. |

| Tax depreciation period 7 | 498 | 16 Depreciation value for current year period 7. Must be a numeric value or blank. |

| Tax depreciation period 8 | 514 | 16 Depreciation value for current year period 8. Must be a numeric value or blank. |

| Tax depreciation period 9 | 530 | 16 Depreciation value for current year period 9. Must be a numeric value or blank. |

| Tax depreciation period 10 | 546 | 16 Depreciation value for current year period 10. Must be a numeric value or blank. |

| Tax depreciation period 11 | 562 | 16 Depreciation value for current year period 11. Must be a numeric value or blank. |

| Tax depreciation period 12 | 578 | 16 Depreciation value for current year period 12. Must be a numeric value or blank. |

| Tax depreciation period 13 | 594 | 16 Depreciation value for current year period 13. Must be a numeric value or blank. |

| Alternate Valuation 1 Details | ||

| Alternate Valuation 1 cost | 610 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 1 last year depreciation | 626 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 1 accumulated depreciation | 642 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 1 year to date depreciation | 658 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 2 Details | ||

| Alternate Valuation 2 cost | 674 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 2 last year depreciation | 690 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 2 accumulated depreciation | 706 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 2 year to date depreciation | 722 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 3 Details | ||

| Alternate Valuation 3 cost | 738 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 3 last year depreciation | 754 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 3 accumulated depreciation | 770 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 3 year to date depreciation | 786 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 4 Details | ||

| Alternate Valuation 4 cost | 802 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 4 last year depreciation | 818 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 4 accumulated depreciation | 834 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 4 year to date depreciation | 850 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 5 Details | ||

| Alternate Valuation 5 cost | 866 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 5 last year depreciation | 882 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 5 accumulated depreciation | 898 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 5 year to date depreciation | 914 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 6 Details | ||

| Alternate Valuation 6 cost | 930 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 6 last year depreciation | 946 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 6 accumulated depreciation | 962 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 6 year to date depreciation | 978 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 7 Details | ||

| Alternate Valuation 7 cost | 994 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 7 last year depreciation | 1010 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 7 accumulated depreciation | 1026 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 7 year to date depreciation | 1042 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 8 Details | ||

| Alternate Valuation 8 cost | 1058 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 8 last year depreciation | 1074 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 8 accumulated depreciation | 1090 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 8 year to date depreciation | 1108 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 9 Details | ||

| Alternate Valuation 9 cost | 1122 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 9 last year depreciation | 1138 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 9 accumulated depreciation | 1154 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 9 year to date depreciation | 1170 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 10 Details | ||

| Alternate Valuation 10 cost | 1186 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 10 last year depreciation | 1202 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 10 accumulated depreciation | 1218 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 10 year to date depreciation | 1234 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Field | Start position | Field length and description |

|---|---|---|

| Asset Code (mandatory) | 1 | 15 The code for the asset. The system checks that the asset code does not already exist in the system. |

| Acquisition quantity (mandatory) | 16 | 19 This must be a numeric value greater than zero. |

| Investment allowance (%) | 35 | 8 For tax book value. Must be a numeric value or blank. |

| Initial allowance (%) | 43 | 8 For tax book value. Must be a numeric value or blank. |

| Tax paid | 51 | 16 |

| Book Value Details | ||

| Book Value asset cost | 67 | 16 Asset Book Value before any revaluations. Must be a numeric value or blank. |

| Book Value last year depreciation | 83 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Book Value accumulated depreciation | 99 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Book Value depreciation period 1 | 115 | 16 Depreciation value for current year period 1. Must be a numeric value or blank. |

| Book Value depreciation period 2 | 131 | 16 Depreciation value for current year period 2. Must be a numeric value or blank. |

| Book Value depreciation period 3 | 147 | 16 Depreciation value for current year period 3. Must be a numeric value or blank. |

| Book Value depreciation period 4 | 163 | 16 Depreciation value for current year period 4. Must be a numeric value or blank. |

| Book Value depreciation period 5 | 179 | 16 Depreciation value for current year period 5. Must be a numeric value or blank. |

| Book Value depreciation period 6 | 195 | 16 Depreciation value for current year period 6. Must be a numeric value or blank. |

| Book Value depreciation period 7 | 211 | 16 Depreciation value for current year period 7. Must be a numeric value or blank. |

| Book Value depreciation period 8 | 227 | 16 Depreciation value for current year period 8. Must be a numeric value or blank. |

| Book Value depreciation period 9 | 243 | 16 Depreciation value for current year period 9. Must be a numeric value or blank. |

| Book Value depreciation period 10 | 259 | 16 Depreciation value for current year period 10. Must be a numeric value or blank. |

| Book Value depreciation period 11 | 275 | 16 Depreciation value for current year period 11. Must be a numeric value or blank. |

| Book Value depreciation period 12 | 291 | 16 Depreciation value for current year period 12. Must be a numeric value or blank. |

| Book Value depreciation period 13 | 307 | 16 Depreciation value for current year period 13. Must be a numeric value or blank. |

| Tax Details | ||

| Tax asset cost | 323 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Capital gains tax cost | 339 | 16 Capital gains tax cost. Must be a numeric value or blank. |

| Tax last year depreciation | 355 | 16 Total depreciation previous year. Must be a numeric value or blank. |

| Tax accumulated depreciation | 371 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Tax depreciation period 1 | 387 | 16 Depreciation value for current year period 1. Must be a numeric value or blank. |

| Tax depreciation period 2 | 403 | 16 Depreciation value for current year period 2. Must be a numeric value or blank. |

| Tax depreciation period 3 | 419 | 16 Depreciation value for current year period 3. Must be a numeric value or blank. |

| Tax depreciation period 4 | 435 | 16 Depreciation value for current year period 4. Must be a numeric value or blank. |

| Tax depreciation period 5 | 451 | 16 Depreciation value for current year period 5. Must be a numeric value or blank. |

| Tax depreciation period 6 | 467 | 16 Depreciation value for current year period 6. Must be a numeric value or blank. |

| Tax depreciation period 7 | 483 | 16 Depreciation value for current year period 7. Must be a numeric value or blank. |

| Tax depreciation period 8 | 499 | 16 Depreciation value for current year period 8. Must be a numeric value or blank. |

| Tax depreciation period 9 | 515 | 16 Depreciation value for current year period 9. Must be a numeric value or blank. |

| Tax depreciation period 10 | 531 | 16 Depreciation value for current year period 10. Must be a numeric value or blank. |

| Tax depreciation period 11 | 547 | 16 Depreciation value for current year period 11. Must be a numeric value or blank. |

| Tax depreciation period 12 | 563 | 16 Depreciation value for current year period 12. Must be a numeric value or blank. |

| Tax depreciation period 13 | 579 | 16 Depreciation value for current year period 13. Must be a numeric value or blank. |

| Alternate Valuation 1 Details | ||

| Alternate Valuation 1 cost | 595 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 1 last year depreciation | 611 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 1 accumulated depreciation | 627 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 1 year to date depreciation | 643 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 2 Details | ||

| Alternate Valuation 2 cost | 659 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 2 last year depreciation | 675 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 2 accumulated depreciation | 691 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 2 year to date depreciation | 707 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 3 Details | ||

| Alternate Valuation 3 cost | 723 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 3 last year depreciation | 739 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 3 accumulated depreciation | 755 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 3 year to date depreciation | 771 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 4 Details | ||

| Alternate Valuation 4 cost | 787 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 4 last year depreciation | 803 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 4 accumulated depreciation | 819 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 4 year to date depreciation | 835 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 5 Details | ||

| Alternate Valuation 5 cost | 851 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 5 last year depreciation | 867 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 5 accumulated depreciation | 883 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 5 year to date depreciation | 899 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 6 Details | ||

| Alternate Valuation 6 cost | 915 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 6 last year depreciation | 931 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 6 accumulated depreciation | 947 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 6 year to date depreciation | 963 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 7 Details | ||

| Alternate Valuation 7 cost | 979 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 7 last year depreciation | 995 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 7 accumulated depreciation | 1011 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 7 year to date depreciation | 1027 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 8 Details | ||

| Alternate Valuation 8 cost | 1043 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 8 last year depreciation | 1059 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 8 accumulated depreciation | 1075 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 8 year to date depreciation | 1091 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 9 Details | ||

| Alternate Valuation 9 cost | 1107 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 9 last year depreciation | 1123 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 9 accumulated depreciation | 1139 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 9 year to date depreciation | 1155 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

| Alternate Valuation 10 Details | ||

| Alternate Valuation 10 cost | 1171 | 16 Asset book value before any revaluations. Must be a numeric value or blank. |

| Alternate Valuation 10 last year depreciation | 1187 | 16 Previous year depreciation. Must be a numeric value or blank. |

| Alternate Valuation 10 accumulated depreciation | 1203 | 16 Total depreciation for the life of the asset. Must be a numeric value or blank. |

| Alternate Valuation 10 year to date depreciation | 1219 | 16 Depreciation value for current year (Period 1-13). Must be a numeric value or blank. |

-

Before importing asset information into SYSPRO, you first use the Asset Import program to import static information for the assets. Thereafter, you use Asset Acquisition Import program to import all the additional information for the same assets.

-

To import from an Excel spreadsheet file, you need to ensure that the first column of the spreadsheet is blank to accommodate the Validation status flag column in the listview. Ensure that the import file you create in Excel is saved as a text file, not an Excel workbook file.

-

Exclamation marks in the Validation status flag column indicate that one or more fields in the line are invalid. These errors are indicated with an exclamation mark in the relevant column. When you hover your mouse over the exclamation mark, the error message is displayed.

You need to fix these columns before the line can be imported. Once you have made the relevant changes, you use the Validate function to repeat the validation process.

Details of the information required in each column are explained in the Asset Acquisition program.

-

Dates must be entered as CCYY-MM-DD or CCYYMMDD (any delimiter character is valid). You define the default date format on the Date Format tab of the System Setup program.

-

You can create ledger entries when importing data from this program if your Assets module is linked to General Ledger (General Ledger Integration).

Operator access to the following activities within this program can be restricted. You configure this using the Operators program.

| Activity | Description |

|---|---|

| Listview/Forms - Export or print data | Controls whether an operator can print the contents of a listview and/or output the contents of a listview to an HTML page, XML document or Excel spreadsheet. |

| Maintain data in import programs | Controls whether an operator can maintain import data in a data grid within any SYSPRO import program before the import is performed. |

| Allowed to import from client | Controls whether an operator can use a SYSPRO import program to import data from a client machine (in a client/server environment). |

| File Browse on server (C/S system) | Controls whether an operator use the browse function to load the Browse on Files and Folders program to locate files on the server in a client/server environment. Operators can still navigate to a file or folder on the server by typing in the full path name in the entry field. |

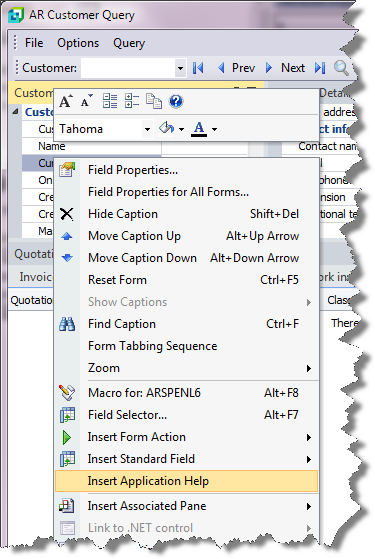

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.

![[Note]](images/note.png)