AR Withholding Tax At Point of Capture

Managing withholding tax obligations can be complex, particularly when regulations require precise timing in tax recording. SYSPRO simplifies this process by automating the calculation and recording of withholding tax at the point of sales invoice creation.

Exploring

This capability ensures accurate tax compliance, eliminates manual intervention, and enhances efficiency in tax reporting.

By seamlessly integrating this functionality into sales processes, SYSPRO supports businesses in meeting regulatory requirements with confidence and precision.

-

Effortless Compliance:

Automatically record withholding tax at the time of invoice creation, meeting new regulatory requirements in the Philippines.

-

Improved Efficiency:

Reduce manual effort with automated tax calculation at the sales order line level.

-

Enhanced Accuracy:

Minimize errors in tax reporting through integrated and automated processes.

A customer provides the mechanism for you to raise sales orders within SYSPRO.

The static information captured against a customer is used when processing sales transactions and determines, for example, the tax and discounts applicable.

Documents generated from these transactions (e.g. invoices, credit notes, debit notes) are also stored against the customer.

The customer code can be used as a filtering tool when generating reports.

Customers are maintained using the Customers program (Program List > Accounts Receivable > Setup).

Sales orders are used to record the sale or transfer of goods and services to both internal and external customers.

It forms a temporary legal contract between your company and the customer, as well a providing an audit trail of goods sold or transferred.

A stock code is a number that uniquely identifies an inventory item that is bought or manufactured and which is typically stored in one or more warehouses.

All activity relating to the forecasting, purchasing, manufacturing, stocking and selling of a stocked item is tracked by means of the stock code.

A stock code can be linked to one or more lot numbers if the item is defined as lot traceable. If there is a warranty, the stock code can be defined as serialized and linked to one or more serial numbers.

If the Bill of Materials module is installed, stocked items may be linked in a parent/component relationship for use in Work In Progress and Sales Orders (Kit sales).

You can use the stock code as a selection criterion when generating reports.

You maintain stock codes using the Stock Code Maintenance program.

Withholding tax is an advance payment of company tax that is collected by the customer when paying a supplier. It is typically used in countries such as the Philippines, Thailand and Singapore.

For example:

Company A sells a computer to Company B for $1000.00.

When Company B pays for the computer they deduct withholding tax from the payment and send it to the tax office.

The full $1000 is credited against the account, but the payment is split into one portion that is paid to the tax office and the remaining portion that is paid to the supplier.

Starting

-

To use this feature, the following setup option(s) must be enabled/defined:

-

Withholding tax required (Setup Options > Tax > Company Tax Options)

-

Accounts Receivable withholding:

-

Accounting basis

-

-

-

Ensure that the operator printing the invoice has a default bank code defined in the Operator Maintenance program (under the Defaults tab).

This is required for withholding tax values to post correctly to AR when the invoice is created.

You can secure this feature by implementing a range of controls against the affected programs. Although not all these controls are applicable to each feature, they include the following:

- You restrict operator access to activities within a program using the Operator Maintenance program.

- You can restrict operator access to the fields within a program (configured using the Operator Maintenance program).

- You can restrict operator access to functions within a program using passwords (configured using the Password Definition program). When defined, the password must be entered before you can access the function.

- You can restrict access to the eSignature transactions within a program at operator, group, role or company level (configured using the Electronic Signature Configuration Setup program). Electronic Signatures provide security access, transaction logging and event triggering that gives you greater control over your system changes.

- You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

- You can restrict operator access to programs by assigning them to roles and applying access control against the role (configured using the Role Management program).

Solving

Why don't you drop us a line with some useful information we can add here?

Using

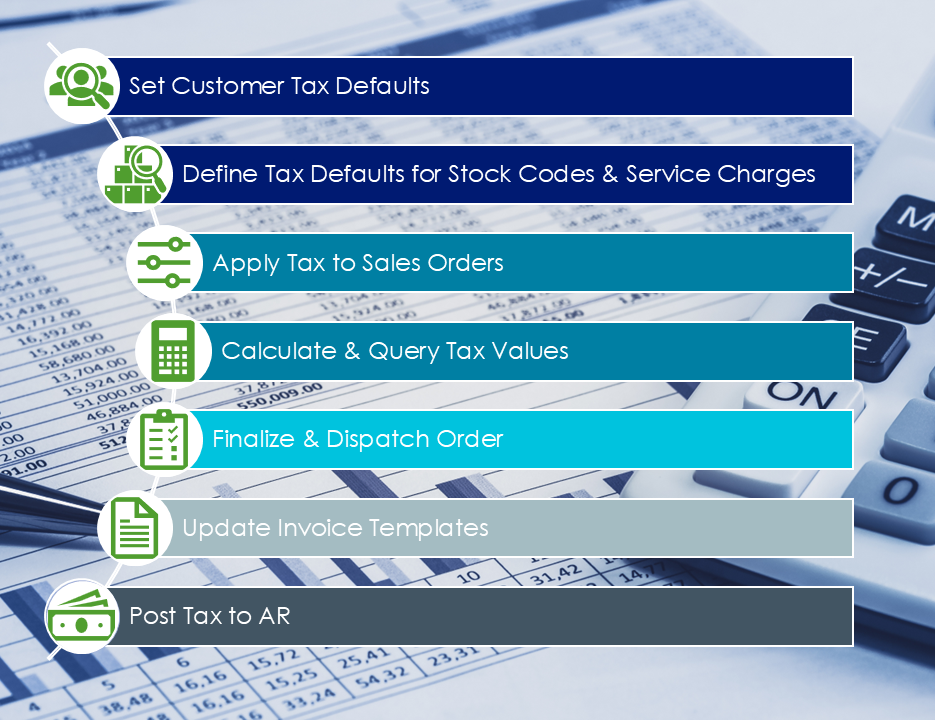

With the AR Withholding Tax At Point of Capture functionality configured, you can now integrate it into your business operations.

The following provides a high-level overview of the standard business process for using this capability:

-

Set default customer preferences:

-

Optionally, configure default settings for a customer to apply withholding tax.

-

If this is not set, the company's default tax option will be applied.

-

-

Define default tax codes for stock items:

-

Optionally, assign a default withholding tax code to specific stock codes for automated application.

-

-

Define default tax codes for service charges:

-

Optionally, assign a default withholding tax code to service charges.

-

A default withholding tax code is mandatory for service charges attached to a stock code.

-

For service charges added directly to the sales order, the operator can specify the withholding tax code when saving the line.

-

-

Configure withholding tax at sales order creation:

-

During sales order creation, you can choose whether to apply withholding tax.

-

If applying, ensure that each sales order line includes a valid withholding tax code (use the browse function to select an existing tax code).

-

-

Calculate and query withholding tax values:

-

The withholding tax value is automatically calculated.

-

View order and invoice values using the Query toolbar function of the Sales Order Entry program.

-

-

Complete the sales order process:

-

Once the order is finalized (i.e. End Order), proceed with dispatching or follow the normal sales order work flow.

-

-

Withholding tax during dispatch:

-

During dispatch, the withholding tax code for each sales order line is carried over to the dispatched lines.

New non-merchandise lines cannot be added in the Dispatch Note Maintenance program. Additional lines must first be added in Sales Order Entry.

-

-

Update invoice print templates:

-

To display the total withholding tax value on printed invoices, ensure the corresponding print format/template is updated.

-

-

Post withholding tax to Accounts Receivable (AR):

-

As invoices are created, the withholding tax value for each line is automatically posted to AR.

-

The following indicates areas in the product that may be affected by implementing this feature:

Syspro Ribbon bar > Setup

The Company Tax Options form includes a Accounts Receivable withholding section that lets you configure the following setup options:

-

Accounting basis

This can be defined as one of the following:

-

Point of payment

-

Point of capture

-

This field only becomes available once the Withholding tax required setup option is enabled.

Program List > Contact Management > Setup

The General Details pane contains the following field for defining the withholding tax requirement per customer:

-

Apply AR withholding tax

This can be defined as one of the following:

-

Y = Withholding tax will be applied

-

N = Withholding tax will not be applied

-

Blank = The default company tax option will be used for the customer.

-

Program List > Inventory > Setup

The Sales Details pane contains the following field for viewing the withholding tax requirement defined against the stock code:

-

AR Withholding tax code

Program List > Sales Orders > Setup

This program enables you to add the following field to the totals section of any SO invoice format:

-

Total withholding tax (i.e. SORFMT05.MAM)

Program List > Sales Orders > Sales Order Processing

The Service Charge Maintenance pane contains the AR Withholding tax code field for viewing the withholding tax requirement defined.

Program List > Sales Orders > Sales Order Processing

-

Within the Order Header, the following field lets you define the sales order's withholding tax requirement:

Apply AR withholding tax

This can be defined as one of the following:

-

Y = Withholding tax will be applied

-

N = Withholding tax will not be applied

-

Blank = The default company tax option will be used for the customer.

-

-

You can view the AR withholding tax code defined against each line type within the following panes:

-

Stocked line

-

Non-stocked line

-

Freight line

-

Miscellaneous Charge line

-

-

The corresponding withholding tax values are displayed within the Order Value and Invoice Recap (accessible from the Query menu).

-

The Invoice Recap displays the WHT value based on the shipped quantity.

-

The Order Value displays the WHT value based on the order quantity (Original values), outstanding order quantity (Outstanding values) and ship quantity (To invoice values).

-

Accessible from the Sales Order Entry program

The AR Withholding Tax At Point of Capture functionality extends to managing sales orders involving kit-type items (i.e. 'K' or 'S') and finished goods (i.e. 'F').

-

When adding a sales order line for a kit-type item:

The WHT code for each component is assigned and saved at the component level. In these cases, the parent item does not require a WHT code, as the total value is calculated from its components.

-

Conversely, for finished goods:

The WHT code is mandatory at the parent level, and no WHT codes are required for the associated components.

This ensures proper tax application and compliance based on the type of item processed within the sales order.

Accessible from the Sales Order Entry program

The Service Charge Line pane contains the AR Withholding tax code field for viewing the withholding tax requirement defined.

Program List > Sales Orders

The Order header pane contains the AR Withholding tax code field for viewing the withholding tax requirement defined.

The withholding tax recorded against a sales order is displayed within the Order Values pane.

Program List > Sales Orders

The withholding tax recorded against a sales order is displayed within the following panes:

-

Invoice Header

-

Dispatch Invoice Header

-

Consolidated Invoice Header

The following indicates the business objects that are affected by this feature:

The XML element, <ApplyWithholdingTax>, provides flexibility in specifying whether withholding tax should be applied to a customer.

While this element is optional, when included, it accepts the following values:

-

Y = Withholding tax will be applied

-

N = Withholding tax will not be applied

-

Blank = The default company tax option will be used for the customer.

The XML element, <WithholdingTaxCode>, facilitates the setup of a default withholding tax code against stock items.

This element accepts either a valid withholding tax code or a blank value:

-

Valid withholding tax Code:

Assigns the specified withholding tax code as the default for the stock code.

-

Blank Value:

Clears any existing default withholding tax code for the stock code.

The Accounting basis tax setup option controls when the AR Withholding Tax functionality is applied, provided the Withholding tax required setup option is enabled.

This can be defined as one of the following:

-

P – Point of Payment (default):

Withholding tax is applied when payment is made, ensuring that no existing customers are impacted by this change.

-

C – Point of Capture:

Withholding tax is applied at the time of sales order capture and invoicing, enabling early recognition of withholding tax obligations.

When creating a dispatch note for a sales order, the <CopyCustomForm> parameter must be set to ‘Y’ to ensure that the associated withholding tax custom form fields are carried over from the sales order.

Additionally, for non-merchandise lines added directly to the dispatch note (not originating from the sales order), a valid WHT code must be provided in the corresponding <…WHTCode> element if the sales order is configured to apply WHT functionality.

When adding a dispatch note line to an existing dispatch, the corresponding WHT custom form fields must be copied from the custom forms of the related sales order line.

It is important to note that lines with a withholding tax code cannot be added directly in the dispatch note program. To include such lines, they must first be added to the originating sales order and then incorporated into the dispatch from there.

This ensures proper handling of withholding tax and maintains data consistency across the sales order and dispatch processes.

Elements related to AR Withholding Tax At Point of Capture:

-

The <ApplyWithholdingTax> element within the Order Header indicates whether withholding tax is applied to the customer in the sales order being captured.

-

The <StockWhtCode>, <MiscWhtCode> and <FreightWhtCode> elements specify the withholding tax codes for each line type in the order details.

Additional validation rules ensure accurate application:

-

For Kit ('K') items:

Each component must have a default WHT code applied before the kit item is processed.

-

For stocked lines with attached service charges:

Each service charge must also have a default WHT code. If any service charge is missing a WHT code, an error will occur, and the line will not be added.

The customer's withholding tax (WHT) option is included in the XML output when the <IncludeCustomForms> parameter is set to ‘Y’. This ensures that withholding tax-related settings are accurately returned and available for integration or reporting purposes.

Copyright © 2026 SYSPRO PTY Ltd.