Update Invoice Reprint Tables

Exploring

This program lets you indicate a date range of invoices that the system can use to pull the tax values recorded within the ArTrnSummary table to update the corresponding re-print tables.

This ensures the accurate re-print of taxes for SYSPRO AR invoices that were processed before linking to Avalara, by updating existing data in the following tables:

-

SorUsaTaxRep (Sales Order USA Tax Reprint)

-

MdnMasterRep (MDN Reprint Dispatch Note Master)

-

MdnMasterRepCon (MDN Reprint Consolidated Dispatch Master)

We recommend that you perform a backup of these tables before proceeding with the update.

This program can't be run standalone and is accessed from the following program(s):

-

Tax Interface Setup

From the Update hyperlink against the Update invoice reprint tables field of the Avalara pane.

The Avalara platform is a powerful and easy-to-use API that helps businesses automate the calculating, storing, auditing and reporting of transactional taxes.

The CertCapture component helps you maintain compliance by creating, validating, storing and managing sales tax exemptions and reseller certificates.

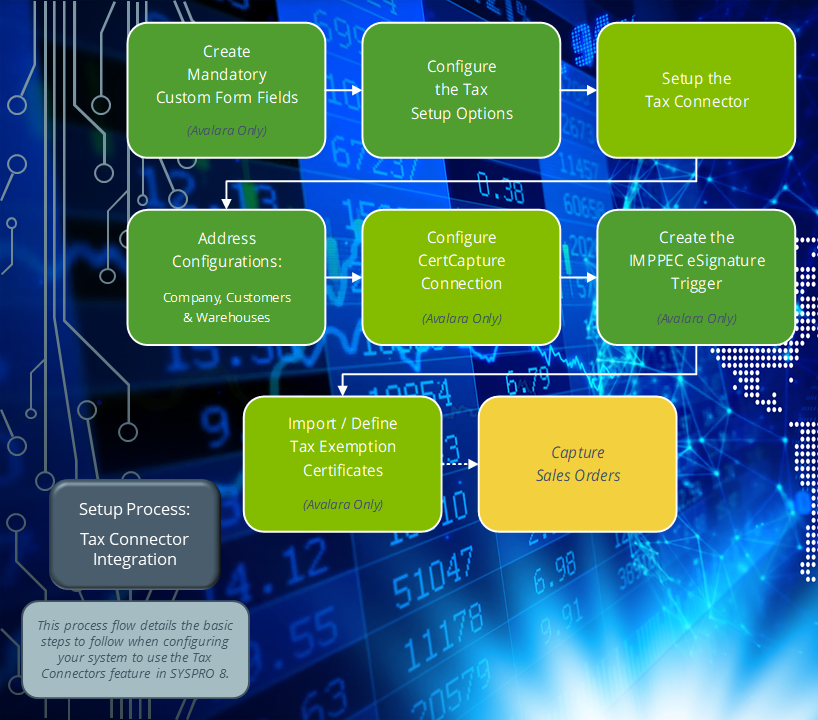

Tax Connectors provide a connection for establishing a direct link between SYSPRO and compatible cloud-based tax calculation systems (e.g. Avalara and Vertex).

Tax Connectors manage the export of data to these systems so that quarterly and annual sales tax returns can be produced for state filing purposes.

Starting

-

You must configure the Tax Connector - Avalara within the Tax Interface Setup program before using this program.

-

We recommend that you perform a backup of the applicable tables before proceeding with the update process.

You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

The following configuration options in SYSPRO may affect processing within this program or feature, including whether certain fields and options are accessible.

The Setup Options program lets you configure how SYSPRO behaves across all modules. These settings can affect processing within this program.

Setup Options > Company > General

- Nationality code

Setup Options > Tax > Company Tax Options

- Tax system

Setup Options > Tax > Sales and Use Tax

- Sales and use tax system required

- Interface type

- Default ship from information

- Update tax for this company

Solving

-

Open the Update Invoice Reprint Tables program.

-

Indicate the Invoice date range required for the system to pull the tax values recorded within the ArTrnSummary table to update the corresponding re-print tables.

We recommend setting the From date as the date when SYSPRO was initially implemented and the To date as the date on which you implemented the Tax Connector - Avalara.

Reprint records created after the switch to Avalara contain U in the LimitFlag field. Therefore, the program checks this field first and doesn’t make any changes to the database for records already defined as U. This ensures that data is not negatively impacted if the program is executed more than once.

-

Indicate the required GL code and Tax code.

-

Select the function.

Upon completion, a summary window is displayed with the number of processed records, errors found (if any) and invoices converted successfully.

When you select the function, the program locates the tax amounts that were used when the AR invoices were originally printed (as recorded within the ArTrnSummary table) and uses the original amount for reprinting the invoices.

Using

-

Fields on a pane are sometimes removed by default. You can reinstate them using the Field Selector option from the context-sensitive menu (displayed by right-clicking any field in the pane). Select and drag the required fields onto the pane.

The captions for fields are also sometimes hidden. You can select the Show Captions option from the context-sensitive menu to see a list of them. Click on the relevant caption to reinstate it to the form.

If the Show Captions option is grayed out, it means no captions are hidden for that form.

-

Press Ctrl+F1 within a listview or form to view a complete list of functions available.

Referencing

| Field | Description |

|---|---|

| Invoice date range |

Indicate the date range of invoices that the system can use to pull the tax values recorded within the ArTrnSummary table to update the corresponding re-print tables. We recommend setting the From date as the date when SYSPRO was initially implemented and the To date as the date on which you implemented the Tax Connector - Avalara. |

| Default values for tax reprint |

Indicate the default GL code and Tax Code required for the new records. |

Copyright © 2025 SYSPRO PTY Ltd.