You use this program to capture and maintain details of banks required within the system.

| Field | Description | ||||||

|---|---|---|---|---|---|---|---|

| Bank information | |||||||

| Bank | Indicates the code of the bank you are currently maintaining. | ||||||

| Bank name | Indicates the description for the bank code entered

above. It is displayed throughout SYSPRO whenever you enter

the bank code and can therefore be used to verify that the

correct bank code was entered. If you have more than one type of account with the same bank, you can include the account type in the Bank name field (e.g. ABC Bank Ltd - Current a/c). |

||||||

| Account number |

Indicates the bank account number assigned to the account by the bank. |

||||||

| Telephone |

Indicates your bank's telephone number. |

||||||

| Next check number | In Cash Book, this refers to the number of the next

on-line check to be used. In Accounts Payable, this refers to the number of the next system check to be used. The next check number is updated when system checks are printed from within the Accounts Payable module (see AP Check and Remittance Print) or on-line checks are printed from within the Cash Book system (see Cash Book Deposits & Withdrawals). |

||||||

| Enter bank charges in AR payments | Enables you to process bank charges at the time of

posting Accounts Receivable payments. This option is available only if both the Accounts Receivable and Cash Book modules are installed and if Accounts Receivable payments are integrated to Cash Book. If you enabled this option (and Accounts Receivable is integrated to General Ledger in summary or detail) then you must enter a ledger account for these bank charges at the Bank charges field below. |

||||||

| EFT options |

See Field considerations in Notes and warnings. |

||||||

| EFT payments required | Enables you to enter additional EFT information and process EFT payments from this bank once you select the Save function. | ||||||

| Next EFT number | Set the starting point for the reference numbers that

must be allocated to EFT payments. This only apples when the EFT payments required option is enabled. It is not necessary to use separate numbers for Accounts Payable system checks and EFT payments, as the system records check payments as type R and EFT payments as type E. This means that if the same numbers are used for both EFT and system check payment runs in AP, the system can differentiate between them and no duplication occurs. This differentiation does not apply to Cash Book transactions or to Manual checks. However, it is best practice to use a different series of numbers to make it easier to identify EFT and AP system check payments (e.g. if your next check number is 1000, you could make the next EFT number 7000). |

||||||

| Cash Book integration | This option is only enabled if you indicated that EFT

payments are required.

|

||||||

| Currency options | |||||||

| Local or foreign bank |

|

||||||

| Currency | Indicate the currency code for a foreign bank. An entry can only be made if either the Accounts Payable module is installed, or a foreign Cash Book is required (Cash Book Setup) and you selected the Foreign currency bank option. If you selected the Local currency bank option then the local currency defined against the company is automatically entered in this field and it cannot be changed. |

||||||

| Exchange rate |

This defaults to the rate defined against the currency code in the Currencies table. The exchange rate for a local currency bank is always 1. |

||||||

| Statement balance in bank's currency | Indicates the balance as shown on the latest bank

statement. If you enter a statement balance when adding a new

foreign bank, then the calculation of the local value

equivalent is based on the exchange rate held against the

foreign bank. See also: Notes and warnings. |

||||||

| Statement balance in local currency | Indicates the local currency equivalent of the

statement balance entered for a foreign currency

bank. When you add a foreign currency bank and you enter a statement balance in the bank's currency, then this field is automatically updated using the exchange rate for that currency as defined in the currencies table. An entry can only be made here if you indicated that a foreign currency Cash Book is required (Cash Book Setup) and you are adding a foreign currency bank. A negative statement balance can be entered. See also: Notes and warnings. |

||||||

| Ledger codes |

These accounts are validated if either the Accounts Payable or Cash Book modules are integrated to General Ledger in Summary or Detail (General Ledger Integration). |

||||||

| Cash account | In Cash Book, this is the control account to which all

deposit, withdrawal and adjustment entries for the bank are

posted. In Accounts Payable all withdrawals (i.e. payments to suppliers) made from this bank are credited to this account. If Accounts Receivable is integrated to Cash Book, then all deposits (i.e. payments from customers) made to this bank are debited to this account. |

||||||

| Exchange variance | This control account is the General Ledger code to

which variances (arising from adjustments made to the exchange

rate of foreign currency transactions) are posted. If you did not use the AP Currency Variance GL Interface program to define the interface ledger accounts required for the revaluation of outstanding foreign currency supplier invoices using the AP Exchange Rate Revaluation program, then the exchange variances arising from running the AP Exchange Rate Revaluation program are posted to this account. In Accounts Payable, this would apply when, for example, you change the currency rate at the time of processing a manual payment against a foreign supplier. In Cash Book, this would apply when you print the Currency Variance Report and you have selected to revalue your outstanding transactions at the latest exchange rate. |

||||||

| Bank charges | This indicates the default account to which bank charges (captured during the processing of Accounts Receivable payments) must be posted. |

-

Access to this program can be restricted per operator group (see Security Access).

-

Additional security can also be implemented in the following areas:

-

Functions/Activities can be restricted:

-

per operator (see Security Activities).

-

per operator role (see Role Activities and Fields Maintenance).

-

using Electronic Signatures (see eSignature Setup).

-

-

Fields can be restricted:

-

per operator (see Security Fields and Access).

-

per operator role (see Role Activities and Fields Maintenance and Role Access Control Maintenance).

-

-

-

You cannot change the currency of a bank once you have captured and saved details for the bank. You will have to delete the bank and recapture it with the new currency code required.

-

You cannot delete a bank if:

- the bank balance is not zero;

- outstanding deposits, withdrawals or EFT payments exist; or

-

there are unreconciled entries for the bank.

![[Note]](images/note.png)

|

|

|

You can run the Cash Book Reconciliation Statement program for the bank you want to delete to check whether the bank balance is zero and if there are any unreconciled transactions. |

|

-

Statement balance in bank's currency

Although the statement balance of selected banks can be changed using this program, you are advised to exercise extreme caution when doing so.

If the statement balance is changed at any stage, you must run the Balance function of the Cash Book Period End program to recalculate the correct current balance of your Cash Book.

If you change this balance for a foreign currency bank, then you must manually calculate and enter the equivalent local currency amount for the statement balance in the local currency field.

The eSignature: CB Maintain Bank Statement Balance (eSignature Setup) can be used to restrict access to changing the bank statement balance.

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the eSignature Setup program.

| eSignature Transaction | Description |

|---|---|

| CB Maintain Bank Statement Balance |

Controls access to the field Statement balance in bank's currency in the Banks program. |

Operator access to the following fields within this program can be restricted. You configure this using the Security Fields function of the Operators program.

| Field | Description |

|---|---|

| AP Bank EFT payments allowed | Controls whether an operator can access the EFT payment required option when adding or maintaining a bank using the Banks program. |

| AP Bank Total posting for EFT runs | Controls whether an operator can access the Cash Book integration option when adding or maintaining a bank using the Banks program. |

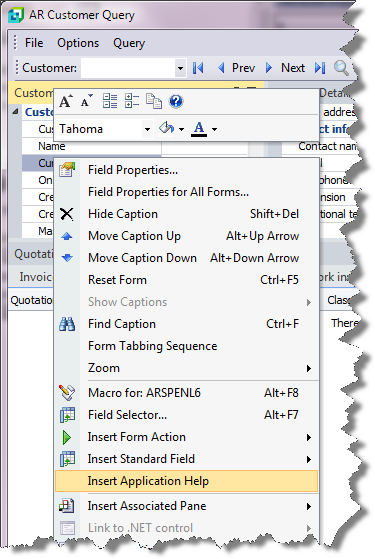

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.