You use this program to add and maintain the tax codes required for a basic tax system or a tax system based on geographic areas when you are not using the USA tax system. The equivalent program for the USA tax system is the Extended Tax Code Maintenance program.

Although this program only allows you to define a current and previous rate of tax against each tax code, the Tax Effective Rates program enables you to define an unlimited number of historical tax rates and effective dates for each tax code.

| Field | Description | ||||||

|---|---|---|---|---|---|---|---|

| Tax code information | |||||||

| Tax code | The tax code you are currently maintaining. | ||||||

| Description | Enter a description for the tax code. | ||||||

| Tax rate decimals | The number of decimal places to use for tax rates for

this specific tax code. The number of decimals defined here takes precedence over the number of decimals defined in the Company Maintenance program for this tax code. |

||||||

| Current rate |

Assign a tax percentage rate to the tax code which will be used to determine the taxable value of an invoice captured with this tax code. When processing a credit note or debit note against an existing sales invoice (where the date of the invoice is earlier than the effective date specified at the Rate effective from field) your entry at the Previous rate field is applied. |

||||||

| Rate effective from |

The date from which the current tax rate is effective. This date is used to establish which rate must be used when processing a credit note or debit note against an existing sales invoice. If the date of the invoice being credited/debited is earlier than the date specified here, then the entry made in the Previous rate field is used instead. |

||||||

| Previous rate | Assign a tax percentage rate to the tax code that will be used instead of the current rate whenever the date of an invoice being credited/debited is earlier than the effective date of the current rate. | ||||||

| Tax options | |||||||

| Sales tax | You cannot access this field if your nationality code

is defined as CAN.

|

||||||

| Tax based on | You cannot access this option if your nationality code

is defined as CAN.

|

||||||

| Neutral tax based on | You cannot access this option if your nationality code

is defined as CAN.

|

||||||

| Price code | The price code from which sales tax must be calculated (if you selected to base neutral tax on price). | ||||||

| GL ledger codes | |||||||

| Sales tax ledger code | The control account to which you want to post sales tax

amounts entered in the Sales Order module. You can only access this field if sales tax integration to the General Ledger is at tax code level (Company Tax Options Setup). By implication, you cannot access this field if you are using the Canadian GST tax system, as it is always integrated at branch level. |

||||||

| Sales tax ledger description | The description of the ledger code. | ||||||

| AP tax ledger code | The control account to which tax entries must be posted

during the ledger distribution phase of the Accounts Payable

AP Invoice Posting program. You can only access this field if the Accounts Payable Tax distribution method is required in Detail or Summary and you enabled the Disburse tax amount over- Multiple GL tax accounts option (Accounts Payable Setup). |

||||||

| AP tax ledger description | The description of the ledger code. |

-

Access to this program can be restricted per operator group (see Security Access).

-

Additional security can also be implemented in the following areas:

-

Functions/Activities can be restricted:

-

per operator (see Security Activities).

-

per operator role (see Role Activities and Fields Maintenance).

-

using Electronic Signatures (see eSignature Setup).

-

-

Fields can be restricted:

-

per operator (see Security Fields and Access).

-

per operator role (see Role Activities and Fields Maintenance and Role Access Control Maintenance).

-

-

-

You cannot delete a tax code if the period-to-date, month-to-date, or year-to-date sales tax totals are not zero.

-

If you delete a tax code for which a sales order has yet to be processed, then no tax is calculated for that order.

-

The Descriptive tax code (where used) is also deleted when the Tax code is deleted.

-

Tax rate decimals

-

The only reports that support the use of 5 decimal places are SRS reports.

-

For all documents on which the tax rate is printed, the use of 5 decimal places is supported on Standard, Word and SRS documents.

-

-

Descriptive tax codes

If Use descriptive tax codes is enabled (Company Tax Options Setup) then you must define a descriptive tax code using the Descriptive Tax Code Browse/Maintenance program against each three character SYSPRO Tax code added. A Tax code without a corresponding Descriptive tax code cannot be used.

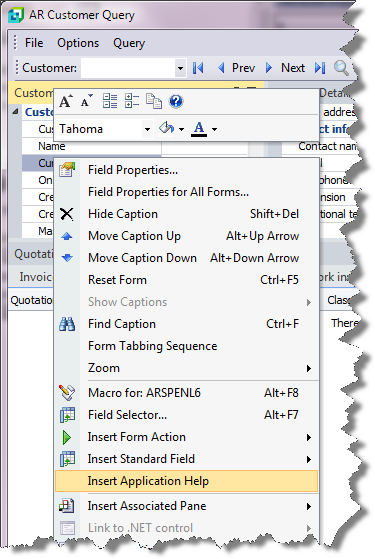

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.