Cash Book Currency Variance

You use this program to revalue unreconciled foreign transactions and foreign bank balances to the current exchange rate and to update the exchange rate variance account and bank control accounts with the difference.

Over a period of time, the local value of outstanding foreign transactions and bank balances varies according to changes in the currency exchange rates. This program enables you to report on the gains or losses associated with these fluctuations.

You typically use this program when you have changed the exchange rates using the Currencies program and want to revalue transactions at the new rate.

Toolbar and menu

| Field | Description |

|---|---|

| Start processing |

Select this to calculate the exchange variances and generate the report according to your selections. If you selected the Report and update option, then a General Ledger journal entry is also created. If Dimension Analysis is in use, the transactions are automatically tagged with default dimension codes (without displaying the GL Dimension Analysis Capture program). If no default dimension codes are defined, the Dimension Code field will be blank. Dimension Analysis is switched on by defining the Dimension analysis setup option for the relevant module as Transaction entry level or GL entry level (Setup Options > General Ledger Integration > General Ledger Codes). |

| Select this to print the information currently displayed in the Report pane. | |

| Save Form Values | This option is only enabled in Design mode (Automation Design). Your selections are saved and applied when the

program is run in automated mode. Form values and defaults are applied at operator level. They are not saved at role or group level. |

Options

| Field | Description |

|---|---|

| Report options | |

| Posting year | This indicates the current posting year of your Cash Book and is displayed for information purposes only. |

| Posting month | This indicates the current posting month of your Cash Book and is displayed for information purposes only. |

| Options |

Select this to generate a report reflecting the gains and losses associated with variances arising from fluctuations in the currency exchange rates. This enables you to view the effect of the change before you actually update your records. Select this to print the report and revalue unreconciled foreign transactions and foreign bank balances by updating the currency exchange rate held against each transaction. This calculates the effects of the currency change and creates the General Ledger journal entry. |

| Bank selection |

Indicate the specific bank(s) for which you ant to generate the report. The values for each bank are printed on a separate page. Banks to which you are denied access are automatically excluded when you generate the report for all banks. |

| Currency selection |

Select this to calculate all exchange variances for the selected bank(s), regardless of the currency. Select this to calculate the exchange variances for a single currency. You indicate this currency in the Currency field. The report only calculates exchange variances for the selected banks where the currency of the bank matches the selected currency. Select this to calculate all exchange variances for a range of bank(s), regardless of the currency. Select this to calculate exchange variances for a list of bank(s), regardless of the currency. |

| Currency |

Indicate the single currency for which you want to calculate the exchange variances if you selected to calculate for a Single currency. A specific Currency can only be entered when the option Foreign currency cash book required (Cash Book Setup) is selected and you selected to include All banks. |

|

Effective date |

Enter or browse for the date of the dated exchange rate that you wish to use for revaluation purposes. Once entered, the Show hyperlink is enabled. This can be selected to open the Dated Exchange Rates Maintenance program. Take care when entering or maintaining the date as this will determine the dated exchange rate that will be applied to all deposits and withdrawals being revalued. This is especially important when you select to revalue more than one currency.

This field will be disabled if dated exchange rates are not in use.

|

|

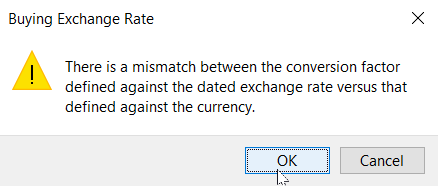

Buying exchange rate |

Enter the buying rate for revaluing withdrawal transactions. This field will be disabled and cannot be overridden if the currency is defined as a fixed currency or the eSignature to override buying dated exchange rates is denied. This field will be disabled if dated exchange rates are not in use. |

|

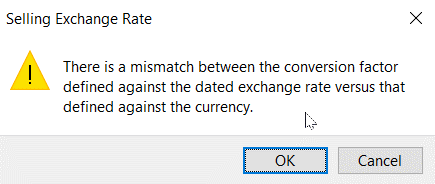

Selling exchange rate |

Enter the selling rate for revaluing deposit transactions. This field will be disabled and cannot be overridden if the currency is defined as a fixed currency or the eSignature to override selling dated exchange rates is denied. This field will be disabled if dated exchange rates are not in use. |

| After processing completed |

These options are displayed within programs that can be automated. They enable you to indicate the action you want to perform once processing is complete (see Automation Design). |

Report Details

Deposit transactions are calculated using the Selling exchange rate and withdrawal transactions are calculated using the Buying exchange rate defined against the respective currencies (Currencies).

The Cash Book opening balance is revalued at the buying rate if the balance is a credit (overdraft) and at the selling rate if it is a debit.

See also: Notes and warnings.

| Column | Description |

|---|---|

| Detail |

This displays the results of processing. The following information is included in the Detail column:

|

| Date | This indicates the date on which the transaction was originally processed. |

| Reference | This indicates the reference entered against the transaction when it was processed. |

| Type |

A 'W' indicates that the transaction was a withdrawal. These transactions are converted at the Buying exchange rate defined against the currency Currencies). A 'D' indicates that the transaction was a deposit. These transactions are converted at the Selling exchange rate defined against the currency (Currencies). |

| Check number | This indicates the check/cheque number for a withdrawal transaction, if the transaction was a check/cheque payment. |

| Foreign currency | This indicates the currency in which the transaction was processed. |

| Foreign amount | This indicates the foreign currency transaction amount. |

| Original exchange rate | This is the exchange rate at which the transaction was originally processed. |

| Last exchange rate | This is the previous exchange rate defined against the currency. This changes each time you use the Currencies program to change currency rates. |

| Current exchange rate | This is the current exchange rate and is the rate at which the transaction will be revalued if you select to run the report in update mode. |

| Currency variance | This indicates the currency variance for each transaction, based on the original exchange rate and the current exchange rate. |

| New local value | This indicates the local value of the foreign

transactions included on the report using the Current exchange

rate. This is calculated as the Foreign Amount multiplied by the CurrentExchange rate. |

Notes and warnings

Prerequisites

-

If your opening balance is in overdraft (credit), but you want to convert it at the selling rate, then you need to change the buying rate to equal the selling rate (Currencies) before generating the Cash Book Currency Variance report.

GL Analysis considerations

-

If the GL analysis required option is enabled for a ledger account used in this program (General Ledger Codes or GL Structure Definition) then the Capture GL Analysis Entries program is displayed when you post the transaction, so that you can enter the analysis details. For a sub module transaction, the sub module must also be linked to the General Ledger in Detail at company level (General Ledger Integration) or at ledger account code level (General Ledger Codes or GL Structure Definition). GL analysis entries cannot be entered from sub modules if the sub module is linked to the General Ledger in Summary at company level or at ledger account code level.

Note that the GL analysis required option is ignored for all GL codes which are defined in General Ledger Integration. This applies even when the GL code is manually entered in a posting program. Although GL integration programs may be entered manually, they may also be called automatically by other programs or may be automated, which means that they can never be stopped to allow GL analysis entries to be captured.

If the GL analysis code used does not exist in the GenAnalysisCat table, then a message to this effect is displayed and the program will not prompt for analysis again. The GL journal will be created but not posted until the GL code, GL analysis code and GL journal are corrected.

The Ask Me Later function is only available when the option: Force GL Analysis - GL journal posting is enabled for the sub-module (General Ledger Integration).

General Ledger analysis entries are always distributed in the local currency, regardless of the currency in which the original transaction is processed.

Restrictions and Limits

-

If you select to run the cash book revaluation for a single local currency bank, the currency defaults to the currency of the bank and is disabled on screen. However, when the revaluation runs, the program will attempt to revalue all foreign currency transactions that it finds.

-

Transactions will not be revalued if the currency is defined with a fixed rate.

-

AP and AR invoices captured with a fixed rate will not be revalued.

-

Within the CB Variance Report, any currencies with errors will be reported on in the Report pane. Please note that if this is the case, none of the banks will have transactions revalued and a rollback will be initiated. If the only error encountered is a conversion mismatch error, the banks will be revalued as this is regarded as a warning and not an error.

System Messages

Copyright © 2026 SYSPRO PTY Ltd.