Customers

You use this program to capture and maintain details of customers required within the system. The information captured is also used in the Customer Query program.

Exploring

Things you can do in this program include:

-

Create and populate information for a new customer

-

Edit information related to an existing customer

-

Delete an existing customer

-

Assign contacts to an existing customer

-

Link an existing customer to a price group

This program is accessed from the Program List of the SYSPRO menu:

-

Program List > Accounts Receivable > Setup

Accounts in the Contact Management System let you manage your contacts, such as customers and suppliers (existing or potential), leads, colleagues or any other internal or external contact person.

Contacts assigned to prospective accounts can later be converted into customers and suppliers.

Within SYSPRO, branches are used for reporting and analysis purposes and as a means of integrating transactions to General Ledger for balancing and control purposes.

Branches are linked to suppliers. This enables you to classify suppliers by branch (e.g. all local suppliers can be assigned a branch number together with one ledger control account and all foreign currency suppliers can be assigned a different branch number with another ledger control account.

Accounts Payable integration to General Ledger is mandatory at branch level.

Currency variance integration is mandatory at branch level and optional at currency and bank level.

You maintain branches using the AP Branch Maintenance program.

Branches are linked to customers. All salespersons and product classes must also be associated with an Accounts Receivable branch for sales analysis purposes.

Accounts Receivable integration to General Ledger is mandatory at branch level.

Sales integration is mandatory at branch level and optional at product class, geographic area, and warehouse level.

Payment integration is mandatory at branch level and optional at geographic area and counter sales payment level.

Currency variance integration is mandatory at branch level and optional at currency level.

The branch enables the selection, subtotaling and sequencing of a number of Sales Analysis reports.

You maintain branches using the AR Branch Maintenance program.

Branches are linked to assets. Costs incurred against an asset are recorded against the branch to which the asset is assigned. The branch is also used to apportion costs when an asset is moved between locations.

Asset ledger integration is mandatory at branch level and optional at cost center, and group level.

Cost centers are linked to asset branches and can be used as an optional asset ledger interface.

You maintain branches using the Asset Branches program.

WIP branches are linked to jobs.

You can define the general ledger integration at branch or job classification level. Depending on the GL integration level defined, the ledger codes set up against the branch or against the job classification are used.

GL integration by WIP branch facilitates reporting and analysis of work in progress transactions by branch. A default branch can be defined against the route, an operator, a bill of material and a job.

You maintain branches using the WIP Branch Maintenance program.

Contacts are the customers, suppliers, and accounts that are connected to the organizations with which you do business.

A currency refers to the monetary unit in which a country processes financial transactions. It enables you to conduct business with foreign currency customers or suppliers by converting values to the local currency equivalent.

You maintain currencies using the Currency Maintenance program.

A customer provides the mechanism for you to raise sales orders within SYSPRO.

The static information captured against a customer is used when processing sales transactions and determines, for example, the tax and discounts applicable.

Documents generated from these transactions (e.g. invoices, credit notes, debit notes) are also stored against the customer.

The customer code can be used as a filtering tool when generating reports.

Customers are maintained using the Customers program (Program List > Accounts Receivable > Setup).

Customer classes can be used to classify customers according to your requirements.

Once a customer is assigned a particular classification, you can generate reports and analyze sales history selectively by customer class.

You maintain customer classes using the Customer Classes program.

This is the currency captured against the customer (i.e. the customer's local currency).

International customers located in a foreign country will use a foreign currency. These foreign currencies are converted using the currency exchange rate as at the date and time of the transaction.

This comprises a primary customer and secondary customers (i.e. one or more associated downstream customers).

Group customers simplify the payments process by letting you process a single large payment against a group customer (the primary and secondary customers) instead of having to make smaller individual payments.

Group customers are maintained using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Transaction Processing).

A dunning group is a category into which you can group customers. Dunning letters are issued to all customers in the selected dunning group.

A dunning letter is a notification letter or a payment reminder that is sent to customers when payment is due or overdue.

European community

Within SYSPRO, a geographic area represents a specific region in which your customer or supplier resides.

You assign customers to geographic areas and configure your system to apply the rate of tax for a stocked order line according to the customer's geographic area.

You use geographic areas to integrate sales and payments to General Ledger.

You use the geographic area as a report selection criterion and for subtotalling and sequencing a number of reports within SYSPRO.

You capture geographic area details using the Geographic Area Maintenance program.

This is a single large payment processed from a primary customer instead of smaller multiple payments from many individual customers.

This type of payment is processed for a group customer that comprises a primary customer (who is liable for settling the payment) and multiple associated downstream secondary customers. A group customer is created using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Transaction Processing).

A group payment is created, executed and processed using the AR Group Payment Run program (Program List > Accounts Receivable > Setup).

International Commercial Terms are pre-defined terms published by the International Chamber of Commerce (ICC) that are widely used in international commercial transactions.

Incoterms comprise a series of three-letter trade terms related to common contractual sales practices and the rules of each are intended primarily to communicate the ownership of costs and risks associated with the transportation and delivery of goods.

Within SYSPRO, the Incoterms code indicates the portion of costs and risks agreed to by the parties in a contract of purchase or sale.

For example:

The delivery term CIP (Carriage and Insurance Paid) indicates that the seller pays the cost of carriage and insurance necessary to bring the goods to a named destination (i.e. shipping location).

Invoice terms enable the system to calculate discount amounts as well as discount dates and due dates of supplier and customer documents processed using the AP Invoice Posting, AP Permanent Entries Posting and AR Invoice Terms programs.

You maintain invoice terms for suppliers using the AP Invoice Terms program.

You maintain invoice terms for customers using the AR Invoice Terms program.

Within SYSPRO, the nationality code identifies the country in which your local site is located (configured at the time of setting up the system for the first time).

It influences how transactions are processed when raising sales orders for a customer in an EC Member State (e.g. ensuring that the correct EC information is captured) and affects the display of tax fields (e.g. the fields displayed for the Canadian Tax System differ vastly from the fields displayed for the EC Vat System).

The nationality code also identify the countries in which your suppliers and customers are located, determining the applicable the tariff codes for suppliers (if using Landed Cost Tracking).

A standard list of nationality codes is defined against ISO 3166-1. The IMPNAT.IMP file (located in the \Base\Store folder of your SYSPRO installation) contains a list of these countries, together with their 2 or 3-digit codes.

We recommend you use these codes (except for the reserved nationality codes: CAN, USA, AUS, RSA and UK).

You maintain nationalities using the Nationality Maintenance program.

This is the customer against which a single payment is processed (i.e. the recipient of the aggregate payment). This single remittance is known as a group payment.

When processing intercompany group payments, this is the customer in the primary SYSPRO company against which payments from multiple secondary customers either in the same or secondary SYSPRO company is processed.

Primary customers are created and maintained using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

In SYSPRO, a quotation consists of a number of offers that can be presented to a customer for consideration.

Offers can consist of bought-out or made-in stocked and non-stocked items.

When the customer accepts a quotation, the quotation can be confirmed and then converted into a sales order, a job, or a combination of both.

When a non-stocked item must be specially made, a supporting estimate can be created.

Besides using the Quotations module, SYSPRO has a simplified quoting system that can be used within the Sales Orders module.

The Quick Sales Order Entry program is ideally suited to a telesales environment, as it enables the rapid entry of a sales quotation without having to enter all the details associated with the entry of a normal sales order. The quick entry quote can be stored for retrieval at a later stage and converted into a sales order for a specific customer.

Within SYSPRO, a salesperson serves as a mandatory link for customers (i.e. a customer must be assigned to a valid salesperson).

You can use salespersons as a selection criterion within various reports, as well as for subtotalling and sequencing purposes.

You can measure salesperson performance against actual sales by assigning monthly budgets to salesperson which can be compared to actual sales made.

You maintain salespersons using the Salesperson Maintenance program.

This is a customer to whom a portion of the payment that was received by the primary customer, is allocated. All secondary customers and the primary customer they are linked to form a customer group. The payment made to the primary customer is referred to as a Accounts Receivable group payment.

A secondary customer can be in the primary or secondary SYSPRO company.

Customers for group payments are defined using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

Trade promotions refers to the management and control of special deals you offer to your customers. These deals include promotions, special offers and rebates.

The Trade promotions module is integrated to the Sales order module.

Starting

You restrict operator access to activities within a program using the Operator Maintenance program.

Controls whether an operator can place a customer on hold within the Customers program.

Controls whether an operator can release a customer's on hold status within the Customers program.

Controls whether an operator can add, remove and change customer notes and management notes for a customer within the following programs:

- Customer Query

- Customers

Operators can still view these notes and maintain additional notes.

You can restrict operator access to the fields within a program (configured using the Operator Maintenance program).

Controls whether an operator can access the Credit Checking fields when adding or maintaining a customer within the Customers program.

Controls whether an operator can access the Credit limit field when adding or maintaining a customer within the Customers program.

Controls whether an operator can access the Invoice terms field when adding or maintaining a customer within the Customers program.

You can restrict access to the eSignature transactions within a program at operator, group, role or company level (configured using the Electronic Signature Configuration Setup program). Electronic Signatures provide security access, transaction logging and event triggering that gives you greater control over your system changes.

Controls access to the Add new customer function of the following programs:

- Customers

- Browse on Customers

Controls access to customer maintenance in the following programs:

- Customers

- Browse on Customers

Controls access to the Delete function in the following programs:

- Customers

- Browse on Customers

You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

You can restrict operator access to functions within a program using passwords (configured using the Password Definition program). When defined, the password must be entered before you can access the function.

This password restricts access to deleting a customer using the following programs:

- Browse on Customers

- Customers

This password restricts access to maintaining Management Notes for a customer using the following programs:

- Customer Query

- Customers

This does not prevent the notes from being displayed.

The following configuration options in SYSPRO may affect processing within this program or feature, including whether certain fields and options are accessible.

The Setup Options program lets you configure how SYSPRO behaves across all modules. These settings can affect processing within this program.

Setup Options > Configuration > Financial > Accounts Receivable

- Consolidate brought forward customers

Setup Options > Configuration > Distribution > Sales Orders

- Pricing method

- Price group level

- Check customer's credit limit

- Check customer's invoice terms

- Load planning required

Setup Options > Configuration > Distribution > Trade Promotions

- Apply Trade Promotion customers discount

Setup Options > Preferences > Financials > Accounts Receivable

- Amendment journals required

- Foreign currency sales required

- Validate customer class on AR master

- E-invoicing required

Setup Options > Preferences > Distribution > Sales Orders

- Validate order type

- Shipping via usage

- Back order release or retain

-

Reset credit status after invoicing

Setup Options > Tax > Company Tax Options

-

Tax system

-

EC VAT system required

- Canadian GST required

Setup Options > Tax > Intrastat

- Invoices

-

Credit notes

-

Arrivals

Setup Options > History > Financials > Accounts Receivable

- Zero balance invoices

Setup Options > User Defined Fields > Financials > Accounts Receivable

- User-defined fields

Setup Options > Keys > Financials

- Key type

-

Suppress leading zeros

- Presentation length

-

Numbering method

Setup Options > Company > General

- Nationality code

Setup Options > System Setup > General

- Multi-language for document printing

Setup Options > System Setup > System-Wide Personalization

- Use short names when resolving addresses

-

Delivery Terms and Shipping Locations can only be captured if:

- A valid entry is defined against the Nationality code setup option and the EC VAT system required setup option is enabled.

-

or, the Capture non EC members delivery terms setup option is enabled.

- If default entries for these fields are defined in the Suppliers and Customers programs, they take precedence over those defined in the Setup Options program.

- To reflect Delivery Terms and Shipping Location on order documents, ensure that these fields are enabled in the document format setup programs (only available with Word and SRS document printing).

-

You can use the Customer Amendment Journal report to print details of customers added, deleted or changed.

Additionally you can print sub-account changes, if the Amendment journals required setup option is defined as Yes, including additions.

Solving

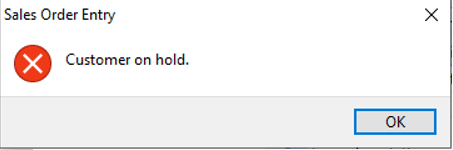

This message is displayed when you have attempted to create a new sales order or maintain existing sales order lines against a customer who has been placed on hold.

When a customer is on hold, you can edit existing sales order headers, but you can't do the following:

-

Maintain existing sales order lines

-

Create new sales orders

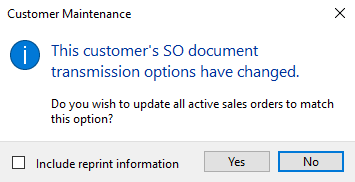

This message appears when saving information for the customer, after changing the Document transmission method.

Select Yes to update all active sales orders for the customer to the new document transmission method.

Optionally, enable the Include reprint information option to also change the reprint data for the same orders.

Or, select No to leave the customer's orders as they are.

Orders can also be updated using the Order Purge program, where you can update the transmission method and additionally reprint data when running the Balance function.

When running the Balance and Purge function, you cannot select to reprint data.

You'd typically convert from an alphanumeric to numeric data type if you want to automate the creation of unique codes. This automation requires your codes to be in a numeric format as you can't increment an alphanumeric code. Another reason is that it can be difficult to keep track of alphanumeric naming conventions (e.g. BB001 for Bayside Bicycles).

-

Check your configurations for the setup options for customer codes.

-

Navigate to the setup options for customer codes (Setup Options > Keys > Financials).

-

Under the Customers grouping, change the value for the Presentation length setup option to the maximum value of 15 characters.

By increasing the value against this setup option, you eliminate any chance of truncating your data. For example, your customer code is currently A000001, which is a length of 7. The higher the value of your Presentation length, the less possibility for truncation.

-

Ensure the Key type is configured as Alphanumeric.

This ensures the successful conversion of your unique customer codes data, because the AR Customer Code Conversion program can recognize the customer key during validation.

-

Save your changes and exit SYSPRO.

-

-

Navigate to the AR Customer Code Conversion (Program List > Accounts Receivable > Setup) program.

-

From the Customer Code Conversion grid, select the code that you want to convert using the Customer column.

-

Indicate the new code associated with the customer in the New customer column.

This new code needs to be padded with preceding zeroes in alignment with your selected Presentation length (which is 15 in this example).

For example:

If your Customer code is A000001, then you need to indicate 000000000100001 in the New customer code field (i.e. the A is replaced by 1).

-

Repeat steps 3 and 4 for every customer code that you want to convert.

-

Select the Validate function from the toolbar to ensure that the data integrity of the customer codes is retained.

During this process, any tables containing your the list of customer codes that you want to convert is highlighted in the Customer Code Conversion Tickover grid.

This enables the Start Processing function.

-

Select the Start Processing function to begin the conversion process.

The screen is cleared once the conversion is complete.

The program can read this new key as alphanumeric while also being a valid numeric key (i.e. 0100001 can be read as an alphanumeric code because it is a code that can contain either digits or alphabetical characters or a combination of both).

-

Open the AR Customer Browse program and indicate the new code associated with a converted customer to ensure that the conversion was successful.

-

Complete the reconfiguration your setup options for customer codes:

-

Navigate to the Setup Options program (Setup Options > Keys > Financials).

-

Now, you can change your Key type for Customers to Numeric.

-

Change your value for the Presentation length setup option to the previous value indicated when you were working exclusively with the Alphanumeric Key type of 15 characters.

For example:

In this example, the Presentation length needs to be reverted back to 7. This was the character length initially associated with customer A000001.

-

Save your changes and exit SYSPRO.

-

-

Check whether the customer codes are complying with the new configurations and the conversion:

-

Log back into SYSPRO and navigate to either one of the following programs:

-

Customers (Program List > Contact Management > Setup)

-

Customer Query (Program List > Accounts Receivable )

-

-

Indicate a converted customer code in the toolbar.

For example:

In this example, the A000001 customer code should now be of a Numeric Key type in the format 0100001. Indicating this new code should bring up the associated customer info.

-

You've successfully converted your customer codes from an Alphanumeric to a Numeric data type.

An unsuccessful conversion (i.e. invalid or unreadable customer code) means that data associated with these customer codes, from invoices to customer details can be compromised.

Review the steps outlined above and if you still struggle to successfully convert your customer codes, please contact your local support office.

When a customer is on hold, you can edit existing sales order headers, but you can't do the following:

-

Maintain existing sales order lines

-

Create new sales orders

Using

-

Columns in a listview are sometimes hidden by default. You can reinstate them using the Field Chooser option from the context-sensitive menu (displayed by right-clicking a header column header in the listview). Select and drag the required column to a position in the listview header.

-

Fields on a pane are sometimes removed by default. You can reinstate them using the Field Selector option from the context-sensitive menu (displayed by right-clicking any field in the pane). Select and drag the required fields onto the pane.

The captions for fields are also sometimes hidden. You can select the Show Captions option from the context-sensitive menu to see a list of them. Click on the relevant caption to reinstate it to the form.

If the Show Captions option is grayed out, it means no captions are hidden for that form.

-

Press Ctrl+F1 within a listview or form to view the Shortcut Keys available.

The following tables indicate the valid tax registration number formats for the various European Community countries.

The following fields are validated against the formats listed in these tables, provided that the nationality code assigned to the customer or supplier is defined as an EC Member State in the Nationality Maintenance program:

-

VAT registration number in the Suppliers program

-

Tax exemption number in the Customers program

The following table indicates the format for EC VAT registration numbers in each of the member states:

| Member State (Nationality Code) | Format of VAT Number |

|---|---|

|

Austria (AT) |

U12345678 9 characters. 1st character will always be U |

|

Belgium (BE) |

0123456789 A 10 digit number. The first digit must always be zero. Prior to 31/12/2007, the EC VAT number for Belgium was a nine digit number (123456789). |

|

Bulgaria (BG) |

123456789 or 1234567890 A 9 or 10 digit number. |

|

Croatia (HR) |

12345678901 An 11 digit number. |

|

Denmark (DK) |

12345678 An 8 digit number. |

|

Finland (FI) |

12345678 An 8 digit number. |

|

France (FR) |

12345678901 or 1X123456789 or X1123456789 or XX123456789 May include an alpha character as the 1st or 2nd or 1st and 2nd character. The alphabetic characters I and O are invalid. |

|

Germany (DE) |

123456789 A 9 digit number |

|

Greece (EL) |

012345678 From 1/1/1999, numbers were amended to 9 digits. Existing 8 digit numbers may be changed by adding a leading 0. |

|

Ireland (IE) |

1234567X or 1X34567X Include one alpha character as the last character or two alpha characters as the 2nd character and the last character. 1234567XX 9 characters. The last two characters are alphabetic. |

|

Italy (IT) |

12345678901 An 11 digit number |

|

Luxembourg (LU) |

12345678 An 8 digit number |

|

Netherlands (NL) |

123456789B01 The last 3 characters must be in the range B01 to B99 |

|

Northern Ireland (XI) |

123456789 A 9 digit number |

|

Portugal (PT) |

123456789 A 9 digit number |

|

Spain (ES) |

X12345678 or 12345678X or X1234567X Include one alpha character either as the 1st or the last character or two alpha characters as the 1st character and the last character (i.e. the first and last character may be alpha or numeric, but they may not both be numeric). |

|

Sweden (SE) |

123456789001 Last 2 digits must be 01 |

|

United Kingdom (GB) |

123456789 A 9 digit number. One block of 3 digits, one block of 4 digits and one block of 2 digits. or One block of 3 digits, one block of 4 digits, one block of 2 digits and one block of 3 digits or One block of 3 digits, one block of 4 digits, one block of 2 digits and one block of 5 characters. 999 9999 99 999 (identifies branch transfers) GD999 (identifies Government Departments) HA999 (identifies Health Authorities) |

The following table indicates the format for EC VAT registration numbers in each of the accession states.

| Accession State | Format of VAT Number |

|---|---|

|

Bulgaria (BG) |

123456789 or 1234567890 A 9 or 10 digit number |

|

Croatia (HR) |

12345678901 An 11 digit number |

|

Cyprus (CY) |

12345678X 9 characters. The last character is alphabetic |

|

Czech Republic (CZ) |

12345678 or 123456789 or 1234567890 An 8, 9 or 10 digit number |

|

Estonia (EE) |

123456789 A 9 digit number |

|

Hungary (HU) |

12345678 An 8 digit number |

|

Latvia (LV) |

12345678901 An 11 digit number |

|

Lithuania (LT) |

123456789 or 123456789012 A 9 or 12 digit number |

|

Malta (MT) |

12345678 An 8 digit number |

|

Poland (PL) |

1234567890 A 10 digit number |

|

Romania (RO) |

1234567890 A minimum number of 2 digits and a maximum of 10 digits. |

|

Slovenia (SI) |

12345678 An 8 digit number |

|

Slovak Republic (SK) |

1234567890 A 10 digit number |

This section indicates the fax and email codes that are required when:

- using the Report Writer module to print and/or maintain customer fax and email options.

- using the AR Customer Maintenance business object to maintain customer information.

- using the Document Print program.

The following table lists the entries defined against the FaxInvoices column in the ArCustomer table, depending on the fax and/or email options defined for the customer:

|

Sales Order Document Type |

Fax Code |

Email Code |

|---|---|---|

|

Order acknowledgment |

W |

w |

|

Delivery note |

X |

x |

|

Invoice |

Y |

y |

|

Dispatch note |

Z |

z |

|

Order Acknowledgment and Delivery note |

A |

a |

|

Order Acknowledgment and Dispatch note |

B |

b |

|

Order acknowledgment and Invoice |

C |

c |

|

Delivery note and Dispatch note |

D |

d |

|

Delivery note and Invoice |

E |

e |

|

Dispatch note and Invoice |

F |

f |

|

Order acknowledgment and Delivery note and Dispatch note |

G |

g |

|

Order acknowledgment and Delivery note and Invoice |

H |

h |

|

Order acknowledgment and Dispatch note and Invoice |

I |

i |

|

Delivery note and Dispatch note and Invoice |

J |

j |

|

Order acknowledgment and Delivery note and Dispatch note and Invoice |

K |

k |

|

None |

N |

n |

The following entries are written to the FaxStatements column of the ArCustomer table, depending on the fax and/or email options defined for statements:

|

Fax Code |

Email Code |

None |

|---|---|---|

|

Y |

E |

N |

The following entries are written to the FaxQuotes column of the ArCustomer table, depending on the fax and/or email options defined for quotations:

|

Fax Code |

Email Code |

None |

|---|---|---|

|

Y |

E |

N |

You can only ascertain whether a dispatch invoice was emailed if you are using Syspro Reporting Services document archiving.

The FaxInvInBatch column of the SorMasterRep table merely indicates that against the customer, invoices were to be emailed at the time the dispatch invoice was created. It is simply a copy of the flag against the order and does not indicate that the invoice was actually emailed.

The Credit status of a customer indicates the current credit status based on the age of the customer's oldest invoice.

The credit status is calculated by the following:

- Using the Balance function or Reset customer credit status option of the AR Period End program.

- The AR Payments and Adjustments program after posting a payment or adjustment if you selected the Reset credit status option.

- The Document Print program after processing a credit note if you selected the Reset credit status after invoicing setup option.

The following table describes each of the status codes available:

| Status | Description |

|---|---|

|

0 |

This indicates only current invoices. |

|

1 |

This indicates at least one invoice which is 30 days or over. |

|

2 |

This indicates at least one invoice which is 60 days or over. |

| 3 | This indicates at least one invoice which is 90 days or over. |

| 4 | This indicates at least one invoice which is 120 days or over. |

| 5 | This indicates at least one invoice which is 150 days or over. |

|

6 |

This indicates at least one invoice which is 180 days or over. |

| 9 |

This indicates a manual hold on the account which suspends all credit for the customer. This status is manually added and removed against customers.

|

Referencing

This deletes the current customer and their associated details.

You cannot delete a customer if one or more of the following exists against the customer:

- Outstanding invoices

- RMA entries

- Work in progress jobs

- Projects or contracts

- Outstanding orders

- Outstanding orders against any sub accounts attached to the customer

- Zero balance invoices on the customer's account that became zero in the past three months, or that became zero within the number of months defined against the Zero balance invoices setup option

- The customer's balance is not zero for the current month, previous month 1 and previous month 2

- Sub accounts are attached to the customer

The existence of customer movements are not considered when checking whether a customer can be deleted. Movements are a history of transactions made for the customer; they do not indicate that the customer is still active.

For example:

AR journals that were posted but not yet purged could exist for a customer and SYSPRO doesn't enforce purging data to be able to delete a customer.

If you reuse a deleted Customer code, then the original customer's invoices are added back to that customer's account when you run the Balance function of the AR Period End program.

You can't use the Document Print program to reprint invoices for deleted customers. You have to add the customer back on file before the invoice can be reprinted.

Selecting this function deletes all transaction and payment details associated with the customer as well as links to Contact Management contacts.

This lets you assign default data for selected fields.

The data entered is automatically applied when adding a new record, but can be changed. Entries are validated when you save the details to file.

This lets you save the default data you entered for selected fields.

The data entered is automatically applied when adding records, but can be changed. Entries are validated when you save the details to file.

This indicates the unique code that identifies the customer or supplier you are adding, maintaining or deleting.

There are some things that you need to take into consideration regarding this field:

-

The Key type setup option can be configured as follows:

Alphanumeric: allows for both alphabetic and numeric characters. The code is left-aligned with trailing blanks.

Numeric: allows for the entry of numeric characters. The code is right-aligned with preceding zeros (e.g. 000000000000001) unless the Suppress leading zeros setup option is ticked.

- The length of this field is determined by the Presentation length setup option.

-

You can only assign a unique code to identify a new customer or supplier added if the Numbering method setup option is defined as Manual.

If this setup option is defined as Automatic, the system automatically creates a code for the customer or supplier. This only applies if the Key type is defined as Numeric.

You should not change any configurations defined for this code once you have added customers or suppliers.

Changing configurations for this code may compromise access to your data.

For example:

If you capture customers or suppliers using an alpha key and then change the key to be numeric, you will be unable to access any customers or suppliers that were captured with the alpha key (unless the alpha key captured was purely numeric without alphabetic numbers).

If you change your key from numeric to alphanumeric, then you can only access any previously-entered numeric codes by entering the code with leading zeros regardless of whether the Suppress leading zeros setup option is ticked.

This loads the Admin Notepad Editor (Rich Text) program to let you capture additional free format notes.

This lets you copy the details captured from the Sold to address to the Ship to address section in the Contact Details pane.

You would typically use this function if the two addresses are the same.

This loads the Browse on Multiple Ship to Addresses program from which you can access the Multiple Ship to Addresses program to define more than one address to which to deliver or ship goods to the customer.

When adding a new customer, this option is only enabled once the details for the new customer are saved. This prevents the creation of multiple Ship to address details against a blank customer code.

This loads the Contact Management Query program to create and maintain information for contacts and activities associated with the customer.

Additionally, you can filter your contact information according to various criteria.

This indicates the code of the customer that you would like to add, maintain or delete.

This indicates the name associated with the customer. This assists you in verifying that the correct customer code has been entered.

The information entered here is automatically populated in the Short name field.

This field is alphanumeric and is limited to 50 characters.

This indicates the shortened description of the customer's name and is used when searching for customers in the Customer entry field in the toolbar.

This automatically defaults to the first 20 characters of the Customer name field. But if you would like to, you can change this field.

This lets you associate a default branch with the customer by selecting a branch code using the Browse on AR Branches program.

This lets you indicate the specific region which your customer resides using the Browse on Geographic Areas program.

You assign customers to geographic areas and configure your system to apply the rate of tax for a stocked order line according to the customer's geographic area.

This information can be used as a report selection criterion and for subtotaling and sequencing a number of reports within SYSPRO.

If you require tax by geographic area, then the tax code assigned to the customer's geographic area can be used to override the tax codes normally used throughout the system.

This lets you select the primary salesperson associated with this customer using the Browse on Salespersons program.

This lets you select the default settlement terms required for the supplier using the AR Invoice Terms program.

This lets you indicate the currency in which transactions are processed for the customer using the Browse on Currencies program.

Once transactions have been processed against a customer, you must use the AR Currency Conversion if you want to change the customer's currency.

This lets you indicate the category to which a customer is assigned using the Browse on Customer Classes program.

This field enables you to classify customers for:

- Reporting purposes

- Sales history analysis

This field is mandatory if the Validate customer class on AR master setup option is enabled.

This indicates the nationality code for the country in which the customer is located.

This field is mandatory if the EC VAT system required setup option is enabled.

This indicates whether the customer account is on hold.

If you select to place a customer account on hold:

-

Any sub-account customers attached to the master account customer, where sub-account invoices are held against the master account, are also placed on hold.

-

You can still create WIP jobs for the customer.

-

You can still maintain existing sales order headers.

This option prevents new sales orders from being processed against the customer when using the following programs:

- Sales Order Entry

- Sales Order Entry Express

- AR Invoice Posting:

You can maintain existing sales order headers, but you're not allowed to maintain existing sales order lines against a customer that is placed on hold.

This indicates whether the customer is exempt from finance charges calculated by the AR Finance Charge Calculation program.

This indicates whether you require detail sales history to be recorded for all transactions processed against the customer.

If not enabled, then no sales records are posted to the sales analysis history table for this customer (i.e. sales for this customer are not included in any sales analysis reports).

This indicates whether you require to retain detail sales movements against the customer.

These movements can be viewed using the Customer Query program and reported on using the AR Customer Movement Report program.

This indicates whether you require special prices (or price discounts) for stock items to be available for the customer over a fixed time period.

When processing an order for the customer, the lowest contract price is used as the price for the order line.

Contract prices are maintained using the SO Contract Prices program.

This indicates whether you require to limit the type of order processed against the customer to counter sales orders and credit notes only.

This enables you to prevent any part of a counter sales invoice being placed on account.

This option is only enabled if the Counter Sales module is installed as part of your registration details.

This lets you select the order type that must be assigned as the default to sales orders generated for the customer.

The default order type assigned to the customer takes precedence over the default order type configured for the Sales Orders module.

Order types are maintained using the SO Browse on Order Types program.

This field is only validated at the time of entering an order if you enabled the Validate order type setup option.

This lets you select the type of sales order that must be created by default when generating orders for the customer.

The Operator Default option allows you to indicate that the default type of order created for the customer must be determined by the settings assigned to the operator within the Preferences... function of the Sales Order Entry program.

This lets you select the document format that must be used as the default when generating batch invoices and/or delivery notes for the customer (see SO Document Formats).

This format is used for sales order documents by default. However, if you select a different format when generating the first document for a sales order (e.g. an order acknowledgment) then, the selected format is used from that point as the default for that sales order, through to the end of the order.

This lets you select the code associated to the comment that you want to assign to sales orders processed for the customer.

This comment text can be printed on order documents (and quotes) provided that you have defined a print position for the Customer standard comment field within the SO Document Formats program (General > Format options > Heading section > Change).

Standard comment codes are maintained using the Browse on Standard Comments program.

This displays the associated text for the selected Standard comment code.

This field is purely for display purposes and is therefore disabled.

You can indicate the language code to use if you enabled the Multi-language for document printing setup option (Setup Options > System Setup > General).

The Global dropdown option is the default selection and refers to the default language at the time of the creating the entry.

This lets you indicate any additional shipping instructions that you would like to assign to orders captured for the customer.

These instructions can be printed on invoices generated for the customer.

This lets you select the default warehouse from which items will be sold to the customer using the Browse on Warehouses program (see Warehouse Maintenance).

This indicates whether you would like to apply trade promotions to sales orders for this customer.

To be able to apply order level discounts or trade promotions discounts to customer orders when using the Sales Order Entry and Point of Sale Entry programs, you need to enable the Apply Trade Promotion customers discount setup option.

This indicates whether you would like to apply trade promotions pricing to sales orders for this customer (see Browse on Prices).

When enabled, you cannot apply order level discounts to the customer using the following programs:

- Sales Order Entry

- Point of Sale Entry

This field does not apply if:

- Contract pricing is enabled for the customer.

- A valid contract exists for the customer.

Actual trade promotions, where applicable, are still applied.

This field is only enabled if the Trade promotions pricing field is ticked.

This indicates whether you require to enter inter-branch transfers when processing sales orders for the customer.

An IBT follows the normal tax rules (i.e. tax is applied to an IBT transaction if the customer is defined as taxable).

This indicates the date that the customer was created.

The information in this field cannot be changed.

This section lets you select up to three additional salespersons to split the commission earned for any sales generated by this customer to, by selecting their associated salesperson code.

You can indicate the amount of commission that each salesperson should earn, at the end of capturing an order for this customer.

This facility is for documentary purposes only (i.e. no calculations are actually performed by the program at the time of capturing an order).

This section is enabled only if a primary salesperson is selected.

This section lets you select up to five additional buying groups that you would like to associate the customer to.

This section is only enabled if Contract pricing is required for the customer.

This lets you indicate the customer code if your Numbering method setup option is set to Scripted.

Use the VBScript Editor to build an unique customer code for each new customer added.

The Sold to address section refers to the address to which documentation such as statements and invoices must be sent to the customer.

The Ship to address section refers to the address to which goods must be shipped to the customer.

If you are using the USA AVP sales tax system as defined for the Tax system setup option, take the following into consideration:

- The SoldToAddr4 and ShipToAddr4 columns in the ArCustomer table are updated with the Description against the extended tax code (Extended Tax Code Maintenance).

- The SoldToAddr5 and ShipToAddr5 columns are set to the State value of the extended tax code.

However, if the Reference field of the Company Setup program has a value of AVP, then the SoldToAddr4 and ShiptoAddr4 columns are updated with the State value against the extended tax code, and the SoldToAddr5 and ShipToAddr5 columns are not updated.

This indicates the geographic location of the address in terms of longitude and latitude and includes a hyperlink to the map directions.

An additional hyperlink is available (Resolve GeoLocation from address) to resolve addresses using the long or short name. For this to resolve correctly, ensure that you provide as much information related to the physical address as possible.

The Use short names when resolving addresses option (System-wide Personalization) determines which name to use by default.

For example:

Short names are NY and USA; whereas long names are New York and United States of America.

SYSPRO reads the name returned from the map provider in XML. If the short name returned in the XML is the same as the long name, then no short names are available from the map provider.

This lets you specify the state code that forms part of the full tax geocode for the Sold to address.

This field only applies if the Tax system setup option is defined as USA tax by advanced geocodes.

This lets you specify the county code that forms part of the full tax geocode for the Sold to address or Ship to address.

This field only applies if the Tax system setup option is defined as USA tax by advanced geocodes.

This lets you specify the zip code that forms part of the full tax geocode for the Sold to address or Ship to address.

This field only applies if the Tax system setup option is defined as USA AVP sales tax system.

This lets you specify the city code that forms part of the full tax geocode for the Sold to address or Ship to address.

This field only applies if the Tax system setup option is defined as USA tax by advanced geocodes.

This lets you specify the nine-character tax geocode to use for the Sold to address Ship to address (see Browse on Extended Tax Codes).

This field only applies if the Tax system setup option is defined as USA tax by advanced geocodes or USA AVP sales tax system.

This lets you specify the tax rate to use as defined against the extended tax code (see Browse on Extended Tax Codes).

This field only applies if the Tax system setup option is defined as USA tax by advanced geocodes or USA AVP sales tax system.

This lets you specify the e-mail address of the primary contact person of the customer entity or organization.

When you change the e-mail address of the customer:

-

Invoices raised from existing sales orders for the customer are emailed to the previous e-mail address.

To prevent this, you can select the Use email address from document option against the relevant document format using the SO Document Formats program (General > Preferences > Change > Print Options...).

-

Invoices for new sales orders raised after this change, are sent to the new e-mail address.

This lets you specify the primary telephone number for the customer.

This information can be printed on reports and viewed within the Customer Query program.

This indicates the customer's telephone extension number.

This information can be printed on reports and viewed within the Customer Query program.

This lets you specify an additional telephone number for the customer.

This information can be printed on reports and viewed within the Customer Query program.

This lets you specify the fax number associated with the customer.

This information can be printed on reports and sales orders documents. Additionally, this can also be viewed within the Customer Query program.

This lets you specify the telex number associated with the customer.

This information can be printed on reports and viewed within the Customer Query program.

This lets you indicate the contact name of the customer using the Browse on Contacts program.

This field is displayed in the following programs:

-

Customer Query

-

AR List of Customers

When saving information for this customer, if the contact name entered is not associated with a contact in the Contacts program of the Contact Management Query, then you are prompted to create a contact for the customer.

Alternatively, you can decide not to create a contact and use the information you entered against the customer in this pane.

To record multiple contacts for each customer, you can use the Contacts program of the Contact Management system.

This lets you indicate the shipping instruction code to use for the customer (see Shipping Instructions).

The code you enter in this field is used as the default code when you process sales orders for the customer when using the Sales Order Entry program.

If a message or message code is not defined against the customer, then the message against the setup option configured for the Sales Orders module is used.

This field is only enabled if you set the Shipping via usage setup option to Coded.

This indicates the default shipping instruction that is used when used when processing sales orders for the customer when using the Sales Order Entry program.

This field can either:

- Display the associated message for the selected shipping instruction code in the Ship via code field. This verifies that the correct code has been indicated.

- Allow you to enter a 30-character shipping instruction message, provided that you defined the Shipping via usage setup option as Free form.

This lets you indicate the Electronic Data interchange (EDI) sender code of the company from which you import orders electronically.

These orders can be imported using the Business-to-Business Trading Sales Order Import program if the entry made here matches the sender code of the company transmitting the file using the Interface Setup program as indicated in the Local site field.

This indicates whether the Electronic Data Interchange (EDI) system can generate orders for this customer.

If you would like to enable this option for a foreign currency customer, ensure that you enable the Foreign currency sales required setup option.

This indicates whether the customer must be included for selection when statements are produced for customers when using the AR Statement Print program.

This lets you select the document format to use for the customer using the AR Statement Format program.

If you want to e-mail statements to this customer, then the document format you select must have a Print method of Word document or SRS document as defined in the AR Statement Format program.

This lets you indicate what information you would like to hold against a customer, therefore affecting the month-end procedures and the printing of statements.

It is important to take the following into consideration regarding this field:

- When you change this option for a customer against whom current transactions exist, you must run the Month end function of the AR Period End program before your change takes effect (i.e. before statements are printed using the new balance type).

- If you are using master or sub-accounts, then the master account and all its sub accounts must have the same balance type. If not, then statements are not printed for these accounts.

This option doesn't accumulate the customer's balance at the end of each month.

All transactions are retained on file until the outstanding balance reaches zero and the number of months defined against the Zero balance invoices setup option is reached.

This option accumulates the total amount owing by the customer at the end of each month and represents the figure as a balance brought forward from previous months on the statement.

If the Consolidate brought forward customers setup option is enabled, because you require balance forward customers to be consolidated at month end, then all details are accumulated into a series of aged balance figures.

Payments, adjustments and transactions are made against a specific aged balance.

For Balance forward customers you should not post transactions into prior periods, as this will result in inconsistencies with the balance brought forward from one month to the next.

These options let you indicate how you want to send sales orders documents to the customer. You can also indicate the sales order document types to transmit electronically.

Details on codes required for sales order document types are listed below if you are using the:

- Report Writer module to print or maintain customer Fax or Email options.

- AR Customer Maintenance business object to maintain customer information.

You are prompted to update the customer's active sales orders and optionally the reprint data for these orders when you change the Fax or Email document transmission methods.

This lets you indicate the fax number that must be used when faxing documents, such as statements and invoices, to the customer.

This lets you indicate the contact name that is inserted into the Subject section of the Microsoft Exchange Outbox.

If you are faxing documents to the customer, then this indicates the contact name that inserted into the Subject section of the cover page, provided that a cover page precedes the fax.

This lets you indicate the transmission method for the customer's documents.

This option enables you to fax the selected documents to the customer.

If you select this option, then a fax number must be assigned to the customer in the Fax field. If you do not assign a fax number then it is requested at the time of sending the fax, but you will only be able to fax invoices on-line (i.e. not in batch mode).

You can only fax a document if the Office Automation and Messaging module is installed and your operator code is configured to allow the Email integration required facility in the Operator Maintenance program.

This option enables you to e-mail the selected documents to the customer.

If you select this option, then you need to enter the customer's e-mail address in the Email field.

You can only e-mail a document if its Print method is defined as Word document or SRS document as defined in the AR Statement Format program and your operator code is configured to allow the Email integration required facility in the Operator Maintenance program.

This option indicates that you don't require to fax or e-mail documents to the customer.

This indicates whether you would like to fax or e-mail order acknowledgments to the customer.

This indicates whether you would like to fax or e-mail delivery notes to the customer.

This lets you indicate whether you would like to fax or e-mail invoices to the customer.

This indicates whether you would like to fax or e-mail multiple dispatch notes to the customer.

This lets you indicate the transmission method for this customer's statements.

An error message is displayed if you select to e-mail statements and the Statement format defined against the customer is not defined with a Print method of Word documentor SRS document as defined in the AR Statement Format program.

This option enables you to fax the statements to the customer when using the AR Statement Print program.

This option enables you to e-mail statements to the customer when using the AR Statement Print program.

This option indicates that you don't require to fax or e-mail statements to the customer.

This lets you indicate the transmission method for this customer's quotations.

This option enables you to fax the selected quotations to the customer when using the Quotation Batch Printing program.

This option enables you to e-mail the selected documents to the customer when using the Quotation Batch Printing program.

This option indicates that you don't require to fax or e-mail quotations to the customer.

This switches on the electronic invoicing functionality on customer level.

This option is available if the Customers affected setup option is defined as Selected customers only.

This lets you determine when the electronic invoice is printed using the Document Print program that is accessed from within the Sales Order Entry, Sales Order Entry Express, or Dispatch Note Maintenance programs.

This option indicates that you don't want to print the e-invoice.

This lets you print the e-invoice when it is generated.

This lets you print the electronic invoice once it has been submitted to the 3rd-party authority for approval.

This is the default option.

This lets you print the electronic invoice when the 3rd-party authority has authorized the e-invoice.

This option indicates whether back order quantities are allowed when processing sales orders for the customer, or if they are not required to be processed.

Your selection here overrides the Back order release or retain setup option, as the customer option takes precedence over the company option.

For example:

If you set Not required against the Back order release or retain setup option, and selected Allowed here, then back orders are allowed and processed accordingly for this customer.

Back order rules do not apply to dispatch notes because of the back order process inherent in dispatches (e.g. if back orders were not allowed for a customer, then you would not be able to cancel or change a dispatched line).

Your selection here is ignored when using the Quick Sales Order Entry program to process a quote for the customer.

It is only applied when you convert the quote into a sales order.

This option indicates that you allow items to be placed on back order on sales orders for this customer.

This option prevents you from being able to place sales order quantities on back order for the customer.

Order quantities can be placed into back order in some circumstances if you enabled the sales order preference Allow b/orders when copy/rlse fwd orders when using the Sales Order Entry program (Options > Line ship date calculation).

This option indicates that back orders are not required.

The sales order status is set to complete (i.e. 9 - Complete) once the invoice is printed.

The order quantity which could not be shipped is ignored.

This indicates whether you would like the customer's stock codes to be converted to the standard system stock codes when processing sales orders.

During sales order entry, the customer stock codes are saved against sales order lines and can be printed on order documents.

The customer stock codes must be linked to SYSPRO stock codes using the Customer Stock Codes program.

This indicates whether you want to retain the last two sales details of any stock item sold to the customer.

At the time of entering sales order detail lines you can retrieve this information if you want to duplicate the details previously processed for the customer.

You cannot disable this option once a cross-reference exists for the customer.

This indicates whether you would like to force the entry of a customer purchase order number for orders processed against the customer.

This check is performed at the time of ending the order (when adding or maintaining) as well as at the time of confirming a quick entry quote into an order.

This lets you indicate the code that is used to establish the price (or discount code) applicable to the sale of a specific stock code to the customer, depending on whether the inventory pricing method is coded or discounted.

This field is only enabled if the Pricing method setup option is defined as Simple.

This section is disabled if your Pricing method setup option is defined as Price Groups, as this indicates that the Sales Pricing Engine is used instead of contract pricing.

The discount can only be applied to a foreign currency customer if the:

-

Basis for discount field is defined as List Price in the AR Invoice Discounts program

- List price of the stock code, as defined in the Pricing for a Stock Code program, is in the customer's currency

This opens the Price Group Browse program from where you can select the price group to which the customer must be linked.

The price groups displayed in the listview of the Price Group Browse program depend on the selection at the Price group level setup option:

-

Customer

-

Branch

-

Geographic area

-

Customer class

-

Form field

This indicates the description of the price group to which the customer is linked.

This lets you indicate a 3-character code that can be viewed in the Customer Query program and printed on sales order documents.

This lets you indicate a default delivery route code to use for deliveries to this customer.

If a number of ship to addresses (delivery addresses) are assigned to the customer, then you can use the Multiple Ship to Addresses program to assign a default delivery route code to each of these addresses. However, only the delivery route code defined here is used when using the Sales Order Entry program to copy to sales orders.

Delivery route codes are maintained using the Browse on Delivery Routes program.

This field is only enabled if the Load planning required setup option is enabled.

This lets you indicate a default delivery sequence number or distance to use for deliveries to this customer.

You may want to assign this customer as the first customer to which deliveries must be made on the default delivery route specified, in which case you enter 1 in this field.

Alternatively, you may enter the distance of the customer's location from your delivery warehouse as the sequence. If you specify this distance against all your customers on this route, then you can sequence the loads on the route based on the delivery distance from your premises to your customers' premises.

This field is only enabled if the Load planning required setup option is enabled.

This option indicates that the customer is exempt from tax.

This option indicates that the customer must be charged tax.

This option indicates that you would like to use the tax entry held against the stock item's Other tax code field, as defined in the Stock Code Maintenance program, when processing a sale for the customer.

The entry in the Other tax code field could be either a taxable or a non-taxable tax code. This enables you to apply different rates of tax to the customer for a single item when using the Sales Order Entry program.

For example:

You would use this field if you may need to sell a certain stock item (in this scenario A100) to Customer 00001 using exclusive tax, and to Customer 00002 using inclusive tax.

You would follow this procedure:

-

Use the Tax Code Setup program to define Tax code A as Exclusive and Tax code B as Inclusive.

-

Select Tax code A against stock item A100 in the Tax code field (Stock Code Maintenance).

-

Select Tax code B in the Other tax code field (Stock Code Maintenance).

-

Set Customer 00001 to be Taxable at the Tax exemption selection field (Customers).

When processing sales orders for this customer, the tax code for the order lines will default to Tax code A.

-

Against Customer 00002, select Other tax code at the Tax exemption selection field (Customers).

When processing sales orders for this customer, the tax code for the order lines will default to Tax code B.

This option lets you define the withholding tax requirement per customer, which can be one of the following:

-

Y = Withholding tax will be applied

-

N = Withholding tax will not be applied

-

Blank = The default company tax option will be used for the customer.

This is a custom form field (WHT001) that must be configured and added to the program.

This option indicates whether the customer is from an EC country and is registered for EC VAT.

You typically select this option if the customer is in an EC member state, but falls below the threshold for VAT registration.

If you do not select this option, then only the Supplementary declaration listing (dispatches) report is updated for sales to this customer.

When you deselect this option, the EC VAT registration number in the Tax exemption number field is automatically deleted.

If you select this option and the Nationality code defined against the customer is defined as a member of the EC in the Nationality Maintenance program, then you must enter a valid EC VAT registration number in the Tax exemption number field.

You can only select this option if the EC VAT system required setup option is enabled.

This option indicates whether you would like to print the VAT portion of a sales order invoice in GBP (Pounds sterling).

You would typically use this option if:

- You are based in the UK, but your base currency is not GBP (Pounds sterling)

- The currency of the customer is not GBP (Pounds sterling)

This enables you to comply with UK tax legislation, which states that a VAT invoice must show the total amount of VAT chargeable, expressed in sterling. Therefore, whilst it is acceptable for a UK VAT invoice to show the net amount in a foreign currency (such as Euros), the amount of UK tax chargeable must be expressed in Pounds sterling.

Selecting this option enables you to invoice the customer in a currency other than GBP but still report the VAT in GBP.

The applicable VAT values can be printed on invoices using the Total tax/Total merch tax in home currency fields of the SO Document Formats program.

You can only select this option if the EC VAT system required setup option is enabled and the Registered for VAT field is selected.

This lets you select your GBP (Pounds sterling) currency code using the Browse on Currencies program.

A valid currency code must be entered and cannot be the same as the customer's currency code.

This field cannot be left blank if you selected the UK VAT applicable field.

You can only select this option if the EC VAT system required setup option is enabled and the UK VAT applicable field is selected.

This lets you indicate your customer's tax exemption number.

If EC VAT is installed then you use this field to enter your customer's VAT registration number.

This field is only validated if the EC VAT system required setup option is enabled, the Nationality code defined against the customer is defined as a Member of EC, as indicated in the Nationality Maintenance program and the Registered for VAT field is selected.

This lets you specify the customer's tax registration number.

This information is required in the event that legislative authorities dictate that the customer's tax registration number must be printed on sales order documentation. It is therefore important to fill in this field.

Changes to this field are printed on the AR Period End and Customer Amendment Journal report, if the Amendment journals required setup option is enabled.

This lets you specify any additional information assigned to the customer, but can be changed.

You can define your own wording for these fields, namely Field 1 and Field 2, against the User-defined fields setup option (Setup Options > User Defined Fields > Financials > Accounts Receivable).

This lets you indicate whether you would like to automatically replace a stock code that is not available for a sales order line with an alternate stock code.

This lets you enable or disable the Marshalling feature for specific customers.

Optionally indicate the default shipping location associated with the Delivery terms.

This is used for sales order documentation.

Optionally indicate the three-character alphanumeric Incoterms code, denoting the terms of delivery.

This code is also used when processing a purchase order for a supplier in an EC Member State and ultimately for use on the Supplementary Declaration.

The Incoterms code indicates the portion of costs and risks agreed to by the parties in a contract of purchase or sale.

For example:

The Delivery term CIP (Carriage and Insurance Paid) indicates that the seller pays the cost of carriage and insurance necessary to bring the goods to a named destination (i.e. shipping location).

If this field is left blank, then the default delivery terms defined against the company for the Arrivals setup option is used.

This lets you enter the default delivery term code for invoices for this customer.

This lets you enter the default delivery term code for credit notes for this customer

This lets you optionally indicate the default nature of transaction codes for the customer for dispatches.

These codes are used when processing a sales order for a customer in an EC Member State and ultimately for use on the Supplementary Declaration.

This lets you select the transaction codes associated to the dispatches for the customer, for invoices, using the Browse on Intrastat Transaction Nature program.

This lets you select the transaction codes associated to the dispatches for the customer, for credit notes, using the Browse on Intrastat Transaction Nature program.

This field only applies if the EC VAT system required setup option is enabled.

If these fields are left blank, then the default nature of transaction codes defined against the Invoices and Credit notes setup options are used in sales transactions.

This field only applies if:

- The Nationality code setup option assigned to your company is specified as CAN.

- The Canadian GST required setup option is enabled.

This option indicates that the customer is exempt from tax.

This option indicates that the customer must be charged tax.

This lets you indicate the customer's tax registration number.

This lets you define how the GST for the customer must be shown.

- For stocked items that have GST included in the price, this option has no effect for non-exempt customers as the GST is already part of the price shown at line level.

- For exempt customers, the GST value that is part of the price is deducted from the line or the total GST value, depending on your selection for this field.

This lets you display the GST calculated on invoice lines separately in the invoice totals and not be included in the prices.

This lets you include the GST that is calculated on invoice lines in the line values.

This section lets you specify how order discounts must be calculated.

This section is disabled if your Pricing method setup option is defined as Price Groups, as this indicates that the Sales Pricing Engine is used instead of contract pricing.

This lets you indicate whether you would like to assign order discount breaks when processing sales orders for the customer. If you select this option, you cannot assign an automatic invoice discount to the customer.

These discounts are applied to the total value or total quantity of the stocked and non-stocked lines of a sales order processed for the customer. Freight and miscellaneous charges are excluded.

When you change this option from selected to deselected, the order discount breaks are deleted. A warning message is displayed, enabling you to cancel.

Order level discounts are not applied to customers for whom Trade promotions pricing is enabled.

This lets you indicate the automatic discount that is applicable to each invoice processed for the customer using the Browse on AR Invoice Discounts program.

A blank entry indicates that you do not require an automatic invoice discount for the customer.

This option is disabled if you selected to calculate order discounts Based on order value/quantity.

This section lets you specify how order line discounts must be calculated.

This section is disabled if your Pricing method setup option is defined as Price Groups, as this indicates that the Sales Pricing Engine is used instead of contract pricing.

This indicates whether you would like to assign order discount breaks to specific customer/product class combinations.

These discounts are applied to the order line value or order line quantity of the stocked and non-stocked lines of sales orders processed for the customer.

All common product classes for an order are accumulated; the total of each product class is compared to the discount break tables; and the discount applied to each line accordingly.

Line discounts by product class are not applied to customers if they are defined as a Trade promotions customer.

If you select this option, then you cannot assign an automatic line discount to the customer.

This indicates the automatic discount that is applicable to each sales order line processed for the customer using the Browse on AR Invoice Discounts program.

A blank entry indicates that you do not require automatic invoice discount for the customer.

This discount is applied automatically to all sales order lines if the pricing method of the stocked item is Coded or Quantity Discounted. You can manually enter a line discount when you enter or maintain a sales order line.

If you specify an automatic line discount code for a customer and decide to enter a manual discount for a sales order line, then the manual discount overrides the automatic discount.

If the customer has a line discount based on Cost, the cost plus the chain discount is applied to inventory items with a pricing method of Coded or Quantity discounted. Inventory items with a pricing method of Discounted are treated as normal.

Line discount codes are maintained using the AR Invoice Discounts program.

This option is not available if you selected to calculate order line discount according to product class sold.

This section lets you configure credit checking for this customer.

You can only access these options if you have enabled either the Check customer's credit limit or the Check customer's invoice terms setup option.

This option indicates that credit checking needs to be performed against this customer based on your selections made at company level.

These selections refer to the Check customer's credit limit and Check customer's invoice terms setup options.

This option indicates that you don't require credit checking to be performed against this customer.

This option lets you select the criteria for which to perform credit checking for this customer (i.e. Check credit limit and Check terms).

This option enables the Check credit limit and Check terms fields.

This lets you indicate whether you would like to base credit checking on the credit limit defined against the customer.

The credit limit is the maximum limit that the customer's balance can reach, taking into account any outstanding order values.

This lets you indicate whether you would like to base credit checking on the invoice terms defined against the customer.

The invoice terms indicate the default settlement terms required for the customer.

This lets you indicate whether you would like to also apply trade promotions credit checking to the customer.

When you select this option, the standard SYSPRO credit check is applied first. If this does not fail, then this credit check is applied.

You can use the Trade Promotions Account program to maintain details of Trade Promotions Customer accounts.