You use this program to maintain the integrity of data in your Assets Register module, to close the current month and open up a new month for processing your assets transactions and to delete assets information that is no longer required in the system.

This is achieved through the following functions:

- Balance

- Month end

- Year end

- Purge

- Labor weekly update

- Reset lowest unprocessed entry no

| Field | Description |

|---|---|

| Start Processing | Select this to begin processing the function selected. |

| Select this to print the information currently displayed in the Report pane. | |

| Save Form Values | This option is only enabled in Design mode (Automation Design). Your selections are saved and applied when the

program is run in automated mode. Form values and defaults are applied at operator level. They are not saved at role or group level. |

| Field | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Current year | This indicates the current assets year. | ||||||||||||||||||||||||

| Current period | This indicates the current assets period. | ||||||||||||||||||||||||

| Last year-end date | This indicates when last a year end was processed for the Assets Register module. | ||||||||||||||||||||||||

| Period-end date | This indicates the period end date for the current month as defined in the Assets Setup program. | ||||||||||||||||||||||||

| Last date balance was run |

This indicates the date on which the Balance function was last run. |

||||||||||||||||||||||||

| Processing options | |||||||||||||||||||||||||

| Function |

Indicate the processing function to perform. See also: Notes and warnings.

|

||||||||||||||||||||||||

| Reset lowest unprocessed journal |

Enable this to locate the earliest Assets journal that has not been posted. The Asset GL Integration program creates and/or posts General Ledger journals from Assets transaction journals according to your General Ledger Integration settings. The Asset GL Integration program uses the lowest unprocessed Assets journal number as a starting point to create/post these General Ledger journals. Selecting this option therefore ensures that no Assets journal is skipped when the General Ledger journals are created/posted for the Assets module. This function can also be performed using the GL Integration Utility program. |

||||||||||||||||||||||||

| Include balance function |

This lets you choose whether you want to run the Balance function when you run a Month end or Year end function (i.e. it does not apply when processing the Balance or Purge only functions). This option is ticked automatically if the Last date balance was run field does not reflect today's date. This could have implications when using the Automation Design program where, for example, you don't want to run a Balance function before running another function. See also: Notes and warnings. |

||||||||||||||||||||||||

| After processing completed |

These options are displayed within programs that can be automated. They enable you to indicate the action you want to perform once processing is complete (see Automation Design). |

||||||||||||||||||||||||

| Warning messages | |||||||||||||||||||||||||

| Suppress warning messages |

When enabled, warning messages are ignored and do not cause the program to stop. When not enabled, processing stops and the warning messages are displayed in the Task Messages pane. |

||||||||||||||||||||||||

This pane displays the results of the processing function you selected once processing is complete (unless you selected the option to close the application from the After processing completed section).

The Balance function is used to balance transactional records to header records and ultimately to the control record. The balance function does not test data integrity.

When processing a Balance function, the program first reads the Assets control totals files for each of its depreciation books. These are Book value, Tax value and Alternate values files.

The program then reads through the Asset master file and stores the balances for the assets for value, depreciation and quantity before the balance function commences. Thereafter, the program balances each of its depreciation books in the following sequence:

- the history for the current year is cleared, including all the history buckets

- the current year's entries are used to rebuild the history.

- the current year's history is accumulated, including all the history buckets, and the depreciation master totals are recalculated.

- when balancing of depreciation books is complete, the new balances of value, depreciation and quantity are compared with the stored balances and a report is generated on any differences found.

No entries are retained when the tax depreciation basis for an asset is Life of asset (Assets Register Setup). The depreciation calculation always calculates the depreciation for the life of the asset, so the balance function does not apply.

No balance function is performed on assets that have been fully disposed.

When balancing of the depreciation books is complete, the program compares the new balances for value, depreciation and quantity with the stored balances and reports on any differences found.

If you converted your assets from SYSPRO 6.0 to SYSPRO 6.1, the asset entries files will not contain enough information to perform a full Balance function in the Asset Period End program as the current year's asset entries are used to reconstruct the asset history file. Only after the first year end function is performed in SYSPRO 6.1 will a full Balance function be performed when using the Asset Period End program. Note that this does not apply when you create a new SYSPRO company in SYSPRO 6.1.

You use the Month end function to perform a month end for the Assets Register module.

If you also want to delete records no longer required in the assets system then you select the Month end and purge function to perform the month end and purge at the same time. Alternatively, you can run the Purge function as a separate process to speed up the month end processing.

The Month end function should be performed at the end of each month after you have processed all transactions for the month, created all ledger journals for these transactions (see Asset GL Integration), and run the Asset Depreciation Calculation program.

Once you have successfully run a Month end, the current period for the Assets Register is closed and the following period is opened for processing (Assets Setup).

You will be unable to run a month end for the final period of your assets year as you then need to perform the Year end function.

You use the Year end function to perform the final month end of the year and to start a new financial year in the Assets Register module.

If you also want to delete records no longer required in the system then you can run the Year end and purge function to perform the year end and purge at the same time. Alternatively, you can run the Purge function as a separate process to speed up the month end processing.

This option is only available in the final period of your Assets Register year (i.e. period 12 or period 13 depending on the number of Accounting periods defined against your company (Company Setup).

Once you have successfully run a year end, the current period for the Assets Register is closed, and the first period of the following year is opened for processing (Assets Setup).

In addition, the following procedures are performed by the Year end function:

-

The tax allowance fields held against each asset are updated.

The value in the Tax allowance field this year is added to the value in the Accumulated tax allowance brought forward field.

The value in the Tax allowance this field is moved to the Tax allowance last year field.

The Tax allowance this year field is zeroed.

-

The history fields against each asset are updated for both the Expensed and After reval depreciation fields.

The values held in the periods for This year are moved to the periods in the Previous year column.

The values held in the periods for This year are zeroed.

The total depreciation amount for the current year is added to the Accumulated depreciation brought forward prior year field.

-

The depreciation allowance fields held against each asset are updated.

The value in the Depreciation this year field is added to the value in the Accumulated depreciation brought forward field.

The value in the Depreciation this year field is moved to the Depreciation last year field.

The Depreciation this year field is zeroed.

-

The ledger entries group number is reset to 1.

You use the Purge function to delete asset history information that is no longer required.

![[Note]](images/note.png)

|

|

|

The cut-off date according to which information is deleted in the Assets Register module is determined by the length of time information must be retained (Assets Setup). The minimum number of months you can retain information in the Assets Register module is 24 months (i.e. you cannot delete any information for the Assets register module for 2 years). If you indicated that records are to be retained indefinitely (i.e. set to 99) then they are ignored by the Purge function. |

|

Capex items/lines are deleted by the Purge function if:

- they are in a status of Closed

-

the Start period of the capex item is earlier than the cut-off period. The cut-off period is calculated by subtracting the number of periods to retain Capex items (Assets Setup) from the current assets period.

A capex item can only be purged if all its associated capex lines are in a status of Closed.

-

the Start period of the capex line is earlier than the cut-off period. The cut-off period is calculated by subtracting the number of periods to retain Capex lines (Assets Setup) from the current assets period.

A Capex line that qualifies for purging by virtue of its Start period will not, however, be purged if:

- the status of the capex item to which it belongs is not set to Closed

- there is an asset in suspense (Assets in Suspense) for the capex line

- the capex line is linked to a Purchase Order Requisition, Purchase Order or Job that has not been purged. The reason is that these Purchase Order Requisitions, Purchase Orders or Jobs could be reactivated elsewhere in the system (for example if purchased goods are returned).

-

It is strongly recommended that you take a backup of your data before processing a Month end, a Year end or a Purge.

-

You must run the Asset Depreciation Calculation and create all ledger journals for the Assets module (see Asset GL Integration) before you can process a Month end only, Month end and purge, Year end only or Year end and purge.

-

To prevent data imbalances occurring, it is advisable to either process a Balance function immediately before processing any Month end or Year end function, or to enable the Include balance function option when processing any Month end or Year end function.

The following warning message is displayed if the current date is not the same as the date displayed in the Last date balance was run field: Imbalances may occur if you continue as the 'Balance' function has not been run today. Do you wish to continue?

-

Resource locking applies to this program, which prevents multiple operators running this program concurrently.

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the eSignature Setup program.

| eSignature Transaction | Description |

|---|---|

| Asset Month end performed |

Controls access to the Month-end processing options of the Asset Period End program. |

| Asset Year end performed |

Controls access to the Year-end processing options in the Asset Period End program. |

| Asset Purge performed |

Controls access to the Purge processing options in the Asset Period End program. |

| Asset Labor weekly update performed |

Controls access to the Labor weekly update processing option in the Asset Period End program. |

| Asset Reset lowest unprocessed journal |

Controls access to the Reset lowest unprocessed journal processing option in the Asset Period End program. |

| Asset Balance function |

Controls access to the Balance processing option in the Asset Period End program. |

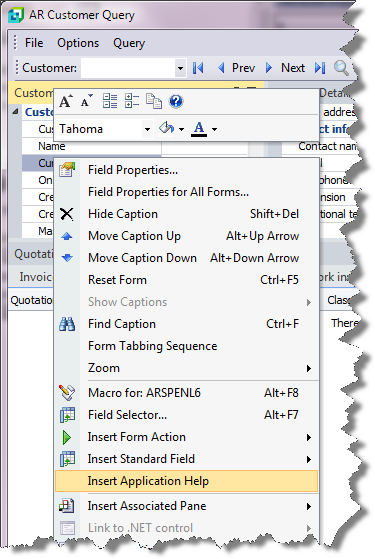

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.