You use this program to output order documents for transmission to a customer who has been designated as an EDI trading partner.

These order documents comprise invoices, credit notes, and debit notes generated for EDI customers within the Sales Order Entry and Detail Invoice Posting programs.

The file that is generated can be output in either EDI (Electronic Data Interchange) or XML (Extensible Markup Language) format.

- Toolbar and menu

- Invoice, Cr and Dr Note Export Criteria

- Invoice, Cr and Dr Notes Exported

- File Structure

- Notes and warnings

| Field | Description |

|---|---|

| Start Export |

Begins the export process. The customer's Company tax registration number (Customers) is automatically exported for Invoices, Credit notes and Debit notes exported in XML or EDI format. |

| Change Criteria | Resets the Invoice, Cr and Dr Note Export Criteria pane to its defaults enabling you to change the criteria. |

| Prints the information displayed in the Invoice, Cr and Dr Notes Exported listview. |

| Field | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Export details | |||||||||||||

| Document format |

|

||||||||||||

| Directory | Indicate the folder in which the export file must be saved. The full path name must be specified. | ||||||||||||

| Next generated file name |

Indicates the name of the file that will be created. For an EDI file, the naming convention is AINnnnn.EDI, where:

For an XML file, the naming convention is AINnnnnnnnn.XML, where:

|

||||||||||||

| Customers | Indicate the range of customer codes for which to include documents for export. | ||||||||||||

| Export options | |||||||||||||

| Document selection |

|

||||||||||||

| Include sub-accounts | Include documents for any sub-accounts attached to an exported master customer account in the export. | ||||||||||||

| Separate file per customer | Generate a separate file for each customer selected for

processing. This only applies to EDI Document formats. |

||||||||||||

| Customer/EDI partner selection |

|

||||||||||||

| Customer | Indicate the EDI trading partner customer for whom to export documents. | ||||||||||||

| EDI partner | Indicate the EDI partner for whom to export documents. | ||||||||||||

This displays details of the documents exported in a treeview and can be printed using the Print function.

The following sections describe the structure of the export file when exported in EDI format:

| Field | Start position | Field length and description |

|---|---|---|

| Record type | 1 | 2 10 - Document header |

| Message type | 3 | 6 INVCRN |

| Document type | 9 | 1 Can be C,D or I to denote Credit note, Debit note or Invoice. |

| Document number | 10 | 20 |

| Document date | 30 | 8 |

| Customer number | 38 | 15 |

| Customer name | 53 | 50 |

| Company name | 103 | 50 |

| Company address line 1 | 153 | 40 |

| Company address line 2 | 193 | 40 |

| Company address line 3 | 233 | 40 |

| VAT registration number | 273 | 15 |

| Salesperson name | 288 | 50 |

| Last delivery note number | 338 | 20 |

| Sales order number | 358 | 20 |

| Sales order date | 378 | 8 |

| Customer purchase order | 386 | 30 |

| + or - sign of next field | 416 | 1 |

| Document total excl tax | 417 | 14 |

| + or - sign of next field | 431 | 1 |

| Total tax | 432 | 14 |

| + or - sign of next field | 446 | 1 |

| Gross document total | 447 | 14 |

| + or - sign of next field | 461 | 1 |

| Total invoice discount | 462 | 14 |

| EDI sender code | 476 | 40 |

| + or - sign of next field | 516 | 1 |

| Terms discount amount | 517 | 14 |

| + or - sign of next field | 531 | 1 |

| Document total excl tax Foreign currency | 532 | 14 |

| + or - sign of next field | 546 | 1 |

| Total tax Foreign currency | 547 | 14 |

| + or - sign of next field | 561 | 1 |

| Gross document total Foreign currency | 562 | 14 |

| + or - sign of next field | 576 | 1 |

| Total invoice discount Foreign currency | 577 | 14 |

| + or - sign of next field | 591 | 1 |

| Terms discount amount Foreign currency | 592 | 14 |

| Ship date | 606 | 8 |

| Company reg / GST no | 614 | 20 |

| Invoice terms code | 634 | 2 |

| Terms description | 636 | 50 |

| Terms due date | 686 | 8 |

| Currency code | 694 | 3 |

| Currency description | 697 | 50 |

| Currency rate | 747 | 12 |

| Currency multiplier | 759 | 1 |

| State - USA tax | 760 | 2 |

| County or zip code - USA | 762 | 5 |

| Extended tax code - USA tax | 767 | 3 |

| Terms discount percent | 770 | 5 |

| Terms discount due days | 775 | 3 |

| Terms discount allowed days | 778 | 3 |

| Invoice due date | 781 | 8 |

| + or - sign of next field | 789 | 1 |

| Total mass | 790 | 18 |

| + or - sign of next field | 808 | 1 |

| Total volume | 809 | 18 |

| + or - sign of next field | 827 | 1 |

| Total quantity invoiced | 828 | 18 |

| Customer tax registration | 846 | 15 |

| Filler | 861 | 1 |

This record is created from the ship to address or customer from the ARSMST file, depending on which one was used for the order.

| Field | Start position | Field length and description |

|---|---|---|

| Record type | 1 | 2 20 - Customer address |

| Message type `spaces' | 3 | 6 |

| Document type | 9 | 1 Can be C,D or I to denote Credit note, Debit note or Invoice. |

| Document number | 10 | 20 |

| Customer delivery name | 30 | 50 |

| Delivery address line 1 | 80 | 40 |

| Delivery address line 2 | 120 | 40 |

| Delivery address line 3 | 160 | 40 |

| Delivery address line 4 | 200 | 40 |

| Delivery address line 5 | 240 | 40 |

| Postal code | 280 | 10 |

| Customer sold to name | 290 | 50 |

| Sold to address line 1 | 340 | 40 |

| Sold to address line 2 | 380 | 40 |

| Sold to address line 3 | 420 | 40 |

| Sold to address line 4 | 460 | 40 |

| Sold to address line 5 | 500 | 40 |

| Sold to postal code | 540 | 10 |

| Filler | 550 | 1 |

| Field | Start position | Field length and description |

|---|---|---|

| Record type | 1 | 2

|

| Message type `spaces' | 3 | 6 |

| Document type | 9 | 1 Can be C,D or I to denote Credit note, Debit note or Invoice. |

| Document number | 10 | 20 |

| Line number 1 upwards | 30 | 4 Stocked & non-stocked merchandise lines and miscellaneous charges |

| SYSPRO stock code | 34 | 30 |

| Customer stock code | 64 | 30 |

| Description or misc charge description | 94 | 50 |

| + or - sign of following field | 144 | 1 |

| Ship quantity | 145 | 18 |

| + or - sign of following field | 163 | 1 |

| Stocking quantity to ship | 164 | 18 |

| Unit of measure | 182 | 10 |

| Rate of tax as percentage | 192 | 8 |

| Contract number | 200 | 20 |

| Unit price | 220 | 15 |

| + or - sign of following field | 235 | 1 |

| Line value extended | 236 | 14 |

| + or - sign of following field | 250 | 1 |

| Line tax value | 251 | 14 |

| + or - sign of following field | 265 | 1 |

| Original order quantity | 266 | 18 |

| + or - sign of following field | 284 | 1 |

| Current b/o quantity | 285 | 18 |

| + or - sign of following field | 303 | 1 |

| Line discount | 304 | 14 |

| Customer retail price | 318 | 15 |

| + or - sign of following field | 333 | 1 |

| Line value extended Foreign currency | 334 | 14 |

| + or - sign of following field | 348 | 1 |

| Line tax value Foreign currency | 349 | 14 |

| + or - sign of following field | 363 | 1 |

| Line discount Foreign currency | 364 | 14 |

| Order unit of measure | 378 | 10 |

| Pricing unit of measure | 388 | 10 |

| Order Price in pricing unit of measure (no sign required) | 398 | 15 |

| Filler | 413 | 115 |

| 50 Comment line |

||

| Lots and Serials | ||

| 30 SYSPRO stock code |

||

| 30 Customer stock code |

||

| 50 Lot number - Blank if serial only |

||

| 50 Serial number - Blank if lot only |

||

| 1 + or - sign of following field |

||

| 18 Line quantity |

-

This program does not select lines from the invoice to export. It picks up the detail lines from the contents of INTDET table, which is written out by the Document Print program and the totals from INTINH file.

-

The program responsible for creating the INTDET output the number of decimals for the stock code quantities.

The INTDET-NDEC (no of decimals) field in the INTDET file should specify the number of decimals for the quantity columns. This field is used to format the quantity columns for the number of decimals for each stock code is displayed. If the program that creates the INTDET records does not output this, then it will always be zero and quantities in the export file will have zero decimals.

-

All miscellaneous charge lines are reported as 'Other charges'.

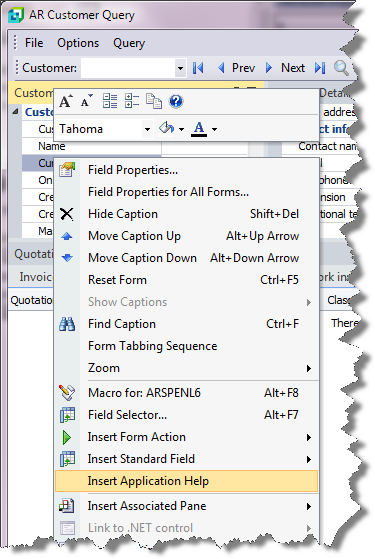

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.

![[Note]](images/note.png)