You use this program to:

-

Process invoices, credit notes and debit notes received from your supplier

-

Process adjustments to suppliers' accounts

-

Approve registered invoices, credit notes and debit notes (these transactions are maintained using the AP Invoice Registration program)

-

Match Accounts Payable invoices to GRNs (Goods Received Notes)

| Field | Description |

|---|---|

| Options | |

| Preferences | This enables you to indicate your preferences for this program (see Preferences). |

| Change Period | Select this to use the Change Posting Period program to change the

posting period to which the transactions are

posted. See Password considerations in Notes and warnings. |

| Default Dates | Select this to define a default due date and default discount date to apply to all transactions for this run of the program (see Default Dates). |

| Default Branch | Select this to indicate the default AP branch against which the transactions are to be processed (see Default Branch). |

| New | Select this to enter a new transaction. If you entered transaction details, but did not post the transaction, then the message: Do you want to save your changes? is displayed. If there is no undistributed amount on the GL Distribution pane and you select Yes to this question, then the entry is posted. If you select No, then the transaction is discarded, the fields are cleared and focus is set to the Supplier field. |

| Transaction type |

Indicate the type of transaction you want to process. The following transaction types are available:

See also: Notes and warnings. |

| Supplier | Enter the code of the supplier for whom you want to process the transaction. |

| Edit Transaction Details |

Select this to edit information in the Transaction and GRN Matching panes. This is enabled only after you select the GL Distribution function. All entries in the GL Distribution pane are cleared. |

| GL Distribution | Select this to distribute the transaction amount(s) to

individual General Ledger accounts. If you selected the GRN matching required option, then you need to complete the GRN matching process before the GL Distribution option becomes available. Once you select the GL Distribution option, the Transaction pane is disabled. The transaction values will have been validated and the contents of the GL Distribution pane are dependent on these values. Changes can therefore only be made by selecting the New option and re-entering the transaction information. |

| Post |

Select this to post the transaction to the supplier's account. This option is only available when the Undistributed value in the GL Distribution pane is zero. If you distributed the tax across multiple General Ledger tax accounts on an Exclusive basis and the entered tax amount does not match the tax calculated by the system, then you must apply the difference to one of the tax codes until the difference is zero from the Exclusive Tax window that is displayed. If you distributed the tax to a single General Ledger tax account on an Exclusive basis and the entered tax amount does not match the tax calculated by the system, you can optionally change the tax amounts from the Exclusive Tax window that is displayed (see Exclusive Tax and Notes and warnings). |

| Print Journal | Select this to use the AP Invoice Journal program to generate the

report of AP journals created during the current run of the

program. This is only available after at least one transaction is posted. |

This screen is displayed when you select the Preferences option.

| Field | Description |

|---|---|

| Distribution | |

| G/L distribution in foreign currency |

Select this to post the General Ledger distribution entries in the currency of the supplier when you process transactions for foreign currency suppliers. |

| Save Preferences | Select this to save these preferences against your operator code. The preferences are saved until next you change them. |

| Close | Select this to save the preferences for the current run of the program only. |

This screen is displayed when you select the Default Dates option.

![[Note]](images/note.png)

|

|

|

These dates override any date normally calculated according to the invoice terms held against the supplier. |

|

| Field | Description | ||||

|---|---|---|---|---|---|

| Discount date |

Enter the Discount date you want to apply to your transactions.

|

||||

| Due date | Enter the Due date you want to apply to your transactions. This is the date on which the invoice is due for payment. | ||||

| OK | Select this to accept the information you entered and to return to the previous screen. | ||||

| Clear |

Select this to clear any entered values in the Due date and Discount date fields. The dates are reset to 00/00/00, which means that default dates are not specified for transactions during this run of the program. |

||||

This screen in displayed when you select the Define Branch option.

| Field | Description |

|---|---|

| Branch selection | |

| Use branch defined against each supplier | Select this to use the AP branch defined against the supplier for the transaction. |

| Override supplier's branch | Select this to ignore the branch defined against the supplier and to indicate a different branch. |

| Branch | Indicate the AP branch code you want to use for the transaction(s). |

| OK | Select this to accept your selections and to return to the previous screen. |

| Cancel | Select this to ignore any changes you made and to return to the previous screen. |

This is displayed when the entered tax or QST amount differs from the calculated tax or QST amount. Change the tax amounts so that the calculated tax or QST amounts equal the entered tax or QST amounts.

| Toolbar functions | Description |

|---|---|

| Entered tax |

Displays the tax amount you have entered. |

| Calculated tax |

Displays the system calculated tax amount. |

| Entered QST |

Displays the QST amount you have entered. |

| Calculated QST |

Displays the system calculated QST amount. |

| OK |

Select this to post your transaction without changing the tax amounts. If you select this, the tax amounts on the tax reports will be different from those on the tax return. This option is not available if the AP setup option Disburse tax amounts over multiple GL Tax accounts is enabled. |

| Change Tax Amounts |

Select this to open the Change Tax Amounts window to distribute the tax amounts. You can change the tax or QST amounts, and Post when the undistributed tax amount is zero. This option is disabled when only one tax code is defined as the Entered tax value is automatically assigned to that tax code. If you use multiple tax codes on different GL distribution lines, then this option is enabled for you to indicate which multiple tax codes values to change. |

-

When GRN matching is not required:

-

The contents of the Transaction pane are validated when you select the GL Distribution function from the toolbar. You cannot proceed if any errors are encountered. The GL Distribution pane is only enabled when no errors are encountered.

-

Once the GL Distribution pane is enabled, only the Transaction reference, Journal notation and Hold invoice fields are enabled. When approving an invoice, only the Journal notation and Hold invoice fields are available.

The rest of the Transaction pane is disabled, but can be re-enabled by selecting the Edit Transaction Details option from the toolbar. However, all information in the GL Distribution pane will be lost.

-

-

If your Accounts Payable module is linked to the General Ledger, then the listview is populated with default values and ledger accounts as follows:

-

Merchandise and Freight lines as entered on the Transaction pane

-

When GRN matching is not required:

The freight and merchandise ledger codes defined against the supplier are used. If these are not defined, then the Default freight and Default merchandise control accounts are used (General Ledger Integration).

When none of these are defined, then you must manually enter the ledger codes. These ledger codes cannot be control accounts. This is prevented by the AP Invoice Posting regardless of the IMPGLB.IMP file.

-

When GRN matching is required:

The first ledger code listed is the GRN suspense account defined in the General Ledger Integration program.

Therefore, the default GL accounts and values that populate the GL Distribution window are directly related to the data that is entered in the Transaction pane and the GRN pane.

When you select the Edit Transaction Details button, the changes that you make to either of these panes can result in the GL default account being different or being of a different value from what was originally populated in the GL Distribution pane. The GL Distribution pane is cleared so that it can be correctly re-populated with default accounts and values that reflect the changes that the operator makes in the Transaction or GRN pane.

-

| Field | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Transaction details | |||||||||||||||||

| Transaction type | This indicates the transaction type currently being processed. | ||||||||||||||||

| Registered Cr/Dr note |

Use the Select option to use the Browse on AP Registered Credit and Debit Notes program to indicate the registered credit or debit note to approve. You must re-establish the debit or credit note if it was not linked to an existing supplier invoice when it was added in the AP Invoice Registration program. |

||||||||||||||||

| Invoice |

Enter the supplier's document number according to the transaction type you are processing:

See Tax considerations in Notes and warnings. |

||||||||||||||||

| Entry number | This indicates the entry number of the transaction and is determined by the system. | ||||||||||||||||

| Branch | This defaults to the branch associated with the supplier or the branch that you entered to override the supplier's branch (see Default Branch). | ||||||||||||||||

| Transaction amount | Enter the total transaction amount including tax. Changing this amount recalculates the Tax amount or QST amount. This field is disabled for an Approve invoice, Approve credit note or Approve debit note transaction. You need to use the AP Invoice Registration program to maintain a registered invoice, credit note or debit note. |

||||||||||||||||

| Freight charge | Enter the applicable freight charge amount. | ||||||||||||||||

| Miscellaneous charge | Enter the applicable miscellaneous charge amount. | ||||||||||||||||

| Transaction reference |

Optionally enter a free format reference for the transaction. When adding an invoice, the reference entered is written to the ApInvoice table. When adding a Dr note, Cr note or Adjustment, the reference entered is written to the ApInvoicePay table. The original invoice reference is not meant to be overridden when processing a Dr note, Cr note or Adjustment. This reference is used as the transaction reference for both the Work in Progress detail transaction reference and the Purchase Order history of receipts reference. For example: You can use a reference of 'Take on' when you use the Accounts Payable module for the first time and you are posting invoices to be able to balance with the General Ledger totals. When you re-establish an invoice and you leave this field blank, the reference of RESTAB is entered by the system. The reference is printed on the AP Invoice Journal and is displayed when you query the supplier's invoices, or if you do an Adjustment, Credit note, Debit Note or Approval. In addition, the reference can be printed on your AP Check Format Remittance Advice. This field is disabled for an Approve invoice, Approve credit note or Approve debit note transaction. |

||||||||||||||||

| Journal notation |

Enter the description of the transaction that you want to print on the AP Invoice Journal. This could for example be a description of items received, or the receiving warehouse and Purchase Order number, or a description relating to an Adjustment, Debit note, Credit note or Approval. |

||||||||||||||||

| Manual check required | Select this to enter payment details for a manual

check. This only applies to the transaction types of Invoice and Approve invoice. |

||||||||||||||||

| Manual check details |

Edit Select this to enter the manual check details for an invoice you are posting against the supplier (e.g. C.O.D invoices that you post to the supplier's account). See Manual Check Details for details. |

||||||||||||||||

| GRN matching required |

Enable this to match the transaction to a GRN (Goods Received Note) that was previously entered against a Purchase Order for the Supplier. GRN matching only applies when the GRN suspense system is required and GRN matching is required for the supplier. See Activity considerations in Notes and warnings. |

||||||||||||||||

| Hold invoice | Select this to place the transaction on hold. This does not apply when the Manual check required option is enabled. |

||||||||||||||||

| Discount |

|

||||||||||||||||

| Amount subject to discount | Indicate the portion of the invoice amount subject to a

discount. This defaults to the Transaction amount entered. |

||||||||||||||||

| Discount based on percentage | Select this to override the default discount amount value calculated by the system and base the discount amount on the Discount percentage entered. This option is only enabled by default when processing an Invoice. | ||||||||||||||||

| Discount percentage | Enter the discount percentage you want the system to use to calculate the discount amount. | ||||||||||||||||

| Discount amount | Enter the discount amount if to override the amount

calculated by the system. This field is disabled when you select the Discount based on percentage option. |

||||||||||||||||

| Discount adjustment | Enter the discount amount to override the amount

calculated by the system. You can enter the new discount amount at the Discount adjustment field, or use the Discount based on percentage option to allow the system to calculate the amount according to a percentage. You can only post a negative discount adjustment when a discount was applied to the invoice originally. BY default, this option applies when processing a Credit note, Debit note or Adjustment. |

||||||||||||||||

| Dates |

|

||||||||||||||||

| Invoice date | Indicate the invoice transaction date. When processing an invoice, this defaults to the current system date, but can be changed. This date is typically the date printed on the supplier's document. Changing this date recalculates the Tax amount or QST amount based on the tax effective rates defined in the Tax Effective Rates program. In addition, this date is used to determine the tax/QST rate for Settlement discount when the Calculate tax using historical tax rateAccounts Payable Setup option is enabled.

|

||||||||||||||||

| Discount date |

When processing invoices, the system determines the Discount date for each transaction according to the Invoice Terms of the Supplier, but this can be changed. If you make a payment to the Supplier before or on the Discount date, you qualify for a discount on the invoice, as it is set up in the Invoice Terms of the Supplier. You can only access the Discount date field if a Discount amount, Discount adjustment or Discount percentage was entered. If you entered a default Discount date (Default Dates), then that date is displayed in this field. This only applies to the Invoice transaction type. For Credit notes, Debit notes and Adjustments, this displays the Invoice discount date. This field is enabled when the Discount amount is non-zero or the Original discount amount against the invoice is non-zero (i.e. there was discount when the invoice was originally captured). The Original discount is displayed in the Information pane.

|

||||||||||||||||

| Due date | This indicates the date on which the Invoice is due for

payment. If you entered a default Due date (Default Dates), then that date is displayed in this field. For Credit notes, Debit notes and Adjustments, this displays the Invoice due date.

|

||||||||||||||||

| Tax | The following cause the QST amount and Tax amount to be recalculated:

|

||||||||||||||||

| Nationality | This defaults to the nationality defined against the supplier, but can be changed. | ||||||||||||||||

| Acquisition | This option applies if the supplier's nationality code

differs from your SYSPRO company nationality

code.

|

||||||||||||||||

| Tax basis |

The tax basis can only be changed if GRN matching required is not selected.

|

||||||||||||||||

| QST amount |

If you selected the option: QST calculated on tax, then second tier tax is calculated on the (selling price + Tax). The second tier tax portion of the transaction is calculated using the Transaction amount and the rate held against the second tier tax code as follows: ((Transaction amount of tax) / (100 + tax%)) x Tax% If the option: QST calculated on tax is deselected, then the second tier tax portion of the transaction is calculated on the selling price only. The tax portions of the transaction are calculated as follows:

This second tier tax amount is posted to the Default second tier tax ledger code if the Accounts Payable Setup option: Disburse tax amount over single G/L tax account is selected. If the option: Disburse tax amount over multiple G/L tax accounts is selected, then the second tier tax amount is posted to the A/P tax ledger code defined against the entered QST code. The tax amount entered here is posted to the Input tax ledger code if the Accounts Payable Setup option: Disburse tax amount over single GL tax account is selected. If the option: Disburse tax amount over multiple GL tax accounts is selected, then the second tier tax amount is distributed to the A/P tax ledger code defined against each second tier tax code entered in GL Distribution. This amount is recalculated according to the tax effective rates in the Tax Effective Rates program when the Invoice date is changed. It is also changed when the Transaction amount is changed. QST only applies to local currency transactions. |

||||||||||||||||

| QST code |

This field is displayed if the Accounts Payable Setup options: Second tier tax is set to Required and Required for foreign currency suppliers, if the supplier is a foreign currency supplier. If the QST code is blank or invalid, then 0 % is assumed for the QST rate. This field defaults to the second tier tax code (Accounts Payable Setup). The system automatically calculates the second tier tax amount according to this tax code. Tax codes are maintained using the Tax Code Setup program. |

||||||||||||||||

| QST calculated on tax |

Select this to calculate the second tier tax on the Selling price plus tax. Deselect this to calculate the second tier tax on the Selling price only. This field is displayed if the Accounts Payable Setup options:Second tier tax required and Required for foreign currency suppliers (if the supplier is a foreign currency supplier) options are enabled. This field defaults to the setting at the Calculated on tax option (Accounts Payable Setup). |

||||||||||||||||

| Tax code |

When the EC VAT system is not required, the default tax code is the Default code for Tax that is defined in Accounts Payable. If the Tax code is blank or invalid, then 0 % is assumed for the tax rate. The Descriptive tax code must be used if defined (Descriptive Tax Code Browse/Maintenance). If the Company Tax Options Setup option: EC VAT system required option is selected and the Accounts Payable Setup setup option: Supplier default tax code required is selected, then this field defaults to the tax code defined against the supplier. If the option: Supplier default tax code required is not selected, then this field defaults to the Default tax code defined in Accounts Payable Setup. If the transaction is defined as an acquisition, then this field is disabled. If the Company Tax Options Setup setup option: EC VAT system required is selected, and the transaction is for an Acquisition transaction, then this field is disabled. When processing a transaction for a foreign currency supplier, this field is only enabled if the option: Allow tax entry for foreign currency suppliers is selected. The system automatically calculates the Tax amount according to this tax code. Tax codes are defined using the Tax Code Setup program. To change the code you must indicate that a Global tax file is required (General Ledger Setup) or that a Tax distribution file is required in Detail or Summary from the Accounts Payable Setup program.

See Tax considerations in Notes and warnings. |

||||||||||||||||

| Tax amount |

The system calculates the Tax amount, using the Transaction amount value and the rate held against the Tax code to calculate the tax portion of the transaction. The tax calculation is performed as follows: ((Total value inclusive) / (100 + tax %)) x Tax % If the Accounts Payable SetupSecond tier tax required option is enabled then the second tier tax amount is deducted from the Total invoice value inclusive before the tax amount is calculated. If second tier tax is required, then the tax is calculated as follows: (Total value inclusive - second tier tax amount) / (100 + tax%) x Tax % To change the tax amount, you must indicate that a Global tax file is required from the General Ledger Setup program, or that a Tax distribution file is required in Detail or Summary from the Accounts Payable Setup program. When processing a transaction for a foreign currency supplier, this field is only enabled if the Accounts Payable Setup option: Allow tax entry for foreign currency suppliers is selected. If the Company Tax Options Setup setup option: EC VAT system required is selected, and the transaction is for an Acquisition transaction, then this field is disabled. The tax amount entered here is posted to the Input tax Ledger code if the General Ledger Integration option: Disburse tax amount over single G/L tax account is selected. If the option: Disburse tax amount over multiple G/L tax accounts is selected, then the tax amount is distributed to the A/P tax ledger code defined against each tax code entered in GL Distribution.

This amount is recalculated according to the tax effective rates in the Tax Effective Rates program when the Invoice date is changed. It is also changed when the Transaction amount is changed. |

||||||||||||||||

| Notation |

Enter a notation to describe the Tax amount and/or ledger code when it is posted to the General Ledger. The notation is printed on the AP Invoice Journal and General Ledger reports and displays in GL Query. This only applies if the Ask notation per detail distribution entry option is enabled in the Accounts Payable Setup program. |

||||||||||||||||

| Foreign currency | |||||||||||||||||

| Exchange rate |

This indicates the exchange rate to use for the transaction. This is the rate at which foreign currency transactions are converted to your local currency equivalent, before being posted into the General Ledger. You can only access this field when all of the following apply:

|

||||||||||||||||

| Fixed exchange rate | Select this to fix the exchange rate for the transaction to the rate in the Exchange rate field. | ||||||||||||||||

This screen is displayed when you select the Edit option at the Manual check details field.

![[Note]](images/note.png)

|

|

|

|

| Field | Description |

|---|---|

| Accept and Close | Select this to save the information you entered and to return to the previous screen. |

| Cancel | Select this to ignore any information you entered and to return to the previous screen. |

| Payment information | |

| Bank | Indicate the code of the bank on which the check was drawn. |

| Gross payment | This defaults to the Transaction amount entered on the previous screen, but can be changed. |

| Use Defaults | Select this to apply the Gross

payment and Discount amount

calculated in the

Transaction pane of the previous

screen. You typically use this function if you changed these amounts on the Manual Check Details screen and now want to restore them to the original values. |

| Discount amount |

Indicate the discount amount taken from the payment. This defaults to the discount calculated on the previous screen, but can be changed. |

| Check date | Indicate the payment date reflected on the manual check. |

| Payment run |

This field is only enabled if you are using the Payment Cycle Maintenance program to process supplier payments and your Payment run numbering method is set to Manual in the Set Key Information program. Enter a payment run number for the manual check. The payment run number must be unique (i.e. you cannot use an existing payment run number). If your Payment run numbering method is set to Automatic, then the system allocates the next payment run number when you post the transaction. |

| Check number | Indicate the number on the manual check. |

| Withholding tax information | This section only applies if the Company Tax Options Setup option: Withholding tax required is selected and a valid withholding tax code is defined against the supplier. |

| Taxable amount |

If the option: Automatic calculation of withholding tax is not selected, then you use this field to enter the amount of the transaction which is subject to tax. Alternatively, you can use the Calculate function to calculate the taxable amount. If the option: Automatic calculation of withholding tax is selected, then the taxable amount is automatically displayed. The calculated amount can be changed. When the taxable amount is automatically calculated, if you select the Manual Check function before you enter any G/L Distribution entries, then the Taxable amount is calculated as: Payment amount - discount. The reason is that the program needs the tax code of the first GL distribution entry to calculate the invoice tax amount. If you select the Manual Check function after you enter the GL Distribution entries, then the program uses the tax code against the first G/L distribution entry to calculate the invoice tax amount. In this case, the taxable amount is calculated as: Payment amount - tax on invoice - discount. |

| Calculate |

Select this to automatically calculate the Taxable amount based on the current transaction values. If the option: Automatic calculation of withholding tax is not selected, then the taxable amount is calculated as: Payment amount - discount amount) If the option: Automatic calculation of withholding tax is selected, then the taxable amount is calculated as: (Gross payment - invoice tax amount - discount). When the taxable amount is automatically calculated, if you select the Manual Check function before you enter any G/L Distribution entries, then the Taxable amount is calculated as: Payment amount - discount. The reason is that the program needs the tax code of the first GL distribution entry to calculate the invoice tax amount. If you select the Manual Check function after you enter the GL Distribution entries, then the program uses the tax code against the first G/L distribution entry to calculate the invoice tax amount. In this case, the taxable amount is calculated as: Payment amount - tax on invoice - discount. |

| Withholding tax code |

This defaults to the Withholding tax code defined against the supplier, but can be changed. The Tax amount is not automatically recalculated when you change the Tax code. You need to select the Calculate function to re-calculate the Tax amount. The Tax code determines the tax rate to use (see Browse on Tax Codes). |

| Tax amount |

If the option: Automatic calculation of withholding tax is not selected, then you use this field to enter the amount of tax you are withholding from the invoice being paid. Alternatively, you can use the Calculate function to calculate the tax amount. If the option: Automatic calculation of withholding tax is selected, then the tax amount is automatically displayed. It is calculated as: ((Taxable amount * withholding tax rate) / 100). The calculated amount can be changed. |

| Calculate |

Select this to automatically calculate the Tax amount, based on the current transaction values entered. The tax amount is calculated as: ((Taxable amount * withholding tax rate) / 100). |

| Tax rate % | This indicates the rate defined against the tax code used. |

| Field | Description |

|---|---|

| Supplier information | This displays information defined against the Supplier you entered. |

| Invoice information | This displays information recorded against the transaction you have entered. |

| Posting information | |

| Posting period | Indicates the period and year to which the transaction will be processed. |

| Journal | Indicates the AP journal number created for the transactions processed during the current run of the program. |

| Recap totals | Displays transaction totals for the current run of the program. |

This is enabled when the GRN Matching required option is enabled in the Transaction pane.

All values are displayed in the currency of the supplier when matching GRNs for a foreign currency supplier and the preference GL distribution in foreign currency is enabled.

Once GRN matching is complete, the GL Distribution function can be selected.

![[Note]](images/note.png)

|

|

|

|

See Password considerations in Notes and warnings.

| Field | Description | ||||

|---|---|---|---|---|---|

| GRN | Enter the GRN you want to match to the

invoice. Each GRN entered is validated and added to the end of the grid. GRNs currently displayed are not affected. Only lines with the GRN you entered are displayed in the listview, enabling you to select the required lines you want to match. A message is displayed when:

|

||||

| Load Multiple GRNs |

|

||||

| Range of GRNs | Enables you to indicate a range of GRNs to display. | ||||

| All GRNs | Displays all GRNs for the supplier. A GRN is excluded from the listview when:

|

||||

| Value to Match | This is the transaction value to be matched to the GRN

and is calculated as: Transaction amount less Freight charge less Miscellaneous charge less Tax amount This always displays the value as at the time you selected the GRN Matching option in the Transactions pane. It is not reduced as you select lines to match. The values currently matched are displayed in the footer section of the grid. |

||||

| Match All Lines | Enables you to simultaneously select all the detail lines in the grid to match to the invoice.

|

||||

| Match Filtered Lines |

This enables you to select all the GRNs available on the grid after using the Ctrl+F option, and match them to the invoice. Note: The Ctrl+F function filters on all columns and rows in the grid, so the filter results could return more lines than expected. |

||||

| Remove All GRNs | Clears the listview. | ||||

| Reload GRNs | Resets any changes made to the lines and redisplays them. All changes made to the grid are lost. | ||||

| GRN Adjustment |

Uses the GRN Adjustment program to maintain details of Goods Received Notes.

|

||||

| Match |

A tick in this checkbox indicates that the GRN line is selected for matching and allows you to change the Merch matched value for the line. You can toggle between selecting and deselecting each line. This is set to enabled when you select the Match All Lines option. |

||||

| Partial match |

Select this to match only a part of the selected GRN quantity or value to your transaction. This allows you to change the Matched qty and Matched value and Merch matched value fields in the grid. The Match check box must be ticked before you can select this option. |

||||

| Goods Received Note | This indicates the GRN number for the line. | ||||

| Outstanding value |

This is calculated as follows: Outstanding value (in local currency) = Current GRN value (in local currency) - Value matched to date (in local currency) When performing GL Distribution in foreign currency, then it converts the Outstanding value in local currency to Outstanding value (in foreign currency) using the exchange rate entered in AP Invoice Posting. |

||||

| Matched qty | This defaults to the Outstanding

qty for the GRN and can only be changed when the

Partial match checkbox is

ticked. Indicate the quantity of the line item that you want to match for the GRN line. |

||||

| Matched value | This defaults to the Outstanding

value for the GRN and can only be changed if the

Partial match checkbox is

ticked. Indicate the value to match for the GRN line. |

||||

| Merch matched value | This defaults to the Outstanding

value for the GRN and can only be changed when the

Match checkbox is ticked. Indicate the merchandise value to match for the GRN line. See GRN variance in Notes and warnings. The value in this column has nothing to do with the purchase price variance value calculation. |

||||

| Withholding tax expense type |

This indicates the expense type defined against the supplier. |

||||

This is displayed when you select the Load Multiple GRNs function.

Although this is an editable form, it cannot be customized. It is not a dockable pane.

| Field | Description |

|---|---|

| Load | Replaces the currently displayed GRNs in the listview with the range of GRNs indicated. |

| Cancel | Returns to the listview as it was. |

| From GRN | Indicate the first GRN you want to display. |

| To GRN | Indicate the last GRN you want to display. |

The GL Distribution pane enables you to distribute the portions that make up the total transaction amount to General Ledger accounts.

When you select the GL Distribution option from the toolbar, the contents of the Transaction pane are validated and the GL Distribution pane is enabled if no errors were found.

This is an editable grid (not an editable form) and cannot therefore be customized (e.g. changing the tabbing sequence).

If Accounts Payable is linked to General Ledger, then the listview is populated with default values and ledger accounts as follows:

-

Merchandise and Freight entered on the Transaction pane

If GRN matching is not required, then:

-

the Freight and Merchandise Ledger codes defined against the supplier are used

or if not defined,

-

the Default freight and Default merchandise control accounts (General Ledger Integration).

-

When none of these are defined, you must manually enter the ledger codes. These ledger codes cannot be control accounts. This is prevented by the AP Invoice Posting program regardless of the IMPGLB.IMP file.

When GRN matching is required, the first ledger code listed is the GRN suspense account defined in the General Ledger Integration program.

-

-

Miscellaneous charge

Amounts must be manually distributed.

-

Tax

To distribute the taxable portion of the transaction amount you must indicate that a Global tax file is required (General Ledger Setup) or that a Tax distribution file is required in Detail or Summary (Accounts Payable Setup).

To distribute the taxable portion for foreign currency suppliers you have to select the option Allow tax entry for foreign currency suppliers.

If you selected the preference: GL distribution in foreign currency, then the values displayed on the GL Distribution pane are in the currency of the supplier.

Once the GL Distribution process is complete, you can select the Post function.

| Toolbar functions | Description |

|---|---|

| Delete | This removes the highlighted entry from the list of distribution entries. |

| Issue to Job | This posts amounts for non-stocked related amounts

(such as freight and miscellaneous charges) directly to a Work

in Progress job. You can only post to a job when the Accounts Payable and Work in Progress modules are in the same period. See Issue to Job. |

| Apply Undistributed | This distributes the undistributed amount to the Ledger code currently selected. |

| Undistributed | This indicates the amount which must still be allocated

to ledger codes. When the this amount reaches zero, the system calculates the tax portion. Each ledger distribution entry has a Tax code associated with it, which is used to calculate the Tax amount per entry on an Exclusive or Inclusive basis. All these amounts are added up to produce the Total tax amount on the transaction. |

| Column headings | Description |

|---|---|

| Ledger code |

This indicates the General Ledger code to which the amount must be distributed. This field is disabled for a 'Tax only' invoice (see Tax only below). |

| Description | This indicates the description of the Ledger code. |

| Amount | This indicates the amount to distribute to the

Ledger code. You can either enter separate amounts to be posted against different ledger codes, or select the Apply Undistributed function to assign the undistributed value shown on the screen to the ledger code selected. If you selected the preference: G/L distribution in foreign currency, then the General Ledger distribution entries for Invoices, Credit notes, Debit notes and Adjustments processed for foreign currency suppliers are processed in the currency of the supplier. |

| Tax code |

This indicates the tax code to use to determine the applicable tax amount for that distribution entry.

When processing a transaction for a foreign currency supplier, this field is only enabled if the option: Allow tax entry for foreign currency suppliers is selected. If you change the Tax code for a specific General Ledger entry, then the system recalculates the tax amount for that entry according to the new code entered. If you are using Withholding tax and you disburse the invoice value to multiple G/L expense accounts and use different tax rates against the entries, then when the withholding tax amount is calculated for payment purposes, the calculation only uses the first tax code entered. |

| Notation |

You can enter a notation against each line when the Ask notation per detail distribution entry option is enabled in the Accounts Payable Setup program. The notation entered is printed on the AP Invoice Journal and General Ledger reports, and displayed in the GL Query. |

| Job |

This indicates the job number to which the amount was posted. It only applies if you issued the amount to a job (see Issue to Job). |

| Withholding tax code |

This indicates the withholding tax code to use to determine the applicable withholding tax amount for that distribution entry. |

| Withholding tax amount |

This amount is automatically calculated, but can be changed if required. You would typically change this amount for invoices that have both goods and services, but withholding tax is calculated for only one i.e. zero for one line and an amount for the other. |

| Withholding tax expense type |

This indicates the expense type defined against the supplier. |

| Tax only | Enable this to allocate the entire value in the

Amount column as a tax value. This field is not displayed by default, but must be added to the listview, using the Field Chooser option, if required. This field is unavailable when:

This field is disabled when:

When you enable Tax only and the Accounts Payable Setup option: Disburse tax amount over single GL tax account is enabled, then:

When you enable Tax only and the Accounts Payable Setup option: Disburse tax amount over multiple GL tax accounts is enabled, then:

The Apply Undistributed option is disabled when you are using Exclusive tax and posting the entire value as a tax amount. With exclusive tax the value in the Amount column does not include tax, so the undistributed value must not be affected. Refer to Report Details or Report Details for details of imbalances which can occur by posting Tax only entries. See also: Notes and warnings. |

Additional columns can be added to the listview using the Field Chooser option.

This pane is enabled when you select the Issue to Job option from the GL Distribution pane.

The Work in Progress files/tables are only updated when you select the Post function.

| Toolbar functions | Description |

|---|---|

| New | Select this to reset all fields in the pane and to enter a new Job number. |

| Job | Indicate the job number to which the amount must be

posted. The job must exist and be confirmed in the Work in Progress module and must not be on hold. |

| Issue to Job |

Select this to allocate the materials to the job. The following message is displayed when you select this option: "Is this allocation complete?" Select Yes if all material allocations for the job are now complete. The system returns to the GL Distribution pane. Select No if there are additional material allocations to be issued to the job. The system returns to the GL Distribution pane. Select Cancel to return to the Issue to Job pane. |

| Cancel and Close | Select this to cancel out of this pane and to return to the GL Distribution pane. |

| Field | Description |

|---|---|

| Job details | |

| Job | This indicates the job number to which the amount must be posted. |

| Job description | This indicates the job description. |

| Purchase order options | |

| Purchase order required |

Select this if a purchase order was raised for the non-stocked item. The Purchase order and Line fields are enabled for you to enter these details. Deselect this if no purchase order relates to the non-stocked item. |

| Purchase order | Indicate the purchase order number on which the non-stocked item was ordered. |

| Line | Indicate line number (within the purchase order) relating to the non-stocked item. |

| Subcontract options | |

| Subcontract operation |

Select this if the non-stocked item is linked to a subcontract operation. The Operation and Operation complete fields are enabled. Deselect this if the non-stocked item is not linked to a subcontract operation. |

| Operation | Indicate the operation number to which the item must be allocated. |

| Operation complete | Select this if you are making the final issue of the item to the subcontract operation. i.e. If there are no outstanding material allocations for the operation. |

| Posting details | |

| Non-stocked code | Indicate the code for the non-stocked item. |

| Description | Indicate the description for the Non-stocked code. |

| Product class | Indicate the product class for the non-stocked item. |

| Tax code |

The system uses the tax code to determine the applicable tax amount. The default Tax code is defined in Company Tax Options Setup for Non-stocked items. If you selected a Tax basis of Inclusive in the Transaction pane, then you can change this code. |

| Quantity to issue | Indicate the quantity of the non-stocked item that must be allocated to the job. |

| Currency of value to issue | |

| Value of issue |

Enter the value of the non-stocked item that you want to issue to the job from your transaction. This value defaults to the Undistributed amount from GL Distribution pane. |

| Hierarchy | For hierarchical jobs, you must indicate the hierarchy to which the amount must be issued (see P&C Maintenance of Job Hierarchies). |

-

You can only run this program when the Input tax ledger code is defined (General Ledger Integration). The message Accounts Payable - Input tax account is displayed when this code is not defined.

-

Credit notes

You cannot post a Credit note against an invoice which:

-

has a manual check posted against it

-

is on hold

-

has been released for payment

-

-

Adjustments

You cannot post an Adjustment transaction type to the invoice once Manual Check Details have been posted for the invoice.

-

Approve credit note

You cannot approve a credit note which has been released for payment.

-

Freight charges

The MtdFreight and YtdFreight columns in the ApSupplier table are only updated when the freight charges are posted to a GL account code defined with an Expense type of Freight.

The YtdFreightVal column in the ApControl table is only updated with the freight value posted against temporary suppliers when these temporary suppliers are purged by the AP Period End program.

-

When using the Tax only option, it is strongly recommend that you use a separate tax code for this type of transaction.

The Tax Return is unable to pick up the tax line when using the same tax code used for the other distribution lines.

-

The Tax code field is not displayed in the Transaction grid if the Accounts Payable SetupTax distribution method is set to Not required. This applies even if you manually drag the Tax code field into the grid.

-

Where applicable, the letters QST are replaced by whatever you entered at the Second tier tax - Description field.

-

The warning message: Tax Relief already processed on this invoice is displayed when you process a Credit note, Debit note or Adjustment against an invoice which was processed by the AP Tax relief program.

Such adjustments either increase or decrease the invoice balance, which can cause the Tax relief/recovery account in General Ledger Integration to be out of balance. The onus is on you to manually adjust the Tax relief/recovery account.

If you distributed the tax to a single or multiple General Ledger tax accounts on an Exclusive basis and the entered tax amount does not match the tax calculated by the system, you can optionally change the tax amounts from the Exclusive Tax window that is displayed.

The following table indicates how the system processes differences between the entered tax and the calculated tax:

| Change | Same tax code used on all GL Distribution lines | Different tax codes used on different GL Distribution lines |

|---|---|---|

| When the Disburse tax amount over single GL tax account setup option is enabled: | When the Disburse tax amount over single GL tax account setup option is enabled: | |

| 1 cent |

|

|

| Greater than 1 cent |

|

|

| When the Disburse tax amount over multiple GL tax accounts setup option is enabled: | When the Disburse tax amount over multiple GL tax accounts setup option is enabled: | |

| 1 cent |

|

|

| Greater than 1 cent |

|

|

-

If the GL analysis required option is enabled for a ledger account used in this program (General Ledger Codes or GL Structure Definition) then the Capture GL Analysis Entries program is displayed when you post the transaction, so that you can enter the analysis details. For a sub module transaction, the sub module must also be linked to the General Ledger in Detail at company level (General Ledger Integration) or at ledger account code level (General Ledger Codes or GL Structure Definition). GL analysis entries cannot be entered from sub modules if the sub module is linked to the General Ledger in Summary at company level or at ledger account code level.

Note that the GL analysis required option is ignored for all GL codes which are defined in General Ledger Integration. This applies even when the GL code is manually entered in a posting program. Although GL integration programs may be entered manually, they may also be called automatically by other programs or may be automated, which means that they can never be stopped to allow GL analysis entries to be captured.

If the GL analysis code used does not exist in the GenAnalysisCat table, then a message to this effect is displayed and the program will not prompt for analysis again. The GL journal will be created but not posted until the GL code, GL analysis code and GL journal are corrected.

The Ask Me Later function is only available when the option: Force GL Analysis - GL journal posting is enabled for the sub-module (General Ledger Integration).

General Ledger analysis entries are always distributed in the local currency, regardless of the currency in which the original transaction is processed.

-

The total of the Merch matched value column, for all GRN lines selected for matching, is compared to the invoice merchandise value. (i.e. the invoice value net of tax, freight and miscellaneous charges). If the difference between the two values exceeds the GRN variance - Maximum permitted variance defined in Accounts Payable Setup, then the following warning is displayed when you select the GL Distribution option: Acceptable variance is exceeded. Ok to continue.

If a password is defined against the field: AP Entry of a GRN matching value exceeding permitted GRN variance then the password must be entered before the warning can be overridden. This applies to stocked and non-stocked lines.

-

You can generate the GRN Invoice Variance report of all matched GRN's, showing the variance between the original purchase receipt value and the entered invoice value.

-

Any Purchase price or exchange rate rounding variance less than the percentage stipulated at the Ignore rounding variance less than (%) percentage option (Accounts Payable Setup) is posted to the following ledger accounts depending on how you configured Inventory integration to the General Ledger.

-

When integrated, and the rounding variance does not exceed the cut-off percentage defined, then it is posted to the GRN suspense account. Otherwise it is posted to the Purchase Price Variance account.

-

When not integrated, and the rounding variance is less than the cut-off percentage defined, then it is posted to the Merchandise account. If the rounding variance is not less than the cut-off percentage, then it must be manually allocated to a ledger code.

-

-

When matching GRNs for foreign currency suppliers, the invoice merchandise and GRN matched values are calculated. The exchange rate variance value is posted to the Realized variance ledger account if defined (AP Currency Variance GL Interface) otherwise it is posted to the Exchange variance ledger account defined against the bank (Banks).

-

When a credit note, debit note, or adjustment is posted to an existing invoice that was previously revalued, the original exchange rate ('OrigInvRate' in the ApInvoice table) against the invoice is used for the credit note/debit note/adjustment. If the 'OrigInvRate' column in the ApInvoice table is zero, then a check is made to determine if a record exists for the Supplier/Invoice combination in the ApInvoiceReval table. If it does, then the first record with a non-zero 'BefPostConvRate' is used. If no matching record is found in ApInvoiceReval table, then the 'ConvRate' on the ApInvoice table is used.

Any variance between the original rate of exchange for the invoice and the current rate of exchange for the transaction is posted to the Unrealized variance account (AP Currency Variance GL Interface).

-

When defining a VBScript and using the OnSubmit event in the GL Distribution pane, note that the OnSubmit occurs multiple times in this program as the lines in the GL Distribution pane are submitted each time the Undistributed value is calculated. The OnSubmit event is not only invoked when the Post button is selected. VBScripting that prevents the OnSubmit from firing could cause the program to operate incorrectly.

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the eSignature Setup program.

| eSignature Transaction | Description |

|---|---|

| AP Post invoice |

Controls access to the Post Transaction function for Invoices in the AP Invoice Posting program. |

| AP Post credit note |

Controls access to the Post Transaction function for Credit notes in the AP Invoice Posting program. |

| AP Post debit note |

Controls access to the Post Transaction function for Debit notes in the AP Invoice Posting program. |

| AP Post adjustment |

Controls access to the Post Transaction function for Adjustments in the AP Invoice Posting program. |

| AP Approve registered invoice |

Controls access to the Post Transaction function when approving invoices in the AP Invoice Posting program. |

| AP Invoice placed on hold |

Controls access to the Hold function in the Payment Cycle Maintenance, AP Release Invoices to Pay by Review, AP Invoice Posting and AP Supplier Invoices programs. |

| AP Override GRN variance |

Controls access in the AP Invoice Posting program after entering the GRN details and selecting the GL Distribution option. This can be used to prevent/detect/log an operator overriding the maximum GRN variance defined in the Accounts Payable Setup program. When the eSignature is set to Denied and the acceptable GRN variance is exceeded, the message: Acceptable variance exceeded. Operator is denied access to continue is displayed after entering the GRN details and selecting the GL Distribution option. A GRN variance arises when there is a difference between the supplier's invoice value (net of tax, freight and miscellaneous charges) and the total merchandise value of the GRN line(s) you select to match. |

| AP Approve registered credit note |

Controls access to the Post Transaction function when approving credit notes in the AP Invoice Posting program. |

| AP Approve registered debit note |

Controls access to the Post Transaction function when approving debit notes in the AP Invoice Posting program. |

Operator access to the following activities within this program can be restricted. You configure this using the Operators program.

| Activity | Description |

|---|---|

| AP Invoices | Controls whether an operator can process an Invoice transaction type using the AP Invoice Posting program. |

| AP Credit notes | Controls whether an operator can process a Credit note transaction type using the AP Invoice Posting program. |

| AP Debit notes | Controls whether an operator can process a Debit note transaction type using the AP Invoice Posting program. |

| AP Adjustments | Controls whether an operator can process an Adjustment transaction type using the AP Invoice Posting program. |

| AP Approve invoices | Controls whether an operator can process an Approve invoice transaction type in the AP Invoice Posting program. |

| AP Untick GRN matching required |

Controls whether an operator can deselect the GRN matching required option in the AP Invoice Posting program to bypass the GRN matching phase when posting an invoice. This prevents the operator from posting an invoice until at least one GRN line is selected when GRN matching is required for a supplier (Suppliers). This does not apply to setting the GRN matching required option in the (Suppliers) program. |

Password access to the following functions in this program may be defined in the Password Definition program. When defined, the password must be entered before you can access the function.

| Function | Description |

|---|---|

| AP Posting to a previous month | This password restricts access to posting Accounts Payable transactions to a previous period (see Multi-period accounting). |

| AP Entry of a GRN matching value exceeding permitted GRN variance |

This password restricts access to overriding the warning message displayed when the maximum GRN variance defined is exceeded (Accounts Payable Setup). A GRN variance occurs during GRN matching in the AP Invoice Posting program when there is a difference between the supplier's invoice value (net of tax, freight and miscellaneous charges), and the total merchandise value of the GRN line(s) selected to match. This applies to stocked and non-stocked items matched to GRNs. |

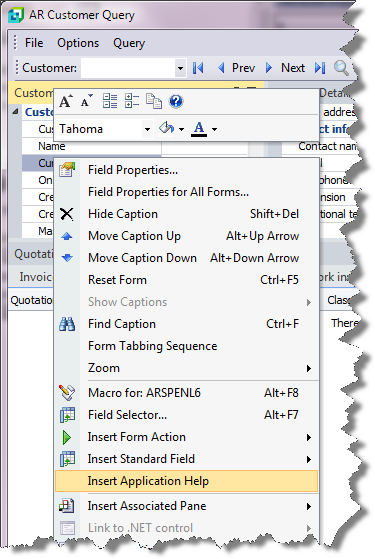

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.