AR Group Payments

The Group Payments feature simplifies the allocation of payments by letting you process a single large payment against groups of customers instead of having to make smaller individual payments.

Exploring

Group payments are processed for the following as part of the normal payment run using the AR Payments and Adjustments and AR Payment Run programs:

-

Customers within the same SYSPRO company (referred to as group payments).

-

Customer groups spanning two or more SYSPRO companies (referred to as intercompany group payments).

-

Payments received from foreign primary or secondary customers (i.e. multi-currency payments).

Multi-currency payments are not supported for group payments, however payment from secondary customers with different base currencies can be included in an intercompany group payment run.

-

Improved administrative processing time.

-

Reduced errors typically associated with the manual preparation of individual transactions.

-

Single payment across multiple SYSPRO companies for numerous customers.

For example:

The OUTDOORS Company owns Grand Adventures, Bayside Bikes and The Garden Executive.

A company needs to pay an amount of $60 to the The OUTDOORS Company and $30 to each of its subsidiaries Grand Adventures, The Garden Executive and Bayside Bikes.

It would make sense for the company to consolidate one payment to The OUTDOORS Company (i.e. the primary customer) who in turn distributes the payments to the subsidiaries Grand Adventures, The Garden Executive and Bayside Bikes (i.e. the secondary customers). The customers can be within one or more SYSPRO companies.

The programs related to this feature are accessed from the Program List of the SYSPRO menu:

-

Program List > Accounts Receivable

A customer provides the mechanism for you to raise sales orders within SYSPRO.

The static information captured against a customer is used when processing sales transactions and determines, for example, the tax and discounts applicable.

Documents generated from these transactions (e.g. invoices, credit notes, debit notes) are also stored against the customer.

The customer code can be used as a filtering tool when generating reports.

Customers are maintained using the Customers program (Program List > Accounts Receivable > Setup).

This comprises a primary customer and secondary customers (i.e. one or more associated downstream customers).

Group customers simplify the payments process by letting you process a single large payment against a group customer (the primary and secondary customers) instead of having to make smaller individual payments.

Group customers are maintained using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Transaction Processing).

This is a single large payment processed from a primary customer instead of smaller multiple payments from many individual customers.

This type of payment is processed for a group customer that comprises a primary customer (who is liable for settling the payment) and multiple associated downstream secondary customers. A group customer is created using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Transaction Processing).

A group payment is created, executed and processed using the AR Group Payment Run program (Program List > Accounts Receivable > Setup).

An intercompany group payment affects two or more SYSPRO companies and involves the Accounts Payable and Accounts Receivable modules.

The transaction is processed in the primary company and involves payments to secondary companies for Accounts Payable or payments from secondary companies for Accounts Receivable.

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

This is the customer against which a single payment is processed (i.e. the recipient of the aggregate payment). This single remittance is known as a group payment.

When processing intercompany group payments, this is the customer in the primary SYSPRO company against which payments from multiple secondary customers either in the same or secondary SYSPRO company is processed.

Primary customers are created and maintained using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

This is the company in which you process the group/intercompany group payment.

This is also the company where the primary customer (for Accounts Receivable) or primary supplier (for Accounts Payable) is located.

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

A document sent from the customer to the supplier indicating which invoices the customer is paying.

For intercompany group payments, this is the document sent from the primary SYSPRO company to the supplier, indicating which invoices the primary SYSPRO company is paying.

This is a customer to whom a portion of the payment that was received by the primary customer, is allocated. All secondary customers and the primary customer they are linked to form a customer group. The payment made to the primary customer is referred to as a Accounts Receivable group payment.

A secondary customer can be in the primary or secondary SYSPRO company.

Customers for group payments are defined using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

Secondary SYSPRO companies are updated by the transaction that is initiated and processed in the primary SYSPRO company.

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

Starting

To use this feature, the following setup option(s) must be configured:

Setup Options > General Ledger Integration > Receivables Ledger Codes

-

Intercompany payments interface

Select the Maintain link to access the Intercompany Payments GL Interface program where you can select the intercompany loan account for each company to which your GL transactions will be posted.

To use the AR Intercompany Group Payments feature, the following setup options must be the same across all companies:

-

This must be performed prior to capturing the Accounts Receivable Intercompany structure.

-

If you want to change a setup option once the AR intercompany structures have been defined, you must remove the company from the AR group structure before attempting the change.

Setup Options > Keys > Financials

-

AR payment run

-

Key type

-

Suppress leading zeros

-

Presentation length

-

Setup Options > Tax > Company Tax Options

-

Use descriptive tax codes

Setup Options > General Ledger Integration > General Ledger Codes

-

Integration level

-

Create general ledger journal

-

Post general ledger journal

-

Force general ledger analysis

-

Dimension analysis

Setup Options > Financial Periods > General Ledger

-

Number of financial periods

You can secure this feature by implementing a range of controls against the affected programs. Although not all these controls are applicable to each feature, they include the following:

-

You restrict operator access to companies for which intercompany payments can be processed using the Operator Maintenance program.

Select the Configure hyperlink at the Intercompany transactions section (within the Security tab) to maintain access control options using the Security per Company program.

The user can only release invoices for payment for companies to which they have been given access.

-

You restrict operator access to activities within a program using the Operator Maintenance program.

-

You can restrict operator access to the fields within a program (configured using the Operator Maintenance program).

-

You can restrict operator access to functions within a program using passwords (configured using the Password Definition program).

When defined, the password must be entered before you can access the function.

-

You can restrict access to the eSignature transactions within a program at operator, group, role or company level (configured using the Electronic Signature Configuration Setup program).

Electronic Signatures provide security access, transaction logging and event triggering that gives you greater control over your system changes.

-

You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

-

You can restrict operator access to programs by assigning them to roles and applying access control against the role (configured using the Role Management program).

The following restrictions apply to intercompany group payments:

-

Multi-currency payments are not supported for group payments, however payment from secondary customers with different base currencies can be included in an intercompany group payment run.

-

Custom form fields in secondary companies aren't supported.

- All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

-

General Ledger Analysis is not supported for Group Payments.

Solving

-

Open the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

-

Indicate the code associated with the primary customer for the customer group in the Primary customer toolbar field and tab off your entry.

-

Indicate the code(s) associated with the secondary customer(s) that you want associated with the group customer (i.e. Primary customer) in the Customer column of the Secondary Customer listview.

-

Save your changes.

To remove a secondary customer from an existing customer group, proceed as follows:

-

Open the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

-

Select the secondary customer that you want to remove.

-

Select the Delete function from the Secondary Customer listview.

-

Save your changes.

Group payments for customers are created, posted and processed within the AR Group Payment Run program (Program List > Accounts Receivable > Transaction Processing).

-

Open the AR Group Payment Run program (Program List > Accounts Receivable > Transaction Processing).

-

Indicate the unique Payment run number associated with the group payment run that you're creating.

This is only applicable if your Numbering method for the AR payment run setup options is defined as Manual (Setup Options > Keys > Financials). However, if this is defined as Automatic, then the next Payment run number is automatically assigned.

-

Specify the details for the group payment in the Payment Options and Bank Deposit Details panes.

-

Indicate the Allocated amount for the primary customer in the Customer Payment Allocation listview.

-

Select the Allocation hyperlink to allocate invoices to the primary customer.

-

Manually allocate one or more invoices associated with the primary customer that you'd like to process for payment using the Add Invoice function.

-

Browse for the unique invoice number associated with the invoice that you'd like to add using the Invoice field.

-

Indicate the following info for this invoice:

- Invoice (only applicable when using Add Invoice)

-

Gross amount

-

Discount amount (not applicable to temporary invoices prefixed by _TP)

-

Reference/Notation (not applicable to temporary invoices prefixed by _TP)

-

Withholding amount (not applicable to temporary invoices prefixed by _TP)

-

Review the invoices selected and exit the window once you're satisfied with the invoices and their associated information displayed in the listview.

Alternatively, you can use one the following functions:

-

Unapplied Payment (to post a payment to the customer's account without allocating it to any invoices)

-

Auto Pay by Invoice (to pay all outstanding invoices for the customer automatically by invoice order from the database until the Undistributed amount is zero)

-

Auto Pay by Date (to pay all outstanding invoices for the customer automatically by date sequence until the Undistributed amount is zero)

-

-

Select the Add Customer function to add a secondary customer to the payment allocation and then allocate applicable invoices to the secondary customer.

-

Save the details captured for this new group payment and the invoices allocated for the customers in the listview.

Saving your details changes the Payment status in the Payment Information pane to 1 - Open.

The ledger code associated with the Bank is defined against the Cash account field in the Banks program (Program List > Accounts Payable > Setup).

-

If applicable, Authorize the group payment before you post it:

Select Approve to set the Status of the payment run to and allow the payment run to be posted.

This only applies if the setup option (Setup Options > Preferences > Financials > Accounts Receivable) is enabled.

-

Select Post to execute the group payment.

You can use the AR Group Payment Reviewlistview to view a brief summary of the transactions that took place in the payment run, as well as which customers and invoices were paid and for which amounts.

Simplified Cash Journal

You can generate a report of the journal created from the single consolidated transaction that you posted for your group payment by selecting the Print Journal Report function of the AR Group Payment Run program (Program List > Accounts Receivable > Transaction Processing).

This loads a simplified view of the AR Cash Journal report.

To define report criteria and view comprehensive report details, you can access this report via the Program List (Program List > Accounts Receivable > General Ledger > GL Integration) or SYSPRO Reporting Services menu.

Total Transaction Values

You can view the total transaction value as well as the bank deposit slip details related to your group payment by proceeding as follows:

-

Open the AR Bank Deposit Slip program (Program List > Accounts Receivable > Transaction Processing).

-

Specify the relevant details in the Options pane.

Ensure that you've selected the correct bank associated with your group payment.

Only a single bank deposit slip is generated despite multiple customers being part of your group payment, as a group payment is a single consolidated transaction of multiple, smaller transactions.

-

Select the Start Processing function to post your group payment directly into the Cash Book, or generate source documents to manually post the payment into the Cash Book.

Customer balances and invoices are also updated, not just the Cash Book.

The following occurs when you delete a AR Group Payment run with a status of either 3 - Posted or 4 - Canceled using the AR Payment Run Purge program (Program List > Accounts Receivable):

-

The statuses of released invoices are reset.

-

The manual payment information against invoices within the payment run is cleared.

-

The record associated with the group payment is deleted in the following SQL tables:

-

ArPayRunHdr

-

ArPayRunDet

-

The group payment is deleted according to the number of months indicated against the AR payment run detail setup option under Number of months to retain (Setup Options > History > Financials > Accounts Receivable).

Group payment run numbers are allocated according to your configuration of the following setup options for AR payment run (Setup Options > Keys > Financials):

-

Numbering method

-

Key type (define whether a payment run number is Alphanumeric or Numeric)

-

Suppress leading zeros

-

Presentation length

-

(Only applicable if your Numbering method is configured as Automatic)

To process intercompany group payments, the currency must exist in primary and secondary companies and the currency code across companies should be the same.

If this is not the case, you can do one of the following:

-

Create the same currency code in primary and secondary companies using the Currency Maintenance program.

-

Use the Intercompany Currency Cross Reference program to create a link between the currency code of the primary company and the currency code in the secondary company.

Customer group data is retained within the ArCustomerGroup table.

-

This table maintains the links between the primary customer and its linked secondary customers.

-

The company ID and transacting currency associated with each customer is also stored in this table.

Payment run information for customer group payments is stored within the following tables:

-

ArPayRunHdr

-

ArPayRunCus

-

ArPayRunDet

Using

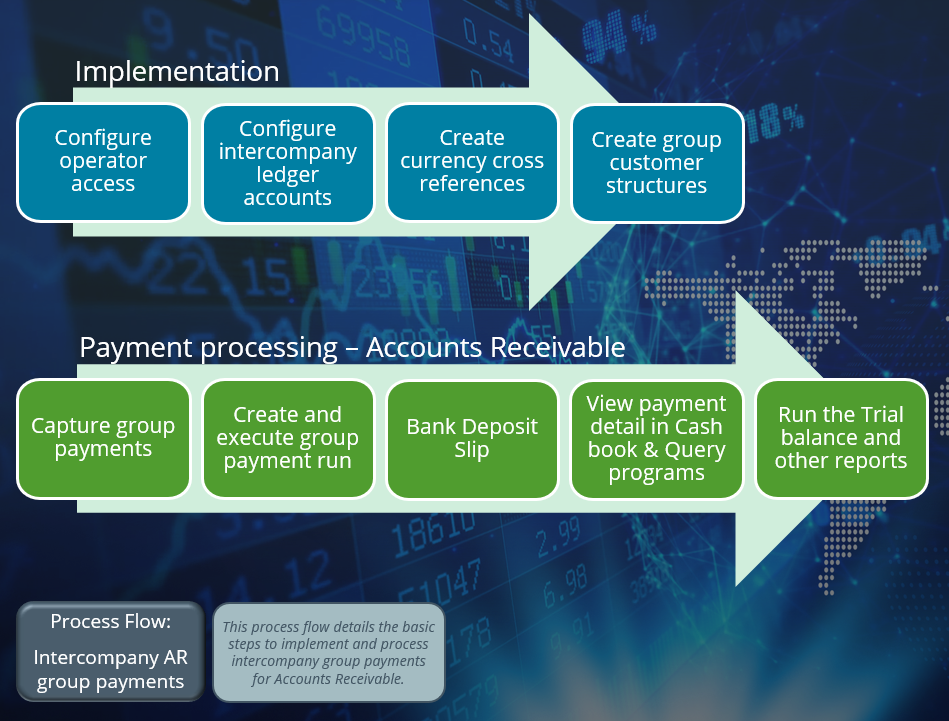

-

Configure operator access and the link between primary and secondary companies.

Step-by-step instructions

Step-by-step instructions

-

Log into the primary company.

-

Open the Operator Maintenance program (SYSPRO Ribbon bar > Setup > Operators).

-

Select the Configure hyperlink at the AR access control field to access the Security per Company program.

-

Configure the operator access type.

Ensure that access is given to all other companies with which you wish to conduct AR intercompany payments (i.e. secondary companies).

-

Save your changes and exit the Operator Maintenance program.

-

-

Configure intercompany ledger accounts.

Step-by-step instructions for the General Ledger integration

Step-by-step instructions for the General Ledger integration

-

Log into the primary company.

-

Create an intercompany ledger account using the General Ledger Codes program.

Specify this as a control account and define the Account type as Asset.

-

Log into every secondary company.

-

Create an intercompany ledger account for every secondary company using the General Ledger Codes program.

Specify this as a control account and define the Account type as Asset.

These ledger accounts will be used when processing intercompany transactions from the primary company to secondary companies.

Step-by-step instructions to set up the sub module integration to the General Ledger

Step-by-step instructions to set up the sub module integration to the General Ledger

-

Log into the primary company.

-

Open the Setup Options program (SYSPRO Ribbon bar > Setup) and navigate to the Receivables Ledger Codes form (Setup Options > General Ledger Integration > Receivables Ledger Codes).

-

From the Intercompany payments interface setup option, select the Maintain hyperlink to access the Intercompany Payments GL Interface program.

-

Select the intercompany loan accounts (defined in step 2 above) for each of the secondary companies to link these to the primary company (i.e. the company you are currently logged in to).

The ledger accounts you select should be defined as control accounts with the account type Asset.

-

Log into every secondary company consecutively, and repeat step b and c. However, this time select the intercompany loan account for the primary company.

The ledger accounts you select should be defined as control accounts with the account type Asset.

-

-

Create currency cross references

This step is only required if the same currency has been created using different currency codes in primary and secondary companies.

For example:

SA Rand could have been defined as SAR in one company and ZAR in another.

Step-by-step instructions

Step-by-step instructions

-

Log into the primary or secondary company.

-

Open the Intercompany Currency Cross Reference program (Program List > Accounts Payable > Setup).

-

Create a cross reference of the currency codes by selecting both companies and both currency codes.

-

-

Create customer groups

Step-by-step instructions

Step-by-step instructions

-

Open the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

-

Indicate the code associated with the primary customer for the customer group in the Primary customer toolbar field and tab off your entry.

-

Indicate the code(s) associated with the secondary customer(s) that you want associated with the group customer (i.e. Primary customer) in the Customer column of the Secondary Customer listview.

-

-

Define your customer groups (i.e. the primary customer and associated secondary customers) using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

-

Create a customer group payment run and allocate the payments to secondary customers using the AR Group Payment Run program (Program List > Accounts Receivable > Transaction Processing).

Step-by-step instructions

Step-by-step instructions

-

The primary customers are automatically displayed in the Customer Payment Allocation grid.

-

Add the secondary customers you want to allocate payments to at the Customer Payment Allocation grid.

-

If a secondary customer uses a different currency (i.e. the group payment is a multi-currency payment) the allocated value is converted.

-

If you add payments to secondary customers across companies, the payment run is considered an intercompany group payment.

-

-

Post the transaction.

-

-

Print the bank deposit slip using the AR Bank Deposit Slip program (Program List > Accounts Receivable > Transaction Processing).

The bank deposit slip can only be printed in the primary company.

-

View payment detail using the following programs:

-

Bank Query (Program List > Cash Book)

-

Customer Query (Program List > Accounts Receivable )

When the payment run includes secondary customers from a secondary company, the Customer Query program must be accessed from the secondary company.

-

-

Run the trial balance and reports to view the ledger transaction in the respective companies.

-

Ensure that your currency rates are as accurate as possible by updating them on a regular basis using the Currency Maintenance program (SYSPRO Ribbon bar > Setup > General Setup > Currencies).

-

By default, payments are posted to each company's current financial period when the payment run is executed or posted.

You can post to previous period 1 or previous period 2 of the companies by selecting the Change Period option.

To easily reconcile the General Ledger and intercompany loan accounts, we strongly advise that the companies included in a payment run are in the same financial period when the payment run is executed.

The status of an AR payment run (i.e. collector run) indicates the current stage of the payment run and changes according to the functions performed against it.

The current status of a payment run dictates the functions that are available. Therefore, the following table indicates the possible statuses for an AR payment run:

| Status | Description |

|---|---|

|

0 - Create / New |

This status represents a new payment run and only applies while the creation of a payment run is in progress. Once you save the payment run, the status updates to 1 - Open. |

|

1 - Open |

This status indicates that the payment run has been created and saved. Records have been created and the payment run is open for editing (i.e. you can add customers and invoices to this payment run). |

|

|

This status only applies if the setup option is enabled (Setup Options > Preferences > Financials > Accounts Receivable). If your system is configured to require authorization of payment runs before they are posted, then the payment run is moved to this status once you authorize it. In this scenario, the AR Payment Run and AR Group Payment Run programs won't allow you to post the payment run unless it is in a status of . |

|

3 - Posted |

This status indicates that the payment run has been posted. The payment allocation to customer documents is recorded as paid and the checks indicated in the payment run are closed. |

|

4 - Canceled |

This status indicates that the payment run was initially saved and then subsequently canceled. All reserved invoices indicated in the payment run have been released. |

|

5 - Payment pending |

This status is used for digital payments and indicates that the payment has been initiated but is not fully processed or confirmed yet. |

The following indicates areas in the product that may be affected by implementing this feature:

Some columns may be hidden by default and can be added using the Field Chooser function.

Program List > Accounts Receivable > Setup

This program lets you capture and maintain details of customers required to create and maintain customer groups.

Customer groups are the mechanism through which you create, process and execute group payments for customers.

Customer groups consist of both primary and secondary customers. These groups are created and maintained using the AR Customer Group Maintenance program.

Program List > Accounts Receivable > Setup

This program lets you define a customer group that is used to create, execute and process a group payment for customers.

The Company column within the grid is editable and allows you to indicate the company of secondary customers.

To use this feature with its entire functionality, enable the following eSignatures in the eSignature Setup program:

-

AR Customer group added

-

AR Customer group deleted

-

AR Customer group updated

Accessible from the Configure hyperlink of the AR access control section within the Security tab of the Operator Maintenance program.

This program lets you restrict operator access to companies for which intercompany group payments can be processed.

The program title bar shows whether you are configuring operator access for Accounts Payable or Accounts Receivable group payments.

Accessible from the Maintain hyperlink of the Intercompany payments interface field within the Setup Options program (Setup Options > General Ledger Integration > Receivables Ledger Codes).

This program lets you set up the Accounts Payable and Accounts Receivable intercompany ledger loan accounts that are used when processing intercompany payments.

The loan account must be set up for each company to and from which intercompany payments will be made.

Program List > Accounts Receivable > Setup

This program lets you establish a link between currency codes in companies, where the same currency was assigned a different code in each company.

For example:

The currency South African Rand could have the currency code SAR in one company and ZAR in the other company.

Program List > Accounts Receivable > Setup

An error message is displayed if you indicate a Payment run number that is associated with an existing customer group payment.

Program List > Accounts Receivable > Transaction Processing

An error message is displayed if you indicate a Payment run number that is associated with an existing customer group payment.

Program List > Accounts Receivable > Transaction Processing

This program lets you make a single payment against a customer group, rather than numerous smaller payments against individual customers. This functions similar to a normal AR payment run.

The docked Customer Filter pane lets you select which customers you want include in the Customer Payment Allocation pane.

Program List > General Ledger > GL Integration

This program lets you create general ledger journals from the transaction journals produced using the AR Group Payment Run program.

This program is called when posting your single transaction arising from your group payment for customers (i.e. when using the Post function in the AR Group Payment Run program).

Program List > Cash Book > Transaction Processing

The following column(s) within the Bank Transactions listview are related to this feature:

- Group payment

- Intercompany

Program List > General Ledger > Transaction Processing

The AR payment run number is a hyperlink that displays the AR Group Payment Run program. The data of the original payment run is displayed in the company where the payment run was posted. In other words, if the user is logged in to the secondary company when accessing the query, then the payment run data for the primary company will be displayed (if the user has access to the primary company).

The following column(s) within the Journal Details listview are related to this feature:

- Group amount (pay cur)

- Group payment

- Intercompany trx

- Intercompany group

Program List > Accounts Receivable > Reports

This report lets you generate customer statements for group payments by adding the DetGroupPay and DetPaymentRun fields to a report template. These fields can be added to both your sample and blank report templates.

This gives you information regarding the Payment run number associated with the group payment, as well as the total transaction value.

Customer statements for group payments are identified based on their Payment run number and whether they are recorded as a Group payment.

The Consolidate Group accounts option in the Print section lets you print statements for the customer group (i.e. the primary customer) and the linked secondary customers.

Group payments are created, executed and processed in the AR Group Payment Run program (Program List > Accounts Receivable > Transaction Processing).

Program List > General Ledger > Tax

This program lets you generate tax return documents.

The following columns within the AR Settlement listview are related to this feature:

-

Group payment

-

Payment run

-

Intercompany

-

AR Payment number

-

Primary company

-

Secondary company

-

Primary customer

-

Secondary customer

Program List > Accounts Receivable > Transaction Processing

An error message is displayed if you indicate a Payment run number that is associated with an existing customer group payment.

Program List > Accounts Receivable > General Ledger > GL Integration

-

The following AR Group Payments information is available within the report:

-

Payment run number

This is the unique number associated with the group payment run created in the AR Group Payment Run program. This information is contained within the PaymRunNumber element.

This information isn't shown for normal payment runs created using the AR Payments and Adjustments program.

-

Alternate Currency Payment Received

This indicates the currency in which the payment was made in and this doesn't only apply to group payments.

For group payments, this information is sourced from the Payment currency field of AR Group Payment Run.

-

Payment Value in Customer Currency

The value of the payment in the currency of the customer and this doesn't only apply to group payments.

-

-

You have the ability to optionally add the associated payment type on the report (i.e. regardless of whether the payment is a group payment) using the AR Cash Journal Query business object.

You can specify your own label and associate that with the GroupPaymFlag element that contains either a Y or N.

For example:

Group payment: Yes is displayed on the report output.

This information is based on your own specified label that you've created and the following element in the format:

{Your label} + {GroupPaymFlag}

-

A gray shaded bar labeled Local currency enables you to differentiate the values specific to your transacting currency associated with the company you're currently logged in to.

The following values are displayed under the already existing columns in this section specifically:

-

Invoice balance

-

Gross

-

Discount

-

Withholding Tax

-

Net

-

Program List > General Ledger > Tax > Reports

This report includes the tax on settlement discount transactions arising from group payments created, executed and processed for suppliers.

The unique payment run number associated with a group payment (and whether a payment run is a group payment) is the data which is used to derive the transactions displayed in this report.

Group payments for customers are created using the AR Group Payment Run program (Program List > Accounts Receivable > Transaction Processing).

Program List > Accounts Receivable > Reports

This report displays information relevant to group payment runs for a primary customer and its associated secondary customers in a customer group.

Group payments for customers are created, executed and processed within the AR Group Payment Run program.

Program List > General Ledger > GL Integration

This lets you generate a report of Accounts Payable and Accounts Receivable payments interfaces (i.e. the ledger accounts used for intercompany payments).

Program List > Accounts Receivable > Transaction Processing

This program prints one slip with the total value of the single large transaction arising from a group payment run for customers.

If the Accounts Receivable link to Cash Book setup option is defined as Posted by cash journal, then the program posts all the normal payments and prints them. For group payments, if this setup option isn't configured, it is temporarily configured as described above.

Program List > Accounts Receivable

The AR payment run number is a hyperlink that displays the AR Group Payment Run program. The data of the original payment run is displayed in the company where the payment run was posted. In other words, if the user is logged in to the secondary company when accessing the query, then the payment run data for the primary company will be displayed (if the user has access to the primary company).

The following columns within the Payments listview are related to this feature:

-

AR payment run (this also applies to payment runs created using AR Payments and Adjustments and AR Payment Run programs)

-

Payment type

-

Intercompany transaction

-

Primary company

-

Secondary company

The data displayed in these columns is based on the data sourced from the AR Group Payment Run program (Program List > Accounts Receivable > Transaction Processing).

Program List > Cash Book

This program includes information regarding transactions associated with group payments applicable to both customers and suppliers for a particular bank.

The following columns within the Transactions listview are related to this feature:

-

Group payment

-

Intercompany

-

Primary company

-

Secondary company

Program List > General Ledger > GL Query

The following columns within the Details listview are related to this feature:

-

Group payment

-

Intercompany trx

-

Intercompany group

Accessible from the View periods option within the AR Group Payment Run program.

This program lets you view the financial periods for the primary company, as well as all companies linked to the primary supplier or customer.

Accessible from the hyperlink within the Bank equivalent column of the Transactions listview within the Bank Query program.

This program lets you view details associated with the relevant group payment related to the transaction selected within the Transactions listview of the Bank Query program.

The AR payment run number is a hyperlink that displays the AR Group Payment Run program. The data of the original payment run is displayed in the company where the payment run was posted. In other words, if the user is logged in to the secondary company when accessing the query, then the payment run data for the primary company will be displayed (if the user has access to the primary company).

Program List > Accounts Receivable > Browses

This program lets you view details of the customers currently defined in the Customers program.

The Primary customer column relates to this feature.

Program List > Accounts Receivable > Browses

This program lets you view details for customer groups that were defined using the AR Customer Group Maintenance program.

Program List > Accounts Receivable > Browses

This program provides a simplified overview of the details associated with your group payments captured, executed and processed.

You can also browse for the group payment you'd like to complete and process in the AR Group Payment Run program.

The following indicates the business objects that are affected by this feature:

The Intercompany Currency Cross Reference business object lets you establish a link between currency codes in different SYSPRO companies and is used when the same currency was assigned a different code in each company.

This business object is used by the Intercompany Currency Cross Reference program.

The AR Intercompany GL Interface business object lets you create and maintain General Ledger accounts for intercompany payments from the Accounts Receivable module.

The Intercompany Transaction Security Setup business object lets you create and maintain General Ledger accounts for intercompany payments from the Accounts Receivable module.

The AR Group Payment Run Post BO business object is used to post intercompany group payment transactions.

The AR Payments and Adjustments business object is used to post payments and adjustments against Accounts Receivable invoices for SYSPRO customers and to post miscellaneous receipts (not linked to a specific customer or invoice).

The Post GL Setup Integration business object lets you maintain setup options for the General Ledger module.

The Post Company Control Setup Options business object lets you maintain company setup options.

The Post Key Information business object lets you update key information defined against the SYSPRO company you are currently logged into.

The GL Journal Posting business object lets you create, maintain and post the different types of journals and post sub-ledger transactions to the General Ledger.

The AR Payment Integration update business object lets you create and post GL journals for Accounts Receivable payment transactions, when your Accounts Receivable module is integrated to General Ledger in detail or summary.

The AR to Cash Book Integration Posting business object lets you integrate Accounts Receivable payments directly into Cash Book.

It emulates all the integration functionality provided in AR Bank Deposit Slip but doesn't produce a printed bank deposit slip.

The Intercompany Transaction Security Query business object lets you query the interface entries created in the Intercompany Payments GL Interface program.

The Tax Submission Query business object lets you query tax information which will be returned in XML format.

The business object returns the supplier, customer, general ledger and tax information based on the selection criteria, as well as purchase, sales and ledger transaction information for the selected financial year.

The business object returns the following based on the selection criteria:

-

Supplier

-

Customer

-

General ledger details

-

Tax information

-

Purchase, sales and ledger transaction information for the selected financial year

The AR Statement Document Print Query business object lets you return the AR Statement document XML for a single customer.

The Customer Query business object lets you view information held against a customer in the Accounts Receivable module.

Copyright © 2025 SYSPRO PTY Ltd.