You use this program to perform a full or partial disposal of an asset.

In addition, this program can be used to view disposal details (i.e. the effect of disposal) without actually disposing, or partially disposing, of the asset.

A full disposal, partial disposal or disposal calculation can be performed against any of the depreciation books held against the asset.

Paragraph 67 of IAS 16 requires that an asset is disposed of when it is de-recognised or when no future economic benefits are expected from its use.

| Field | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Asset | Indicate the code of the asset to dispose of, or for which to calculate the disposal values. | ||||||||||||||||||||||||

| Calculate | Optionally select this to display the asset disposal

details before you actually post them. This function is only enabled when you enter a Disposal quantity. In addition, a Disposal reason must be entered before the calculation can be run. |

||||||||||||||||||||||||

| Post |

Select this to process the full or partial disposal of the asset. Depreciation for this period is only calculated if the Basis for depreciation is Period (Assets Register Setup). When the Basis for depreciation is Year, no depreciation is calculated for this year or period. If the Basis of depreciation is Life of asset, no depreciation is calculated. The Profit on disposal of an asset is calculated as: Sale amount less Net value of asset less Disposal cost. The Net value of the asset is the Cost of the asset less the Accumulated depreciation. The Disposal cost could be zero. If your Assets Register module is integrated to the General Ledger (General Ledger Integration) then the following entries are created for posting to the General Ledger for disposal in the Book value depreciation book:

If the asset was revalued during its lifetime (Asset Revaluation) then the following entry is also created:

|

| Field | Description | ||||

|---|---|---|---|---|---|

| Asset disposal information | |||||

| Asset code | This indicates the code of the asset you entered. | ||||

| Description | This indicates the description of the asset. | ||||

| Asset quantity | This indicates the current quantity of the asset. | ||||

| Disposal quantity | Indicate the quantity of the asset to dispose of, or

for which to calculate the disposal values. To process a full disposal of the asset, you enter the Asset quantity total in this field. To process a partial disposal, you enter any non-negative value which is less that the Asset quantity. Decimals can be used. For example, you can enter 0.5 or 1.3. The disposal quantity cannot be zero or more than the Asset quantity. |

||||

| Disposal date |

Enter the date on which the asset was sold or disposed. This date must be within the current Assets Register period.

The default date is the period end date of the period in which your Assets Register module is currently running and not the current system's date. |

||||

| Disposal period | This will be calculated by the system according to the Disposal date. | ||||

| Disposal year | This will be calculated by the system according to the Disposal date. | ||||

| Disposal reason |

Enter a reason for the disposal of the asset. A valid reason for disposal code must be entered. Reason for disposal codes are maintained using the Asset Reasons for Disposal program. |

||||

| Comment |

Optionally enter free format comments relating to the disposal of the asset. For example, you could record to whom the asset was sold. |

||||

This pane displays all depreciation books currently held for the asset. You use this editable listview to enter the Disposal details.

When you select the Calculate function, the disposal details are displayed according to the Disposal quantity you entered.

For a partial disposal, the disposal depreciation is calculated as pro-rata for the partial disposal quantity. For example, if an asset has a quantity of 10 and you dispose of 1, then the program calculates the depreciation values as one tenth of the depreciation.

![[Note]](images/note.png)

|

|

|

|

| Field | Description |

|---|---|

| Book | This displays the depreciation books currently defined against the asset. |

| Disposal amount | Enter the amount that the asset was sold/disposed

of. For a partial disposal, this amount must be less than the asset value and indicates the value by which to change the asset value. |

| Cost of disposal |

Enter the cost (if any), directly related to the disposal of the asset. For example, the condition of sale of the asset may stipulate that you must pay for the transportation of the asset to the buyer's premises. This would be cost of disposal to you. The amount you enter in this field reduces the selling price of the asset. The value debited to the Asset Clearing account is the value entered in the Disposal amount field less the value entered in the Cost of disposal field. |

| Disposal asset cost | Indicate the amount by which to change the asset cost. |

| Disposal depreciation this period | Indicate the amount by which to change the asset depreciation for the current period. |

| Disposal depreciation this year | Indicate the amount by which to change the asset depreciation for the current year. |

| Disposal accumulated depreciation | Indicate the amount by which to change the accumulated depreciation for the asset. |

| Disposal revaluation reserve | Enter the value in the Revaluation reserve account to

dispose of. This only applies if the asset was revalued

(Asset Revaluation). For example, if you revalued the cost of the asset for 1000 to 1500, then you will have 500 in the Revaluation reserve account on your Balance sheet. If the asset quantity is 1 and you now dispose 0.5 of the asset (50%) then the disposal revaluation reserve is calculated as 250 (0.5 x 500), but can be changed. |

| Cost/cash price | This indicates the current cost value of the asset. This is changed by acquisitions processed (see Asset Acquisition). |

| Depreciation this year | This indicates the amount depreciation for the current year to date. |

| Accumulated depreciation | This indicates the total depreciation processed against the asset to date. |

| Current value | This indicates the current value of the asset. |

-

You cannot dispose of an asset that is defined as a master while it has one or more a sub assets attached to it (see Asset Master Sub-assets).

-

If the GL analysis required option is enabled for a ledger account used in this program (General Ledger Codes or GL Structure Definition) then the Capture GL Analysis Entries program is displayed when you post the transaction, so that you can enter the analysis details. For a sub module transaction, the sub module must also be linked to the General Ledger in Detail at company level (General Ledger Integration) or at ledger account code level (General Ledger Codes or GL Structure Definition). GL analysis entries cannot be entered from sub modules if the sub module is linked to the General Ledger in Summary at company level or at ledger account code level.

Note that the GL analysis required option is ignored for all GL codes which are defined in General Ledger Integration. This applies even when the GL code is manually entered in a posting program. Although GL integration programs may be entered manually, they may also be called automatically by other programs or may be automated, which means that they can never be stopped to allow GL analysis entries to be captured.

If the GL analysis code used does not exist in the GenAnalysisCat table, then a message to this effect is displayed and the program will not prompt for analysis again. The GL journal will be created but not posted until the GL code, GL analysis code and GL journal are corrected.

The Ask Me Later function is only available when the option: Force GL Analysis - GL journal posting is enabled for the sub-module (General Ledger Integration).

General Ledger analysis entries are always distributed in the local currency, regardless of the currency in which the original transaction is processed.

Electronic Signatures provide security access, transaction logging and event triggering. This enables you to increase control over your system changes.

Access to the following eSignature transactions within this program can be restricted at Operator, Group, Role or Company level. You configure this using the eSignature Setup program.

| eSignature Transaction | Description |

|---|---|

| Asset Disposed |

Controls access to the disposal of assets in the Asset Disposal program. |

| Asset Partially disposed |

Controls access to the partial disposal of assets in the Asset Disposal program. |

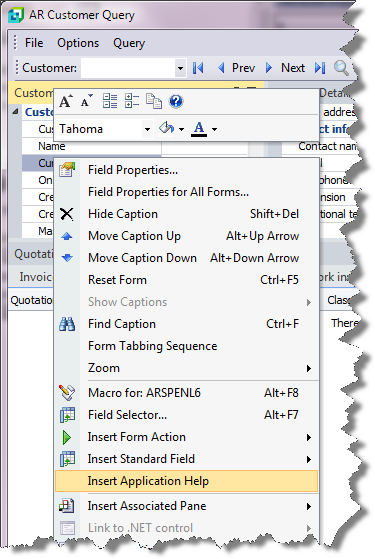

Inserting Application Help

You would typically follow this procedure to display help for the current program in a customized pane that can be pinned to the program window.

Information includes step-by-step instructions for the various functions available within the program, including a brief overview of what the program does, what setup options are required and how to personalize the program.

-

Open the program for which you want to insert application help into a customized pane.

This functionality is only available for a program that has panes.

-

Right-click any form field.

You can also click the triangle menu icon that appears in the title area of a pane.

-

Select Insert Application Help from the context-sensitive menu.

The application help appears in a pane within your program. You can reposition the pane using the docking stickers or pin it to the program window.

Removing the Application Help pane

If you no longer want to display application help in a pane for your current program, you can simply remove it.

-

Select the Close icon in the right-hand corner of the application help pane.

-

Confirm that you want to delete the pane.