Tax Interface Setup

Exploring

This program lets you configure the following information for your selected tax connector:

-

Connection details

-

Filter requirements (by state, country or product class)

-

Location code source (Avalara only)

-

Date format (Avalara only)

-

File submission archiving

-

Audit log retention

-

Company options

-

Customer address format (i.e. Ship-to addresses)

-

Warehouse address format (i.e. Ship-from addresses)

This program can't be run standalone and is accessed from the following program(s):

-

Setup Options

From the Run Setup function of the Sales and Use Tax form:

Setup Options > Tax > Sales and Use Tax > Tax interface > Run Setup

The Avalara platform is a powerful and easy-to-use API that helps businesses automate the calculating, storing, auditing and reporting of transactional taxes.

The CertCapture component helps you maintain compliance by creating, validating, storing and managing sales tax exemptions and reseller certificates.

The tax code is linked to a percentage rate that is applied to the value of a transaction so that the relevant amount of tax can be determined.

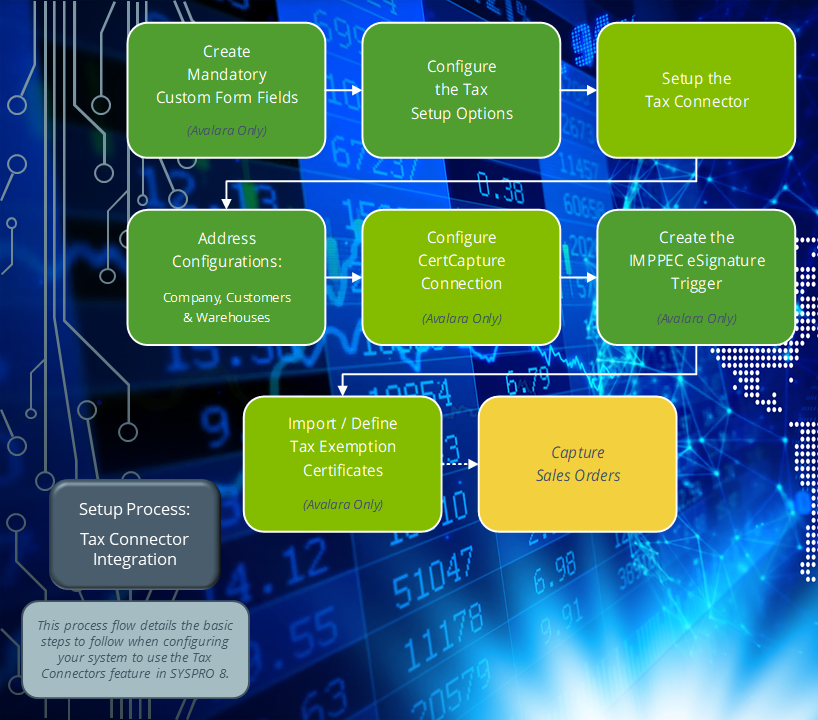

Tax Connectors provide a connection for establishing a direct link between SYSPRO and compatible cloud-based tax calculation systems (e.g. Avalara and Vertex).

Tax Connectors manage the export of data to these systems so that quarterly and annual sales tax returns can be produced for state filing purposes.

Tax rate refers to the percentage of sales tax charged in a particular area.

For example:

The sales tax rate is 8.0% in Costa Mesa, California.

Vertex solutions are powered by technology that combines pre-built integrations to leading business applications, a global content database supporting major indirect tax types, and flexible deployment options spanning on-premise, cloud or hybrid.

The Vertex platform is desktop software that provides all US and Canadian sales, use and rental tax rates at the component part level, and it also includes a combined rate.

Starting

-

Your Nationality code must be defined as USA (Setup Options > Company > General).

You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

The following configuration options in SYSPRO may affect processing within this program or feature, including whether certain fields and options are accessible.

The Setup Options program lets you configure how SYSPRO behaves across all modules. These settings can affect processing within this program.

Setup Options > Company > General

- Nationality code

Setup Options > Tax > Company Tax Options

- Tax system

Setup Options > Tax > Sales and Use Tax

- Sales and use tax system required

- Interface type

- Default ship from information

- Identification level

- Update tax for this company

Setup Options > Keys > Financials

- Customers:

- Presentation length

Setup Options > Keys > Distribution - Sales Management

- Sales orders:

- Presentation length

Solving

The Tax Connectors feature is limited to the North American markets at present.

When you process sales orders and the transactions are passed through to Avalara or Vertex, the invoice and tax details are written the SorUsaTaxRep and AdmTaxAuditLog tables in the SQL database during the upload process.

An archive file is also created within the \Base\AvtxArch folder which includes the invoice details and tax breakdown. An AV prefix indicates an Avalara file and an VR prefix indicates a Vertex file. This is followed by the SYSPRO company ID and then the sales order number.

The LineType column of the AdmTaxAuditLog table (or the last line of the AvtxArch archive file) indicates if the upload was successful or if there was a failure:

-

“S” indicates that the process was successful.

-

“F” indicates that the process has failed and provides a reason for the failure.

For example:

-

This occurs if your customer or warehouse address is not defined correctly in SYSPRO.

-

This occurs if the current invoice number already exists within the Avalara database.

-

The Special calculations fields within the Tax Interface Setup program are used to calculate tax on a different amount from what is actually on a sales order line.

For example:

In some states a vendor may sell particular items at a discount, but is still required to pay sales tax on the full retail price.

The special calculation will be applied only to invoices for customers who are in the customer class defined in the Tax Interface Setup program, and whose ship-to zip code falls within the defined range.

The special price is then calculated by replacing the price paid by the customer with the price code defined in the Tax Interface Setup program.

If you don't receive tax rate updates directly from the tax integration software and want to view or print any errors that may have occurred during the posting of transactions, then you can access the error log as follows:

-

Open the Tax Interface Error Log Print program (Program List > General Ledger > Tax > Tax Interface).

-

Within the Tax Interface Error Log Print Options pane, enter the date range that you want to include in the report.

-

Optional... Indicate whether you want the report to be sequenced by transaction date or sales order.

-

Select the Start Processing function.

The results are displayed within the Tax Interface Error Log Print pane.

-

Indicate if you want the log file to be deleted or not.

-

Exit the program.

Using

-

Fields on a pane are sometimes removed by default. You can reinstate them using the Field Selector option from the context-sensitive menu (displayed by right-clicking any field in the pane). Select and drag the required fields onto the pane.

The captions for fields are also sometimes hidden. You can select the Show Captions option from the context-sensitive menu to see a list of them. Click on the relevant caption to reinstate it to the form.

If the Show Captions option is grayed out, it means no captions are hidden for that form.

-

Press Ctrl+F1 within a listview or form to view a complete list of functions available.

Referencing

| Field | Description |

|---|---|

|

|

This saves the details you entered or changed and returns to the previous screen. |

|

Integration Software |

Indicate the tax connector software that you want to integrate with:

This must match the entry defined against the Interface type setup option. |

|

Test Connection |

This tests your connection to the integration software as per the connection details configured in the Avalara or Vertex pane. |

This pane only applies when the Integration Software toolbar field is defined as Avalara.

| Field | Description |

|---|---|

| AvaTax URL |

Indicate the Avalara web address, as provided by Avalara. |

| Account number |

Indicate your Avalara account number. |

| Licence key |

Indicate the license key for your Avalara account. |

| Timeout |

This indicates the number of attempts allowed for the server connection before timing out. This field is no longer applicable. |

| Default tax code for freight |

Indicate the tax code that you require as the default for freight sales order lines. |

| Default tax code for misc charges |

Indicate the tax code that you require as the default for miscellaneous sales order lines. |

| Filter |

Enable the Filter required option to exclude certain states, countries or product classes from submission to Avalara. When this is enabled and the specific state, country or product class filtering is defined, any invoices from a warehouse within an excluded state or country, or that include items within a filtered product class, are not sent through to Avalara for tax calculation. Select the Define hyperlink to indicate the states that must be excluded using the Define Filter by State program. Select the Define hyperlink to indicate the countries that must be excluded using the Define Filter by Country program. Select the Define hyperlink to indicate the product classes that must be excluded using the Filter by Product Class program. Select the Define hyperlink to indicate the branches that must be excluded using the Filter by A/R Branch program. |

| Location code source |

Indicate which information must be displayed as the "Location" in the transaction header within the Avalara website. Avalara then uses this location code to capture and calculate the tax amount for the invoice line submitted.

|

| Date format for AvaTax |

Indicate the format that you require transaction dates to be rendered in Avalara. For example: USA uses MM/DD/CCYY, whereas Canada generally uses DD/MM/CCYY. If this is not configured correctly, failures will occur when you submit your taxes. |

| Update invoice reprint tables |

To allow for the accurate re-print of taxes for SYSPRO AR invoices that were processed before linking to Avalara, select the Update hyperlink to update the existing data in the following tables (using the Update Invoice Reprint Tables program):

We recommend that you perform a backup of these tables before proceeding with the update. |

| Archive submitted files |

This lets you archive the files submitted to Avalara and is enabled by default. These details are also retained within the SorUsaTaxRep and AdmTaxAuditLog tables of the SQL database. This option doesn't apply in a SYSPRO Cloud ERP environment. |

| Archive sub-directory |

This indicates the location of the archive folder that contains the communication data required between Avalara and SYSPRO (i.e. invoice details and tax breakdowns of all transactions submitted). |

| Retain audit log |

This lets you retain an audit log of all transactions processed (i.e. the entries recorded within the AdmTaxAuditLog table) and is enabled by default. |

| Period to retain audit log |

This lets you indicate the number of months (i.e. retention period) according to which you want to retain audit log entries, and defaults to 99 months. An entry of 99 indicates that the audit should be retained indefinitely. Therefore, any entry lower than 99 will allow purging of the records. |

This pane only applies when the Integration Software toolbar field is defined as Vertex.

| Field | Description |

|---|---|

| Vertex URL |

Indicate the Vertex web address, as provided by Vertex. |

| Connect to Vertex |

Indicate how SYSPRO connects to the Vertex platform.

|

| Timeout |

This indicates the number of attempts allowed for the server connection before timing out. This field is no longer applicable. |

| Vertex department |

Indicate the Vertex department if applicable. This field is for informational purposes only. |

| Archive submitted files |

This lets you archive the files submitted to Vertex and is enabled by default. These details are also retained within the SorUsaTaxRep and AdmTaxAuditLog tables of the SQL database. This option doesn't apply in a SYSPRO Cloud ERP environment. |

| Archive sub-directory |

This indicates the location of the archive folder that contains the communication data required between Vertex and SYSPRO (i.e. invoice details and tax breakdowns of all transactions submitted). |

| Retain audit log |

This lets you retain an audit log of all transactions processed (i.e. the entries recorded within the AdmTaxAuditLog table) and is enabled by default. |

| Period to retain audit log |

This lets you indicate the number of months (i.e. retention period) according to which you want to retain audit log entries, and defaults to 99 months. An entry of 99 indicates that the audit should be retained indefinitely. Therefore, any entry lower than 99 will allow purging of the records. |

| Field | Description |

|---|---|

| Print invoice (regardless of errors) |

This lets you print invoices regardless of any errors returned during the integration process. The Tax Interface Error Log Print report lets your view and print any errors that may have occurred during the posting of transactions to the tax integration platform. |

| Use company code against branch |

By default, the system sends the SYSPRO Company code (e.g. EDU1) to the tax integration platform when processing transactions. Alternatively, enable this option to indicate that the system must replace the SYSPRO Company code with the code entered in the AvxCo custom form field against the branch of the sales order header. This is useful if you have a single company in Avalara or Vertex, but multiple companies within SYSPRO. |

| Update existing tax code rates in SYSPRO |

Enable this option if you require the system to overwrite the tax rates in SYSPRO when new rates are received from Avalara. Every time an invoice is printed, the system then takes the tax rates returned from Avalara and overwrites the rates in the AdmUsaTax table against the extended tax code on the sales order header. |

| Always send tax exemption number |

By default, tax exemption numbers are sent to Avalara only for non-taxable orders, thus ensuring that the order will be tax exempt. However you can enable this option if you want the tax exemption number to be sent to Avalara independently if the order is taxable or not. |

| Use customer/invoice presentation length |

This option lets you use the presentation length when passing customer codes and invoice numbers to Avalara or Vertex. Alternatively, the full 15-character numeric number is used when this option is disabled. The presentation length for customer codes is defined against the Presentation length setup option (Setup Options > Keys > Financials) and the presentation length of sales orders is defined against the Presentation length setup option (Setup Options > Keys > Distribution - Sales Management). |

| Update tax database |

This links to your configuration of the Update tax for this company setup option and indicates if SYSPRO must update the tax information in the Avalara or Vertex database. |

| Special Calculations |

Enter the appropriate Customer class and Price code if your company uses any special tax calculations. Then select the Define hyperlink against the Define range of zip codes field to define the range of Zip codes for the special tax calculations using the Define Filter by ZIP Codes program. |

Ensure that the addresses defined against your company, customers and warehouses match the configuration defined within this pane to ensure that the mapping works correctly and no errors occur when integrating with Avalara or Vertex.

| Field | Description |

|---|---|

| Ship-to Address (Customer) |

These fields enable you to configure how addresses are formatted on sales orders. This indicates how the integration will pass the address lines through to Avalara or Vertex, as sales tax is determined by city and state, so the interface must be able to determine where to find this information. |

| Address line number for street |

Indicate the line number for the customer's street name. |

| Address line numbers for city and state |

Indicate if the customer's city and state must be combined on a single line, or split on separate lines. |

| City and state in a single line |

Indicate the line number for the customer's city and state if you selected City and State in a single line at the Address line numbers for city and state field. |

| Address line for city |

Indicate the line number for the customer's city if you selected City and State in separate lines at the Address line numbers for city and state field. |

| Address line for state |

Indicate the line number for the customer's state if you selected City and State in separate lines at the Address line numbers for city and state field. |

| Use ZIP code to determine city and state |

This allows SYSPRO to determine the customer's city and state based on the ZIP code to ensure that the correct details are passed through to Avalara or Vertex. This is useful if sales order header addresses are not always formatted the same way. The system can then cross-reference the customer’s zip code with the zip code table to determine the city and state. |

| Country |

Indicate the line number for the country where the customer is located. |

| Show custom field |

This loads the Custom Forms Entry program from where you can create custom form fields for use against customers. |

| Ship-from Address (Warehouse) |

These fields enable you to configure how addresses are formatted on warehouse records. This indicates how the integration will pass the address lines through to Avalara or Vertex, as sales tax is determined by city and state, so the interface must be able to determine where to find this information. |

| Address line number for street |

Indicate the line number for the warehouse's street name. |

| Address line numbers for city and state |

Indicate if the warehouse's city and state must be combined on a single line, or split on separate lines. |

| City and State in a single line |

Indicate the line number for the warehouse's city and state if you selected City and State in a single line at the Address line numbers for city and state field. |

| Address line for city |

Indicate the line number for the warehouse's city if you selected City and State in separate lines at the Address line numbers for city and state field. |

| Address line for state |

Indicate the line number for the warehouse's state if you selected City and State in separate lines at the Address line numbers for city and state field. |

| Use ZIP code to determine city and state |

This allows SYSPRO to determine the warehouse's city and state based on the ZIP code to ensure that the correct details are passed through to Avalara or Vertex. This is useful if warehouse delivery addresses are not always formatted the same way. The system can then cross-reference the warehouse's zip code with the zip code table to determine the city and state. |

| Country |

Indicate the line number for the country where the warehouse is located. |

| Use the country name as entered |

This option allows the system to use the country name as it is entered within the customer or warehouse address and is disabled by default. Avalara uses the ISO 2-digit country code (e.g. US for the USA, ZA for South Africa, CA for Canada, etc.). Therefore, the actual country name from the address is converted to the corresponding 2-digit code before transactions are submitted to the tax integration platform (e.g. if the address field is defined as “South Africa”, this will be converted to ZA before submission). If the sales order address already contains this 2-digit code (instead of the actual country name) then this option must be enabled to prevent the system from trying to convert the code already in place. We recommend enabling this option if you use the Tax Connector - Vertex, as Vertex uses the actual country name. |

Copyright © 2025 SYSPRO PTY Ltd.