You use this program to create and maintain a series of entries that are required to be posted into the Cash book system on a given day of a particular month.

| Field | Description |

|---|---|

| New | Select this icon to add a new Cash Book permanent entry. |

| Delete | Select this icon to delete the entry currently displayed. |

| Save | Select this icon to save the details you entered or changed. |

| Day | Enter the specific calendar day of the month on which the entry must be posted into the Cash Book. A valid day must be entered. |

| Reference | Enter a unique reference by which the entry may be identified (maximum 9 characters). Because the Day and Reference fields uniquely identify a Cash Book permanent entry, once defined, you will be unable to change them for that entry. |

| Play | Select this to use the Multimedia program to view multimedia objects defined against the entry. |

| Edit | Select this to use the Multimedia program to define multimedia objects against the entry. |

| Field | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Permanent entry information | |||||||||

| Day | This indicates the specific calendar day of the month on which the entry must be posted into the Cash Book. | ||||||||

| Reference | This indicates the unique reference for the permanent entry. | ||||||||

| Bank |

This indicates the bank code from which the transaction amount is withdrawn, or into which the amount is deposited. Once you have specified a valid Bank, the Description will be displayed for verification purposes. |

||||||||

| Currency | This indicates the currency of the bank you selected and is displayed for information purposes. | ||||||||

| Total amount inclusive | This indicates the total amount (including tax) that will be withdrawn or deposited to the bank selected above. It is not necessary to enter withdrawals as negative amounts. | ||||||||

| Transaction type |

This refers to the type of transaction within the Cash Book module.

|

||||||||

| Tax details | These options are only enabled if a Global Tax File is

required (General Ledger Setup) or the

Tax distribution method is defined as

Detail or Summary

(Cash Book Setup). When processing a Withdrawal, you can only access these options if Tax distribution is required for Withdrawals (Cash Book Setup). When processing a Deposit, you can only access these options if Tax distribution is required for Deposits (Cash Book Setup). |

||||||||

| Inclusive | When enabled, the system calculates the tax portion of

a distribution entry based on the tax code entered. If you do not select this option, then tax is calculated on an exclusive basis. You will need to enter the tax amount manually, and post the remaining distribution value exclusive of tax. |

||||||||

| Tax code | Indicate the tax code for the entry. This defaults to

the Default tax code(s) defined for Deposits and Withdrawals

(Cash Book Setup) but can be

changed. The system automatically calculates the Tax amount according to this code. |

||||||||

| Tax amount | This indicates the amount of tax for the transaction

and must be entered in the currency of the bank. For foreign

currency banks, the transaction value and tax value are

converted to local currency at the currency exchange rate

prevailing at the time if posting the entry. A Tax amount can only be entered if you selected an Exclusive tax calculation basis. A warning is displayed if the amount entered exceeds 50% of the transaction amount. The system uses the transaction amount and the rate defined against the Tax code to calculate the tax portion of the transaction as follows: Tax amount = ((Transaction amount) / (100 + tax%)) x Tax% |

||||||||

| Entry details | |||||||||

| Entry type |

This indicates how the permanent entry must be processed. You can change a permanent entry from one type to another (e.g. from Permanent to Temporary, or from Projection to Permanent). This is useful in situations where a change in circumstances requires that the transaction is terminated earlier (or extended longer) than expected.

|

||||||||

| Frequency of transfer | Indicate how often (in months) you want the entry to be

posted. For example, If the entry is to be transferred every

month, then enter 1; if every 6 months, then enter 6; and if

once a year, enter 12. This option does not apply to Temporary and Projection entry types. |

||||||||

| Expires on | Select this if you want the entry to expire on a

specified date. Do not select this option if you want to retain the entry indefinitely. |

||||||||

| Expiry date |

This indicates the date on which the entry expires. The entry will only be posted up to the date specified in this field. Once expired, the entry is deleted the next time you run the Purge function of the Cash Book Period End program after this date. If the expiry date you enter is before the next posting date, then a warning message is displayed. You are given the option of continuing or returning to the maintenance screen. |

||||||||

| Next posting |

The Next postingCalendar month and Calendar year fields indicate when next the entry must be posted to the Cash Book module. The permanent entries processing program updates these fields accordingly, so even after entries have been transferred, these fields will always reflect the relevant month and year of the next posting. You should not alter these fields unless you want to postpone the next posting. |

||||||||

| Calendar month | This indicates the month in which the next entry must be posted to the Cash Book. | ||||||||

| Calendar year | This indicates the year in which the next entry must be posted to the Cash Book. | ||||||||

| Notes |

This enables you to enter any applicable Notes against the entry. 3 lines of text, each up to 25 characters long, can be used for this purpose. |

||||||||

| Ledger integration |

The Ledger integration information, contains the distribution entry for the Cash Book. For a projection entry, these fields are for documentation purposes only. |

||||||||

| Company |

This indicates the Company in which the entry must be processed. |

||||||||

| Ledger code |

This indicates the General Ledger code to which the transaction amount excluding tax must be debited (for withdrawal entries) or credited (for deposit entries). The taxable portion (if applicable) is posted to the default Tax for deposits or the Tax for withdrawals ledger code (General Ledger Integration). |

||||||||

| Narration |

This enables you to enter a narration if required. You can enter up to 60 characters of text to be held against the entry. The text entered here is printed on the Cash Book Journal. |

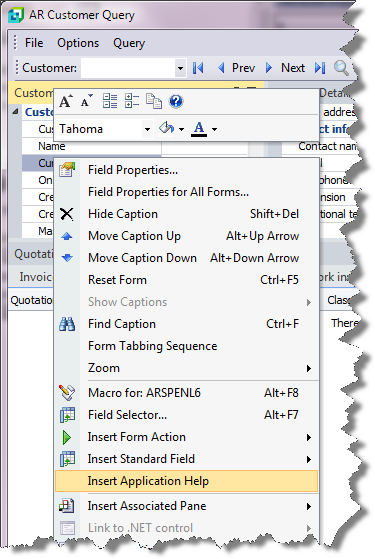

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.