You use this program to define the default settlement discount you want to extend to a customer whose payments are made within a prescribed period of time and to define when an invoice becomes due for payment.

The AR invoice term code is used to calculate the terms discount and invoice due date when:

- a transaction is posted using the AR Invoice Posting program

- sales orders are invoiced using the Sales Order Entry program

- permanent entries are posted using the AR Post Permanent Entries program

- quotations are printed using the Quotation Batch Printing program

Although each customer is assigned an AR Invoice term code using the Customers program, this can usually be overridden with a different terms code at the time of processing transactions.

| Field | Description | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Terms | This indicates the invoice terms code you entered on

the toolbar. This terms code can be assigned to a customer using the Customers program, to establish the terms applicable to that customer. The terms discount is calculated according to the AR invoice terms code defined against the transaction, together with the options selected at the Calculation of terms discount setup option (Accounts Receivable Setup). If none of the options against the Calculation of terms discount are selected, then the terms discount is calculated only on the merchandise portion of the transaction. For example: A taxable Billing is entered using the Sales Order Entry program, with the following lines:

The discount percentage defined against the invoice term applicable to this Billing is 2.50%. The tax portion amounts to 14.50 against the invoice. The following indicates how the terms discount for this transaction is calculated depending on your selections at the Calculation of terms discount setup option (Accounts Receivable Setup).

Discount is only calculated for credit and debit notes if the Credit and/or debit notes setup option is enabled (Accounts Receivable Setup) |

||||||||||

| Invoice terms information | |||||||||||

| Description | Enter a description for the invoice terms code. To make this description more meaningful, you could include both the number of days and the percentage. For example: 30 Days - net or 30 Days -2.5%. |

||||||||||

| Discount percent |

This indicates the discount percentage which must be used to calculate the actual discount amount. The discount amount is the amount given to customers if their payment is received within the discount options specified below. This discount is only applied when receiving payment from the customer. |

||||||||||

| Discount | |||||||||||

| Discount option | Specify the conditions under which the discount amount

is given to customers.

|

||||||||||

| Discount days | Indicate the number of days (from the invoice date)

within which payment must be made by a customer in order to

qualify for the settlement discount applicable to this terms

code. If you are using the Number of days fixed option, then the Discount days should match the length of the periods of your user defined discount ageing buckets. |

||||||||||

| Day of month | Indicate the specific fixed day of the month within

which payment must be made by a customer in order to qualify

for the settlement discount applicable to this terms

code. This field is disabled when the Invoice ageing method is By invoice date (Accounts Receivable Setup). |

||||||||||

| Number of months |

Indicate the cut-off number of months for which the discount is applicable. This field is disabled when the Invoice ageing method is set to By invoice date (Accounts Receivable Setup). The Day of month is the fixed day of the month and the Number of months indicates how many months to add. The program overwrites the invoice date with the Day of month. The Number of months is then added to the invoice date to give the due date. If the due date is less than the invoice date, then an extra month is added to the month. For example: Invoice date is 28/10/yy Day of month = 10 Number of months = 0 Replacing the invoice date with the Day of month makes the invoice date 10/10/yy Adding the Number of months to the invoice month (10 + 0 = 10) giving 10/10/yy The calculated due date is less than the invoice date so 1 is added to the month. The new calculated due date is now 10 + 1 = 11 making the due date 10/11/yy. The Day of month with Number of months option is therefore only totally accurate when the Day of month is the last day of the month. |

||||||||||

| Discount date | Indicate the cut-off date by which payment must be made by a customer in order to qualify for the settlement discount applicable to this terms code. | ||||||||||

| Defined fixed day calendar - Define |

Select this to use the AR Terms Due Dates program to specify the end dates of the ageing buckets if you selected the Discount option - Number of days fixed. The headings for these ageing buckets must be defined using the AR Terms Ageing Headings program, because the standard headings (Current, 30 days, 60 days, 90 days and Over 120 days) only apply for 30 day ageing buckets. |

||||||||||

| Ageing heading code | This only applies to the Number of days fixed options for Discount and Due. When you define your own ageing buckets, the standard headings of Current, 30 days, 60 days, 90 days and Over 120 days can no longer be assumed, so you need to define your own ageing bucket headings against a heading code in the AR Terms Ageing Headings program. You indicate the heading code to use in this field. | ||||||||||

| Due | |||||||||||

| Invoice due option |

The invoice options enable you to define the time periods within which an invoice is due for payment. Once the periods defined here are exceeded, the invoice is classified as overdue for payment. The Invoice options are used:

|

||||||||||

| Invoice days | Indicate the number of days (from the invoice date)

within which payments must be made by a customer before an

invoice is classified as overdue. If you are using the Number of days fixed option, then the Invoice days should match the length of the periods of your user defined invoice ageing buckets. |

||||||||||

| Invoice day of month | Indicate the specific day of the month after which the invoice becomes overdue. | ||||||||||

| Invoice number of months |

Indicate the cut-off number of months before an invoice is classified as overdue. In the example below, the day of the month is 25 and the number of months is 1. A/R Invoice Terms - Invoice due dates defined using Fixed Day option

|

||||||||||

| Invoice due date | Indicate the date after which the invoice is classified as overdue. | ||||||||||

| Invoice defined fixed day calendar - Define |

Select this to use the AR Terms Due Dates program to specify the end dates of your ageing buckets for invoice ageing if you selected the Invoice due option - Number of days fixed. The headings for these ageing buckets must be defined using the AR Terms Ageing Headings program, because the standard headings (Current, 30 days, 60 days, 90 days and Over 120 days) only apply for 30 day ageing buckets. |

-

You are able to delete a terms code even if it is assigned to existing customers and invoices.

Before you delete the terms code you will receive a warning message informing you of the number of customers and invoices linked to the terms code, as well as the invoice balance.

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the eSignature Setup program.

| eSignature Transaction | Description |

|---|---|

| AR Invoice terms added |

Controls access to the New Invoice Term function in the AR Invoice Terms program. |

| AR Invoice terms changed |

Controls access to the maintenance of invoice terms in the AR Invoice Terms program. |

| AR Invoice terms deleted |

Controls access to the Delete function in the AR Invoice Terms program. |

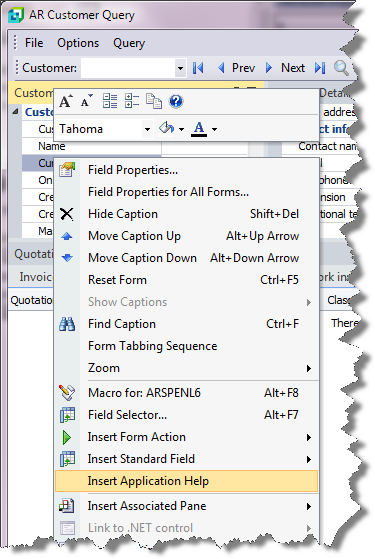

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.