VAT reverse charges for tax submission

The VAT reverse charges for tax submission feature lets you record VAT which would've been paid by a company if services were procured from within their EU state, but which were in fact procured from another EU state. It caters for VAT requirements in UK and EU countries that need to disclose reverse charges when submitting tax reports.

Exploring

The notional tax transactions are accumulated and made available for subsequent reporting using the MTD 9-Box Tax Return report and the Digital Tax Tool.

To determine the reverse charge amounts, a notional invoice is raised with the same value as is reflected on the actual invoice. Tax is then calculated using local tax rates. A notional tax credit note is generated to contra and therefore cancel the notional invoice.

Changes on the MTD 9-Box Return:

- The notional tax value of the invoice is displayed in box 4 (VAT Reclaimed).

- The notional tax value on the credit note is added to box 1 (VAT Due).

- The effect on the Net VAT in box 5 is thus zero.

The notional invoice and tax credit notes are pro forma entries with implied costs and are not recorded against the supplier.

Starting

To use this feature, the following setup option(s) must be enabled:

Setup Options > Tax > Company Tax Options

-

Reverse charge tax required

Setup Options > Tax > Accounts Payable

- Tax distribution method (detail or summary)

Setup Options > Preferences > Financials > General Ledger

- Global tax file required

You can secure this feature by implementing a range of controls against the affected programs. Although not all these controls are applicable to each feature, they include the following:

- You restrict operator access to activities within a program using the Operator Maintenance program.

- You can restrict operator access to the fields within a program (configured using the Operator Maintenance program).

- You can restrict operator access to functions within a program using passwords (configured using the Password Definition program). When defined, the password must be entered before you can access the function.

- You can restrict access to the eSignature transactions within a program at operator, group, role or company level (configured using the Electronic Signature Configuration Setup program). Electronic Signatures provide security access, transaction logging and event triggering that gives you greater control over your system changes.

- You can restrict operator access to programs by assigning them to groups and applying access control against the group (configured using the Operator Groups program).

- You can restrict operator access to programs by assigning them to roles and applying access control against the role (configured using the Role Management program).

The Setup Options program lets you configure how SYSPRO behaves across all modules. These settings can affect processing within this program.

Setup Options > Tax > Company Tax Options

-

Reverse charge tax required

-

Use GL periods for tax returns

Setup Options > Tax > Accounts Payable

- Tax distribution method

- Foreign currency suppliers tax entry

Setup Options > Preferences > Financials > General Ledger

- Global tax file required

-

Reverse charge current rate

- Reverse charge rate effective from

- Reverse charge previous rate

- Reverse charge sales tax ledger code

- Reverse charge sales tax ledger desc

- Reverse charge AP tax ledger code

- Reverse charge AP tax ledger desc

-

Reverse charge tax code

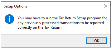

Solving

This message is displayed when you enable the Use GL periods for tax returns setup option (Setup Options > Tax > Company Tax Options).

You need to populate the AdmTaxReturn with the historical data required to run the Tax Return report. To achieve this, access the Tax Return Setup program and select the modules you want to include, before choosing the Start Processing function to run the conversion.

This message is displayed when you access the AP Invoice Posting program and the EC VAT system required setup option is enabled (Setup Options > Tax > Company Tax Options) but the tax code at the EC VAT acquisition setup option is not defined (Setup Options > General Ledger Integration > Payables Ledger Codes).

Ensure that the appropriate ledger account is selected at the EC VAT acquisition setup option (Setup Options > General Ledger Integration > Payables Ledger Codes).

Using

The following indicates areas in the product that may be affected by implementing this feature:

The following Tax code information fields were added:

-

Reverse charge only

This field is only available when the Reverse charge tax required setup option is enabled (Setup Options > Tax > Company Tax Options).

- Reverse charge current rate

- Reverse charge rate effective from

- Reverse charge previous rate

The following fields were added to the GL ledger codes section:

-

Reverse charge sales tax ledger code

-

Reverse charge AP tax ledger code

The GL codes are used for the GL Integration transactions of notional tax values generated for reverse charge supplier invoices.

The Reverse charge tax code field was added to the General Details pane and lets you define the default tax code for reverse charges against the supplier.

This field is only available when the Reverse charge tax required setup option is enabled (Setup Options > Tax > Company Tax Options).

- The Reverse charge tax code field was added to the Transaction pane and defaults to the reverse charge tax code defined against the supplier, but can be changed.

- The value displayed in the new Reverse charge tax amount field is calculated using the transaction amount and the Reverse charge tax code.

-

You can use the Field Chooser option from the GL Distribution listview's context-sensitive menu to add the Reverse charge tax amount field.

The GL Integration transactions are generated for the notional tax code values and the AdmTaxReturn tax table is updated with the notional reverse charge values. The reverse charge flag against these entries is Y to indicate reverse charge only transactions.

The following columns were added to the report and the Tax Return Summary listview so that reverse charge transactions are easily identified:

- Reverse charge flag

- Reverse charge code

- Reverse charge tax rate

- Reverse charge tax value

Copyright © 2024 SYSPRO PTY Ltd.