CertCapture - Show Exemption Certificate

Exploring

This program only applies to the Tax Connector - Avalara.

This program lets you perform the following actions with regards to the exemption certificate saved against a customer:

-

View the customer's current exemption certificate recorded in CertCapture.

-

Email the customer to request their exemption letter.

-

View the customer’s current status and client ID within CertCapture.

-

Establish the current status of a customer's exemption certificate within CertCapture.

This program can't be run standalone and is accessed from the following program(s):

-

Customer Query

Accessible from the following fields within the Avalara section of the Customer Information pane:

-

View exemption certificate

-

Request exemption letter

-

View customer status

-

View certificate status

-

The Avalara platform is a powerful and easy-to-use API that helps businesses automate the calculating, storing, auditing and reporting of transactional taxes.

The CertCapture component helps you maintain compliance by creating, validating, storing and managing sales tax exemptions and reseller certificates.

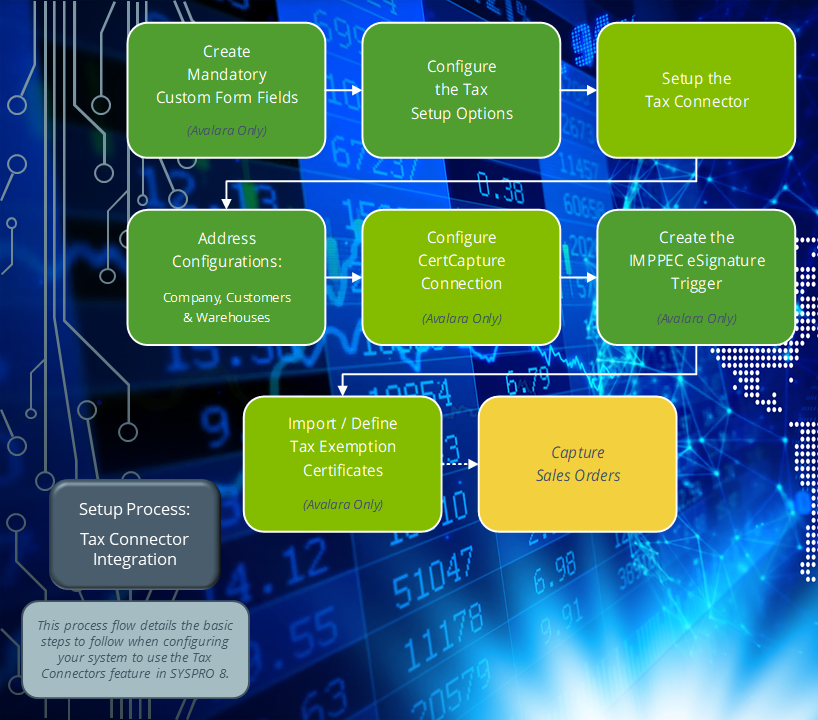

Tax Connectors provide a connection for establishing a direct link between SYSPRO and compatible cloud-based tax calculation systems (e.g. Avalara and Vertex).

Tax Connectors manage the export of data to these systems so that quarterly and annual sales tax returns can be produced for state filing purposes.

Starting

You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

The following configuration options in SYSPRO may affect processing within this program or feature, including whether certain fields and options are accessible.

The Setup Options program lets you configure how SYSPRO behaves across all modules. These settings can affect processing within this program.

Setup Options > Company > General

- Nationality code

Setup Options > Tax > Company Tax Options

- Tax system

Setup Options > Tax > Sales and Use Tax

- Sales and use tax system required

- Interface type

Solving

Ensure that you have a valid connection to CertCapture to avoid failed transactions when you add, change or delete a customer:

-

Open the Exemption Certificates Setup program (Program List > General Ledger > Tax > Tax Interface).

-

Capture your connection details.

-

Select the Test Connection function to ensure all entries are valid.

-

Save and exit the program.

If you have a list of existing tax exemption state certificates and want to import these into SYSPRO, proceed as follows:

-

Open the CertCapture Import program (Program List > General Ledger > Tax > Tax Interface).

-

Indicate the name and full location path of the import file.

-

Select the Import function.

-

Review the Process completed fields for summary information about the records imported.

Using

Copyright © 2025 SYSPRO PTY Ltd.