You use this program to assign default values for selected fields when you use the Assets in Suspense program to transfer capex requisition lines from suspense into the assets register. Although these default values are automatically entered when using the Assets in Suspense program, they can be changed while transferring an asset from suspense.

Asset templates (default values) can be defined at Branch, Cost center and Group level.

| Field | Description |

|---|---|

| Delete Entries | Select this to delete the templates for the asset branch, cost center and group combination you selected. |

| Apply Changes | Select this to update the selected asset branch, cost center and group with the information you entered. |

| Field | Description | ||||

|---|---|---|---|---|---|

| Template level | Select this to set the integration level you require

for templates. Asset templates can be defined by:

|

||||

| Branch | This option is selected by default and cannot be changed. | ||||

| Cost center | Select this to define templates by cost center within asset branch. | ||||

| Group | Select this to define templates by asset group within asset branch. | ||||

| Template selection | |||||

| Branch selection | Indicate the asset branch(es) for which to maintain template entries. | ||||

| Cost center selection | Indicate the asset cost center(s) for which to maintain

template entries. This option is only enabled if you selected to define templates by cost center within branch. |

||||

| Group selection | Indicate the asset group(s) for which to maintain

template entries. This option is only enabled if you selected to define templates by group within branch. |

||||

| Template values | Specify the defaults to display in the corresponding fields in the Assets and Assets in Suspense programs. | ||||

| Asset location | This indicates the location of the asset, which is used

as a subtotaling criterion when printing reports. Asset locations are maintained using the Asset Locations program. |

||||

| Asset type | This indicates the asset type which is used to classify

the asset. Asset types are maintained using the Asset Types program. |

||||

| Asset cost center | This indicates the cost center to which the asset is

allocated and must be defined against each asset. Cost centers are maintained using the Asset Cost Centers program. |

||||

| Asset group | This indicates the group code to be assigned to the

asset. A valid group code must be defined against each

asset. Asset groups are maintained using the Asset Groups program. |

||||

| Depreciate by asset | Select this to define the General Ledger code that must be used for the expense side of depreciation transactions for this asset. | ||||

| Ledger code | This indicates the ledger account to which the expense side of depreciation entries must be distributed for General Ledger integration purposes. | ||||

| Asset status | This indicates the status code for the

asset. Asset status codes are used for information purposes only and do not have to be defined against an asset. Asset status codes are maintained using the Asset Statuses program. |

||||

| Resp user | This indicates the person responsible for the asset. | ||||

| Asset owner | This indicates the person responsible for the

safe-keeping and/or the maintenance of an asset, or the person

responsible for authorizing any costs spent on the

asset. Owners are maintained using the Asset Owners program. |

||||

| Cycle | This indicates the number of times per annum that the asset must be counted. | ||||

| Alternate valuation | |||||

| Alt valuation 1 - 10 | This enables you to indicate the alternate valuation

depreciation books to maintain against each asset. The wording displayed for these books defaults to Alt valuation 1, Alt valuation 2,etc., but is replaced by whatever wording is assigned to these user-defined fields (Assets Setup). |

||||

| Book value information | This information applies only to the Book value depreciation book. | ||||

| Depreciation code | This indicates the book value depreciation code for the

asset. Depreciation for the asset is calculated based on the

depreciation type defined against the depreciation

code. Depreciation codes are maintained using the Asset Depreciation Codes program. |

||||

| Suspend depreciation | Select this if Book value depreciation must not be calculated for the asset. | ||||

| Residual value | This indicates the residual value (if any) for book value purposes. | ||||

| Throughput EUL | This indicates the estimated throughput value for the entire life of the asset. This is used for calculating the Statistical Estimated Usable Life depreciation amount. | ||||

| Statistical GL code | This indicates the General Ledger code to which you will process the statistical throughput value for the current period. This ledger code must have an Account type of Statistical (General Ledger Codes). | ||||

| No of periods EUL | This indicates the default number of periods you entered against the depreciation code, but can be changed. You use this field to enter the fixed number of periods over which the asset must be depreciated. | ||||

| No of years EUL | You use this field to enter the fixed number of years over which the asset must be depreciated. This defaults to the default number of periods defined against the depreciation code, but can be changed. This only applies of the Depreciation code is defined as Sum of year digits or Declining balance with or without switch. |

||||

| Remaining periods EUL | This is calculated by the system. | ||||

| Total periods depr to date | This is calculated by the system. | ||||

| Varying depreciation anniversary | This option is only enabled if you entered a Depreciation code with varying depreciation. | ||||

| Tax information | This information applies only to the Tax value depreciation book. | ||||

| Depreciation code | This indicates the tax depreciation code for the asset.

Depreciation for the asset is calculated based on the

depreciation type defined against the depreciation

code. Depreciation codes are maintained using the Asset Depreciation Codes program. |

||||

| Suspend depreciation | Select this if Tax depreciation must not be calculated for the asset. | ||||

| Residual value | This indicates the residual value (if any) for tax valuation purposes. | ||||

| Throughput EUL | This indicates the estimated throughput value for the entire life of the asset. This is used for calculating the Statistical Estimated Usable Life depreciation amount. | ||||

| Statistical GL code | This indicates the General Ledger code to which you will process the statistical throughput value for the current period. This ledger code must have an Account type of Statistical (General Ledger Codes). | ||||

| No of periods EUL | This indicates the default number of periods you entered against the depreciation code, but can be changed. You use this field to enter the fixed number of periods over which the asset must be depreciated. | ||||

| No of years EUL | You use this field to enter the fixed number of years over which the asset must be depreciated. This defaults to the default number of periods defined against the depreciation code, but can be changed. This only applies of the Depreciation code is defined as Sum of year digits or Declining balance with or without switch. |

||||

| Remaining periods EUL | This is calculated by the system. | ||||

| Total periods depr to date | This is calculated by the system. | ||||

| Varying depreciation anniversary | This option is only enabled if you entered a Depreciation code with varying depreciation. | ||||

| Capital gains tax cost |

This indicates the value of the asset for Capital Gains Tax purposes. This is a notational field only. |

||||

This listview displays details of either the currently defined template entries or the missing entries, depending on your selection a the Template entries to view option.

| Field | Description |

|---|---|

| Template entries to view | Select the type of entries to display in the listview. |

| Existing entries | Select this to display the existing entries defined against the Branch and cost center/group in the listview. |

| Missing entries | Select this to view the missing template entries. |

You use these panes to enter the default details of the Alternate valuations you selected to define for the asset (Asset Template Details pane). Only the fields for the selected Alternate valuation flags are enabled.

The details entered for each alternate valuation book are used for information purposes only. This information does not affect the General Ledger.

The wording displayed for these tabs defaults to Alt valuation 1, Alt valuation 2,etc., but is replaced by whatever wording is assigned to these user-defined fields (Assets Setup).

The same fields are available against each Alternate valuation as against the Book value information section in the Asset Template Details pane.

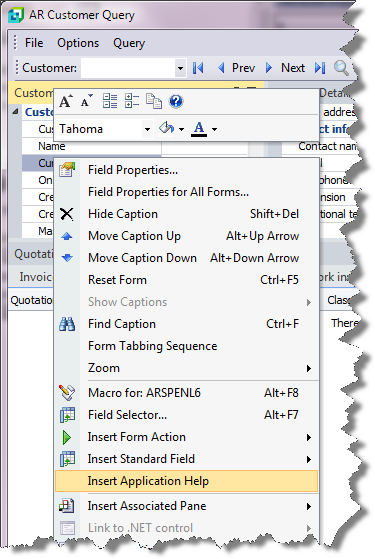

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.

![[Note]](images/note.png)