AP Exchange Rate Revaluation

You use this program to calculate and optionally update the local equivalent balances of foreign currency suppliers. This is required when fluctuating currency exchange rates cause inaccurate outstanding invoice values.

This program enables you to restate the value of outstanding foreign currency supplier invoices (where a fixed exchange rate was not applied) at a revised exchange rate and update GL accordingly with the currency variance. You typically do this to meet statutory requirements that require you to restate your debt at a realistic rate of exchange at reporting dates (i.e. when you prepare your Balance Sheet).

Toolbar options

| Field | Description |

|---|---|

|

Start Processing |

Generates the revaluation process according to the selections you made. If Dimension Analysis is in use, the transactions are automatically tagged with default dimension codes (without displaying the GL Dimension Analysis Capture program). If no default dimension codes are defined, the Dimension Code field will be blank. Dimension Analysis is switched on by defining the Dimension analysis setup option for the relevant module as Transaction entry level or GL entry level (Setup Options > General Ledger Integration > General Ledger Codes). |

|

Save Form Values |

This option is only enabled in Design mode (Automation Design). Your selections are saved and applied when the program is run in automated mode. Form values and defaults are applied at operator level. They are not saved at role or group level. |

AP Revaluation Options

| Field | Description |

|---|---|

|

Options |

|

|

Report Options |

Performs the revaluation calculation and produce the report without generating the entries to update the General Ledger. This enables you to check the results of the calculations before actually performing the update. You can run the report in Report only mode as often as required. Performs the revaluation calculation and to generate the entries to update the General Ledger. |

| Use invoice branch | Filters the invoices by invoice branch (i.e. the AP

branch defined against the invoice). Invoices are filtered according to the AP Branch defined against the supplier when this option is not enabled. This also determines the General Ledger account to which the GL journal is posted, as the ledger code is defined against the branch. |

| Branch selection | Indicate the supplier branch(es) to include in the calculation. |

| Currency selection | Indicate the currency(ies) for which to process the calculation. |

|

Effective date |

Enter or browse for the date for which a dated exchange rate is required. This will default to the current system date. However, this can be changed.

Take care when entering or maintaining the date as this will determine the dated exchange rate that will be applied to all invoices being revalued. This is especially important when you select to revalue more than one currency.

This field will be disabled if dated exchange rates are not in use.

|

|

Buying exchange rate |

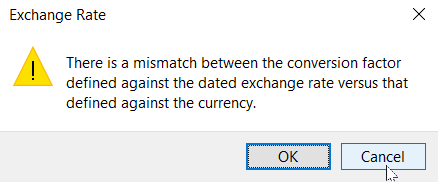

Enter a buying exchange rate to override any exchange rate currently on file for the effective date. The buying exchange rate will be used to revalue all invoices for a single currency based on the branches, suppliers and supplier classes selected. This exchange rate is only used for revaluation purposes and does not update any of the currency tables. The default exchange rate will be determined by the date entered in the Effective date field.

This field will be disabled if dated exchange rates are not in use. The field will only allow operators to change it if:

If enabled, the operator can override the default buying exchange rate. |

|

Dated exchange rates |

Select the Show hyperlink to view dated exchange rates in the Dated Exchange Rates Maintenance program. This field will be disabled if dated exchange rates are not in use.

|

|

Supplier selection |

Indicate the supplier(s) to be included in the calculation. |

| Supplier class selection | Indicate the supplier class(es) to be included in the calculation. |

| After processing completed |

These options are displayed within programs that can be automated. They enable you to indicate the action you want to perform once processing is complete (see Automation Design). |

AP Revaluation Report

This pane displays the results of the processing function you selected once processing is complete (unless you selected the option to close the application from the After processing completed section).

Notes and warnings

Prerequisites

Before running the report, you need to:

-

enter the buying exchange rate for each foreign currency to be revalued (Currencies).

-

ensure all payment cycles for the currency(ies) to be revalued are complete (Payment Cycle Maintenance).

-

preferably define the interface ledger accounts by branch/currency for the revaluation of outstanding foreign currency customer invoices using the AP Currency Variance GL Interface program.

Revaluation considerations

-

The balances in the GRN suspense file/tables that relate to foreign payables are not revalued by the revaluation program.

-

Currencies defined with a fixed exchange rate are excluded (in accordance with IAS 39 which applies to hedge accounting for foreign currency items).

If you set the currency to Fixed, then it is assumed that you have applied a hedge against the currency (e.g. you have taken foreign exchange cover). Transactions with a fixed exchange rate are therefore not revalued for the purposes of financial reporting, but are reported at the rate of the hedge.

-

The currency variance is calculated as: (Currency rate of invoice when captured - Current currency rate) x Invoice balance

-

A new journal is created for each 999 lines revalued.

Exchange variance considerations

-

When running the report in Report and update mode, exchange rate variances resulting from the revaluation are posted to the Unrealized variance ledger account defined in the AP Currency Variance GL Interface program (General Ledger Integration - Variance Interfaces).

A warning message is displayed if no Unrealized variance account is defined. If you select to continue, then the variances are posted to the Exchange variance account defined against the supplier's bank (Banks).

Exchange variance calculation

-

Exchange Variance = [Round to 2 decimals(new rate * invoice balance amount)] - [Round to 2 decimals (original invoice rate * invoice balance amount)]

Printing considerations

-

To ensure all the report details are clearly displayed when printing the report in a portrait layout, you can drag all columns off the listview except for the Bank details, Supplier details and Transaction details. These 3 columns contain the report details in a format more appropriate for the portrait layout.

Restrictions and Limits

-

The AP Revaluations override dated exchange rate eSignature determines the operator access to the Buying exchange rate field.

If access is not permitted, operators must accept the default exchange rate or exit the program and update the exchange rate to the desired value for the effective date using the Dated Exchange Rates Maintenance program.

If access is permitted, operators can override the default exchange rate displayed. Depending on the eSignature configuration, they may be prompted for a password or the transaction may be logged.

-

If there are currencies where a relevant exchange rate cannot be found, these errors will be displayed in the AP Revaluation Report pane. The transactions for these currencies will not be revalued. However, currencies with valid exchange rates will still be processed.

Error messages

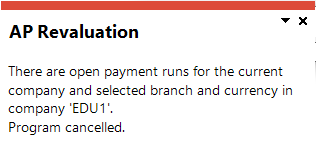

This message is displayed when you access the AP Exchange Rate Revaluation program while open payment runs exist in the database.

Ensure all payment runs that were created using the Payment Cycle Maintenance or the AP Group Payments programs have been executed and completed before accessing this program.

Copyright © 2026 SYSPRO PTY Ltd.