EFT File Format Maintenance

This program lets you design the format for an EFT payment file according to the specification of the financial institution. This information is stored in the EftPayFormat and EftPayFormatDet tables.

The program maps fields to the XML elements created by the EFT Payments Extract and EFT Payments Re-extractprograms, which can include custom form fields from the EftBankCtl, EftApSupplier and EftCshSupplier tables.

Exploring

This program is accessed from the Program List of the SYSPRO menu:

- Program List > Electronic Fund Transfer > Setup

NACHA, originally the National Automated Clearinghouse Association, manages the ACH Network, which is the backbone for the electronic movement of money and data in the United States, and is an association for the payments industry.

CPA stands for Canadian Payments Association (also called Payments Canada), which is an organization that operates a payment clearing and settlement system in Canada.

Starting

To use this program, the following module(s) must be installed according to the terms of your software license agreement:

-

Electronic Funds Interface

-

Electronic Funds Transfer

You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

You can restrict operator access to programs by assigning them to roles and applying access control against the role (configured using the Role Management program).

Solving

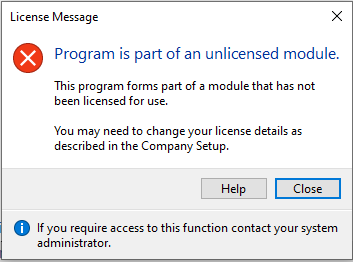

This message is displayed when you have attempted to access the EFT File Format Maintenance program, but your system is not configured to use the Electronic Funds Interface module.

Ensure that your license agreement allows you access to the Electronic Funds Interface module.

Using

-

Columns in a listview are sometimes hidden by default. You can reinstate them using the Field Chooser option from the context-sensitive menu (displayed by right-clicking a header column header in the listview). Select and drag the required column to a position in the listview header.

-

Fields on a pane are sometimes removed by default. You can reinstate them using the Field Selector option from the context-sensitive menu (displayed by right-clicking any field in the pane). Select and drag the required fields onto the pane.

The captions for fields are also sometimes hidden. You can select the Show Captions option from the context-sensitive menu to see a list of them. Click on the relevant caption to reinstate it to the form.

If the Show Captions option is grayed out, it means no captions are hidden for that form.

-

Press Ctrl+F1 within a listview or form to view a complete list of functions available.

| Position | Length | Name | Contents | Description & Comment |

|---|---|---|---|---|

|

1-1 |

1 |

Record Type Code |

1 |

Constant |

|

2-2 |

3 |

Priority Code |

01 |

Constant |

|

4-13 |

10 |

Immediate Destination |

bNNNNNNNNNN |

Typically your bank's 9-digit ABA Routing number, with a preceding blank space. Determined by your bank. |

|

14-23 |

10 |

Immediate Origin |

Numeric |

Typically, 1 + your federal ID number. Determined by your bank. |

|

24-29 |

6 |

File Creation Date |

YYMMDD |

Must be in YYMMDD format |

|

30-4 |

33 |

File Creation Time |

HHMM |

Must be in 24-hour HHMM format |

|

34-34 |

1 |

File ID Modifier |

Alphanumeric |

Alphanumeric field, upper-case A-Z and 0-9 allowed. Start with A and increment for each file created during the calendar day. |

|

35-37 |

3 |

Record Size |

094 |

Constant |

|

38-39 |

2 |

Blocking Factor |

10 |

Constant |

|

40-40 |

1 |

Format Code |

1 |

Constant |

|

41-63 |

23 |

Immediate Destination Name |

Alphanumeric |

Your bank's name |

|

64-86 |

23 |

Immediate Origin Name |

Alphanumeric |

Your company's name |

|

87-94 |

8 |

Reference Code |

Blank |

8 blank spaces - constant |

| Position | Length | Name | Contents | Description & Comment |

|---|---|---|---|---|

|

1- 9 |

1 |

Record Type Code |

1 |

Constant |

|

2-7 |

6 |

Batch Count |

Numeric |

The number of batches in file |

|

8-13 |

6 |

Block Count |

Numeric |

The number of blocks in file (10 records = 1 block) |

|

14-21 |

8 |

Entry/Addenda Count |

Numeric |

The number of detail entry (transactions) and addenda records within the file. |

|

22-31 |

10 |

Entry Hash |

Numeric |

The sum of the receiving DFI ID (first 8 digits of the other party's ABA routing number) for each entry/transaction within the file. If the sum exceeds 10 places, use the rightmost 10 digits. |

|

32-43 |

12 |

Total Debit Entry Dollar Amount |

Numeric |

Total debits for the file. No decimal. |

|

44-55 |

12 |

Total Credit Entry Dollar Amount |

Numeric |

Total credits for the file. No decimal. |

|

56-94 |

39 |

Reserved |

Blank |

Constant |

| Position | Length | Name | Contents | Description & Comment |

|---|---|---|---|---|

|

1-1 |

1 |

Record Type Code |

5 |

Constant |

|

2-4 |

3 |

Service Class Code |

200 220 225 |

Represents whether the batch contains: 200 Both debits and credits, mixed 220 Credits 225 Debits |

|

5-20 |

16 |

Company Name |

Alphanumeric |

Your company name. Often the same as the Immediate Origin Name in the file header. PRINTED - This value will appear on the other party's bank statement. |

|

21-40 |

20 |

Company Discretionary Data |

Alphanumeric |

Optional (as instructed by your bank) Otherwise (typically), leave blank. |

|

41-50 |

10 |

Company Identification |

Numeric |

Typically, 1 + your Federal ID number. Determined by your bank. Often the same as the Immediate Origin ID in the file header. No hyphen, numbers only. |

|

51-53 |

3 |

Standard Entry Class Code (SEC) |

PPD CCD |

3 letter mnemonic which identifies the batch and its' layout. PPD is used if the other party is an individual (ie. payroll). CCD is used if the other party is a corporate account (ie. vendor payments and customer collections). Other values (not part of this layout/sample) include ARC, BOC, CTX, IAT, TEL and WEB. |

|

54-63 |

10 |

Company Entry Description |

Alphanumeric |

A description of the general nature of the transactions to help the other parties identify the purpose, e.g. Payroll, Payables, etc. PRINTED - This value will appear on the other party's bank statement. |

|

64-69 |

6 |

Company Descriptive Date |

Alphanumeric |

Optional, often YYMMDD. Descriptive date - often in YYMMDD format with the same value as the effective date. Useful in recurring transaction scenarios, such as payroll. PRINTED - This value may appear on the other party's bank statement. |

|

70-75 |

6 |

Effective Entry Date |

YYMMDD |

Effective / transaction date. Date the other party is debited or credited. |

|

76-78 |

3 |

Reserved |

Blank |

Julian Settlement Date - left blank. Will be filled in by your bank. |

|

79-79 |

1 |

Originator Status Code |

1 |

Constant |

|

80-87 |

8 |

Originating DFI ID |

Numeric |

Enter the first 8 digits of your ABA routing number. |

|

88-94 |

7 |

Batch Number |

Numeric |

Start with 00000001 and increment by 1 for each batch. |

| Position | Length | Name | Contents | Description & Comment |

|---|---|---|---|---|

|

1-1 |

1 |

Record Type Code |

8 |

Constant |

|

2-4 |

3 |

Service Class Code |

200 220 225 |

Represents whether the batch contains: 200 Both debits and credits, mixed 220 Credits 225 Debits Must match the entry in the batch header. |

|

5-10 |

6 |

Entry/Addenda Count |

Numeric |

Number of detail entry (transactions) and addenda records within the batch. |

|

11-20 |

10 |

Entry Hash |

Numeric |

Sum of the receiving DFI ID (first 8 digits of the other party's ABA routing number) for each entry/transaction within the batch. If the sum exceeds 10 places, use the rightmost 10 digits. |

|

21-32 |

12 |

Total Debit Entry Dollar Amount |

Numeric |

Total debits for the batch. No decimal. |

|

33-44 |

12 |

Total Credit Entry Dollar Amount |

Numeric |

Total credit for the batch. No decimal. |

|

45-54 |

10 |

Company Identification |

Numeric |

Typically, 1 + your Federal ID number. Determined by your bank. Must match the entry in the batch header. |

|

55-73 |

19 |

Message Authentication Code |

Blank |

Blank |

|

74-79 |

6 |

Reserved |

Blank |

Blank |

|

80-87 |

8 |

Originating DFI ID |

Numeric |

Enter the first 8 digits of your ABA routing number. Must match the entry in the batch header. |

|

88-94 |

7 |

Batch Number |

Numeric |

Start with 00000001 and increment by 1 for each batch. Must match the entry in the batch header. |

| Position | Length | Name | Contents | Description & Comment |

|---|---|---|---|---|

|

1-1 |

1 |

Record Type Code |

6 |

Constant |

|

2-3 |

2 |

Transaction Code |

22 32 27 37, etc. |

For credit (ie. payroll, vendor payments) transactions: 22 Checking account 32 Savings account For debit (ie. collections from a customer's) transactions: 27 Checking account 37 Savings account For pre-notes: 23/28 for checking credit/debit 33/38 for savings debit/credit See ACH rules for additional codes. |

|

4-11 |

8 |

Receiving DFI ID |

Numeric |

The first 8 digits of the other party's ABA routing number. |

|

12-12 |

1 |

Check Digit |

Numeric |

The last digit of the other party's ABA routing number. |

|

13-29 |

17 |

DFI Account Number |

Alphanumeric |

The other party's account number. This is an alphanumeric field and should be left justified zero padded. |

|

30-39 |

10 |

Amount |

Numeric |

Transaction amount. No decimal. |

|

40-54 |

15 |

Identification Number |

Alphanumeric |

Optional This helps the receiver (other party) identify themselves within your system, should they need to contact you. This is typically their account number. PRINTED - This value may appear on the other party's bank statement. |

|

55-76 |

22 |

Receiving Company Name |

Alphanumeric |

The other party's company name (in CCD) - or if this is a consumer transaction (in PPC) such as payroll, then the individual's name. |

|

77-78 |

2 |

Discretionary Data |

Alphanumeric |

Typically blank, unless instructed otherwise by your bank. |

|

79-79 |

1 |

Addenda Record Indicator |

0 or 1 |

0 - No addenda following 1 - Addenda following |

|

80-94 |

15 |

Trace Number |

Numeric |

The first 8 digits of the originating DFI number, followed by the entry detail sequence number. |

| Position | Length | Name | Contents | Description & Comment |

|---|---|---|---|---|

|

1-1 |

1 |

Record Type Code |

7 |

Constant |

|

2-3 |

2 |

Addenda Type Code |

05 |

Constant The only valid value for CCD and PPD origination, but other SEC codes can contain other values. |

|

4-83 |

80 |

Payment Related Information |

Alphanumeric |

Invoice or other remittance information specific to the entry detail / transaction. PRINTED - This value may appear on the other party's bank statement Don't rely on the other party for obtaining this information. Most banks require an election for additional services to receive this. |

|

84-87 |

4 |

Addenda Sequence Number |

0001 |

As PPD and CCD codes only support 1 addenda record, this will always be 0001. |

|

88-94 |

7 |

Entry Detail Sequence Number |

Numeric |

This 7-digit field contains the last 7 digits of the related (preceding) entry detail / transaction record's trace number. |

| Position | Length | Name | Contents | Description & Comment |

|---|---|---|---|---|

|

01-01 |

1 |

Record Type |

Alphanumeric |

A |

|

02-10 |

9 |

Record Count |

Numeric |

000000001 |

|

11-20 |

10 |

User Number |

Alphanumeric |

10-digit client number |

|

21-24 |

4 |

File Creation Number |

Alphanumeric |

4-digit number (numeric) to identify this file. |

|

25-30 |

6 |

File Creation Date |

Numeric |

Format 0YYDDD |

|

31-35 |

5 |

Processing Center |

Numeric |

The centre where the file will be processed (5-digit Institution ID). |

|

36-55 |

20 |

Reserved |

Alphanumeric |

Leave blank |

|

56-58 |

3 |

Destination Currency Code ID |

Alphanumeric |

USD or CAD - if blank, defaults to the currency of service |

|

59-1464 |

1406 |

Filler |

Alphanumeric |

Leave blank |

| Position | Length | Name | Contents | Description & Comment |

|---|---|---|---|---|

|

01-01 |

1 |

Record Type |

Alphanumeric |

C |

|

02-10 |

9 |

Record Count |

Numeric |

Increment by 1 |

|

11-20 |

10 |

Client Number |

Alphanumeric |

10-digit client number |

|

21-24 |

4 |

File Creation Number |

Alphanumeric |

Number to identify this file. |

| SEGMENT ONE | ||||

|

25-27 |

3 |

Transaction Code |

Alphanumeric |

3-digit transaction code as defined by the CPA '450' |

|

28-37 |

10 |

Amount |

Numeric |

Payment amount format (implied decimal) |

|

38-43 |

6 |

Payment Date |

Numeric |

Format 0YYDDD - cannot be more than 30 days in the past or 173 days in the future |

|

44-52 |

9 |

CAD Financial Institution and Branch Transit # |

Numeric |

0999 Bank Number plus 99999 Branch Transit |

|

53-64 |

12 |

Account Number |

Alphanumeric |

Enter all significant digits |

|

65-86 |

22 |

Reserved |

Numeric |

Zero fill |

|

87-89 |

3 |

Reserved |

Numeric |

Zero fill |

|

90-104 |

15 |

Client Short Name |

Alphanumeric |

One word. Will appear on customer statements. (No zeros) |

|

105-134 |

30 |

Customer Name |

Alphanumeric |

If missing, payment will reject. |

|

135-164 |

30 |

Client Name |

Alphanumeric |

Client Long name. |

|

165-174 |

10 |

Client Number |

Alphanumeric |

10-digit EFT account number assigned by bank |

|

175-193 |

19 |

Customer Number |

Alphanumeric |

Client-assigned ID number (some banks require). |

|

194-202 |

9 |

Reserved |

Numeric |

Zero fill |

|

203-214 |

12 |

Reserved |

Alphanumeric |

Blank |

|

215-229 |

15 |

Client Sundry Information |

Alphanumeric |

Optional to client; electronic message printed on some customer bank statements. |

|

230-251 |

22 |

Reserved |

Alphanumeric |

Blank |

|

252-253 |

2 |

Reserved |

Alphanumeric |

Blank |

|

254-264 |

11 |

Reserved |

Alphanumeric |

Blank |

|

SEGMENTS TWO THROUGH SIX (Same as Segment One) 265-1464 |

||||

| Position | Length | Name | Contents | Description & Comment |

|---|---|---|---|---|

|

01-01 |

1 |

Record Type |

Alphanumeric |

Z |

|

02-10 |

9 |

Record Count |

Numeric |

Increment by 1 |

|

11-20 |

10 |

Client Number |

Alphanumeric |

Must be the same as the Header |

|

21-24 |

4 |

File Creation Number |

Alphanumeric |

Number to identify this file. Must be different (or higher) from previous numbers. |

|

25-38 |

14 |

Reserved |

Numeric |

Zero fill |

|

39-46 |

8 |

Reserved |

Numeric |

Zero fill |

|

47-60 |

14 |

Total Value of Transactions |

Numeric |

Total value of record type C transactions. Right justify with leading zeros. Format with implied decimal. Credit |

|

61-68 |

8 |

Total Number of Transactions |

Numeric |

USD or CAD - if blank, defaults to the currency of service |

|

69-1464 |

1396 |

Filler |

Numeric |

Zero fill |

Referencing

This lets you enter or select a unique code for the file format you want to add or maintain.

This displays the Format Templates window and lets you select a predefined file format.

| Field | Description |

|---|---|

|

Description |

This lets you enter a description for the EFT file format. This is the file format you can select at the Bank payment format field in the EFT Bank Control program. |

|

Format type |

This lets you select the file format type, which is either NACHA or CPA005. |

|

Standard entry class |

This lets you select the type of transactions that will be included in the EFT file format so that the entries in the batch can be identified. |

|

Generate company control |

Enable this to indicate that the company control record (Type 8) must be included in the file that is generated for submission to a financial institution. This option is required by and only enabled for the NACHA format. |

|

Generate file control |

Enable this to indicate that the file control record (Type 9) must be included in the file that is generated for submission to a financial institution. This option is required by and only enabled for the NACHA format. |

|

Create balanced file |

Enable this to indicate that the debits and credits in the XML file must be equal. To achieve this, an offset record must be added to balance the file. This is required by some financial institutions.

|

|

Max line length |

This lets you indicate the maximum line length per transaction in the XML file. |

This pane displays the record types and record titles, which depend on the file format selected at the Format type field.

| Field | Description |

|---|---|

|

Field mapping |

This indicates the type of field, which could be one of the following:

|

|

Field name |

This indicates the name of the field. |

|

Length |

This indicates the length of the field, i.e. the number of characters. |

|

Fixed value |

This indicates the constant value assigned to fixed value fields, as required by the financial institution. |

|

Field description |

This indicates the description of the field. |

|

Calculation |

This indicates if a calculation is assigned to the field. |

Copyright © 2026 SYSPRO PTY Ltd.