Digital Tax Tool

Exploring

This program lets you generate tax return documents.

A summary view of total tax values and number of entries for each sub-module is provided and you can select which tax tables you want to submit. The data can also be returned in multiple formats.

Things you can do in this program include:

-

Select data to include in the tax return documents.

-

View tax return balances.

-

View details of consolidated tax amounts.

-

Create a re-usable template with your preferred input and output options.

This program is accessed from the Program List of the SYSPRO menu:

- Program List > General Ledger > Tax

This is a single large remittance to a primary supplier instead of multiple payments to many individual suppliers.

This type of payment is processed using a group supplier, which comprises a primary supplier (who receives the payment) and multiple associated downstream secondary suppliers. A group supplier is created using the AP Group Suppliers program (Program List > Accounts Payable > Setup).

A group payment is created using the AP Group Payments program (Program List > Accounts Payable > Payment Processing).

An intercompany group payment affects two or more SYSPRO companies and involves the Accounts Payable and Accounts Receivable modules.

The transaction is processed in the primary company and involves payments to secondary companies for Accounts Payable or payments from secondary companies for Accounts Receivable.

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

This is the customer against which a single payment is processed (i.e. the recipient of the aggregate payment). This single remittance is known as a group payment.

When processing intercompany group payments, this is the customer in the primary SYSPRO company against which payments from multiple secondary customers either in the same or secondary SYSPRO company is processed.

Primary customers are created and maintained using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

This is the supplier against which the single remittance for payments to multiple secondary suppliers is processed (i.e. recipient of the aggregate payment). This single remittance is known as a group payment.

When processing group/intercompany group payments, this is the supplier in the primary SYSPRO company against which payments to multiple secondary suppliers either in the same or secondary SYSPRO company are processed.

Primary suppliers are created and maintained using the AP Group Suppliers program (Program List > Accounts Payable > Setup).

This is the company in which you process the group/intercompany group payment.

This is also the company where the primary customer (for Accounts Receivable) or primary supplier (for Accounts Payable) is located.

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

This is a customer to whom a portion of the payment that was received by the primary customer, is allocated. All secondary customers and the primary customer they are linked to form a customer group. The payment made to the primary customer is referred to as a Accounts Receivable group payment.

A secondary customer can be in the primary or secondary SYSPRO company.

Customers for group payments are defined using the AR Customer Group Maintenance program (Program List > Accounts Receivable > Setup).

This supplier is paid together with its associated primary supplier via a single remittance (i.e. group payment).

Suppliers for group payments are defined using the AP Group Suppliers program (Program List > Accounts Payable > Setup).

Secondary SYSPRO companies are updated by the transaction that is initiated and processed in the primary SYSPRO company.

All secondary SYSPRO companies must be located on the same SYSPRO server as the primary SYSPRO company.

Starting

You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

You can restrict operator access to programs by assigning them to roles and applying access control against the role (configured using the Role Management program).

The following configuration options in SYSPRO may affect processing within this program or feature, including whether certain fields and options are accessible.

The Setup Options program lets you configure how SYSPRO behaves across all modules. These settings can affect processing within this program.

Setup Options > Company > General

- VAT registration number

-

User defined tax reference

If different VAT registration numbers are required for multiple branches, capture the VAT details at branch level within the Tax numbers section of the AR Branch Maintenance program.

Setup Options > Tax > Accounts Payable

- Determine tax based on invoice paid

- Foreign currency suppliers tax entry

- Request tax amount

-

For electronic tax return submissions, an XSL stylesheet must be created that adheres to the format required by the relevant revenue authorities.

Solving

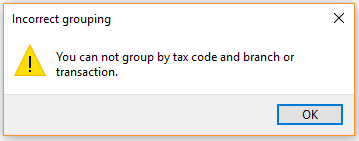

This message is displayed when you select to group the tax return data in a way that can't be processed.

Although output options include Group by tax code, Group by branch and Group by transaction, you can only select a combination of Group by branch and Group by transaction (i.e. Group by tax code cannot be selected together with either of the other options.

Reverse charge transactions can be viewed from the following:

- Tax Return Summary (grid view)

- SRS report

- CSV files

- XML files

To view the reverse charge transaction data on screen:

-

Select Return to grid against the Select option field.

-

The Tax Return Summary grid view is displayed, where you can select the View Details hyperlink against the transaction.

-

Right-click on the column heading and drag the following columns onto the listview (using the Field Chooser function):

- Reverse charge flag

- Reverse charge code

- Reverse charge tax rate

- Reverse charge tax value

You can capture the VAT registration details at company level using the VAT registration number and User defined tax reference setup options (Setup Options > Company > General).

Alternatively, if you have different VAT registration numbers required for multiple branches, you can capture the VAT details at branch level within the Tax numbers section of the AR Branch Maintenance program.

Using

-

When generating tax returns for large volumes of data, we recommend you do this per sub-module.

The following data appears on the report by default:

- Company Information:

- Company ID

- Company name

- Company registration number

- Company tax number

- Building

- Street

- City

- Locality

- State

- Country

- Postal code

- Financial year

- Start date

- End date

- Creation date

- Purchase Information:

- Supplier name

- Supplier

- Invoice date

- Invoice

- Tax rate

- Tax code

- Tax reg number

- Invoice year

- Invoice month

- Edited invoice value

- Edited tax value

- Expense GL code

- Journal

- Accounts Payable Invoices:

- Supplier

- Supplier name

- Invoice date

- Invoice

- Tax code

- Edited tax amount

- Edited distribution value

- Expense GL code

- Transaction year

- Transaction month

- Journal

- Accounts Payable Settlements:

- Supplier

- Supplier name

- Invoice date

- Invoice

- Edited invoice discount

- Edited tax value

- Edited tax percentage

- Discount GL code

- Year

- Period

- Check register

- Tax code

- Sales Analysis Information:

- Name

- Customer

- Invoice date

- Invoice

- Edited net sales value

- Edited tax value

- Tax code

- Tax rate

- Company tax number

- Transaction year

- Transaction month

- Transaction GL code

- Register

- Accounts Receivable Settlement Information:

- Customer

- Name

- Pay invoice date

- Invoice

- Edited pay disc allowed

- Edited pay tax amt disc

- Edited tax percentage

- Tax code

- Transaction year

- Transaction month

- Journal

- Discount GL code

- Accounts Receivable Adjustment Information:

- Customer

- Name

- Adj invoice date

- Adj invoice

- Edited adjustment value

- Edited tax portion adj

- Edited tax percentage

- Tax code

- Adjustment GL code

- Transaction year

- Transaction month

- Journal

- Cash Book Information:

- Bank

- Reference

- Edited dist value

- Tax code

- Edited tax percentage

- Edited tax value

- Transaction date

- CB transaction year

- CB transaction month

- Journal

- Audit File Summary:

- Edited total purchase amount

- Edited Total purchase tax amount

- Edited total sales amount

- Edited total sales tax amount

- Edited total AR settle amount

- Edited Total AR Settle tax amount

- Edited total AR adjust amount

- Edited total AR adjust tax amount

- Edited AP invoice amount

- Edited total AP invoice tax amount

- Edited AP settle amount

- Edited total AP settle tax amount

- Edited total Cash Book amount

- Edited total Cash Book tax amount

The report can be customized to include the following data:

- Company Information:

- GPS lat

- GPS long

- Local currency

- Local currency description

- Software version

- Version

- Purchase Information:

- Tariff code

- Purchase order line

- Stock description

- Edited currency GRN value

- Currency

- Edited foreign price

- Edited qty received

- Edited currency value

- Edited currency tax value

- Tax GL code

- Accounts Payable Invoices:

- Tax GL code

- EntryNumber

- Accounts Payable Settlements:

- Currency

- Tax GL code

- Distribution entry

- Sales Analysis Information:

- Edited detail line

- Stock description

- Sold to address

- Currency

- Edited qty invoiced

- Edited price

- Edited currency value

- Edited currency tax value

- Tax account

- Summary line

- Accounts Receivable Settlement Information:

- Edited pay gross payment

- Currency

- Entry number

- Sub entry

- Tax GL code

- Accounts Receivable Adjustment Information:

- Currency

- Tax GL code

- Entry number

- Cash Book Information:

- Description

- Narration

- Distribution ledger code

- Tax ledger code

- Entry type

- Translated entry type

- Entry number

- Audit File Summary:

- Edited total ledger credit

- Edited total ledger debit

- Edited total ledger balance

Referencing

| Field | Description |

|---|---|

| Start Processing |

This begins processing according to your selections. |

| Save Values |

This lets you save the template or form values as well as changes you made to an existing template. |

| Field | Description |

|---|---|

| Option |

This lets you run the Digital Tax Tool program. This lets you design a template with your preferred input and output options. Designing and using the template minimizes the time spent selecting options, as you can use the template instead of individually selecting what to include in the report. |

| Template name |

Your action here depends on your selection at the Options field:

|

| Template description |

This indicates the description of the template. |

|

Input options |

|

|

Transactions |

This lets you select which transactions you want to include in the tax return data. Select a financial year and period which you want to include in the tax return. The Year and Period fields are then made available. This lets you select a specific date range according to which you want to include transactions in the tax return. The browse on the Start date and End date fields are then made available. |

|

Year |

Select a financial year for which you want to generate the tax return. |

|

Period |

Select a financial period for which you want to generate the tax return. |

|

Start date |

Select a start date in the date range for which you want to generate the tax return. |

|

End date |

Select a end date in the date range for which you want to generate the tax return. |

|

Include AP invoices with GRNs |

This lets you include invoices from the Accounts Payable module with good received notes (GRNs). |

| Include AP invoices with no GRNs |

This lets you include invoices from the Accounts Payable module excluding good received notes (GRNs). |

| Include AP settlement |

This lets you include settlement discounts from the Accounts Payable module. You can apply settlement discounts against individual invoices in the Tax on settlement discount section of the AP Group Payment Manual Allocation program. The following setup options must be enabled to apply a settlement discount to these individual invoices:

The Discount amount has to be indicated under Payment Information. The following functions also need to be used against the group payment in the AP Group Payments program:

Group payments for suppliers are created, executed and processed using the AP Group Payments program. |

| Include AR sales |

This lets you include sales transactions from the Accounts Receivable module. |

| Include AR settlement |

This lets you include settlement discounts from the Accounts Receivable module. |

| Include AR adjustments |

This lets you include adjustment transactions from the Accounts Receivable module. |

| Include CB transactions |

This lets you include transactions from the Cash Book module. |

| Include GL transactions |

This lets you include transactions from the General Ledger module. |

| Print/reprint |

This lets you choose which transactions you want to print or include in the ouptut. You can have the following options:

|

| Version |

This lets you specify a 3-digit version number for the tax return and is only available when generating an XML file or using a style sheet. The version number is not saved or verified by the system and is purely to help you identify the version of the tax return data once it is generated. |

| Stylesheet |

This lets you select a style sheet that will format the tax report data according to the required specifications. For electronic tax return submissions, an XSL stylesheet must be created that adheres to the format required by the relevant revenue authorities. |

| Output options | |

| Select option |

This lets you select how you want to view the report results. This displays the tax return data in the Tax Return Summary grid. This generates the Consolidated Tax Return report. This generates a CSV file containing the report data. The Filename and Path fields then become available for you to specify where the CSV file must be saved.

This generates an XML file containing the report data. If you have selected a style sheet, the XML document will be generated according to the format stipulated in the style sheet. The Filename and Path fields then become available for you to specify where the XML file must be saved. |

| Filename |

This lets you specify a file name when generating the tax return report in CSV or XML file format. |

| Path |

This lets you select the folder to which the CSV or XML file will be saved. Once you have selected the folder, the full path is displayed. |

| Group by tax code |

This groups the tax return data by tax code. |

| Group by branch |

This groups the tax return data by branch. |

| Group by transaction |

This groups the tax return data by transaction type. |

| After processing completed

|

These options are displayed within programs that can be automated. They let you indicate the action you want to perform once processing is complete. |

| Print the details |

This generates a report of the contents of the Details entry grid. |

| Email the details |

This generates an email of the contents of the Details entry grid. |

| Email recipients |

This indicates the email addresses of recipients to whom you want to email the information displayed in the output pane. |

|

Close the application |

This lets you close the program once processing is complete. |

| Field | Description |

|---|---|

|

Change Criteria |

Select this to change the previously selected review criteria. This function is only enabled after you select the Start Review function. |

| Refresh Details |

This refreshes the pane information. |

| Description |

This indicates the category associated with the various information generated after selecting Start Processing. The Value, Action and Entries columns are displayed according to the following categories:

|

| Value |

This indicates the total tax value of the entry. |

| Action |

Select the View details hyperlink to drill-down to transaction level information that opens in a new window. You can add columns to the transaction grid by using the Field Selector option from the context-sensitive menu (displayed by right-clicking any column in the listview). Select and drag the required fields onto the pane. |

| Entries |

This indicates the count of entries that make up the total tax value. |

This window is displayed when you select the View Details hyperlink associated with the AP Settlement balance in the Tax Return Summary window.

Some of the columns that are displayed:

-

Group payment

-

Payment run

-

Intercompany

-

Primary company

-

Primary supplier

-

Xref check register

If you are logged in at the primary SYSPRO company, then this indicates the cross-reference check register used in the secondary SYSPRO company.

If you are logged in at the secondary SYSPRO company, then this indicates the actual check register generated in the primary SYSPRO company.

This window is displayed when you select the View Details hyperlink associated with the AR Sales balance in the Tax Return Summary window.

Some of the columns that are displayed:

-

Customer

-

Invoice

-

Invoice date

-

Warehouse

-

Description of warehouse

-

Nationality of warehouse

This indicates the nationality code of the source warehouse.

-

Description of warehouse nationality

-

Tariff code

-

Sales order

-

Country of origin

-

Nationality description

Copyright © 2025 SYSPRO PTY Ltd.